ICICI Prudential Long Term Equity Fund: ELSS Fund with terrific wealth creation track record

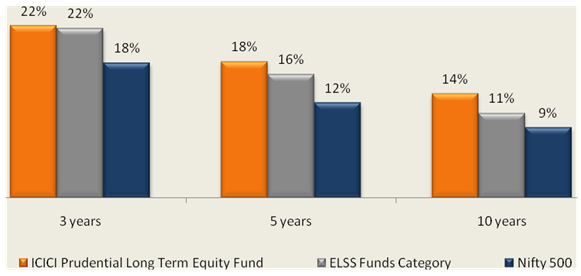

With the March 31st deadline of making tax saving investments for Assessment Year 2017 – 2018 drawing closer, many investors would be looking at mutual fund Equity Linked Savings Schemes (ELSS) for tax planning purposes. ICICI Prudential Long Term Equity Fund (Tax Saving) has been one of the most consistent ELSS funds in the last 5 years (from 2012 to 2016). The fund has consistently ranked in the top 2 quartiles every year from 2012 onwards (please see our Top Consistent ELSS Mutual Fund Performers). See the chart below, for the comparison of annualized returns over three, five and ten year periods, of the fund, the ELSS Category and the benchmark Nifty 500 index (NAVs as on Dec 14 2015).

Source: Advisorkhoj Research

Even from a very long term perspective, ICICI Prudential Long Term Equity Fund (Tax Saving) has been the best performing Equity Linked Savings Schemes (ELSS) over the last 15 years. If you invested Rs 5,000 monthly in ICICI Prudential Long Term Equity Fund (Tax Saving) over the last 15 years, you would have saved aroundRs 3 lakhs in taxes over this period and on top of this accumulated a corpus of close to Rs 60 lakhs.The SIP returns over the past 15 years have been over 20%.

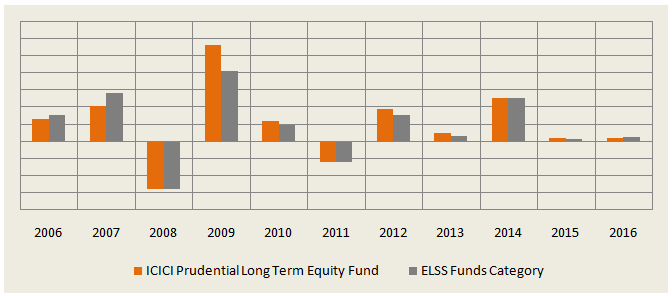

Even in terms of annual returns the fund’s performance has been outstanding, making this fund one of the most long term consistent performers in the ELSS category. The chart below shows the annual returns of the ICICI Prudential Long Term Equity Fund (Tax Saving) and the ELSS category over the last 10 years.

Source: Advisorkhoj Research

Rolling Returns

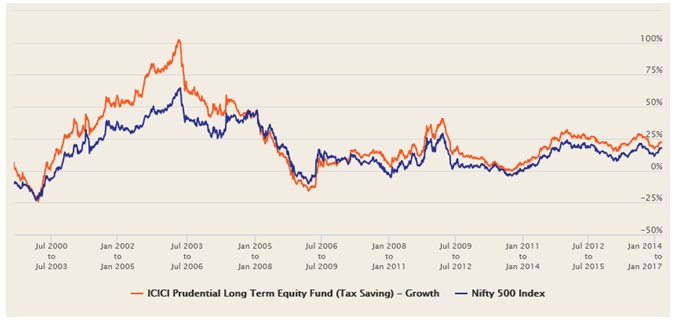

Regular readers of Advisorkhoj blog know that, we are advocates of rolling returns when it comes to evaluating true fund performance. Other return metrics have timing related biases, but rolling returns are free from biases. The chart below shows the 3 year rolling returns of ICICI Prudential Long Term Equity Fund (Tax Saving) from inception relative to the benchmark Nifty 500 index. We have chosen 3 years as the rolling returns time period because ELSS funds have a lock in period of 3 years.

Source: Advisorkhoj Research

You can see the fund outperformed the benchmark index almost 90% of the times from 2007 onwards. The 3 year rolling returns from 2012 onwards has been around 20%+. The rolling returns of ICICI Prudential Long Term Equity Fund (Tax Saving) since inception are testimony of the value additions by the fund managers over the life of the scheme. George Heber Joseph is the manager of this fund. Prior to George, Chintan Haria was the fund manager from 2011. Before Chintan, this fund was managed by ICICI Prudential CIO Shankaran Naren.

Fund Overview

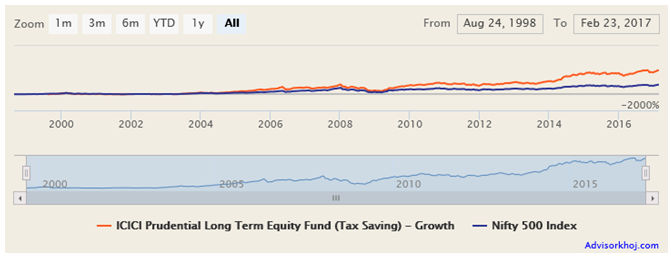

The ICICI Prudential Long Term Equity Fund (Tax Saving)is suitable for investors looking for tax planning investment options under 80C of The Income Tax Act 1961 with the expectation of long term capital appreciation. While ELSS funds are subject to market risk and volatility as compared to the risk free80C tax saving schemes (e.g. PPF, NSC, etc), investors should understand that, equities as an asset class generate superior returns over the long term and serves as an effective hedge against inflation. As such, the fund is suitable for investors planning for long term financial objectives like retirement planning, children’s education, marriage etc. The fund has an AUM base of over Rs 3,794crores, with an expense ratio of only 2.3%. The compounded annual growth rate (CAGR) of the fund NAV since inception is nearly 22%. The chart below shows the NAV growth of the fund since inception.

Source: Advisorkhoj Research

Portfolio Construction

The ICICI Prudential Long Term Equity Fund (Tax Saving)has a large cap bias. The investment style is growth focused. More than 60% of the fund’s assets are invested in large cap companies. However, relative of the average portfolios of ELSS as a fund category, the fund has a higher allocation to small and midcap companies.From a sector perspective, it seems that the fund managers have made contrarians bets, with Pharmaceuticals and Technology the top 2 sectoral allocations. Contrarian bets are risky in the short term, but have the potential of generating exception returns for investors in the long term. ICICI Prudential AMC fund managers have a rich history of making a number of contrarian bets in a variety of funds over the years, and most of the times the bets have paid off very handsomely for investors. Apart of Pharmaceuticals and IT, the scheme also has substantial allocations to Finance, Banking, Transportation and Cement. In terms of company concentration, the portfolio is very well diversified with its top 5 holdings, HCL Technologies, HDFC Bank, Cipla, Thomas Cook, and Power Grid accounting for only 28% of the total portfolio value.

Source: Advisorkhoj Research

Other Performance Measures

From a risk perspective, the volatility of the ICICI Prudential Long Term Equity Fund (Tax Saving), measured in annualized standard deviation over a three to five year period is on the lower side compared to that of the ELSS category. The fund has outperformed the market, both during up-market and down-market periods. The performance of mutual fund schemes in up and down market periods is captured by a set of metrics known as market capture ratios. In our opinion, market capture ratios are very important metrics of fund performance, especially for retail investors. As mutual fund investors, we want our investment to do better than the market, when the market is rising; at the same time, we do not want our investment to fall as much as the market during downturns. Fund managers who are able to beat the market, both during rallies and corrections, are usually able to generate superior returns for investors in the long turn.

The up-market capture ratio of ICICI Prudential Long Term Equity Fund (Tax Saving) over the past 3 years is 117.7 (please see our Market Capture Ratio Tool), which implies that for every 1% monthly increase in the market benchmark (Nifty 500), the fund value (NAV) on an average increased by 1.177%. The down market capture ratio of ICICI Prudential Long Term Equity Fund (Tax Saving) over the past 3 years is 80.6, which implies that for every 1% monthly decline in the market benchmark (Nifty 500), the fund value on an average fell by only 0.8%. The market capture ratios of ICICI Prudential Long Term Equity Fund (Tax Saving) explain the strong performance of this fund.

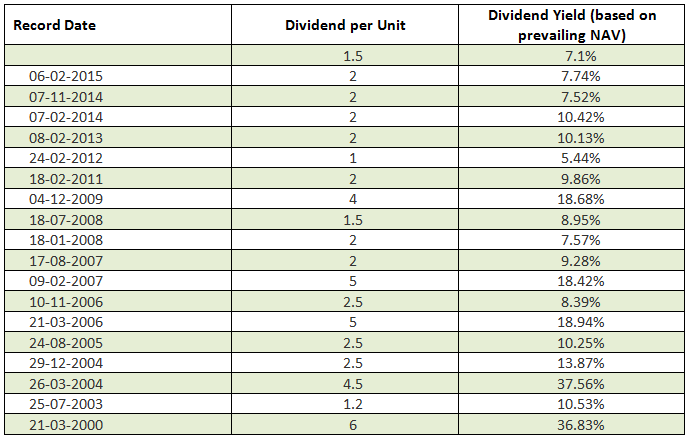

Dividend Payout Track Record

ICICI Prudential Long Term Equity Fund has a terrific dividend payout track record since its inception. The scheme has paid out dividends almost every year since its inception, except 2001, 2002 and 2010. The table below shows the dividend payout history of the scheme.

Source: Advisorkhoj Research

Lump Sum and SIP Returns

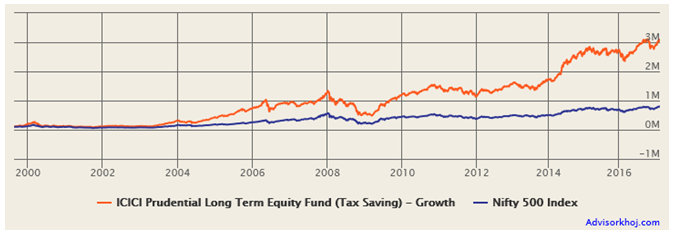

Rs 1 lakh lump sum investment in the ICICI Prudential Long Term Equity Fund (Tax Saving) NFO (growth option) would have grown to value of nearly Rs 31 Lakhs as on February 24 2017. The chart below shows the growth of Rs 1 lakh investment in the scheme since inception.

Source: Advisorkhoj Research

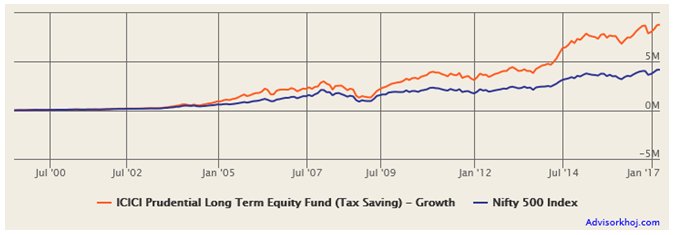

The chart below shows the returns since inception of Rs 5,000 invested monthly through SIP route in the ICICI Prudential Long Term Equity Fund (Tax Saving), growth option, since inception of the scheme.

Source: Advisorkhoj Research

The chart above shows that a monthly SIP of Rs 5,000 started at inception of the ICICI Prudential Long Term Equity Fund (Tax Saving), growth option, would have grown to over Rs 88 Lakhs by February 24 2017, while the investor would have invested in total aroundRs 10 lakhs. The SIP return (as measured by XIRR) since inception of the fund is more than 21%. If you compare these returns, with the returns of other 80C investment options, e.g. traditional life insurance plans, small savings schemes etc, you will realize that the wealth created by ELSS is of a different order of magnitude altogether.

Conclusion

By virtue of its outstanding long term track record of wealth creation, ICICI Prudential Long Term Equity Fund (Tax Saving) has established itself as one the top ELSS funds. Investors planning for tax saving investments can consider buying the scheme through the systematic investment plan (SIP) or lump sum route with a long time horizon. Investors should also ensure that the investment objectives of the fund are aligned with their individual risk profiles and time horizons. They should consult with their financial advisors if ICICI Prudential Long Term Equity Fund (Tax Saving) is suitable for their investment portfolio.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF FOF

Jan 9, 2026 by Advisorkhoj Team

-

Mahindra Manulife Mutual Fund launches Mahindra Manulife Innovation Opportunities Fund

Jan 9, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Short Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Low Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Small Cap Fund

Jan 8, 2026 by Advisorkhoj Team