DSP Black Rock Tax Saver: Strong performance puts this fund in top quartile again

Equity Linked Saving Schemes (ELSS) is one of the most popular investments allowed under Section 80C, since the investors can avail double benefits of tax savings and capital appreciation. An ELSS is a diversified equity scheme with a lock in period of three years from the date of the investment. If you investment in an ELSS through a systematic investment plan (SIP), each investment will be locked in for 3 years from their respective investment dates. The lock-in period of three years in ELSS is advantageous from a fund management perspective, since the fund managers are free from redemption pressures and therefore are able to hold the stocks in their portfolio for a longer period of time, to generate superior returns. For tax purposes, both long term capital gains and dividends from ELSS are tax free.

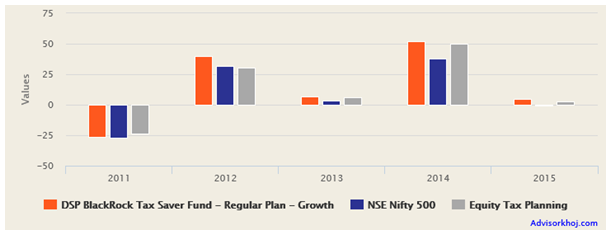

DSP BlackRock TaxSaver Fund, launched in January 2007, has delivered nearly 15% returns since inception. The performance of DSP BlackRock TaxSaver Fund has been stronger in the last 5 years. The fund was a top quartile performer in 2012 but slipped a bit in 2013. In 2014 and 2015 DSP BlackRock TaxSaver Fund bounced back into the top 2 quartiles and thanks to a very strong performance this year, it is again a top quartile tax saver (ELSS) fund (please see our quartile ranking tool for ELSS funds).

DSP BlackRock Tax Saver Fund – Fund Overview

This fund is suitable for investors looking for tax planning investment options under Section 80C of the Income Tax Act 1961 with the expectation of long term capital appreciation. However, since this is essentially an equity oriented mutual fund, it is subject to market risk and volatility, compared to other tax saving instruments like PPF, NSC etc. However, equities as an asset class generate superior returns over the long term and serves as an effective hedge against inflation.

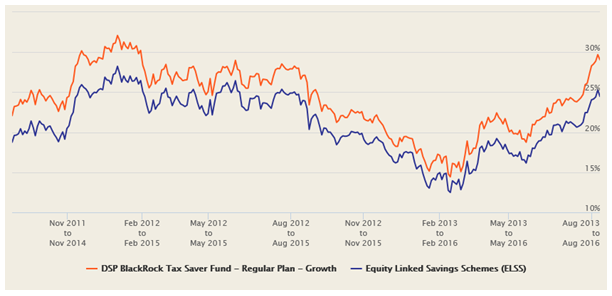

As such the fund is suitable for investors planning for long term financial objectives like retirement planning. The fund has an AUM base of around र 1,267 crores, with an expense ratio of 2.53%. The fund manager of this scheme is Rohit Singhania. Over 1, 3 and 5 year trailing periods, the fund has outperformed average ELSS category returns by a handsome margin. DSP BlackRock Tax Saver Fund is also one of the most consistent ELSS funds in the last 5 years.

The chart below shows the annual returns of DSP BlackRock TaxSaver Fund over the last 5 years.

Source: Advisorkhoj Research

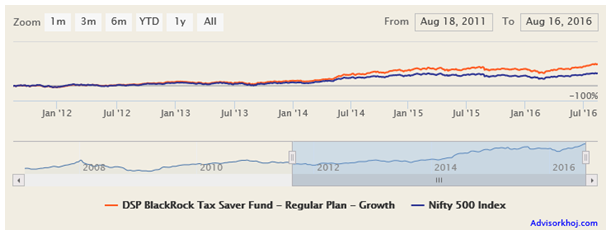

The chart below shows the NAV movement of DSP BlackRock TaxSaver Fund over the last 5 years.

Source: Advisorkhoj Research

Rolling Returns

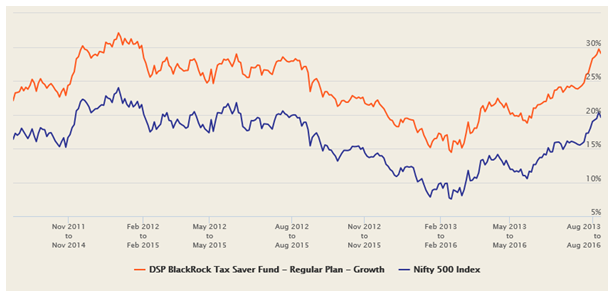

The rolling returns of DSP BlackRock TaxSaver Fund explain, why we think highly of this tax saver fund. The chart below shows the 3 year rolling returns of the fund over the last 5 years. We are showing 3 year rolling returns because ELSS funds have a lock in period of 3 years, from the date of investment.

Source: Advisorkhoj Rolling Returns Versus Benchmark Calculator

You can see that the fund consistently beat the benchmark in 3 year rolling returns over the last 5 years. You can also see that, the 3 year annualized rolling returns were above 20%, more than 85% times, which is a very strong performance, especially since we saw a fair amount of volatility in the market over the last 5 years. You can also see the rolling returns outperformance of the fund versus the benchmark was fairly consistent (around 10%) over the last 5 years. This is an evidence of well thought investment strategy and disciplined approach to portfolio management.

DSP BlackRock TaxSaver Fund also outperformed ELSS funds category in terms of 3 year rolling returns over the last 5 years. Please see the chart below.

Source: Advisorkhoj Rolling Returns Versus Category Calculator

CRISIL rates DSP BlackRock TaxSaver Fund as a strong performer (Rank 2) and Morningstar has a 4 star rating for this fund.

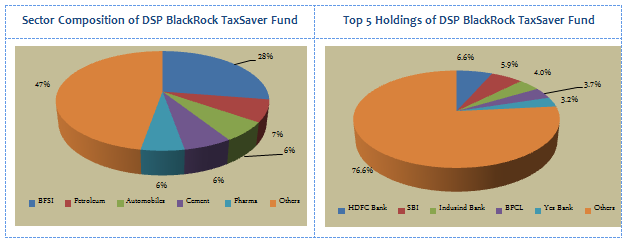

Portfolio Construction

The fund manager has large cap bias and his investment style is growth oriented. From a sector perspective, the portfolio is overweight on banking and finance relative to both the benchmark (Nifty 500) and the category (ELSS). Banking and Finance account for more than 20% of portfolio value. On an YTD basis, the DSP BlackRock TaxSaver Fund has delivered 14.9% returns already. The exceptional YTD returns by the fund were enabled to a large extent by the strong price performance of banking stocks like HDFC Bank, SBI, Indusind Bank and Yes Bank, in the fund portfolio.

Due to the private sector bias in the fund banking sector portfolio, DSP BlackRock TaxSaver Fund was much less impacted by the NPA woes compared to mutual fund schemes which had substantially higher allocations to public sector banks. In addition to banking and finance, DSP BlackRock TaxSaver Fund has a bias for other cyclical sectors like Petroleum, Automobiles and Cement. Aided by lower crude prices, petroleum companies in the fund portfolio like BPCL and HPCL have also delivered outstanding returns for the fund this year. Automobile stocks in the fund portfolio, like Maruti and Tata Motors have bounced back 50 – 70% from their late February lows, helping returns of DSP BlackRock TaxSaver Fund. Cement stocks have done well this year and Ultratech Cement, which comprises of around 2.4% of the fund’s portfolio value, has been one of the best performers in the cement sector.

High quality cyclical stocks, such as the ones in DSP BlackRock TaxSaver Fund portfolio can expected to deliver strong returns over the medium term (2 to 3 years), once we see a cyclical recovery in demand and capex. Some of our readers have expressed concerns that current valuations appear stretched. Whether the current valuations are stretched or not, is matter of debate among market commentators. But equity mutual fund investors, especially ELSS investors, should always have a long investment horizon to realize the benefits of equity as an asset class in the context of long term secular economic growth potential of India. If you believe in the India Growth Story, then current valuations should not be your concern.

Based on our experience, great growth stocks, more often than not, seem over-valued, but they are always able to catch up over a period of time, by delivering great earnings. Mutual fund investors should rely on the wisdom and experience of the fund managers to identify great companies that will create long term wealth instead of trying to time the market.

In terms of company concentration, the portfolio is very well diversified with its top 5 holdings, HDFC Bank, SBI, BPCL, Yes Bank and HPCL accounting for around 23% of the total portfolio value. Even in terms of top 10 holdings of the portfolio account for only 41% of the portfolio value. The charts below show the sector allocation and top 5 portfolio holdings of DSP BlackRock TaxSaver Fund.

Source: Advisorkhoj Research

Risk & Return

In terms of risk or volatility measures, the annualized standard deviation of monthly returns of DSP BlackRock TaxSaver Fund is higher than the ELSS funds category, which is not a surprise, given the fund’s bias for cyclical sectors and stocks. However, on a risk adjusted returns basis, as measured by Sharpe Ratio, the fund has outperformed the ELSS funds category.

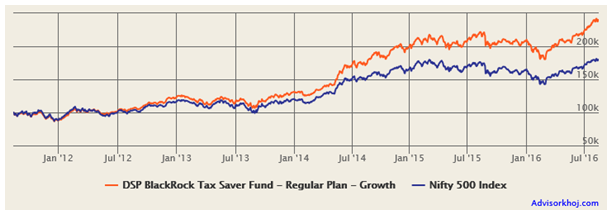

र 1 lac lump sum investment in the fund five years back would have almost grown to 2.5 times the investment value. The chart below shows the growth of र 1 lakh investment in the DSP BlackRock Tax Saver Fund (Growth Option) over the last 5 years.

Source: Advisorkhoj Research

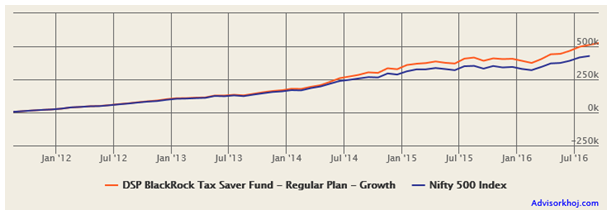

The annualized return of lump sum investment in DSP BlackRock TaxSaver Fund over the last 5 years was over 19%. The SIP returns of the fund are even better. The chart below shows the returns of र 5,000 monthly SIP in the DSP BlackRock TaxSaver Fund (Growth Option) over the last 5 years.

Source: Advisorkhoj Research

The chart above shows that a monthly SIP of र 5,000 started at inception of the DSP BlackRock TaxSaver Fund (Growth Options) would have grown to over र 5.2 lakhs (period ending August 16, 2016), while the investor would have invested in total only around र 3 lakhs; a profit of र 2.2 lakhs on a cumulative investment of र 3 lakhs. The SIP return over the last 5 years is over 22%.

Conclusion

You will hear many market experts saying in the print or electronic media that, the rally in stock market over the last 5 to 6 months has largely been fuelled by global liquidity and has caused stocks to be over-valued. Be that as it may, you should always be clear about your financial goals. By investing in ELSS funds and remaining invested over a long time period, you can save taxes and create wealth. The SIP performance of DSP BlackRock TaxSaver Fund, over the last 5 years, has hopefully demonstrated to you benefit of disciplined investing over a sufficiently long time horizon, irrespective of market conditions (bull market versus bear market, overbought market versus oversold market, over-valued versus under-valued etc) in intervening periods.

DSP BlackRock TaxSaver Fund has delivered nearly 10 years of strong and consistent performance. Investors planning for tax saving investments can consider buying the scheme through the systematic investment plan (SIP) or lump sum route with a long time horizon, for long term financial objectives. However, investors should ensure that the objectives of the fund are aligned with their individual risk profiles and time horizons. They should consult with their financial advisors if DSP BlackRock TaxSaver Fund is suitable for their investment portfolio.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

UTI Mutual Fund launches UTI Nifty500 Shariah Index Fund

Feb 5, 2026 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Multi Asset Omni Fund of Funds

Feb 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Services Fund

Feb 4, 2026 by Advisorkhoj Team

-

HDFC Mutual Fund launches HDFC Nifty India Consumption Index Fund

Feb 4, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team