How ELSS Mutual Funds can help you in tax saving and retirement planning

If you look at the various investment options under Section 80C of Income Tax Act 1961, you will observe that many of these investments are meant to serve your retirement planning needs in addition to tax savings. Employee Provident Fund (EPF), Voluntary Provident Fund (VPF), Public Provident Fund (PPF), life insurance policies (both traditional and unit linked), National Pension Scheme (NPS) etc. are all tax saving investments which are also associated with long term financial planning like retirement.

Equity Linked Savings Scheme (ELSS), another popular investment option under Section 80C, is often perceived to be an investment scheme that matures in 3 years. In this blog post, we will discuss if ELSS can also serve long term investment needs especially retirement planning.

Historically, in India, there was a preference for physical assets (e.g. land, property, gold etc.). Among financial assets, traditionally investors preferred risk free investments like bank fixed deposits, Government small savings schemes etc. This preference extended also to Section 80C investments. As a resultemployee provident fund, public provident fund (PPF) and traditional life insurance policies have been the investment options, commonly associated with long term investments in India. But can risk free investments meet our retirement needs?

There is a thumb rule in retirement planning called the 30 – 30 rule. The 30 – 30 rule in very simple terms means that you have 30 years of working life, in which you earn, save and invest enough to provide for 30 years of retirement. The rule sounds simple and obvious, but its implications make retirement planning a serious challenge.

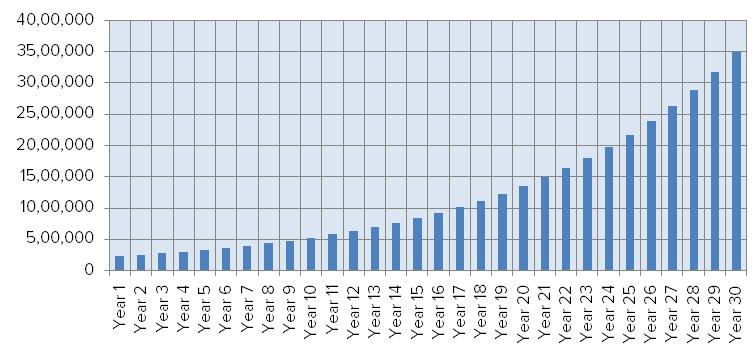

Let us walk through an example with numbers and hopefully you will understand the challenge in retirement planning. Let us assume you are 30 years old. You will retire at 60. Your current income is Rs 10 lakhs per year. Let us assume that, your basic salary is 50% of your gross salary. You contribute 12% of your basic salary to Employee Provident Fund. Your employer makes a matching contribution. In addition, let us assume you will save another 10% of your gross income for retirement planning. Let us further assume that you get a salary increment of 10% every year. The chart below shows how much you will save till your retirement.

EPF interest rate in FY 2017 was 8.65%, but the rate is likely to be lowered this year. PPF interest rate is currently 7.8%. Let us assume that in the long term you will get 8% annualized returns. Please note that this is simply an assumption for the purpose of illustration because in the long term interest rates in our economy will come down and one should not expect high interest rates. If you get annualized return of 8% on your savings accumulated in your working life of 30 years, you will accumulate a corpus of Rs 8.1 Crores at retirement. It is impressive so far. Let us now see, how long this amount will last after your retirement.

Here we come back to one of the key objectives of retirement planning, which is to maintain a certain lifestyle; lifestyle is habit forming and is very difficult to change because we get used to it. Let us assume you want to maintain the lifestyle you had towards the end of your working career. Assuming you get 8% pre-tax returns on your retirement savings, your corpus will last 10 years at best. It does not look that impressive any more. But it is about to get worse, once we factor the ugly 9 letter word, inflation. Factor in 5% inflation and your corpus will last only about 7 – 8 years. As per the 30 – 30 rule, retired lives can be as long as 30 years. In this example, you are losing your financial independence, even before you reach the half way stage of your retired life. Hopefully, this example will help you appreciate the importance of the 30 – 30 rule.

Read what is financial independence and its importance

So what is the solution?

One solution is to save more of your income, but is easier said than done. Rising expenses, home loan EMIs, children’s education and of course, taxes consume a big chunk of our incomes and leave less for savings. While we should always endeavour to save more, the most effective solution to the retirement planning conundrum is getting better returns on your retirement planning investment. If instead of 8% returns you get 15% returns on retirement planning savings, your retirement corpus will last for around 20 years instead of 7 – 8 years.

Is it possible to get high rate of return on your investment? We get quite a few queries in Advisorkhoj.com from investors looking for schemes which can give double digit returns with guaranteed capital safety. If you are looking for capital safety, find the yield of the 10 year Government bond – this is the maximum return you can get. Government small savings schemes like PPF can get you slightly higher returns along with tax savings under Section 80C, but their interest rates are linked with Government bond yields. Coming back to our question, it is not possible to get high rate of risk free assured return.

You may compare PPF versus a ELSS Mutual Fund scheme

ELSS for wealth creation

However, it is possible to get a high rate of return on your investment, if you are ready to take risks. Historical data shows that equity is the best performing asset class in the long term. Among the 80C investment options, mutual fund Equity Linked Savings Schemes (also known as tax saver funds) have given the highest returns over long investment tenures.

Read why ELSS is the best tax saving option

ELSS is a mutual fund equity scheme that qualifies for tax savings under Section 80C up to a limit of Rs 150,000. An ELSS is essentially a diversified equity scheme with a lock in period of three years from the date of the investment. Capital gains in ELSS are tax exempt. Dividends paid by ELSS are also tax free. If you invest in an ELSS through a systematic investment plan (SIP), each investment will be locked in for 3 years from their respective investment dates. Compared to other retirement planning investments under Section 80C ELSS offers higher liquidity and potentially superior post tax returns. However, as with all mutual fund investments ELSS are subject to market risk.

SIPs in top performing ELSS funds have given around 20% or more compounded annual returns in the last 10 years; if you had invested Rs 5,000 monthly in top performance ELSS funds through SIP, you could have accumulated Rs 15 – 18 lakhs with a cumulative investment of just Rs 6 lakhs in the last 10 years. The last 10 year period in equity markets included three bear markets, in 2008, in 2011 and in 2015 – 2016; therefore, we can conclude that the ELSS returns over the last 10 years were not biased by bull markets.

While top performing ELSS funds gave around 20% annualized SIP returns in the last 10 years, investors should understand that such returns are very high and may not be sustained in the future. The best performing ELSS funds got extraordinary returns mainly due to relatively high allocations to midcap stocks. Quality midcap stocks are on a fabulous run over the past 5 – 6 years, to the extent that these stocks are now trading at a premium to large cap stocks, which is quite an unusual situation. We do not know if, high midcap returns are sustainable in the long run.

From a financial planning standpoint, it is always prudent to be a little conservative when forming returns expectations. When forming long term return expectations, we in Advisorkhoj are of the view that, you should form expectations based on asset class returns and then factor in some alpha to be delivered by the fund manager. In the last 20 years, the Sensex gave around 12% returns, which can form the baseline for long term asset class return for equity in India. Midcap funds have delivered as high as 8 to 9% alphas, but as discussed earlier, this may not be sustainable. Large cap fund alphas are considerably lower. Top performing diversified equity funds have delivered 3 – 4% alphas over the last 5 years. Baseline equity returns and alpha assumption should help investors form reasonable long term returns expectations.

Read what is diversification and how to take advantage of it

Why is ELSS the best tax saving investment to create a retirement corpus over a long investment horizon?

Let us see how much wealth could have created in the last 15 years from FY 2001 to FY 2015 by investing in ELSS versus a risk free investment like PPF. We have considered PPF as our 80C risk free investment, since it beats all other risk free 80C investments in terms of interest rate and tax treatment. PPF like ELSS, from a tax standpoint is what is known as E-E-E (Exempt – Exempt – Exempt). E-E-E means that investment is exempt from tax at the time of investment, during the tenure of the investment and on maturity.

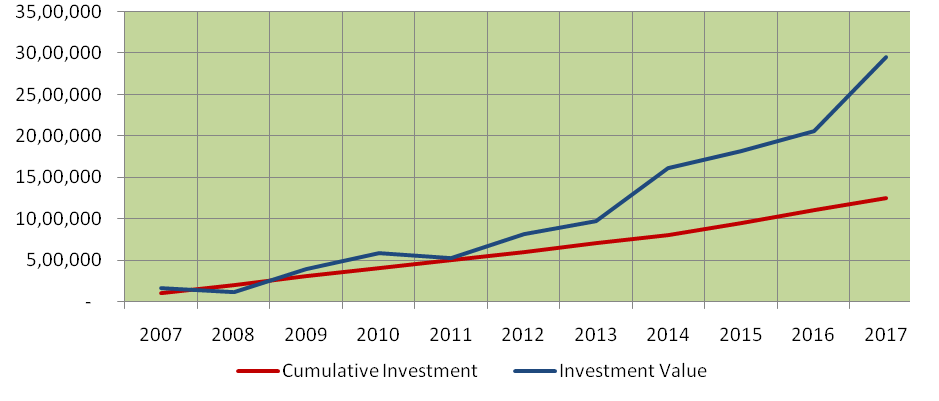

For our analysis we have assumed an annual investment of Rs 100,000 from 2007 to 2014 and Rs 150,000 from 2015 to 2017 as per Section 80C limits for the respective years. Let us first see how much maturity amount one would have accumulated in the last 10 years by investing up to the maximum 80C investment limit in PPF. The chart below shows the cumulative deposit amount and the PPF balance.

Source: Advisorkhoj Research

The total deposit made by the investor is Rs 12.5 lakhs. The PPF balance at the end of 2017 would be Rs 20.2 lakhs.

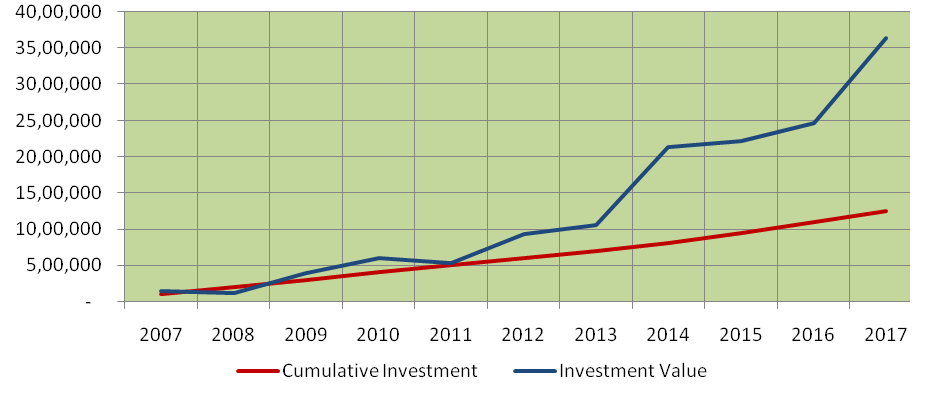

Let us now see how much corpus would an investor have accumulated by investing up to the maximum 80C investment limit in ELSS over the last 10 years. In this example, we have chosen an average ELSS fund (category average returns) which completed 15 years. Please note, top performing ELSS funds have given much higher returns.

Source: Advisorkhoj Research

The total investment made by the investor from 2007 – 2017 is Rs 12.5 lakhs like in the PPF example. However in the last 10 years, the investor could have accumulated Rs 29 lakhs by investing in ELSS investments; this is Rs 9 lakhs higher than what the investor could have accumulated in PPF. The Internal Rate of Return (IRR) over the last 10 years was 15%. As discussed earlier in our retirement planning example, a return of 15% is much more suited for retirement planning in India compared to 8 – 9% returns.

Let us now see the returns which the investor would have got by investing in the best performing ELSS fund in the last 10 years. We will not mention the scheme name because this post is meant for investor education purposes only. We are showing the returns of the best performing ELSS fund to emphasize the importance of fund selection in mutual fund investments.

The total investment made by the investor from 2007 – 2017 is Rs 12.5 lakhs like in the PPF example. However in the last 10 years, the investor could have accumulated more than Rs 36 lakhs by investing in ELSS investments; this is Rs 16 lakhs higher than what the investor could have accumulated in PPF. The Internal Rate of Return (IRR) over the last 10 years was 18%. You can see the difference in wealth creation between ELSS and risk free investments like PPF.

Over a longer investment period, which one should have for retirement planning, the difference will widen much more because power of compounding favours the superior performing asset class much more than underperforming asset class. Over a 30 year investment period, investors can accumulate Rs 1.1 Crores by investing in Rs 1 lakh per annum in risk free tax saving schemes, assuming 8% rate of return.

Assuming a 15% rate of return, over the same period, investors can accumulate Rs 4.3 Crores by investing the same amount in ELSS. Please note that the returns of different asset classes are assumptions to demonstrate the power of compounding. Power of compounding is vital in ensuring success of your retirement planning.

Read how wealth set your free for different stages of life

Conclusion

We had discussed a number of times on our blog that, asset allocation plays the most important role compared to a multitude of other factors, in how much returns you get from your portfolio in the long term. Equity is undoubtedly the most desirable asset class for young investors. Read why mutual funds are the best investment asset class. As such ELSS is one of the best investment options for retirement planning under Section 80C, as far as young investors are concerned. Investors should consult with their financial advisors regarding ELSS investments for tax saving purposes.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY