Measuring Risk Tolerance of Investors

A comprehensive understanding of risk plays the most important in making investment decisions. However, the average the retail investor often does not know how to determine this. When a financial adviser asks an investor, what his or her risk appetite is, investors often instinctively say it is low. It is understandable why investors are risk averse. Nobody likes to lose money. That is why it is very important that investors and financial advisers understand the distinction between risk appetite and risk tolerance. Simply put, risk appetite is the investor’s willingness to take risk, whereas risk tolerance is the investor’s ability to take risk. Risk appetite depends on the investor’s age, experience and knowledge about investments, but it differs from person to person. A 25 year old professional with a good salary and no dependents may have low risk appetite, whereas a 65 year old retiree with a spouse and no mediclaim, but with a lot of investment experience may have a high risk appetite. When a financial adviser asks the investor, “How much risk are you willing to take?” the answer the adviser gets is the risk appetite of the investor. Therefore, in addition to enquiring about the investors risk appetite, it is important that financial advisers employ a structured objective approach to understand the risk tolerance of the investor. The investor with low risk appetite and high risk tolerance needs to understand, how much returns he or she is giving up for capital safety. On the other hand, an investor with high risk appetite and low risk tolerance needs to clearly understand the potential loss implications.

Evaluating Risk Tolerance

There are several methods to determine risk tolerance of an investor. Some of these are nothing more than thumb rules. It is important to note that, none of these methods on a standalone basis is a comprehensive measure of risk tolerance. Financial advisers should use a combination of some or ideally all of these methods, depending upon the situation, to gain a comprehensive understanding of the investors risk tolerance. Financial advisers should also aim to educate the investors, about their actual risk tolerance. Here are some of the methods used to evaluate risk tolerance.

Rule of 100:

This is a very popular thumb rule for measuring risk tolerance. Simply put, you should subtract the investor’s age from 100, and the result suggests the maximum percentage amount of the investor’s portfolio that should be exposed to equities. So for a 25 year old investor, this rule suggests that 75% of his or her portfolio should be invested in equities, and for a 40 year old investor, this rule suggests that 60% of the portfolio should be invested in equities. There are several deficiencies of this method. It is too simplistic and ignores the financial situation of the investors. Another criticism of this method is that it gives high equity allocations to retirees or investors near retirement. Investors and financial advisers can use this thumb rule for directional equity allocationsTime Horizon of Investment:

This is one of the most important factors in determining risk tolerance. The longer is the investor’s time horizon greater is his or her risk tolerance. Investors should look at their investment goals and determine the time horizon for accomplishment of these goals. The following guideline can be used to determine risk tolerance- Low Risk Tolerance: Time Horizon less than 5 years

- Medium Risk Tolerance: Time Horizon between 5 to 15 years

- High Risk Tolerance: Time Horizon more 15 years

Maximum Loss Formula:

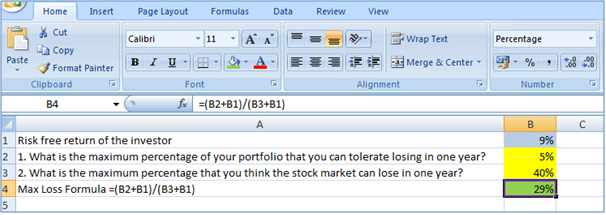

The Max Loss formula seeks to help investors determine the maximum percent of their portfolio that they should expose to equities? The financial adviser can ask the investor two questions:-- What is the maximum percentage of your portfolio that you can tolerate losing in one year?

- What is the maximum percentage that you think the stock market can lose in one year?

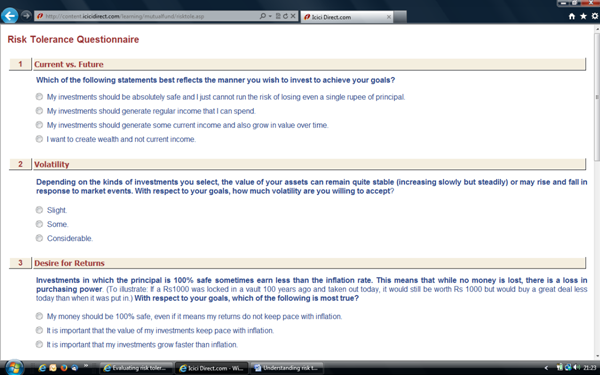

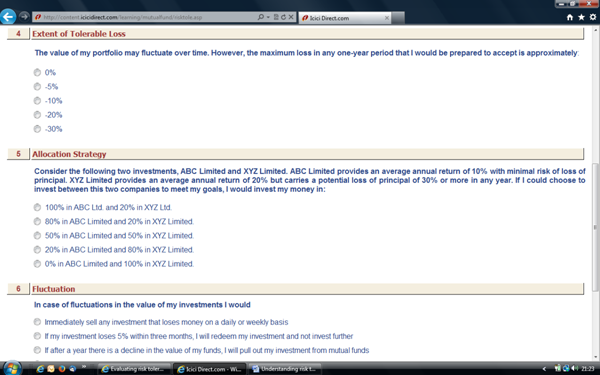

Psychometric Risk Tolerance Questionnaire:

Risk tolerance questionnaire is another popular method of determining the investor’s risk tolerance. Investors answer a set of questions in a questionnaire depending upon the risk profiles. The answers to the questions help in evaluation of the investor’s risk tolerance. Financial advisers have designed a variety of questionnaires that essentially are similar in nature. Just as an example of how to design a questionnaire, below is the screenshot of the ICICI Direct questionnaire to calculate investor risk tolerance.- Financial situation of the investor: While the above methods can give a good indicator of the investors risk tolerance, a comprehensive evaluation of risk tolerance requires an understanding of the financial situation of the investor. Financial advisers should note that all investors may not be comfortable disclosing their financial information to their advisers. In that case advisers can rely on the above methods to determine the risk tolerance of their clients. However, an evaluation of the following factors along with the methods discussed above will help the financial adviser and the investor gain a comprehensive understanding of the risk tolerance of the investor.

- Income and Expenses of the investor

- Liquid (cash savings) of the investor

- Short term financial goals

- Insurance cover (both life insurance and health insurance) of the investor

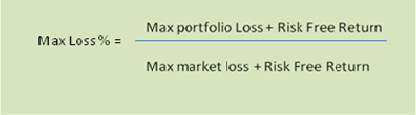

The formula of Max Loss % is as follows:

Let us illustrate this with an example. Let us assume, the answer to question 1 is 5% and question 2 is 40%. In other words the investor can tolerate losing a maximum of 5% of his or her portfolio in one year, and the investor thinks that the stock market can go down by a maximum of 40% in one year. Let us further assume that the investor can get a risk free return of 9% (fixed deposit interest rate). The excel screenshot below illustrates, how to calculate the max loss %.

Therefore, in this method the maximum allocation to equity for this investor should be 29%. Higher the maximum percentage of the portfolio the investor can tolerate losing, higher is the equity allocation.

For each question, the risk model awards lower risk scores to the investor, who chooses the first or second option and higher risk scores to the investor, who chooses the third or fourth option. The criticism of the multiple choice question method is that is based on investor perception of risk. However, a properly designed questionnaire such as the one above enables a psychometric evaluation of the investor’s risk tolerance. Financial advisers can use the questionnaire method along with the other methods discussed above to understand the investor’s risk tolerance.

Conclusion

Risk return relationship is one the fundamental principles of finance. Therefore it is very important that investors do an objective evaluation of their risk tolerance before making investment decisions, instead of relying on perceptions. Investors or financial advisers can use a combination of the methods described above to determine the risk tolerance of the investor.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team

-

Shriram Mutual Fund launches Shriram Money Market Fund

Jan 19, 2026 by Advisorkhoj Team

-

PPFAS Mutual Fund launches Parag Parikh Large Cap Fund

Jan 19, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty200 Value 30 Index Fund

Jan 15, 2026 by Advisorkhoj Team

-

Bandhan Mutual Fund launches Bandhan Silver ETF FOF

Jan 12, 2026 by Advisorkhoj Team