Systematic Withdrawal Plans from Debt Mutual Funds give the most tax efficient income

When the Finance Minister changed the debt mutual fund taxation in his first Budget after the NDA came to power, many people associated with the mutual fund industry said that this was a severe blow to debt funds. Prior to 2014, debt fund returns from investments held for less than 12 months was taxed as per the income tax rate of the investor. Debt fund investments held for more than one year were subject to long term capital gains tax. Long term capital gains back then were taxed at 10% without indexation and 20% with indexation. After the 2014 NDA Government budget, the period for long term capital gains taxation was increased from more than 1 year to more than 3 years. Under the current debt fund tax treatment, capital gains from debt fund investments held for less than three years are taxed as per the income tax rate of the investor. For debt fund investments held for more than three year, returns (long term capital gains) are taxed at 20% after allowing for indexation benefits. The critics of the 2014 new debt fund tax proposal said that while previously debt fund investments held for a period of more than one year enjoyed significant tax advantage over fixed deposits and many small savings schemes, under the current rules that advantage is gone for investments held for less than 3 years. Essentially what they are saying is that, for an investment period of less than 3 years, the tax treatments of incomes from bank fixed deposits and debt mutual funds are the same. While this is theoretically correct, from a practical viewpoint, however, your actual tax from fixed deposit (FD) and debt fund income will be different depending on the mechanics you use to generate the income, even if the income generated by the FD and the debt fund is the same. For example, if you are in the highest tax bracket (30.9% with surcharge) and you take dividends from debt mutual funds, the fund house will deduct dividend distribution tax at the rate of 28.8% before paying dividends which are tax free in your hands, whereas you will have to pay 30.9% tax on your fixed deposit interest income. However, there is a much more tax efficient way of generating income from your debt fund investments. In our blog, we have discussed before that mutual fund systematic withdrawal plans can be used to generate predictable long term cash flows from your investment (please see our post, A smart option for getting regular income from your Balanced Fund investments over a long period).

Systematic withdrawal plans are ideal for generating income in your post retirement years. In this blog post, we will discuss how systematic withdrawal plans in debt funds can give you the most tax efficient cash flows to meet your post retirement income needs. The tax advantage of Systematic Withdrawal Plan (SWP) in equity funds is obvious. If you start your SWP from equity funds after a year of your investments, the SWP withdrawals will be subject to long term capital gains tax, which is tax free for equity funds. But what are the tax implications of SWP in debt funds? After all, post retirement the majority of your assets should be fixed income or debt investments to ensure a much higher degree of capital protection. The tax advantage of returns from debt funds over fixed deposit interest for investments held for over 3 years for investors in the higher tax bracket is quite obvious, given the long term capital gains tax treatment of debt funds. As discussed earlier, long term capital gains from debt funds are taxed at 20% with indexation benefits while fixed deposit interest is taxed as per your tax rate. We will understand the difference in tax outgo with the help of example later in this post. However, some will argue that in the first three years the tax is the same for debt fund and fixed deposit income. While the tax treatment of debt fund and fixed deposit is the same in the first three years of the investment, your actual tax will not be same if you are getting your income from SWP in debt fund. It is our endeavour in Advisorkhoj to share knowledge with our readers on different investment options, so that they can get the maximum benefit from their investments. While all investors should endeavour to get the maximum out of their investment, this is especially important for senior citizens, since they are reliant on their investment income to meet their expenses.

SWP from debt funds are more tax efficient than fixed deposits even in the first three years

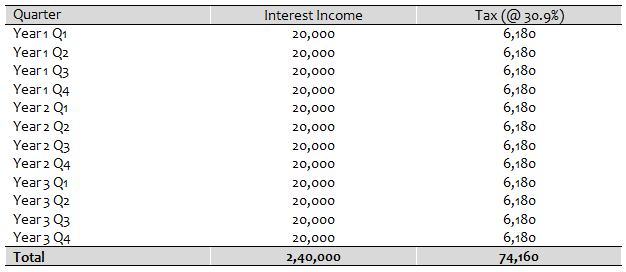

The sub-heading may have surprised some of you, but you will understand how SWP from debt funds are superior to fixed deposit interest even in the first three years of the investment, once we walk through an example. Let us assume there are two investors, Pooja and Richa. Both are retired and are dependent on the income from their investments. Pooja has invested र 10 lacs in an accrual debt mutual fund at the start of a financial year. Richa favours fixed deposits and has put the same amount as Pooja, i.e. र 10 lacs in a bank fixed deposit on the same date. To make for apples to apples comparison, let us assume both the debt fund and the fixed deposit give 8% returns. Let us now see that Richa needs the income on a quarterly basis. Richa’s fixed deposit pays out interest every quarter. For her र 10 lacs fixed deposit, she receives an interest of र 20,000 every quarter. Pooja also needs the income on a quarterly basis. She has set up र 20,000 quarterly SWP from her mutual fund investment. In an SWP, fixed cash flows are generated for the investor by redeeming a certain number of units based on the prevailing Net Asset Value (NAV) and the SWP amount required by the investor. Finally, let us assume that, both Pooja and Richa are in the highest (30.9% with surcharge) tax bracket. So both Pooja and Richa make the same investment. They get the same returns on their investments. They take the same cash flow from their investments. To simplify our analysis we have assumed no exit load. Let us now see, how much income tax each one has to pay in the first 3 years of the investment. Let us start with Richa first.

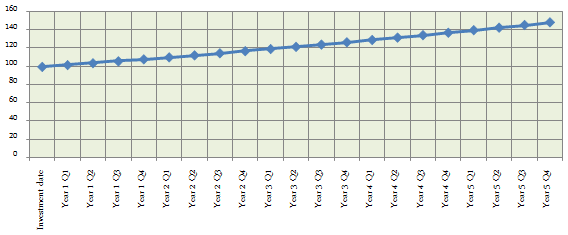

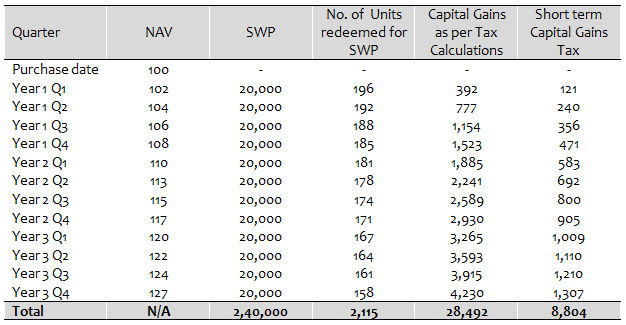

Let us now see how much tax Pooja will have to pay for her र 20,000 quarterly SWP. Let us understand how short term capital gains tax is calculated for mutual funds. You have to multiply the difference of NAVs on the redemption (SWP) date and the investment date with the number of units redeemed to calculated short term capital gains. Short term capital gains tax on your debt fund investment will be your short term capital gains multiplied by your income tax rate. Therefore in order to calculate your short term capital gains tax you need to know the investment NAV and redemption. Let us assume the starting NAV is र 100. The chart below shows the projected quarterly NAVs based on our 8% return assumption.

The table below shows how much tax Pooja has to pay, based on the method described earlier.

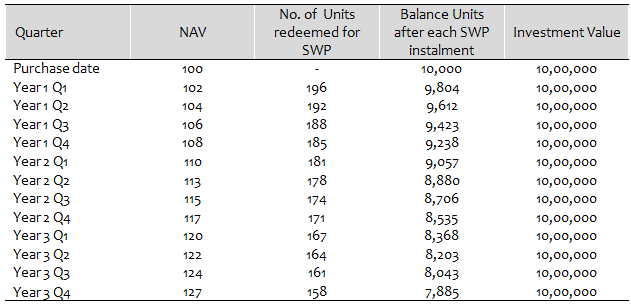

Richa will have to pay र 74,160 as income tax, whereas Pooja will have to pay only र 8,804 as tax. You can see that Pooja will have much less tax than Richa, even though both have the same cash flows. If you had earlier thought that debt funds give tax benefits only after three years, think again. You can see SWP from the debt funds are more tax efficient than fixed deposit interest even in the first three years. While in fixed deposits the tax is levied on your entire income, in mutual funds tax is levied only on the profit made by you on the units sold by you. Some investors think that in SWP the number of units owned by them goes down over time. You should be concerned with the value of your investment, not with how much units you own. The table below shows the value of Pooja’s investment, at the end of each quarter in the first three years.

So we have seen that, SWP from debt funds is more tax efficient than fixed deposit interest even during the period of short term capital gains tax. Many readers are aware that long term capital gains from debt funds offer significant tax advantages compared to fixed deposits and many other fixed income investments. But for benefit of all our readers, let us now see how much tax Pooja saves compared to Richa when long term capital gains tax kicks in.

In the next Part of this article we will discuss how long term capital gains is more beneficial than short term capital gains in debt mutual funds

RECOMMENDED READS

- SWP from Debt Mutual Funds give the most tax efficient income over fixed deposits

- Combination of Home Loan EMI and Mutual Fund SIP can save you lot of money

- How to select the right debt mutual funds for your portfolio: Part 1

- How to select the right debt mutual funds for your portfolio: Part 3

- Mutual Fund ELSS schemes: best way to save tax and create wealth

LATEST ARTICLES

- Different types of diversified equity mutual funds: Schemes from Principal MF stable

- Principal Equity Savings Fund: For investors who look for regular income and capital appreciation

- Regular Withdrawal Plan: A smart and convenient way of getting regular income

- Mutual Fund ELSS schemes: best way to save tax and create wealth

- What are Balanced Mutual Funds

We understand what you're working for

We are committed towards helping individuals, businesses & institutional clients achieve financial security & success.

Quick Links

Product Brochures

More About Principal MF

POST A QUERY