Birla Sun Life MNC Fund: A great wealth creator for investors over 20 years

I have said a number of times in my blog that, the world of investments has many nuances and our endeavour in Advisorkhoj is to make investors aware of these nuances. We often see financial advisors and media influencers making sweeping generalizations, which are not very helpful for investors and in fact, can lead to making sub-optimal investment decisions; in fact, I have wrote an article on this topic (Dangers of oversimplification in investing) around two months back.

A common notion among many investors and also financial advisors is that, sector funds are risky and require the investors to time their entry and exit. I do not disagree with this notion, but I have seen that, many financial advisors and investors paint all thematic funds (which include sector funds) with the same brush. This is incorrect because, while sector funds are exposed to sector concentration risk, there are many a thematic funds, which are diversified across a number of sectors. These funds can add a lot of richness to an investor’s portfolio. Birla Sun Life MNC Fund is a great example of such a thematic fund.

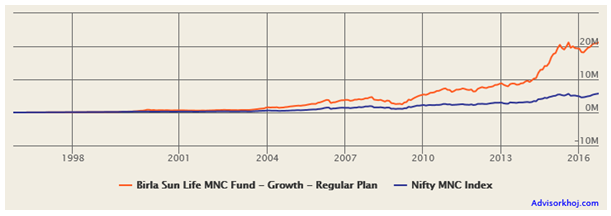

If you had started a hypothetical SIP (र 5,000 monthly) in Birla Sun Life MNC Fund 20 years back, your investment value today would have been over र 2.1 crores with a cumulative investment of just over र 12 lakhs (please see the chart below).

Source: Advisorkhoj Research

You can see from the chart above that, the wealth creation by this fund over a very long term investment horizon has truly been magnificent. The monthly SIP XIRR of this fund over the last 20 years has been over 24%. The SIP returns of this fund even over the last 10 years has been outstanding and this is one of the best performing thematic funds (in terms of SIP returns) over the last 10 years (please see the best performing SIPs of thematic mutual funds over the last years, Top Performing Systematic Investment Plan - Equity Funds Thematic)

Fund Overview

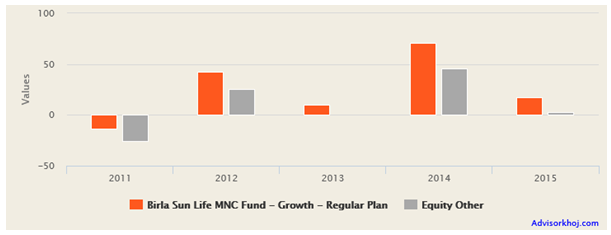

Birla Sun Life MNC Fund is suitable for investors with a long time horizon, looking for high capital for longer term financial objectives like, retirement planning, children’s education etc. The fund was launched in April 1994. It has an AUM base of about र 3,467 crores. The expense ratio of this fund is 2.35%. Veteran fund manager, Ajay Garg, manages this scheme. The CAGR since inception of this fund (22 years back) is more than 20%. The chart below shows the annual returns of this fund, over the last 5 years.

Source: Advisorkhoj Research

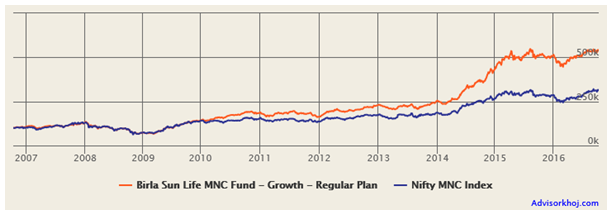

You can see that, the fund outperformed its peers in different (bull and bear) market conditions. The chart below shows the NAV movement of this fund over the last 5 years.

Source: Advisorkhoj Research

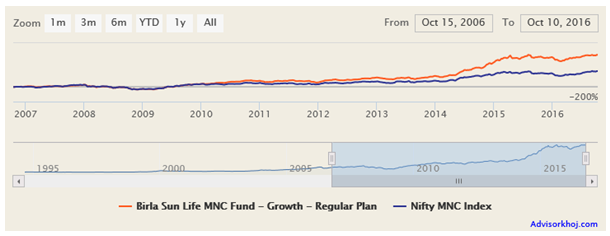

Rolling Returns

The chart below shows the three year rolling returns of Birla Sun Life MNC Fund over the last 10 years. We have chosen three year rolling returns period, because we think that, investors should have a sufficiently long investment horizon for Birla Sun Life MNC Fund.

Source: Advisorkhoj Rolling Returns Calculator

You can see in the chart above that, the 3 year rolling returns of the fund, almost always beat the benchmark, over the last 10 years. You can also see that, the 3 year annualized rolling returns of Birla Sun Life MNC Fund were almost always (more than 95% of the times) in double digits. Further, the three year annualized rolling returns of the fund were over 20%, nearly 50% of the times over the last 20 years. The trailing 3 year annualized return of the fund (as on October 10, 2016) was over 30%. The consistent rolling return performance versus the benchmark is a testimony to high quality fund management of Birla Sun Life MNC Fund.

Portfolio Construction

As per its investment mandate, Birla Sun Life MNC Fund, would invest exclusively in securities of multinational companies in order to achieve long term growth of capital at relatively moderate levels of risk. While the fund manager has a high growth focus, he has constructed a balanced portfolio which limits volatility on the downside. This has enabled the fund manager to give strong returns across bull and bear market cycles.

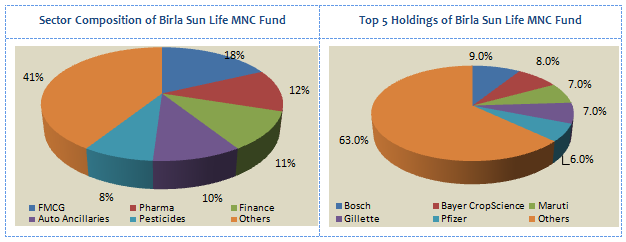

In terms of sector allocation, the portfolio is well balanced between defensive and cyclical sectors like FMCG, Pharmaceuticals, Finance, Automobile and Automobile Ancillaries, Pesticides and Capital Goods. From a company concentration standpoint, the top 5 stock-holdings account for 37% of the company’s portfolio value. The Top 10 holdings account for nearly 60% of the company’s portfolio value. Purely from a concentration risk standpoint, the stock portfolio of the fund may seem a little concentrated, but such is usually the case with thematic funds.

Source: Advisorkhoj Research

The performance of the fund on year to date basis has been relatively subdued due to some sector specific factors like, the regulatory challenges faced by Indian pharmaceutical companies, impact of Brexit on some specific companies. However, we believe these are all temporary issues and strong companies are able to overcome challenges.

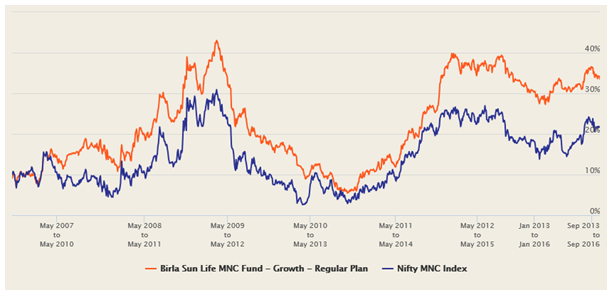

Ajay Garg is an industry veteran, a very experienced fund manager. He does not chase momentum stocks; he identifies great companies which show flexibility in adapting to changing business and market scenarios, and try to enter these stocks early in their growth cycle. The chart below shows the growth of र 1 lakh lump sum investment in Birla Sun Life MNC Fund over the last 10 years.

Source: Advisorkhoj Research

Conclusion

As per a recent Economic Times article (dated October 13, 2016), one in every two listed MNC stocks gave more than 100% returns in the last 5 years. As such, these stocks can add a lot of richness to diversified investment portfolios. र 1 lakh lump sum investment in Birla Sun Life MNC Fund would have grown to र 5.4 lakhs, over the last 10 years. This fund has been a great wealth creator for investors over the years. Investors with high risk tolerance can consider investing in the fund through the systematic investment plan (SIP) or lump sum route for their long term financial planning objectives. Investors should consult with their financial advisors if Birla Sun Life MNC Fund is suitable for their investment portfolios.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Kotak Mahindra Mutual Fund launches Kotak Services Fund

Feb 4, 2026 by Advisorkhoj Team

-

HDFC Mutual Fund launches HDFC Nifty India Consumption Index Fund

Feb 4, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF

Feb 2, 2026 by Advisorkhoj Team

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund