Peerless Equity Fund: Selecting high quality stocks to give superior risk adjusted returns

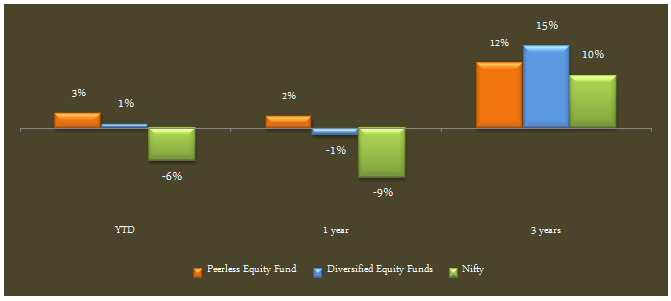

Market cycles are realities that all equity investors have to live with. Over the past 15 years, we had three bear market cycles. Some economists are of the opinion that market cycles will get shorter in the future. However, irrespective of market cycles, it is a fact that mutual fund investors who invested in a disciplined way created substantial wealth in the last 15 years. Some equity mutual funds, especially funds with significant exposure to small and midcap stocks, do exceptionally well in bull markets but also see deep value erosion in bear markets. They pick up again and do well when the market recovers. Amit Nigam, Head Equities, Peerless Mutual Fund, believes in creating long term wealth by earning consistent returns and more importantly by avoiding permanent losses of capital. The key to achieving these objectives is to select high quality companies that gave great business models and run by capable management teams with the highest corporate governance standards. Peerless selects these companies based on the proprietary stock selection model, the Peerless Score of Financial Strength. We will discuss the Peerless stock selection model in more details in a separate blog, but very briefly, Peerless screens companies based on two metrics, Return on Capital Employed (RoCE) and Free Cash Flows (For Manufacturing Companies) and Return on Equity (RoE) and Return on Asset (RoA) (For Financial Companies) over a long period that encompasses several market cycles. Mr Nigam explains that this methodology helps them is market neutral and helps them identify companies with strong business models which can deliver value and growth to investors in the long term. He adds this also ensures the protection of interest of minority shareholders, which include mutual fund investors. Their unique stock selection model has enabled Peerless Equity Fund to beat the benchmark index since its launch in 2011. What stands out in the performance of this diversified equity fund is the fact, that the fund has outperformed most of its peers in deep corrections. The chart below shows the trailing annualized returns of Peerless Equity Fund (growth option) versus the benchmark index and the diversified equity funds category.

Source: Advisorkhoj Research

Peerless Equity Fund has an AUM base of around र 190 crores and an expense ratio of 2.9%. The scheme is open for subscription for both growth and dividend options. Recently Peerless announced additional dividend sub-options for this scheme on prospective basis from November 2015 onwards.

- Quarterly Dividend (Payout and Reinvestment)

- Half Yearly Dividend (Payout and Reinvestment)

- Yearly Dividend (Payout and Reinvestment)

There is no exit load for this scheme. The fund manager of Peerless Equity Fund is Amit Nigam.

Portfolio Construction

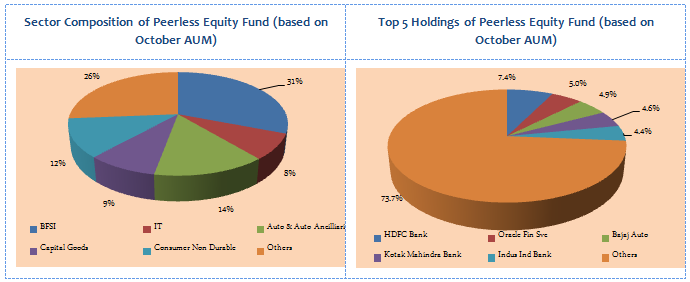

The fund has bias towards large cap stocks with strong growth potential. Large cap stocks account for more than 70% of the portfolio value. From a sector perspective, the portfolio has a pronounced bias towards cyclical sectors like Banking and Financial Services, Automobiles and Auto Ancillaries, Capital Goods etc. The portfolio is positioned to do well, when the capex cycle revives in the Indian economy. In terms of company concentration, the portfolio is very well diversified with its top 5 holdings, HDFC Bank, Oracle Financial Services Software, Bajaj Auto, Kotak Mahindra Bank and Indusind Bank accounting for only 26% of the total portfolio value.

Source: Advisorkhoj Research

SIP returns

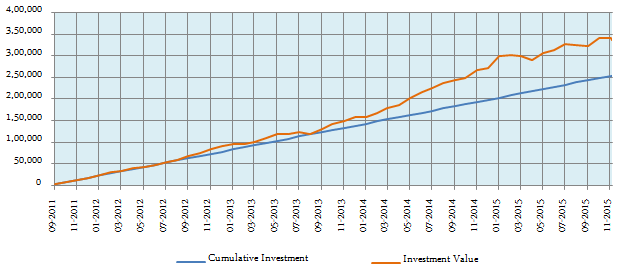

The chart below shows returns as on December 5, 2015 of र 5,000 monthly SIP in the Peerless Equity Fund Growth option, for respective years since inception of the scheme.

Source: Advisorkhoj Research

The chart shows that, a monthly SIP of र 5000 in Peerless Equity fund started at the inception of the fund would have grown to nearly र 3.4 lacs by December 4 2015. with a cumulative investment of only र 2.5 lacs. The SIP return of the fund since inception is nearly 14%.

Conclusion

The Peerless Equity Fund leverages a unique stock selection methodology which has the potential of giving superior risk adjusted returns in the long term. Though some top performing diversified equity funds had outperformed the Peerless Equity Fund over the past 3 years, investors should evaluate performance of this scheme over a long time horizon covering multiple market cycles since the investment approach has the potential to generate long term capital appreciation. Investors can consider buying the scheme through the systematic investment plan (SIP) or lump sum route. Investors can opt either for the growth option or the dividend sub-options depending upon their individual financial planning needs. They should consult with their financial advisors if Peerless Equity fund is suitable for their investment portfolio.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF FOF

Jan 9, 2026 by Advisorkhoj Team

-

Mahindra Manulife Mutual Fund launches Mahindra Manulife Innovation Opportunities Fund

Jan 9, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Short Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Low Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Small Cap Fund

Jan 8, 2026 by Advisorkhoj Team