How SIPs in Top 7 Best Diversified Equity Mutual Funds have created wealth

Systematic Investment Plans (SIPs) were introduced in India almost 22 years back by Franklin Templeton. Since then, SIPs has become the preferred way of investing in Mutual Funds. Currently in India, Investors are contributing almost Rs. 3,000 Crore monthly through SIP route and there are over One Crore active SIP accounts as at end April 2016. Also, Assets managed by the Indian mutual fund industry have grown from Rs. 11.93 trillion in April 2015 to Rs. 13.86 trillion in April 2016. That represents a 16% growth in assets over April 2015. Retail mutual fund investors have significantly contributed to this growth by investing through SIPs and currently their share is 46.30% (Data of April 2016 – Source www.amfiindia.com) to the total Mutual Fund industry assets.

Indian equity or Mutual Fund Investors, over period of time have realised that timing the equity market is difficult and thus investing a small amount systematically makes sense in equity assets as that has given the best returns historically.

Our research shows that investing through SIP route has created immense wealth for the investors in the long run and that is the topic we will cover today. But, first let us recap what are the key benefits of investing through SIPs.

- SIP brings a disciplined approach to investing. By investing a fixed amount which may be as small as

र500, you can build a corpus for your long term financial goals like Retirement Planning and higher education of your child etc. - Through SIPs you can also choose to select schemes which are best suited to your risk profile. Investing through SIP does not mean that you can only invest in Equity Mutual Funds. You can also invest in liquid or debt funds through SIP route.

- The biggest advantage of SIPs is that, you need not time the market. By investing in regular frequency, e.g. weekly, fortnightly or monthly, you are actually investing at the high and the low points of the markets. This helps in averaging the cost of the investment.

- SIPs in Equity oriented mutual funds are far more tax efficient than most other investment options. Long term capital gains for equity mutual funds are tax exempt. Dividends received form equity mutual funds are also tax free.

- Few Asset Management Companies even offer Free Life Insurance Cover if you invest through SIP route. This is just to encourage the habit of regular savings and this has no effect on the overall return on the SIPs.

In this article, we will look at how SIPs in Diversified Equity Mutual Funds have created long term wealth for the investors in the last 15 years. For our discussion, we have selected 7 Diversified Equity Funds that have given good returns in the last 15 years. However, this is, by no means, a comprehensive list of all the funds that gave good returns in the last 15 years. This is just an illustration to show how long investment term in SIPs, have created wealth for investors.

To see the comprehensive list, please click here Top Performing Systematic Investment Plans - Diversified Equity Funds

Each of the funds in our selection has given SIP returns ranging from 19 - 21% annualized. Since SIP investments are made over a period of time, the method of calculating SIP returns is different than that of Lump Sum investments. SIP returns are calculated by a methodology called XIRR, which is a variant of Internal Rate of Return (IRR). XIRR is similar to IRR, except XIRR can calculate returns on investments that are not necessarily strictly periodic

For our examples, we have assumed a monthly SIP of र 3000, made on the 1st working day of every month. Let us assume the SIP start date was 15 years back in June 2001, therefore, the investor would have invested Rs 5.40 Lakhs through 180 instalments of र 3,000 each. Now, let us see how much wealth the investors would have accumulated by investing in the selected funds in their respective Growth options.

Source: Advisorkhoj Top Performing Sip – Diversified Equity Funds (data as on 20/5/16)

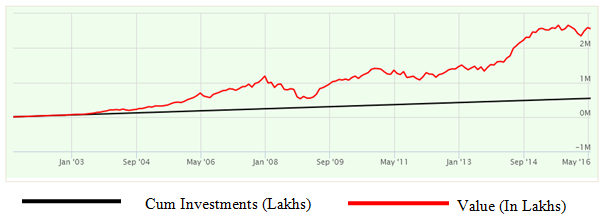

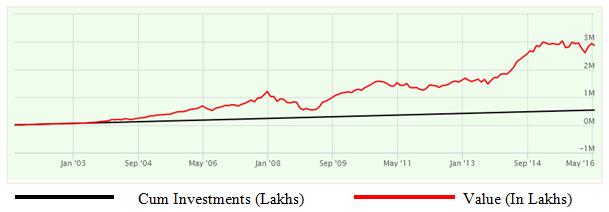

ICICI Prudential Multicap Fund

ICICI Prudential Multicap Fund, a diversified equity fund launched in October 1994, has an AUM base of nearly र 1085 Crores. The chart below shows the SIP returns of the ICICI Prudential Multicap Fund, Growth option, over the last 15 years.

If you had started a monthly SIP of र 3000 in ICICI Prudential Multicap Fund in June 2001, by now you would have accumulated nearly र 25.68 Lakhs corpus, with an investment of only र 5.40 Lakhs.

You would have accumulated corpus of र 4.90 Lakhs by the end of 2005, a corpus of र 10.64 Lakhs by the end of 2009 despite the severe financial crisis of 2008, a corpus of र 15.91 Lakhs by the end of 2013 and finally र 25.68 Lacs at the end of the SIP tenure. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be around 19%.

The fund has been ranked No. 3 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016. It is also a 3 Star rated fund by Valueresearch

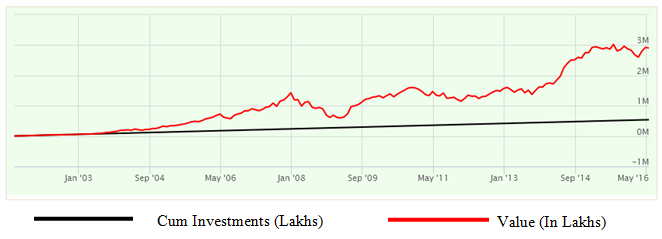

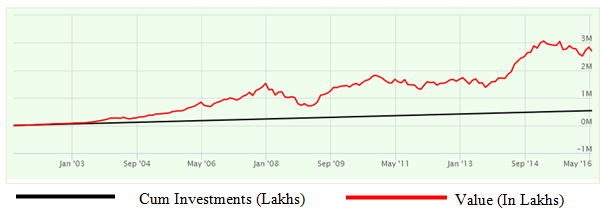

Birla Sun Life Equity Fund

The Birla Sun Life Equity fund is a diversified equity fund launched in August 1998. This fund from the Birla Sun Life stable has an AUM base of nearly र 2,399 Crores (As on April 30, 2016). The chart below shows the SIP returns of the Birla Sun Life Equity fund, Growth option, over the last 15 years.

If you had started a monthly SIP of र 3000 only in the Birla Sun Life Equity fund back in June 2001, by now you would have accumulated a corpus of over र 29.12 Lakhs, with an investment of only र 5.40 Lacs.

You would have accumulated corpus of र 5.65 Lakhs by the end of 2005, a corpus of र 12.88 Lakhs by the end of 2009 despite the severe financial crisis of 2008, a corpus of र 17.21 Lakhs by the end of 2013 and finally र 29.12 Lacs at the end of the SIP tenure. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be 20%.

The fund has been ranked No. 2 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016 up one place from the ranking for the quarter ending December 31, 2015. It is also a 4 Star rated fund by Valueresearch

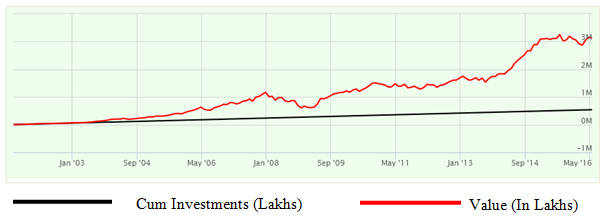

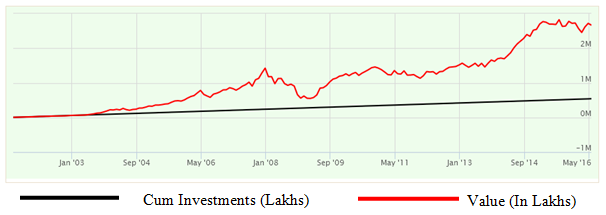

Franklin India Prima Plus

The Franklin India Prima Plus fund is a diversified equity fund launched in September 1994. This fund from Franklin Templeton stable has an AUM base of nearly र 7,425 Crores (As on April 30, 2016). The chart below shows the SIP returns of the Franklin India Prima Plus fund, Growth option, over the last 15 years.

If you had started a monthly SIP of र 3000 only in the Franklin India Prima Plus Fund back in June 2001, by now you would have accumulated a corpus of nearly र 31.36 Lakhs, with an investment of only र 5.40 Lakhs.

You would have accumulated corpus of र 4.75 Lakhs by the end of 2005, a corpus of र 11.57 Lakhs by the end of 2009 despite the severe financial crisis of 2008, a corpus of र 18.21 Lakhs by the end of 2013 and finally र 31.36 Lacs at the end of the SIP tenure. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be 21%.

The fund has been ranked No. 2 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016. It is also a 5 Star rated fund by Valueresearch

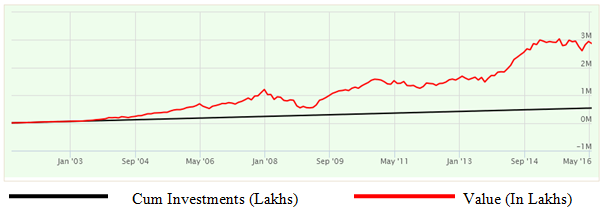

HDFC Capital Builder Fund:

The HDFC Capital Builder Fund is a diversified equity fund launched in February 1994. This fund from India’s second largest AMC has an AUM base of nearly र 1,157 Crores (As on 30 April, 2016). The chart below shows the SIP returns of the HDFC Capital Builder fund, Growth option, over the last 15 years.

If you had started a monthly SIP of र 3000 only in the HDFC Capital Builder Fund back in June 2001, by now you would have accumulated a corpus of nearly र 28.82 Lacs, with an investment of only र 5.40 Lacs.

You would have accumulated corpus of र 5.53 Lakhs by the end of 2005, a corpus of र 11.69 Lakhs by the end of 2009 despite the severe financial crisis of 2008, a corpus of र 18.27 Lakhs by the end of 2013 and finally र 28.82 Lacs at the end of the SIP tenure. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be over 20%.

The fund has been ranked No. 3 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016. It is also a 3 Star rated fund by Valueresearch.

DSP BlackRock Opportunities Fund

The DSP BlackRock Opportunities Fund is a diversified equity fund launched in May 2000. This fund has an AUM base of nearly र 846 Crores (As on 30 April, 2016). The chart below shows the SIP returns of the DSP BlackRock Opportunities Fund, over the last 15 years

If you had started a monthly SIP of र 3000 only in the DSP BlackRock Opportunities Fund back in June 2001, by now you would have accumulated a corpus of nearly र 28.17 Lakhs, with an investment of only र 5.40 Lakhs.

You would have accumulated corpus of र 5.49 Lakhs by the end of 2005, a corpus of र 12.27 Lakhs by the end of 2009 despite the severe financial crisis of 2008, a corpus of र 17.86 Lakhs by the end of 2013 and finally र 28.17 Lacs at the end of the SIP tenure. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be around 20%.

The fund has been ranked No. 3 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016. It is also a 3 Star rated fund by Valueresearch

You may like to read – Consistently Top Quartile SIP Returns in the last 3 to 5 years

Reliance Vision Fund

The Reliance Vision Fund is a diversified equity fund launched in May 2000. This marquee fund has an AUM base of nearly र 3075 Crores (As on 30 April, 2016). The chart below shows the SIP returns of the Reliance Vision Fund Growth Option, over the last 15 years

If you had started a monthly SIP of र 3000 in Reliance Vision Fund in June 2001, by now you would have accumulated a corpus of nearly र 27.15 Lakhs with an investment of only र 5.40 Lakhs.

You would have accumulated corpus of र 6.37 Lakhs by the end of 2005, a corpus of र 14.23 Lakhs by the end of 2009 despite the severe financial crisis of 2008, a corpus of र 17.09 Lakhs by the end of 2013 and finally र 27.15 Lacs at the end of the SIP tenure. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be around 20%.

Although it is a Valueresearch 2 Star rated fund, its ranking has been upgraded to No. 3 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016.

You may also like to read – The Great Wealth Creators Over 20 Years

Tata Equity Opportunities Fund

The Tata Equity Opportunities Fund is a diversified equity fund launched in March 1993. This fund has an AUM base of nearly र 1151 Crores (As on 30 April, 2016). The chart below shows the SIP returns of the Tata Equity Opportunities Fund Growth Option, over the last 15 years

If you had started a monthly SIP of र 3000 only in the Tata Equity Opportunities Fund back in March 1993, by now you would have accumulated a corpus of nearly र 26.72 Lakhs with an investment of only र 5.40 Lakhs.

You would have accumulated corpus of र 5.58 Lakhs by the end of 2005, a corpus of र 12.07 Lakhs by the end of 2009 despite the severe financial crisis of 2008, a corpus of र 16.95 Lakhs by the end of 2013 and finally र 26.72 Lacs at the end of the SIP tenure. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be around 20%.

Although it has been ranked No. 3 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016, Valueresearch has given it a higher rating of 4 Star.

Conclusion

In this article, we have seen how SIPs in large cap and diversified equity funds over the long term have created wealth for the investors. SIPs benefit from the power of compounding, and therefore the earlier we start our SIP, the greater is the potential for wealth creation. However, it is important to select a good fund for our SIPs. Your financial advisers can help you select a good fund that is suitable for your risk profile. As your risk profile changes over time, you should re-balance your portfolio to align with your risk profile. In our next post, we will discuss How SIPs in small and midcap funds have created wealth for the investors in the last 10 years. Stay in touch!

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF

Feb 2, 2026 by Advisorkhoj Team

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team