DSP Black Rock Strategic Bond Fund: Excellent Rolling Returns from this highly rated income fund

Government small savings schemes and bank fixed deposits are the automatic fixed income investment choices for the vast majority of retail investors. Based on information from various sources, the Government is expected to reduce the interest rates in small savings schemes (NSC, PPF etc) from April onwards by as much as 50 basis points. There are also reports of Finance Ministry officials working on a proposal to reset small savings interest rate on a quarterly basis and peg it to the corresponding G-Sec yields. The Reserve Bank of India has been pushing the Government to reduce small savings interest rates so that the banks can transmit the reduction in policy rates. Once the Government reduces the small savings interest rate, the banks are also expected to reduce their term deposit interest rates. While the Government is likely to provide relief to senior citizens and Sukanya Samriddhi Yojana for the girl child, other fixed income investors who rely on small savings schemes and bank FDs are likely to be impacted. However, if investors explore the world of debt mutual funds they will a variety of solutions for different investment tenures and interest rate scenarios. There is very little awareness about debt mutual funds and also misconceptions regarding these products. Many investors think that debt funds are very risky. It is true that debt funds are subject to market risk and do not assure returns. However, if you develop an objective understanding of risks and understand risk return characteristics of different debt funds, you will be able to identify products that are suitable for your investment needs (please see our post, Demystifying debt mutual funds). For long term fixed income investors, income funds are excellent investment choices. In this post, we will review one of the top income funds, DSP Black Rock Strategic Bond Fund.

Many retail mutual fund investors think that, long term debt funds or income funds are very risky and volatile. It is true that long term income funds are sensitive to interest rate movements. However, investors should understand the linkage between volatility and investment tenure. The longer your investment tenure less is the impact of volatility on your final fund value. The chart below shows the 3 year rolling returns of DSP Black Rock Strategic Bond Fund (Growth Option) since the inception of the scheme. At Advisorkhoj, we believe that Rolling Returns over a sufficiently long investment horizon is the best measure of an income fund’s performance. Trailing returns and point to point returns are biased by the market conditions specific to the period in question. Rolling returns are the total returns of the scheme taken for a specified period on every day and taken till the last day of the duration. In this chart we are showing returns on every day from the inception of the scheme and comparing it with the benchmark. We have selected 3 years as the rolling returns period because one should have long investment horizon for income funds covering interest rate cycles. The orange line shows the 3 year rolling returns of DSP Black Rock Strategic Bond Fund (Growth Option) and the black line shows the 3 year rolling returns of CRISIL Composite Bond Index.

Source: Advisorkhoj Research

You can see that DSP Black Rock Strategic Bond Fund has beaten the benchmark consistently from 2009 onwards. This is the hallmark of a well managed fund. Now look at the 3 years rolling returns of DSP Black Rock Strategic Bond Fund from 2010 onwards. The three year rolling returns never fell below 25%, which implies that if you invested in DSP Black Rock Strategic Bond Fund on any day from the beginning of 2010 onwards and remained invested from three years, then after three years you would have got a minimum return of 25%. On an annualized basis the minimum three year returns was 7.7%. During this period, investors also got double digit annualized returns over a three year period. Since 2010 we have gone through periods of increasing interest rates and decreasing interest rates. If you were under the impression that income funds are risky, let the chart above guide you to objectivity.

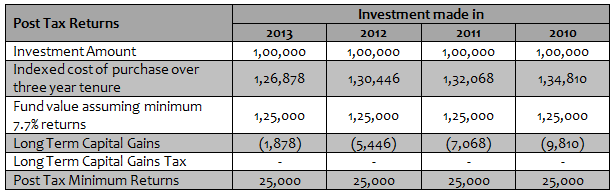

Post tax returns

Let us now look at post tax returns. For investment tenures of over three years, debt funds are taxed at 20% with indexation benefits. Though debt fund taxation was changed in the 2014 Budget, for the sake of our analysis, let us assume that the same tax law applied since 2010. The table below shows the post tax returns of DSP Black Rock Strategic Bond Fund since 2010 assuming minimum 7.7% returns over investment tenures of three years.

