How Passive Investing makes a lot of sense for long term SIP investor

We have discussed a number of times in our blog that Systematic Investment Plans is the ideal way of investing for your long term goals. An important factor in wealth creation is investment tenure due to power of compounding over time. Longer your investment tenure, greater is the effect of compounding. Mutual fund SIPs enable you to start investing small amounts from your regular savings. Over long investment tenures, SIPs can help you accumulate wealth needed for your different life-stage goals.

Mutual fund SIPs have become one of the most popular investment vehicles for retail investors. As per AMFI data more than Rs 1 lakh Crores was invested through SIP is FY 2019-20; total SIP investments in the first three quarters of this fiscal year stood Rs 71,349 Crores. Most of the SIPs in India are made in actively managed equity mutual fund schemes.

Over the last few years, passive funds like Exchange Traded Funds (ETFs) and Index Funds have been slowly gaining traction in India. The COVID-19 pandemic provided a massive boost to passive funds with assets under management (AUM) in index funds, gold ETFs and other ETFs jumping 49% in calendar year 2020.

In this blog post, we will discuss why passive investing makes a lot of sense for long term SIP investors.

What are passive equity funds?

Passive equity funds invest in a basket of stocks which replicate a market index e.g. Sensex, Nifty, etc. Weights of stocks in a passive fund mirror the weights of the constituents in a market index. Unlike actively managed mutual funds, the fund manager of a passive mutual fund does not aim to beat the market. The fund manager simply aims to give index returns to investors and reduce tracking error. Tracking error is deviation of fund returns from the index returns.

Why passive funds make sense for SIP investors

- Harder for fund managers to beat the market over long investment horizon: Fund managers can beat the market in the short term, but research shows that in efficient markets, it is harder for fund managers to beat the market over long investment horizons. Hence, passive funds like ETFs and Index Funds are becoming very popular in the developed markets. With increasing institutional investments in Indian equity markets, especially from Foreign Institutional Investors, the Indian market is becoming much more efficient compared to what it was in the past.

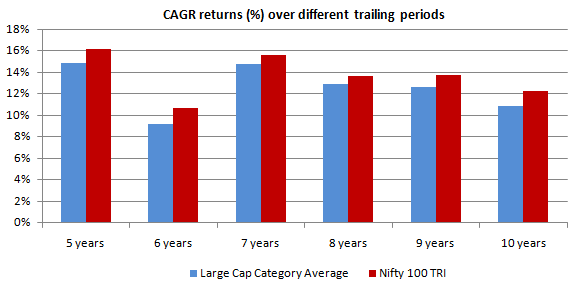

There is growing evidence from even India that it is harder for fund managers to beat the market over long investment horizons. The chart below shows the annualized trailing returns of large cap category (average) and Nifty 100 TRI, which the index of Top 100 companies by market cap. Please note that as per SEBI, top 100 companies by market cap are categorized as large cap stocks. Since SIPs are meant for very long investment tenures, passive funds make a lot of sense for SIP investors.

![Annualized trailing returns of large cap category and Nifty 100 TRI, which the index of Top 100 companies by market cap Annualized trailing returns of large cap category and Nifty 100 TRI, which the index of Top 100 companies by market cap]()

Source: Advisorkhoj Research (periods ending 3rd February 2021). Disclaimer: Past performance may or may not be sustained in the future

- Low cost can be of great advantage in the long term due to compounding effect: One of the biggest advantages of passive funds is significantly lower costs compared to actively managed funds. The total expense ratio (TER) of passive funds (ETFs and Index Funds) can be 1 – 2% lower than TERs of actively managed funds. Over very long investment tenures the difference in expense can result in a substantial difference in returns due to the effect of compounding.

