Do you know the great multi bagger stocks over the last 10 years

If you invested र 1 lac in Eicher Motors stock 10 years back, can you guess what your stock holding will be worth today? If you invested in Eicher Motors 10 years back and have been holding those shares till today, the value of your र 1 lac investment today would be over र 60 lacs (you would have also got dividends over the last 10 year period, which is over and above this). I am sure that, you will agree with me, this is serious wealth creation. Investors, who follow the stock market and are familiar with the Eicher Motor story, may say that Eicher Motors is an exceptional story. Yes, it is quite an exceptional story. Such humungous wealth creation is very rare, but Eicher Motors is not the only exceptional wealth creation story. Let us take Page Industries. If you invested र 1 lac in Page Industries on March 31, 2007 your investment value today will be more than र 40 lacs. This is also huge wealth creation. The compounded annual growth rate is as high as Eicher Motor’s. Now if you factor in the dividends paid by Page Industries, nearly 3600% over the last 10 years, and had you re-invested the dividends to buy shares of Page Industries, your returns would have been even higher. If you want more examples, then how about Gruh Finance? If you invested र 1 lac in Gruh Finance 10 years back, your investment value today will be more than र 30 lacs, after factoring in bonus and splits. If you also include dividends, the returns would be higher. If you had invested in TTK Prestige 10 years back, your returns would be similar to Gruh Finance. These scrips are indeed multi-bagger scrips.

To the people who think real estate is the best asset class, and there are many in India, in the last 10 years, you would have been thrilled with 3 to 4 times return on your investment. With the multi-bagger stocks that we discussed in the previous paragraph, we are talking about 30 – 40 times or even more returns. Many of my elder relatives told me in the early days of my career that, “Son, invest in real estate. Share prices move up and down, but real estate always goes up in value”. 20 years after I started my career, I do realize now that, share prices move up and down, but with respect to real estate, the hard reality today is that real estate prices in many markets in India today are down by more than 10 – 20% and, more worryingly, totally illiquid in many cases, something which many of extremely well intentioned elderly relatives could not even have imagined 15 – 20 years back. The matter of fact is that, the reality has changed substantially in the last 15 years. Anyway, the comparison of real estate and equity is a minor digression in the topic of our discussion in today’s blog post. Today we are discussing wealth creating stocks, more commonly known as multi-bagger stocks or scrips.

Most investors in stock markets would love to own these multi-bagger stocks, but identifying these stocks is not easy. For a Page Industries story, there is also a Suzlon Energy story. While Page Industries would have given you 40 times returns in the last 9 years, Suzlon Energy tells a very different story. In April 2006, Suzlon Energy was trading above र 250 per share and today it is trading below र 14. Some readers may be wondering how to identify these multi-bagger scrips. Most of these multi-bagger scrips that we have discussed are in small and midcap market segment and there are thousands of stocks in this market segment. It is indeed very difficult to identify these multi-bagger scrips. But at the same time, contrary to the perception of many retail investors, it is not true that, only midcap scrips are multi-baggers. There are quite a few examples of large cap scrips which have created substantial wealth for investors. We will discuss some of these scrips in today’s blog post.

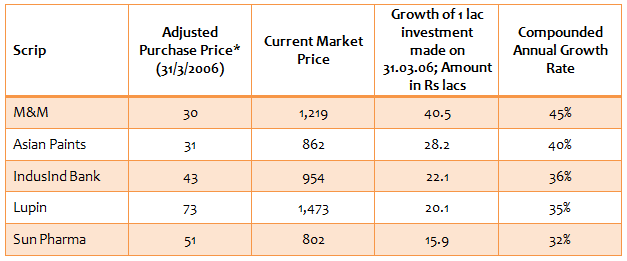

For our discussion today, we have selected 5 large cap scrips which created substantial wealth for their shareholders in the last 10 years. I would say upfront that, these scrips are, by no means, the only large cap scrips which created a lot of wealth for the investors. We have just taken five examples to demonstrate the potential of wealth creation by buying and holding equity shares. Here are some large cap names where you could have grown your र 1 lac investment to more than र 15 lacs, by simply buying and holding these scrips over the last 10 years.

Source: Yahoo Finance

Please note that the purchase price has been adjusted for dividends, splits and bonuses. You can see from the table above that a र 1 lac investment in each of these scrips would have grown to र 15 – 40 lacs in the last 10 years. While the returns of these large cap scrips are lower than the scrips mentioned in the first paragraph of the post, as is to be expected, even these returns are quite substantial from a wealth creation perspective. The annualized return of these investments over the past 10 years is 32 to 45%. You should know that, in the past 10 years, we have gone through three bear market phases (2008, 2011 and 2015 – 16). Even as I write this post, the Nifty is down more than 12% on a year on year basis. Therefore, there is no market timing bias in the wealth creation by these scrips. All these companies are very well known large cap companies. These companies have robust business models and are leaders or, at least, very significant players within their own industry segments or sub-segments. They are known to have significant competitive advantages in their own industry segments. They are also known to have very strong management teams. Finally, the merits of these scrips are not completely new to the investors, if they have been following the stock market regularly. Brokerage houses and independent stock analysts have been recommending these scrips for years now.

Many retail investors may have bought these stocks, but would have likely cashed out when they were making profits. Some investors may have even booked losses in these stocks, fearing further loss of money during bear markets. Our point is that, wealth can be created in equity markets only by buying and holding over a long investment horizon. Some investors ask us, whether they can get good returns by investing in stocks or mutual funds for 2 to 3 years. You can probably get decent returns over a three year investment horizon. But if you want to create substantial wealth, then you have to hold your investment over a long time horizon. The question that some readers of this blog may have is that, since the large cap scrips mentioned in our blog have run up in values considerably over the past few years does it still make sense to invest in them for the future? Well, to these readers, I would ask them to look up the 2006 April P/E ratio of Asian Paints or some other scrips mentioned in our post. Many of these scrips were not cheap even 10 years back. P/E ratio, while an important factor, should not be the only consideration for buying equity shares. Let us discuss this point further, with the help of an example.

Let us take Asian Paints as an example. Even 4 to 5 years back, Asian Paints was one of the costliest stocks, not just in India but in the world as well. The P/E ratio of Asian Paints in 2012 was over 36, much higher than that of Nifty and also other paint stocks. If Asian Paints was expensive at a P/E of 36, then we would have expected Asian Paints to give a much slower compounded annual growth rate (CAGR) relative to the market. However, in the last 5 years, Asian Paints share price has grown by nearly 30% on a compounded annual basis. If you invested र 1 lac in Asian Paints shares 5 years back, your investment value today would be close to र 3.5 lacs. Therefore, even at the perceived “high valuation” 5 years back, Asian Paints would have still given exceptional returns. Today Asian Paints P/E ratio is above 50. The reason why Asian Paints scrip sustained such a strong performance over the years is because the company delivered strong EPS growth, year on year, over the years.

Therefore, to the question, whether some of the scrips which gave very high returns in the past, can give strong returns in the future, there is no reason, why they cannot. However, it does not mean that a stock, which gave 40% CAGR in the past, can repeat that in the future. At the same time, there is no reason to believe that, just because the past returns were high, the future returns will be muted. We have to understand the reasons behind the strong returns in the past. If a stock has given exceptional returns over a period of 10 years, there must be good fundamental reasons why it has been able to deliver such strong returns. While an understanding of the factors behind strong historical returns, requires considerable expertise and experience, at the very least, if a large cap company has given strong returns over a period of, as long as 10 years, one can assume that, the company has a robust business model, competitive advantage in the industry and a strong management, which also takes care of the interest of minority shareholders, like you and me. One important point that we, as investors, should research is whether, there are recent changes in the company’s business or in the industry sector, where the company is operating in, that may cause a deviation from past performance. There are multiple examples, where share prices went through a slump, when there were management changes, e.g. Infosys. Investors should also look at the prospects of the industry sector. Most commodity business are going through a bad phase now and therefore, even if some of these companies gave fantastic returns in the past, one cannot expect such returns to repeated in the near or even medium term.

The more important point is that, you need to have a long investment horizon. The legendary investor, Warren Buffet has held stocks for, as long as, 30 to 40 years. An uncle of mine, who worked in Hindustan Lever Limited, as HUL was called back in 1980s, bought small amounts of the stocks of his company and other companies from mid 1980s onwards to about 2005. He told me many years back, in the 90s, that, his philosophy was to buy shares of only blue-chip companies since they were relatively more immune to stock market scams, which were not uncommon 20 to 25 years back. He never bought into IPOs, but subscribed to rights issues of the shares he owned, whenever he had an opportunity. He never sold his shares in his lifetime. He told me about 20 years back that, his equity shares would be the inheritance he would leave behind for his children. Today, my uncle is no more, but his equity portfolio, after splits, bonuses and dividends, is enough to take care of all the financial needs of his three children. What is remarkable is that, he played quite safe in his choice of scrips, since he only invested in blue-chip scrips. So while he did not get 40 – 50% CAGR on his investment, he was still able to generate enough wealth, which could at least last a generation after him. That is the power of investing in equities. My point is that, you do not have to look for a stock, which can give 40 to 50% annualized returns. Any good stock can become a multi-bagger stock for you, over a long investment horizon, if you are disciplined in your investment approach. Case in point is Infosys.

Infosys Case Study

If you bought 100 shares of Infosys in 1993 at the rate of र 95 / share, today you would own 51,200 shares of Infosys after all the splits and bonuses. At today’s stock price of र 1,200 / share, the value of the 100 shares bought in 1993, would be र 6.1 crores. How much did you invest back in 1993? You would have invested only र 9,500. So your investment of just र 9,500 in Infosys shares back in 1993 would be valued today at र 6.1 crores. Is it not humungous wealth creation? You can say that, how will I have known back in 1993 that Infosys would be, what it is today? It is a fair point. But, by 1997 or 1998, Infosys was a very well known company. Even if you invested र 10,000 in Infosys in 1998, your Infosys shares today would be valued at over र 5 crores today, after splits and bonuses.

Conclusion

In this blog post, we have discussed some multi-bagger scrips in the last 10 years. These scrips were able to create substantial wealth for their investors over a long time horizon. Identifying the right scrips for your investment portfolio requires experience, expertise and effort. For the average retail investors, who do not have the experience, expertise or the bandwidth to devote towards investments, mutual funds are excellent investment choices. Good diversified equity mutual funds have given more 15% annualized returns in the last 10 years. While these returns are lower than 30 – 50% compounded annual returns, which the multi-bagger stocks referred to in our post delivered in the last 10 years, it is still higher than the returns of almost all other asset classes. Further, good diversified equity funds are much easier to identify than these multi-bagger stocks and they have much lower risks compared to investing in shares directly. For the average investor, investing in equities and holding your investment over a long tenure, is the best possible way of wealth creation.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team