ICICI Prudential FMCG Fund: A consistently performing FMCG fund

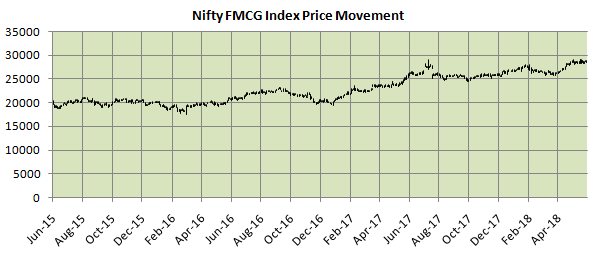

The FMCG sector has historically been a favorite among equity investors because it is seen as an all - weather sector. There are two important reasons why FMCG sector is preferred by investors. Firstly, it is seen as a defensive sector i.e. it is relatively less affected by economic cycles like expansion or recession. If you have followed the stock market over the last few years, you would have seen that the FMCG sector outperforming the cyclical sectors in bear markets. Even in volatile market, like the one we are seeing so far in 2018, the FMCG sector has outperformed the market – Nifty FMCG index has risen over 7.3% on a YTD basis, while the Nifty 50 has risen only 1.9%.

The second reason why FMCG sector is attractive to investors is its growth potential in India. With rising per capita income and India’s demographic advantage this sector has a substantial earnings growth potential. One of the main growth drivers for this sector in the past and more so in the future, according to analysts, will be rural consumption. The initiatives of the Government like higher Minimum Support Price (MSP) for crops, spending on rural infrastructure like the Pradhan Mantri Gram Sadak Yojna, higher budgetary allocation for rural credit, Mudra Yojna to promote self-employment etc., are likely to boost rural disposable income and consumption.

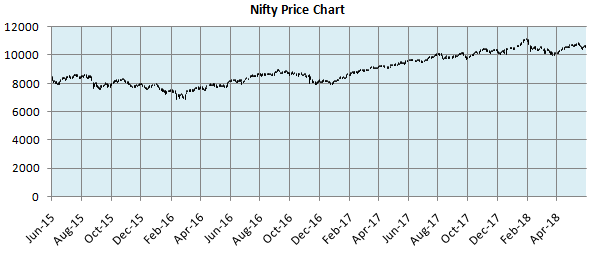

In the last 3 years, the Nifty FMCG Index has outperformed the Nifty 50 index by a wide margin. While Nifty grew at a CAGR of 8% in the last 3 years, the Nifty FMCG index grew at a CAGR of 12%. Please the charts below.

Source: National Stock Exchange

Source: National Stock Exchange

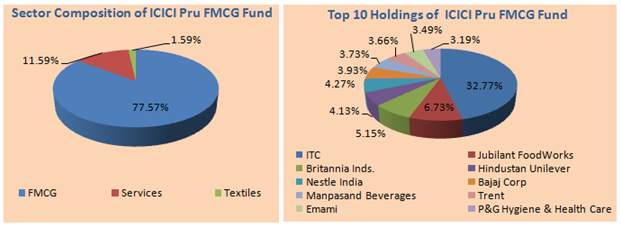

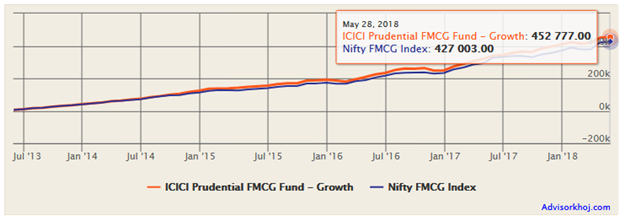

Though there are quite a few consumption oriented equity mutual fund schemes in the market, there are very few funds primarily focused on the FMCG play. ICICI Prudential FMCG Fund is one such fund, which primarily invests in the FMCG space, with small allocations to other sectors. The fund has matched (slightly better) the Nifty FMCG Index returns over the last 3 years, it has beaten the Nifty FMCG Index in the last 1 year by 180 basis points, creating alpha for the investors.

Over a longer term of 5 years, ICICI Prudential FMCG Fund has beaten the Nifty FMCG index. The fund was launched in 1999 and has Rs 389 Crores of AUM. The expense ratio of the fund is 2.9%. Atul Patel has been managing the fund since January of 2018. Mr Patel has 22 years of experience and has been managing ICICI Prudential Equity and Debt Fund (formerly known as ICICI Prudential Balanced Fund), a top performing fund in its category.

The chart below shows the NAV movement of ICICI Prudential FMCG Fund.

Source: Advisorkhoj Research

Rolling Return Analysis

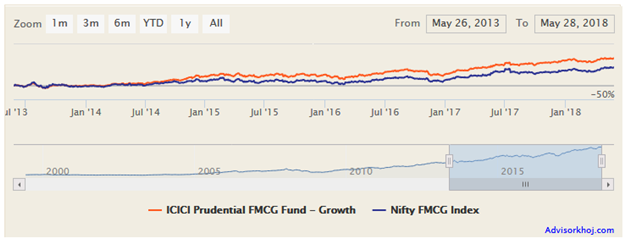

The chart below shows the 3 year rolling returns of the fund versus the benchmark Nifty FMCG Index.

Source: Advisorkhoj Research

You can see that, ICICI Prudential FMCG Fund consistently outperformed the Nifty FMCG Index over a 3 year rolling period in the last 5 years. The maximum 3 year annualized return over the last 5 years was 19.53% and the minimum 3 year return was 9.27%. This shows that, even in the worst case scenario, you have got better post tax returns than fixed deposits and this is why, FMCG stocks and funds can be good investment options for investors who do not want to take too much risk. The average 3 year rolling return of ICICI Prudential FMCG Fund was 14.18%.

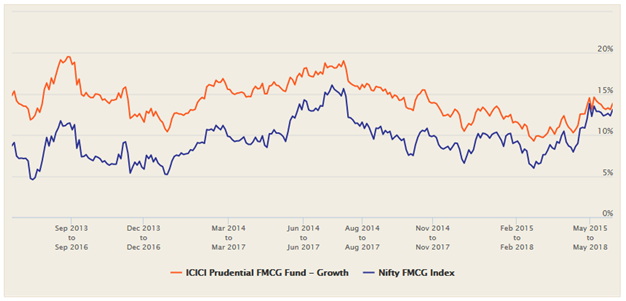

Portfolio Construction

It is important to understand the difference between a diversified equity fund and a sector fund. A diversified equity fund invests across several sectors and thereby, diversifying sector risks. However, in a sector fund considerable allocation is made to one particular sector and therefore, it is subject to sector specific risks. In the case of ICICI Prudential FMCG Fund nearly 78% of the portfolio is allocated to the FMCG sector. However, as discussed earlier, the FMCG sector is relative unaffected by economic cycles and is less volatile compared to other sectors. Think of items like toothpaste, soap, washing powder, refined oil, packaged Atta – these are items that we use in our day to day lives and their consumption will be relatively unaffected by economic conditions.

Apart from FMCG, the two other sectors which this fund invests in are services and textiles. There are 21 stocks in the fund portfolio, but from a proportional standpoint, the portfolio is concentrated in the top 10 stocks, which account for 71% of the portfolio value. ITC, which is the largest FMCG company in India by market capitalization, itself accounts for nearly 33% of the portfolio.

Source: Advisorkhoj Research

Lump Sum and SIP Returns

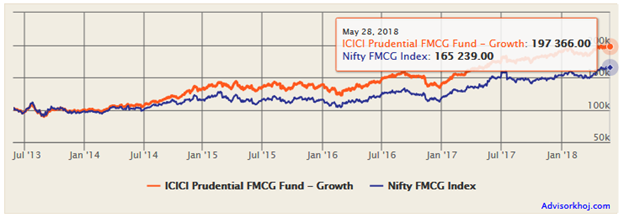

The chart below shows the growth of Rs 1 lakh lump sum investment in ICICI Prudential FMCG Fund made 5 years back. You can see in the chart that, your investment would have nearly doubled in the last 5 years.

Source: Advisorkhoj Research

The chart below shows the value of Rs 5,000 monthly SIP in ICICI Prudential FMCG Fund started 5 years back. Your investment value would have been over Rs 4.5 lakhs with a cumulative investment of Rs 3 lakhs.

Source: Advisorkhoj Research

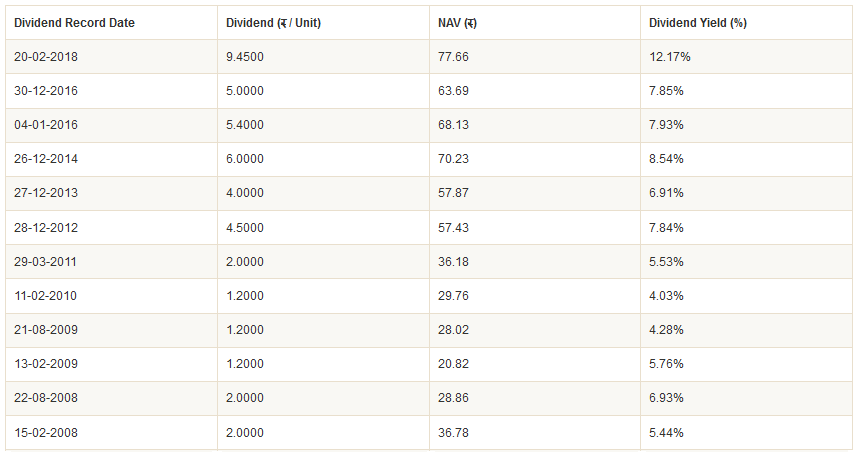

Dividend Track Record

ICICI Prudential FMCG Fund has a good dividend track record over the last 10 years. It has paid dividends in most years and over the last few years, the dividend yield has been fairly good (around 8% or more).

Source: Advisorkhoj Historical Dividends

Conclusion

There is a perception among many investors that sector funds are risky. This perception is correct to a large extent, but you cannot paint all sectors and investments with the same brush. The volatility of ICICI Prudential FMCG Fund is likely to be substantially lower than many diversified equity funds because of the reasons discussed in this post.

In Advisorkhoj’s view, diversified equity funds should form the core your equity investment portfolio but FMCG sector funds can be an interesting addition – it will provide stability to your portfolio in volatile times and also give you good returns over a sufficiently long investment horizon.

You may like to read here – why diversified equity mutual funds are good long term investment choice

Investors should consult with their financial advisors if ICICI Prudential FMCG Fund is suitable for their investment needs before investing.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Sundaram Mutual Fund launches Sundaram Income Plus Arbitrage Active FoF

Jan 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Dividend Yield Fund

Jan 5, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team