Financial Planning in Sweet Sixties

Now it is time to live life king size with no more a list of goals to fulfill. Your life is going to be more than just a list of goals that has to be ticked off. No more living from one goal to another. You can pursue all hobbies that you left midway to get on with ‘real’ life or go on the cruise that you had planned in your 30s. You can embark on this part of life sans all worries because you have saved and invested enough to ensure that from now onwards is nothing short of comfortable. However, you always have to ensure that the fixed income you have generated and the regular income you have planned stay on track. This is how you can keep your finances in track in your 60s:

Make a Financial Inventory

Financial inventory consists of assessing your financial situation in term of assets and liabilities. You are in a stage where you have already taken retirement or are away from it by just a few years. Your Insurance term plan and other policies may be close to their respective maturity dates and you are due to get a lump sum. You may have received a lump sum from a SIP that you started in your 20s OR 30s. The NPS account has reached its maturity period and you will start receiving a monthly income from that. This is the period where you might be receiving or have received lump sums and regular income from your investments. All of a sudden the cash flow might be overwhelming. Hence, it calls for financial inventory where you document every source of cash inflow and match it with cash outflow. This will give you a clear idea of your monthly income and expenses.

Compulsory Capital Protection

Capital protection refers to a situation where whether your investments are making profits or losses the principal amount is in no danger of reducing. Capital protection is crucial in the 60s because from retirement onwards your chances of relying on fixed income are higher. Capital protection funds which invest in fixed income instruments and also allow capital appreciation by investing a small portion in equity is a good investment option. Hasty and risky investments in volatile funds can be fatal for your retirement corpus. Therefore, the aim of your investments is not to get higher returns but to make sure they are earning enough returns and not becoming stagnant or risky.

Adequate Health Insurance

It is no secret that with age you are more prone to a deteriorating health. While at any stage of your life you could have tackled the rising medical cost because of your steady regular income. The same possibility does not apply to retirement. You do not have steady regular income but a fixed fund. Hence the erosion of the fund due to a medical emergency is not an ideal scenario. Having adequate health insurance allows protection against unforeseen medical emergencies and it also becomes a steady investment option.

Invest in Senior Citizen Savings Scheme (SCSS)

This is a savings scheme exclusively for the senior citizens. As on 1/4/2015 the interest rates are 9.3% and paid out on a quarterly basis. The maturity period is 5 years. The minimum deposit is 1000 INR and cannot exceed 15 lakhs INR. After maturity, the account can be extended for further three years within one year of the maturity. This scheme is also applicable for tax exemption under section 80C allowing senior citizens to enjoy tax rebates. The scheme has a moderate risk profile allowing senior citizens to generate returns without putting their capital at risk and avoiding volatility of markets.

Invest in Mutual Fund MIPs & Balanced Funds

Since your risk taking ability has goes down substantially in your sixties, you should shift or invest a part or your investments in MIPs of Mutual Fund with Quarterly or Monthly Dividend payout options. Mutual Fund MIPs are hybrid dent oriented conservative schemes with 15 – 25% exposures in equities which helps you get a little more tax efficient returns over bank or post office fixed deposits.

In your sixties, the other attractive investment option could be balanced fund schemes of mutual funds. Balanced funds are hybrid equity oriented schemes which invests 20 – 25% in debt and rest in equities and thus provides much better return than bank fixed deposits, MIPs, SCSS, Post Office MIPs and fixed deposits. However, please note that due to higher equity allocation in balance funds your investment horizon should be atleast 4 – 5 years onwards. While the longer holding period ensures risk diversity, it also helps in compounding. Another interesting aspect of Balanced Funds is tax free dividends and no capital gain tax in case the holding period is more than 12 months.

Find Alternate Means of Generating Income

The retirement corpus and the receipts of various investments over the years maybe enough to cover your expenses. However, there is no accounting for needs and lifestyle. To accommodate various changes in your lifestyle and to keep up with changing times and prices you always need to be financially prepared. If you have properties that are not being used then you are not tapping into your assets fully. You may let out an empty property which could generate monthly cash flow. If you wish to move to a smaller accommodation because you do not need the big house as your kids have all moved out, then, the big house could also provide a steady source of income. Exploring options within your available assets could provide regular income.

Asset Allocation

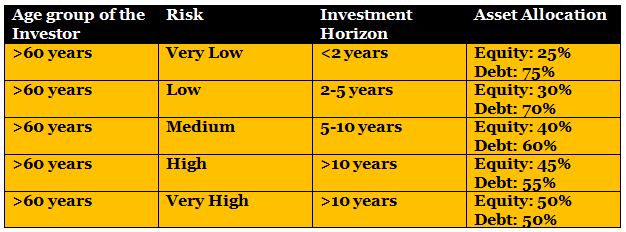

In 60s it is about safekeeping your money rather than chasing returns. Hence, asset allocation should focus on capital protection rather than capital appreciation. Asset allocation is crucial to ensure that your fixed income does not remain stagnant and keeps generating the returns without endangering the capital. Here are some possible asset allocation strategies depending on your investment tastes and preferences. In the table below it is clearly shown that an investor who is above 60, despite having high risk appetite is advised to ride low in equities. This precaution is usually doled out by financial planners who are assisting in your retirement planning. Emphasis is given to debts as it allows moderate returns with lesser risk on the capital.

Draft Your Will

We have always been told to hope for the best and prepare for the worst. Preparing a will is doing just that. In your long life you may have already understood, life rarely goes as planned. Hence, making a will is going to benefit you more than harm you. It will also allow you to do an assessment of your available assets and your financial situation. In case you are incapable of taking financial decisions you may want someone trustworthy and capable to take that place. Hence, nominating the individual in the will safeguards your assets and your family members. Select an executor who is usually an unbiased individual to foresee that the dictates in the will be carried out in your absence.

Conclusion

You are entering a beautiful period in your life where the road ahead allows you the luxury of leisure. Take the pottery class you wanted to take or the dance class in the local school. You have worked hard to build yourself and your spouse a good life. It is time you started reaping those benefits and live a life free of worries. Welcome to the sweet sixties beautiful times are ahead of you.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team

-

Shriram Mutual Fund launches Shriram Money Market Fund

Jan 19, 2026 by Advisorkhoj Team

-

PPFAS Mutual Fund launches Parag Parikh Large Cap Fund

Jan 19, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty200 Value 30 Index Fund

Jan 15, 2026 by Advisorkhoj Team

-

Bandhan Mutual Fund launches Bandhan Silver ETF FOF

Jan 12, 2026 by Advisorkhoj Team