Top stock picks for Samvat 2071 from leading brokerages

There are several reasons to bullish about equity markets this Diwali. Post the state elections in Maharashtra and Haryana, the Government has announced some key policy measures. The long overdue diesel price deregulation has been announced and will lead to substantial easing of the subsidy burden. In the short term diesel price deregulation will have a cooling effect on inflation, leading some market participants to hope for a rate cut by the Reserve Bank of India in the next policy meeting. The Government has also revised the gas pricing formula resulting in a hike of $1.4 per million BTU. This is undoubtedly good news for upstream Oil and Gas companies like Reliance Industries, ONGC and Cairns. The Government has also taken positive steps to cleaning up the coal block mess of the previous UPA Government by acquiring the cancelled coal blocks through an ordinance and reserving a pool of coal blocks for allotment to public sector undertakings like NTPC and State Electricity Boards. The remaining cancelled blocks will be allotted to private sector companies through an e-auction. With the next major state election almost a year away, there is room for the Government to push through tough policy measures to revive economic growth. Among the expected policy measures, financial sector reforms, foreign direct investment (FDI) in insurance, labour reforms and implementation of Goods and Services Tax (GST) are believed to be on top of the agenda of the NDA Government. On the international front, there are concerns about the global economy especially in Europe. However hopes of an ECB stimulus boost have brought cheer to the global equity markets. While concerns about the global economy remain, market experts believe that India will be a strong outperformer.

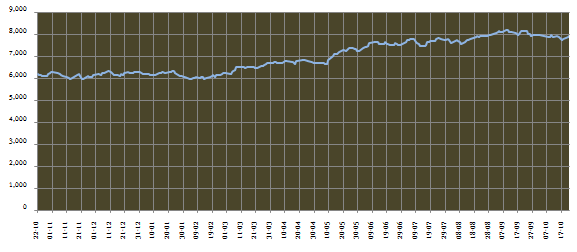

In the last 12 months the Sensex and the Nifty has risen by 28%. Both the indices are trading near their all time highs. The chart below shows the daily Nifty chart over the last 12 months.

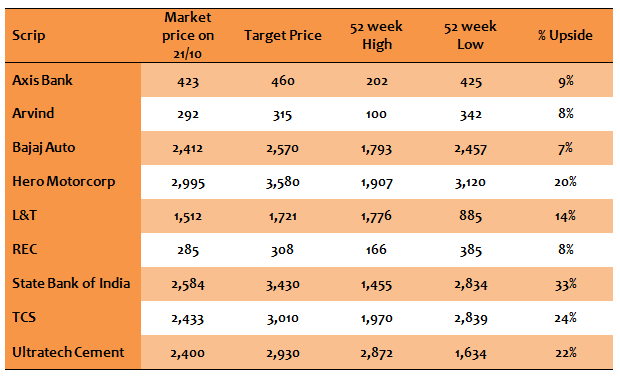

There is reasonably strong resistance level at 8,100 for the Nifty (please read our article, Support and Resistance levels: Technical resistance for Nifty at 8,000 to 8,100). But given the bullishness in the market and policy announcements by the Government, it is quite likely that this resistance may be breached in the short term (maybe even by the time you read this article). But even if there is profit booking at 8100 level, the future outlook of the Indian market is quite positive, as we move into Vikram Samvat 2071. Market experts suggest that the Nifty may touch 9000, 12% upside from the current levels, in the next few months if the Government continues to move forward on its reform agenda. The sectors in focus are the cyclicals like Banks, Infrastructure, Power, Oil and Gas, etc. As we begin Samvat 2071, we have selected some top stock picks for the from leading brokerage houses like Kotak Securities, Prabhudas Liladhar, Motilal Oswal, Angel Broking, Anand Rathi, Religare, ICICI Direct etc. We have selected stock picks that have a significant upside potential from the current levels. Here is the list of top stock picks for Samvat 2071.

Conclusion

In this blog we have discussed top brokerage stock picks, where there is considerable upside potential in Samvat 2071. You should note that these brokerage recommendations are not for intraday or buy today sell tomorrow trades. Investors should be prepared to hold these stocks for at least few months to realize the target price. Smart investors follow a disciplined investment plan and use market dips to accumulate stocks. Investors should note that there are risks associated with investing in equities and should have stop loss targets depending on their risk tolerance levels. Investors should consult with their brokers or financial advisers, before taking a position in any of the stocks mentioned in this blog. If the investment targets are achieved, investors should discuss with their financial advisors, if they should remain invested or book profits.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Kotak Mahindra Mutual Fund launches Kotak Nifty200 Value 30 Index Fund

Jan 15, 2026 by Advisorkhoj Team

-

Bandhan Mutual Fund launches Bandhan Silver ETF FOF

Jan 12, 2026 by Advisorkhoj Team

-

Bandhan Mutual Fund launches Bandhan Gold ETF FOF

Jan 12, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF FOF

Jan 9, 2026 by Advisorkhoj Team

-

Mahindra Manulife Mutual Fund launches Mahindra Manulife Innovation Opportunities Fund

Jan 9, 2026 by Advisorkhoj Team