Reliance Equity Savings Fund: Capital appreciation and Income with moderate risk

Balanced funds are excellent investment option for investors with moderate risk tolerance, since they can generate excellent returns for the investors with limited downside risks. The other major advantage of balanced funds is the capital gains taxation. Balanced funds with equity allocation of 65% or more are treated like Equity Mutual Funds from a tax perspective. Dividends and long terms capital gains are tax free for such funds. However, more conservative investors may not be comfortable with 65 – 70% allocation to equities and therefore opt for other products which offer less volatility but is less tax efficient. Reliance Equity Savings fund, a hybrid scheme, launched earlier this year, is an ideal investment option for investors with moderate risk appetite, since the risk profile of the fund is on the conservative side relative to most of the other schemes in the balanced fund category. The fund’s active equity allocation ranges between 20 to 40% with the objective of capital appreciation. 25 to 70% of the portfolio is allocated to completely hedged equity positions with the objective of generating arbitrage profits. 10 to 35% of the portfolio is invested in fixed income securities with an accrual strategy and moderate duration. Therefore 60 to 80% of the portfolio has fairly low volatility and generates regular income. What makes this fund attractive for investors with moderate risk appetite is that, while the volatility of the fund will be considerably lower than most balanced funds, the Reliance Equity Savings Fund will enjoy equity taxation benefits.

Reliance Equity Savings fund, an open ended equity oriented hybrid scheme, was launched in June 2015 and र 880 crores of assets under management, as on end of November 2015. The expense ratio of the fund is 2.65%. Sanjay Parekh and Anju Chajjer are the fund managers of the Reliance Equity Savings Fund. In line with its asset allocation strategy the fund benchmark is 40% CRISIL Liquid Fund Index, 30% CRISIL Short Term Bond Fund Index and 30% Nifty 50. In addition to growth option, the scheme also offers monthly dividend, quarterly dividend, yearly dividend and bonus options. In the month of October Reliance has revised the exit load structure of Reliance Equity Savings Fund. Now up to 10% redemption of investment amount, there is no exit load even for redemptions within 12 months of allotment of units. Redemptions in excess of 10% of the investment amount within 12 months of allotment of units will attract an exit load of 1%.

Investment Strategy

- Arbitrage: 25 to 70% of the fund’s portfolio can be allocated to arbitrage. As of end of October 2015, 28% of the portfolio was allocated to Arbitrage. The scheme aims to generate arbitrage profits arising out of pricing mismatches in the market. The fund managers employ a prudent strategy to ensure capital safety, returns and liquidity. Arbitrage strategies offer the investors to earn short term returns by taking minimal or no risks. In fact, in volatile market conditions arbitrage funds can provide comparable or even higher returns than low risk liquid funds. To know more about arbitrage strategies in mutual funds, see our article, Arbitrage Mutual Funds: A good short term investment option in volatile markets. For the arbitrage portion of the fund portfolio, the fund managers take completely hedged positions to minimize any risk for the investor.

- Fixed Income: 10 to 35% of the fund’s portfolio can be allocated to fixed income investments. As of end of October 2015, 34% of the portfolio was allocated to Fixed Income. With the fixed income portfolio, the fund managers employ an accrual strategy which minimizes interest rate risk. In an accrual strategy the fund managers aim to hold the fixed income securities till maturity, earning income in form of interest payments. The scheme will earn accrual income through investments in medium term and long term corporate bonds, with excellent credit quality. 60% of the fixed income portfolio is rated AAA, while 40% is rated is slightly lower, AA- and higher, to capture higher yields for the investors. The fixed income portfolio has a moderate duration of 2.5 to 3.5 years to minimize interest rate risk for the investors.

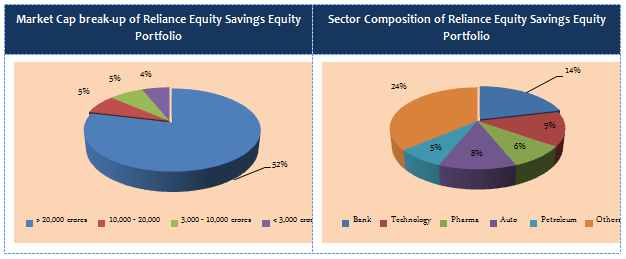

- Pure Equity: 20 to 40% of the fund’s portfolio can be allocated to equity with the objective of capital appreciation. As of end of October 2015, 38% of the portfolio was allocated to equities, net of futures positions. Even within the pure equity portfolio, the fund managers adopt a prudent strategy with 70 – 75% allocation to large cap companies.

For capital appreciation, the fund managers employ the GARP (Growth at a Reasonable Price) strategy. GARP strategy is a fine blend of growth and value strategies. For the benefit of readers who are not informed about growth and value strategies, in Growth funds the fund managers invest in companies that will experience faster growth in revenues, earnings per share (EPS) and consequently share price. Value funds, on the other hand, invest in value stocks, i.e. companies which are trading at a considerable discount to its intrinsic valuation. There can be a number of reasons for these companies to be undervalued in the market. There can be temporary industry specific or company specific issues, which can cause the share price to be depressed. Sometimes a temporary quarterly earnings shock can cause the share price to be depressed. An external event can have an unfavourable impact on the share price, for a limited period. However, over the long term, these stocks present good investment opportunities. A fund manager, who employs GARP strategy, identifies companies that show consistent EPS growth rate and at the same time do not have valuations (P/E multiples).

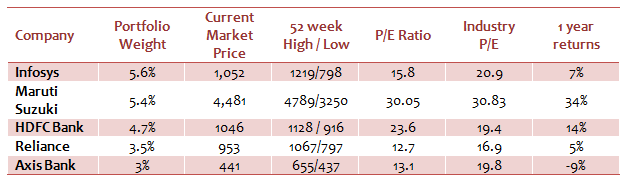

The fund managers of Reliance Equity Savings fund track divergence in valuations between large and midcap stocks in the same sector and also across sectors. Their aim is to create alphas both through bottoms up stock picking and also through sector positioning vis a vis the benchmark index, Nifty. The table below shows different statistics of the top 5 stocks in the portfolio of Reliance Equity Savings fund.

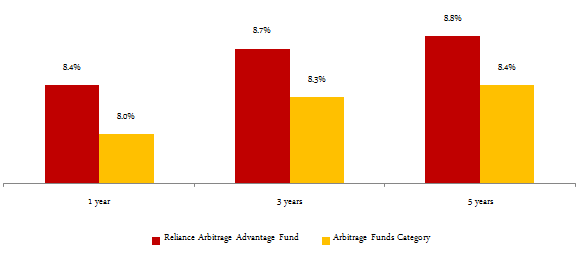

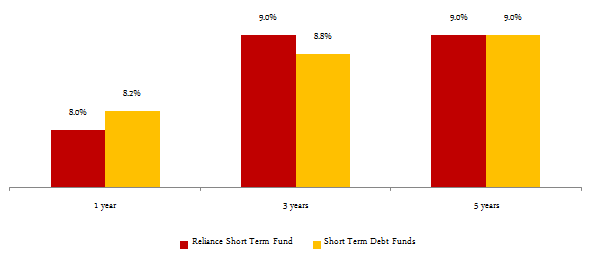

To get a sense of returns through the arbitrage, fixed income and pure equity strategies, we will look at historical returns of top performing Reliance Funds and the average category performance. Investors should note that past performance of mutual funds does not assure future performance. Investors should look at past performance only as reference point and not as an indicator of expected returns.

Let us first look at the annualized trailing returns of arbitrage funds and Reliance Arbitrage Advantage Fund over 1, 3 and 5 year periods.

Now, let us first look at the annualized trailing returns of Short Term Debt Funds and Reliance Short Term Fund over 1, 3 and 5 year periods.

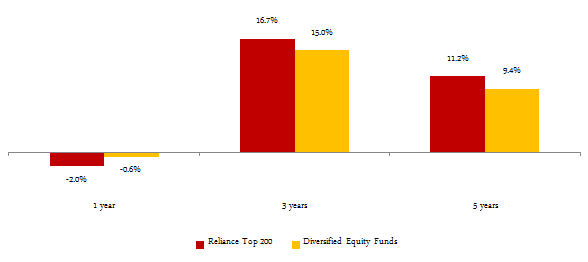

Finally let us look at the annualized returns of Reliance Top 200, a Large Cap oriented Equity fund over 1, 3 and 5 year periods versus Diversified Equity Funds Category.

Taxation Aspect

Earlier in the article, we had briefly touched upon the taxation of Reliance Equity Savings Fund. The scheme is treated as an equity scheme from an income tax perspective. Long term capital gains, for investment period of more than 1 year, are tax free. Short term capital gains, for investment period of less than a year, are taxed at 15%. Dividends paid out by the scheme are totally tax free.

Systematic Withdrawal Plan

Investors, who are looking for regular monthly income from their investments, can opt for Systematic Withdrawal Plan (SWP). In a SWP, investors can draw a fixed amount, at regular intervals, by redeeming an equivalent number of units of their investment. While this ensures stable regular cash flows, the balance units remain invested and continue to compound. Investors opting for SWP should consider short term capital gains tax and exit load. Therefore, it is always advantageous to start your SWP, one year after the allotment of units of the scheme.

Conclusion

For long term investors with moderate risk appetite, Reliance Equity Savings Fund is well positioned to generate both income and capital appreciation in the future. Investors can take advantage of Systematic Withdrawal Plans to generate regular income. Investors should consult with their financial advisors if Reliance Equity Savings Fund is suitable for their long term investment portfolios.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team