The table above shows that, in this example the long term capital gains tax is zero due to indexation benefits. Interest income from fixed deposit and many small savings schemes are taxed as per the income tax rate of the investor. An investor in the highest tax bracket, could have got at least 1.5 – 2.2% higher annualized post tax returns compared to fixed deposits or small savings schemes by investing in DSP Black Rock Strategic Bond Fund since 2010 onwards.

Fund Overview

DSP Black Rock Strategic Bond Fund was launched in May 2007 and र 2,930 crores of assets under management. The expense ratio of the fund is 1.07%. The scheme has no exit load. Dhawal Dalal is the fund manager of this scheme. The scheme has been ranked 1 by CRISIL in their latest quarterly ranking. The scheme has given 7.6% compounded annual return since inception. In addition to the usual Growth and Dividend options, daily, weekly and monthly dividend options are also available.

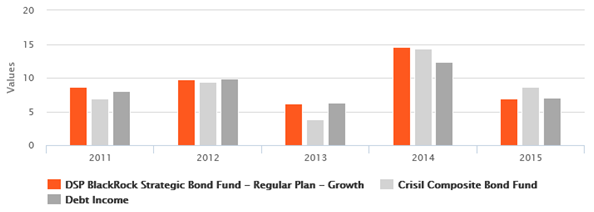

The chart below shows annual returns of DSP Black Rock Strategic Bond Fund compared with average income fund and benchmark returns over the last 5 years.

You can see that the fund has outperformed the income fund category as well the benchmark in most years.

The Yield to Maturity of the fund portfolio is 7.75% and the modified duration is 5.84 years. For the benefit of readers, who are not familiar with the concepts of Yield to Maturity and Modified Duration, Yield to maturity (YTM) is the return which a bond investor will get by holding the bond to maturity. For a debt fund, it is the return which the fund will get by holding the securities in its portfolio to maturity. Modified duration is price sensitivity of a bond to changes in yields or interest rates, in other words modified duration is the change in the price bond with a change of 1% in interest rate. So if the modified duration of a bond is 10 years and interest rates go down by 1%, then the bond price will increase by 10%.

While DSP Black Rock Strategic Bond Fund is sensitive to interest rate changes, the interest rate risk of the scheme is lower than long term income funds with longer modified durations. Some long term income funds have modified durations in the range of 9 to 10 years or even more. The returns of DSP Black Rock Strategic Bond Fund will be more stable than the returns of longer duration funds. The credit quality of the portfolio is excellent. 84% of the portfolio is AAA and 11% is rated AA.

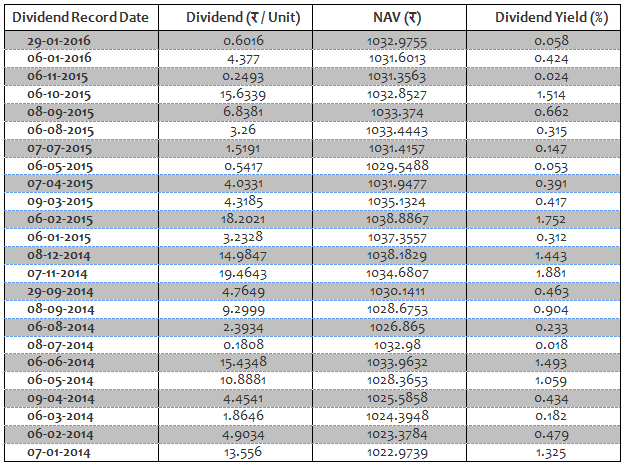

Dividend Payout Track Record

As discussed earlier, the scheme has daily, weekly and monthly dividend options. The scheme has a strong dividend payout track record. The table below shows the monthly dividend payout of the scheme over the past two years.

Conclusion

DSP Black Rock Strategic Bond Fund is a great investment option for long term debt investors. It is important that investors have a long investment horizon of at least 3 years when investing in this scheme. Investors should also have tolerance for short term volatility. Investors who want regular income can opt for various dividend options depending on their cash flow needs. Investors should understand risk factors, particular relating to interest rates, before investing in the scheme.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

UTI Mutual Fund launches UTI Nifty500 Shariah Index Fund

Feb 5, 2026 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Multi Asset Omni Fund of Funds

Feb 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Services Fund

Feb 4, 2026 by Advisorkhoj Team

-

HDFC Mutual Fund launches HDFC Nifty India Consumption Index Fund

Feb 4, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team