Are multicap funds better option for you?

Multicap is an equity investment strategy, where the investment is spread across different market capitalization segments. Market capitalization of a stock is the share price of a stocks multiplied by the total number of shares outstanding. Investors use market cap to denote a company’s size. Different market cap segments have different risk return characteristics. By spreading your investment over different market cap segments you can achieve better diversification across market cap cycles. A multicap strategy can help you get higher returns, in the transition phases of economic cycles like that we may see in the short to medium term. Let us first understand the different market cap segments.

What are different market cap segments?

- Large cap: According to SEBI, the largest 100 companies by market capitalization are classified as large cap companies.

- Midcap: SEBI categorizes 101st to 250th companies by market capitalization size as midcap companies. There are 150 midcap stocks.

- Small cap: 251st and smaller companies by market capitalization are classified as small cap companies by SEBI.

What is multicap fund?

Multicap funds are diversified equity funds which invests in all market capitalization segments e.g. large cap, midcap and small cap. As per the market regulator, SEBI’s mandate, multicap funds are required to invest at least 25% of their assets in large cap stocks, at least 25% in midcap stocks and at least 25% in small cap stocks.

Characteristics of multicap funds

- The large cap portion of multicap asset allocationhelp multicap funds to limit downside risk and provides liquidity in volatile times.

- The midcap and small cap allocations of multicap funds are aimed at generating alpha over long investment tenures. Stocks which give multi-bagger returns usually come from the small and midcap space.

- There are periods in the investment cycles, when mid and small caps can get overheated. We saw this in mid/small cap bull run from 2014 to 2018. When midcap / small cap valuations get over-stretched large caps can provide stability to the portfolio, because large caps tend to outperform in such times.

- Unlike other equity mutual fund categories, multicap funds are trulydiversified because they have significant allocations to all the three market cap segments across all market conditions. Other equity fund categories may have a significant bias towards one or two market cap segments. We will discuss more about this in the next section.

- Multicap funds have minimum 50% of their assets invested in mid and small cap stocks. Mid and small caps are more volatile than large caps. So investors need to have high risk appetites for these schemes.

Difference between Flexicap and Multicap Funds

There is confusion among many investors when comparing multicap and flexicap funds. Flexicap funds can invest across the market cap segments without any upper / lower limits. Many a times, flexicap funds closely resemble large cap funds in terms of asset allocation, especially in bear markets. Multicap funds on the other hand, cannot invest more than 50% in large cap stocks. You should understand the risk / return characteristics of the different fund categories and invest according to your risk appetite.

Suggested reading: what is the difference between multi cap and flexi cap mutual funds?

Benefits of multicap funds

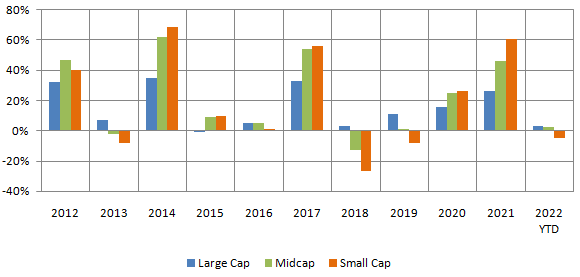

- Different segments of the market outperform each other in different market cycles (see the chart below). For example large cap stocks usually outperform midcap and small cap stocks in bear market conditions. Midcap and small cap stocks have the potential to outperform large cap stocks in bull markets.

![Different segments of the market outperform each other in different market cycles Different segments of the market outperform each other in different market cycles]()

Source: National Stock Exchange, Advisorkhoj Research as on 31st October 2022. Large cap segment is represented by Nifty 100 TRI, midcap by Nifty Midcap 150 TRI and small cap by Nifty Small Cap 250 TRI. Disclaimer: Past performance may or may not be sustained in the future.

- Multicap funds provide exposure to a larger number of industry sectors compared to large cap funds. There are several sectors with high demand driven growth potential where large caps do not have any presence. Investors can exposures to these sectors through multicap funds.

- Multicap funds provide exposure to a much larger universe of stocks compared to large cap or even midcap funds. While the large cap segment is restricted to 100 stocks, the mid cap (150 stocks) and small cap segment (250+ stocks) covers 500+ stocks. Therefore, multicap funds have more investment opportunities compared to large caps and even midcaps.

- There are many industry sectors where large caps do not have any presence i.e. automobile ancillaries, specialty chemicals, textiles, media and entertainment etc. You can get exposure to these sectors through multicap funds.

- Price discovery is more efficient in large cap stocks due to high institutional ownership and greater research coverage. On the other hand, price discovery is not as efficient in the mid and small cap segments, especially small caps. Multicap fund managers may be able to identify midcap and small cap stocks that are trading at deep discounts to their intrinsic long term valuation and create alphas for investors over sufficiently long investment horizon.

- Multicap fund managers have the flexibility to increase or decrease allocations to different market cap segments according to market conditions, subject to SEBI limits. These funds have the flexibility to take advantage of market opportunities by changing market cap allocations depending on market situation and the fund manager’s outlook.

You may also like to read how does one select a good mutual fund?

Why invest in multicap funds now?

- Economic data as well corporate earnings suggest that we are in the early stages of growth recovery in India after the COVID-19 downturn. Historical data suggests that small and midcaps outperform in the early stages of a long term bull market, since they get beaten down more in bear markets. See the performance of small / midcaps in 2013 / 2014-15 and 2018-19 / 2020-21 in the chart above. Small / midcaps suffered more in 2013 and outperformed in 2014-15. Similarly, they suffered more in 2018-19 and outperformed in 2020-21. If history repeats itself, then we can see this again in 2022-23.

- The Indian market is a bright spot in the emerging market pack for FIIs, especially with China showing clear signs of economic slowdown as per latest Chinese exports data. We expect India to be a beneficiary in terms of global portfolio investment flows. Though FIIs have always had a large cap bias as far as Indian equities are concerned, over the last few years, we are seeing increasing FII investment allocations to midcaps and small caps. In this context, a multicap strategy may be beneficial to investors over long investment tenures in the current market scenario.

- India is a domestic consumption driven economy. We are seeing strong signs of domestic demand revival going by sales data in sectors like FMCG, automobiles etc from the recent festive season. Midcap and small cap firms have a strong linkage with consumption driven economy and are likely to be the big beneficiaries of demand revival. As such, multicap investors can see capital appreciation from demand revival.

- At the same time, there are global headwinds to economic growth. High commodity prices, interest rate hikes by central banks especially US Fed, strengthening US Dollar etc tend to have an impact on our financial markets. We can see bouts of volatility in our financial markets over the next few months or quarters, till we have visibility on the end of the interest rate cycle. The large cap allocation of multicap funds can provide stability to your portfolio in volatile markets.

- In the current market scenario, multicap funds are uniquely positioned to capture the current market opportunity as the Indian economy navigates through the global macro challenges and embarks on the next stage of economic growth.

Who should invest in multicap funds?

- Investors who want capital appreciation over long investment tenures.

- Investors with minimum 5 year investment horizon.

- Investors with high to very high risk appetites

- These funds are suitable both for lump sum investments and SIPs. SIPs can help you take advantage of market volatility through Rupee Cost Averaging.

- If you have lump sum funds, but are worried about near term volatility, you can invest in multicap funds through STPs from low volatile funds (e.g. liquid funds)

Investors should consult with their financial advisors if multicap funds are suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY