SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

Current market scenario

The market has made a broad based recovery in the past two months, with Nifty crossing the psychologically important 26,000 level. Though we are seeing profit booking on rallies, we are also seeing lower bottoms, indicating that the market is in consolidation phase. The market is waiting for the outcome of Indo US trade deal discussions. Even though FII flows turned negative again in November, the market has held up. The currency is under pressure with the USD / INR exchange rate inching towards 90. The 10 year Government Bond yield has been in a tight range of 6.5 – 6.6%. With INR under pressure, there is uncertainty whether RBI will cut interest rate in the December MPC meeting or maintain status quo. In uncertain market conditions, dynamic asset allocation can provide greater portfolio stability. In this article, we will review SBI Dynamic Asset Allocation Active FOF.

Dynamic versus fixed asset allocations in changing market conditions

While both dynamic and fixed asset allocation strategies have their pros and cons, dynamic asset allocation can be more effecting in shifting market dynamics for the following reasons: -

- Different asset classes perform differently every year. Dynamic asset allocation can capture those opportunities

Source: NSE, Advisorkhoj Research, as on 31st October 2025. Equity is represented by Nifty 50 TRI and debt by Nifty 10-year Benchmark G-Sec Index

- Dynamic asset allocation has the flexibility to respond to changing market conditions

- Dynamic asset allocation has the potential to limit portfolio drawdowns when market turns volatile.

- Dynamic asset allocation has the potential to capture market insights and shift allocations when sentiments improve.

- Dynamic asset allocation has the potential to generate superior risk adjusted returns.

Dynamic asset allocation FOFs versus Balanced Advantage Funds

Balanced Advantage Funds is a very popular mutual fund category. As per AMFI October data, Balanced Advantage Funds category has the highest assets under management (AUM) among all hybrid fund categories. Balanced advantage funds manage their asset allocation dynamically between equity, debt and arbitrage based on the dynamic asset allocation model / fund manager’s outlook. Dynamic asset allocation fund of funds, on the other hand, invest in portfolio of equity and debt funds. The fund manager actively manages allocations to different funds depending on market outlook.

Dynamic asset allocation fund of funds (FOFs) have an additional layer of flexibility in terms of navigating the market cycles by investing in funds having different strategy and investment styles. The FOFs can based on the evolving market dynamics move from a specific investment style (value or quality etc.), market capitalization and sectors or different duration profiles for debt schemes. This allows investors to benefit from multiple fund management styles, philosophies, and sectoral/cap-size exposures. In contrast, a single fund exposure could have a style or market cap bias.

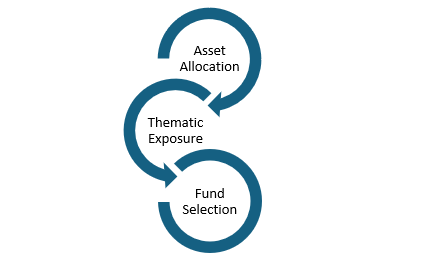

Presenting SBI Dynamic FOF and its FAN approach

SBI Dynamic Asset Allocation Active FOF is a fund of funds (FOF) which invests in equity and debt schemes of SBI MF. SBI Dynamic Asset Allocation Active FOF fine-tunes its allocation between equity and debt depending on market signals. The FOF increases equity exposure in bullish markets and turning toward debt in uncertain or volatile times. This constant adjustment can help keep your investment journey smoother and in tune with changing market conditions

Tax efficiency

The FAN approach can result in better tax efficiency compared to a DIY asset allocation strategy, as movement between funds in the do it yourself (DIY) approach may trigger tax events. In contrast, the investors in the fund will be subject to a long-term capital gains tax of 12.5% after two years of investment.

Investment Process

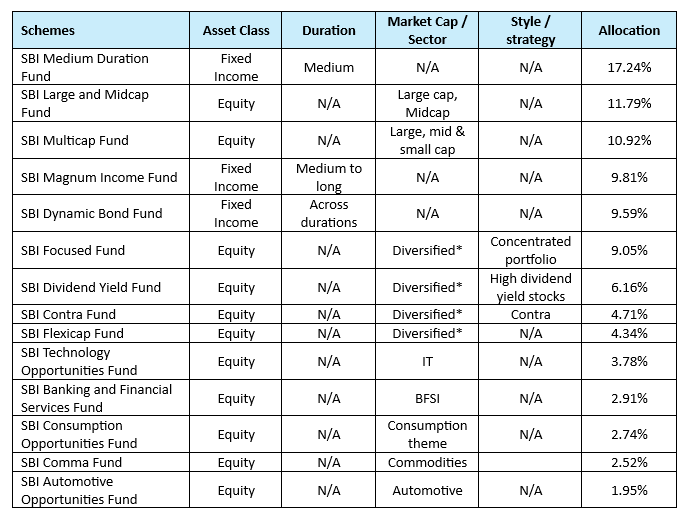

Current portfolio positioning

Source: SBI MF, as on 31st October 2025 *Across market cap segments

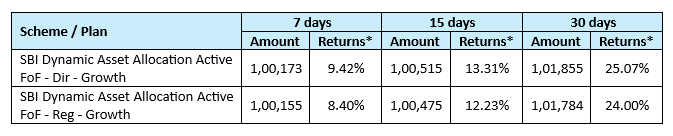

Performance of SBI Dynamic Asset Allocation FOFs

Growth of Rs 10,000 investment

Source: SBI MF, as on 31st October. *7 Days,15 Days,30 Days = Simple Annualized.

Who should invest in SBI Dynamic Asset Allocation FOF?

- Well-suited for investors seeking a professionally managed, diversified and dynamic portfolio that actively adapts to changing market conditions

- Investors who want exposure to multiple asset classes-such as equity debt and commodities etc.-based on prevailing economic cycles

- Investors with a medium- to long-term investment horizon of at least three to five years

- Smart option for those starting their investment journey, combining ease of access with diversified allocation via a Fund of Funds to help navigate different market scenarios

Investors should consult with their financial advisors or mutual fund distributors if SBI Dynamic Asset Allocation FOF is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

- SBI Balanced Advantage Fund: One of the top performing consistent balanced advantage funds

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY