Mutual Fund Taxation for FY 2018

Knowing the tax consequences of investments, income and profits are an important part of financial planning for three important reasons. Firstly, investors should declare all taxable income correctly in their income tax returns and pay the required tax amount. Secondly, if your tax liability exceeds Rs 10,000 then you should pay advance tax in each quarter based on the accrued estimated tax liability for the entire year. If you do not pay advance tax at the right time, you will have to pay interest on the late payment. Thirdly, knowing the tax consequence of income and profits from investments will help you make the most efficient investment decisions. In this blog post, we will discuss the tax implications of mutual fund investments, so that you are able to correctly assess the tax obligation arising out of your mutual fund transactions and also help you in making the correct investment decisions.

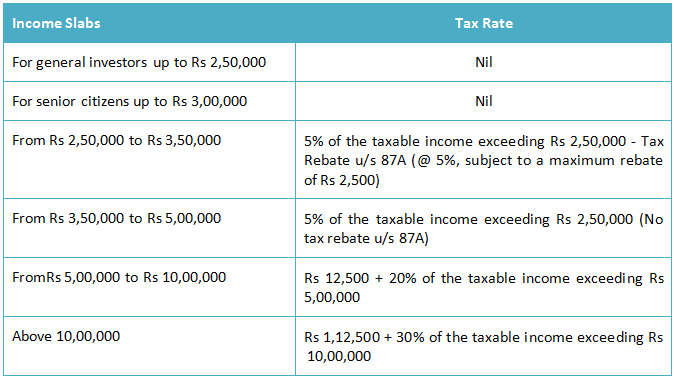

Let us first recap the exemption limits and key income tax slabs for Resident Indians and Hindu Undivided Families (HUF).

Investor whose income exceeds Rs 50 lakhs but is less Rs 1 Crore will have to pay a surcharge of 10% on income exceeding Rs 50 Lakhs. Investor whose income exceeds Rs 1 Crore will have to pay a surcharge of 15% on income exceeding Rs 1 Crore. Education cess at the rate of 3% will be levied on all taxpayers.

Let us now discuss how mutual fund returns are taxed. There are the two different kinds of returns from mutual funds:-

Capital Gains: Capital gain is the appreciation in the value of the units of a mutual fund at the time of the sale. From a tax standpoint, there are two types of capital gains.

- Short term capital gain: If the units are sold within the period defined under tax laws, then it leads to short term capital gain.

- Long term capital gain: If the units are sold after a period defined under tax laws, then it leads to long term capital gain.

Dividends: Dividends are profits returned by the mutual fund to the investor at regular intervals. However, the intervals are not certain and dividend amount is also not fixed.

The tax treatment of capital gains and dividend incomes are different. Tax treatment is alsodifferent for different types of mutual funds. Let us discuss it one by one.

Equity Funds

From a tax perspective, a fund in which at least 65% of the portfolio is allocated to equities (stocks) is an equity fund. Please note that as far as mutual fund taxation is concerned, derivatives whose underlying assets are stocks (or stock indices) are also considered to be equity. Diversified equity funds, sector funds, Equity Linked Savings Schemes (ELSS), balanced funds,index funds and arbitrage funds are categorized as equity funds from a tax perspective. Some of our readers have noted that certain balanced funds had less than 65% allocation to equity and were confused whether they would be treated as equity funds from a tax standpoint. Investors should note that, as per Income Tax rules, average monthly equity allocation over the past 12 months is considered for tax treatment as equity or debt fund.

The minimum holding period for long term capital gains in equity funds is one year. Short term capital gains (if the units are sold before one year) in equity funds are taxed at the rate of 15% plus 3% cess.There is no capital gains tax on the sale of equity fund units held for a period of more than one year. While dividends of mutual funds are tax free in the hands of the investors, for equity funds the dividend distribution tax is zero even for the fund house.

Non Equity Funds

Non Equity funds from a tax standpoint include debt funds like liquid funds, ultra short term debt funds (formerly known as liquid plus funds), fixed maturity plans (FMPs), short term debt funds, corporate bond funds, dynamic bond funds income funds, gilt funds and hybrid debt oriented funds (e.g. monthly income plans). Gold funds, fund of funds, asset allocation funds and international funds are also non equity funds.

The minimum holding period for short term capital gains in debt funds is three years. Short term capital gains (if the units are sold before three years) in debt funds are taxed as per applicable tax rate of the investor. So if your taxable income is above Rs 10 lakhs then short term capital gains tax of your debt fund sale is 30% plus applicable cess and surcharges. Long term capital gains of debt fund are taxed at 20% with indexation. To calculate capital gains with indexation, you should index your purchasing cost by multiplying the purchasing cost with the ratio of the cost of inflation index of the year of sale and cost of inflation index of the year of purchase, and then subtract the indexed purchasing cost from sales value.

While dividends are tax free in the hands of the investor, the fund house pays dividend distribution tax(DDT) for non equity funds before distributing dividends to investors. For Resident Indians and HUFs, the Dividend Distribution Tax paid by non equity fund schemes is 25% + 12% surcharge + 3% cess = 28.84%.

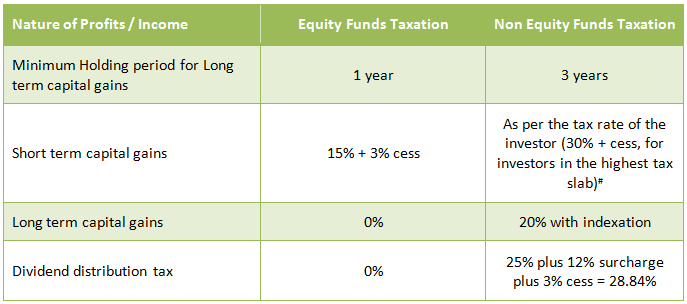

Recap of Equity and Non-Equity Fund Taxation

The table below summarizes the taxation of equity and non-equity funds.

# Surcharge will apply for incomes exceeding Rs 50 lakhs

Tax Savings by Investing in Equity Linked Savings Schemes (ELSS)

Investments in Equity Linked Savings Schemes (ELSS) qualify for deduction from your taxable income under Section 80C of the Income Tax Act 1961. The maximum investment amount eligible for tax deduction under Section 80C is Rs 1.50 Lakhs. Investors in the highest tax bracket (30%) can therefore save up to Rs 46,350 in taxes (Rs 1.5 Lakhs X 30.9% tax + cess) by investing in ELSS schemes. Please note that,Rs 1.50 Lakhs is the overall 80C cap after including all eligible items like, your employee provident fund contribution (deducted by your employer), life insurance premiums, ELSS Schemes etc.

Conclusion

In this post, we have discussed the effect of taxes on your mutual fund investment. When filing Income Tax Returns for AY 2018, you should carefully go through all the mutual fund transactions made in FY 2016 – 2017 and see if capital gains (if any) made by you in FY 2016 – 2017 has any tax consequences. Mutual fund taxation discussed in this post is also applicable for transactions in FY 2016-2017. You can get your capital gains statements online from mutual fund registrars like Karvy and CAMS. You should mention your capital gains in your income tax returns and pay taxes accordingly. For investments planned in FY 2018 and beyond, you should pay due attention to the impact of taxes and plan accordingly, so that you achieve your investment objectives by maximizing the post tax returns from your investment.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY