2015 Pre Budget Rally: What are the brokerages recommending

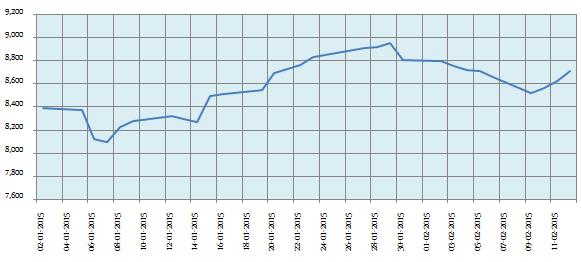

After a few days of weakness the market has resumed its upward journey. As on February 12 end of day, Nifty has reclaimed the psychologically important 8,700 level and is now marching towards the 8,800 level. Whether this marks the beginning of the pre-budget rally, only the next few trading sessions will tell. However, the budget will be an important event for the market, as it always is, but more so this year and it will certainly trigger a major move. The chart below shows the year to date daily price chart of Nifty.

The above chart shows that Nifty made its all time high on January 29 close to 9,000 points. After a period of consolidation, Nifty has resumed its upward journey towards its all time high. Experts believe the rally is likely to continue till the Union Budget, unless we get adverse global cues.

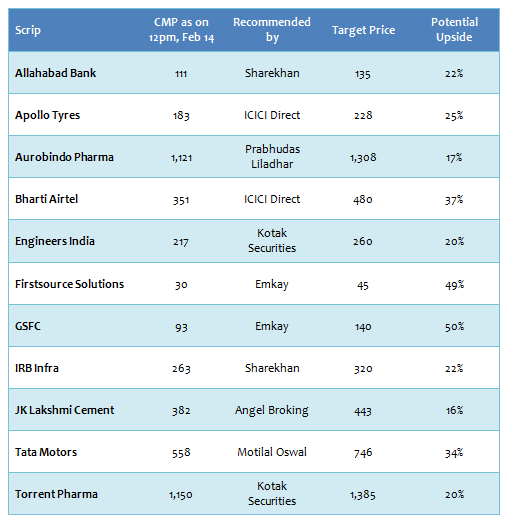

In this blog, we will discuss some stock recommendations in the current market scenario made by the top brokerage houses in the country. We have selected recommendations where there are at least a 15% upside potential, based on the current market price of the stocks. A word of caution, you should not expect the target prices to be achieved in the next few days or weeks. You need to have an investment horizon of a few months. Investors should consult with their broker or investment adviser, if these stocks are suitable for their equity portfolio, before investing in these stocks.

Conclusion

In this blog we have discussed some brokerage recommendation, where there is considerable upside potential, in the current market scenario, if the budget turns out to be favourable for equity markets. Investors should note that there are risks associated with investing in equities and should ensure that the associated risks are aligned with their individual risk tolerance levels. Investors should consult with their financial advisers, before taking a position in any of the stocks mentioned in this article. If the price targets are achieved, investors should discuss with their financial advisers, if they should remain invested or book profits.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Bandhan Mutual Fund launches Bandhan Gold ETF FOF

Jan 12, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF FOF

Jan 9, 2026 by Advisorkhoj Team

-

Mahindra Manulife Mutual Fund launches Mahindra Manulife Innovation Opportunities Fund

Jan 9, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Short Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Low Duration Fund

Jan 8, 2026 by Advisorkhoj Team