It will be easier for you to understand the impact of TER over long term results with the help of an example -

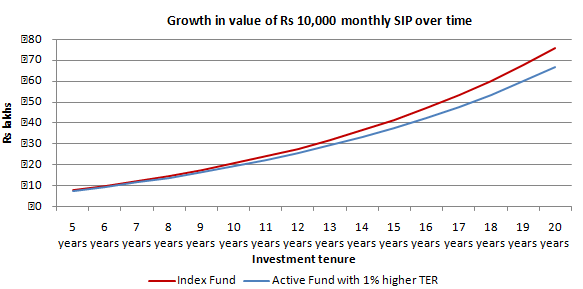

Let us assume that you invest Rs 10,000 every month through SIP in an index fund and an actively managed fund. The difference in TERs of the two funds is 1% and the performance of the underlying portfolio of index fund and the actively managed fund is the same (assumed to be 10% CAGR). The chart below shows the growth in the market value of your SIP over time. You can see that over longer tenures the divergence in performance is significant. Over 20 years SIP tenure, the difference in SIP returns is nearly Rs 10 lakhs.

![Growth in the market value of your SIP over time Growth in the market value of your SIP over time]()

Assumptions: Underlying portfolio performance of index fund and active fund is same (10% CAGR). Difference in TER is 1%. Monthly SIP amount is Rs 10,000. All amounts in Rs lakhs.

- No unsystematic risk in passive funds: In order to beat the market benchmark index (create alpha), the fund manager will have to be overweight or underweight on certain stocks in the index. This will result in unsystematic risk i.e. stock or sector specific risks in addition to market risk. The higher risk may not always result in higher returns.There is no unsystematic risk in passive mutual funds. Passive mutual fundsonly have market risks and you will get market returns subject to tracking error.

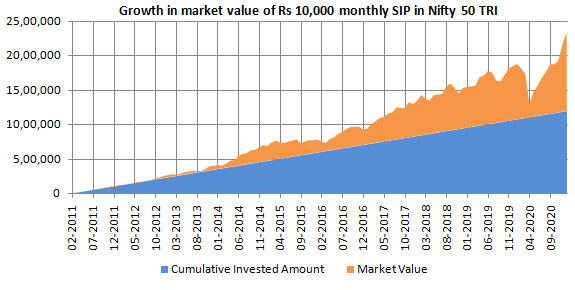

- Create long term wealth by investing in market index: You do not have to take excessively high risks to create long term wealth. You can create wealth even by investing in the index. The chart below shows the growth of Rs 10,000 monthly SIP in Nifty 50 TRI over the last 10 years. With a cumulative investment of Rs 12 lakhs you could have accumulated a corpus Rs 22.8 lakhs in the last 10 years.

![Growth of Rs 10,000 monthly SIP in Nifty 50 TRI over the last 10 years Growth of Rs 10,000 monthly SIP in Nifty 50 TRI over the last 10 years]()

Source: Advisorkhoj Research (periods ending 31st January 2021). Disclaimer: Past performance may or may not be sustained in the future

- Much simpler to invest in passive funds: In passive funds you do not have to check the performance track record of the fund manager across different market conditions, how long has he / she been managing the fund, understand his / her stock selection strategy etc. You simply have to decide which market index you want to invest in and then select a fund which has low cost and tracking error. As such, SIPs in passive funds are ideal investment options for young or new investors.

SIPs in Index Funds versus ETFs

Fund houses do not offer SIP facility for ETFs. It is possible to invest systematically in ETFs by buying units of ETFs at regular intervals (e.g. fortnightly, monthly etc.) from the stock exchange through your broker, however there are some difficulties. It is not possible to setup an ECS mandate for investing in ETFs systematically because just like shares, you cannot buy fractional units of ETFs. So your monthly systematic investment amount may be slightly different every month depending on the real time price of the ETF unit at the time of the transaction. There is no such problem in index funds. Index funds are like any other mutual fund schemes. You can invest a fixed amount through SIP in index funds by providing the ECS mandate.

Conclusion

Inthis blog post, we discussed why passive investing makes a lot of sense for long-term SIP investor. Passive funds have lower costs, no unsystematic risks and much easier to invest compared to actively managed funds. You simply need to select a fund based on your risk appetite and financial goals. You should consult with your financial advisor if index funds are suitable for your systematic investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY