How Sundaram Global Brand Fund can help you Invest in Global Brands

The influence of global brands on modern life both professional and personal is huge. A decade or two back, brands were usually associated with luxury spending e.g. apparel, accessories, gadgets etc. But now from waking up in the morning to going to bed, most of us are consumers of global brands on a daily basis. The toothpaste you use in the morning, the breakfast cereal, car in which you drive to office, the software in your computer, your phone, your TV and other household appliances are all likely to be major global brands.

Sundaram Global Brand Fund provides you with opportunity of owning these brands which you buy.

Sundaram Global Brand Fund

Sundaram Global Brand Fund, erstwhile Sundaram Global Advantage Fund, is a fund of fund which invests in shares of leading global brands. The feeder fund is Sundaram Global Brand Fund, Singapore. The fund was rebranded about a year back and its fundamental attributes were changed. Rohit Seksaria and Ratish B Varierare the fund managers of this scheme. The expense ratio of the scheme is 1.63% and the scheme benchmark is Dow Jones Industrial Average TRI.

What changed after rebranding?

In our fund reviews we usually analyze the long term performance of a fund, but in this case long term performance is not relevant because the fundamental attributes of the fund changed, when it was rebranded on 21st November 2019.

In its previous avatar i.e. Sundaram Global Advantage Fund, the scheme was investing primarily in emerging markets, real estate and commodity markets. After rebranding, the fund invests in global brands. There is no market specific mandate. In fact, most of the investment will be in companies belonging to developed markets, since most of the global brands are headquartered in developed markets e.g. US, Germany, Japan etc.

What are the characteristics of global brands?

- These are global household names and leaders in their sphere of business

- These companies have businesses spanning the globe and product categories

- Global brands have stable operating margins owing to their ability of sustaining pricing power across economic cycles

- They can generate sustainable cash-flows

- Beneficiary of the global aspiration to buy more branded goods as disposable income rises

Examples of global brands include Amazon, Microsoft, Apple, Google, McDonalds, Facebook, Toyota, Intel etc

Why invest in global equities?

We have discussed the benefits of global investing several times in our blog over the past year or so. For the benefit of investors or advisors who are new to Advisorkhoj, here is a brief recap of the benefits of global equity investments:-

- You can get exposure to global growth opportunities which are not available in Indian stock markets. Indian companies do not have the kind of scale, global customer base, network effect and competitive advantage which global brands have.

- You can take exposure to global megatrends which you cannot get in domestic equities. Most of these mega-trends are in sunrise sectors e.g. consumer internet (Alphabet, Facebook), e-commerce (Amazon) etc which are not available in India.

- You can diversify risks by investing in global equities. There is low correlation of returns of different market. Investing in global equities can diversify risk considerably and bring stability to your portfolio.

- You can benefit from Rupee depreciation versus the US Dollar or currencies of other large economies. Over the past 10 years, the Rupee has depreciated considerably versus the Dollar and may continue to depreciate in the future. Rupee depreciation can contribute to a significant portion of your returns from international equity.

Why invest in Sundaram Global Brand Fund?

- Exposure to world’s leading brands

- Geographical diversification benefits

- Consistent outperformance of underlying scheme, Sundaram Global Brands Fund, Singapore versus its benchmark

- Low volatility leading to excellent risk adjusted returns

- Benefit from Rupee Depreciation

- Portfolio of financially very strong companies

What is the investment process of Sundaram Global Brands Fund and underlying scheme?

Sundaram Global Brand Fund is a fund of fund (FOF). The underlying scheme of the FOF is Sundaram Global Brands Fund, Singapore.

The underlying scheme invests in listed equities of 30 top brands. The fund manager has preference for brands with geographically diversified revenues base in order to reduce single country risk.

The portfolio splits the leading 30 brands into three bands. The top band comprises of Top 10 brands (e.g. Amazon, Microsoft, Apple, Alphabet, McDonalds, Facebook etc.) and each stock in the band to start with has 5% weight. The next band comprises of the next 10 brands and each stock in that band has 3% weight. The last band also comprises of 10 stocks and each stock has 2% weight. There are appropriate risk control mechanisms in place for concentration risk and sector risk.

Performance of Sundaram Global Brand Fund

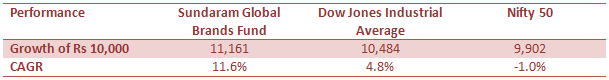

The table below shows the growth of Rs 10,000 in Sundaram Global Brands Fund versus its benchmark DJIA TRI and Nifty 50 TRI for the last 1 year period ending 30th October 2020. As mentioned earlier, the fund attributes changed in November 2019 and therefore, prior period returns are irrelevant.

Source: Sundaram Mutual Fund (as on October 30, 2020)

The above comparative returns are as on 30th October 2020. However, if you take the last 1 year return as on date (26/11/20), the fund has given over 20% absolute return.

Conclusion

We had discussed earlier that investors should consider diversifying single country risk by investing in international equities. Investing in global brands is a very compelling proposition from a long term viewpoint. These are the strongest companies in the world and are likely to be much more resilient even in the face of economic uncertainties such as the ones we are confronted with now.

Investors should note that fund of funds are taxed like debt funds. However, over investment horizon of 3 years or longer you can get indexation benefits. You should consult with your financial advisor if Sundaram Global Brand Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Kotak Mahindra Mutual Fund launches Kotak Nifty200 Value 30 Index Fund

Jan 15, 2026 by Advisorkhoj Team

-

Bandhan Mutual Fund launches Bandhan Silver ETF FOF

Jan 12, 2026 by Advisorkhoj Team

-

Bandhan Mutual Fund launches Bandhan Gold ETF FOF

Jan 12, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF FOF

Jan 9, 2026 by Advisorkhoj Team

-

Mahindra Manulife Mutual Fund launches Mahindra Manulife Innovation Opportunities Fund

Jan 9, 2026 by Advisorkhoj Team