Indiabulls Bluechip Fund beats CRISIL AMFI Large Cap Index

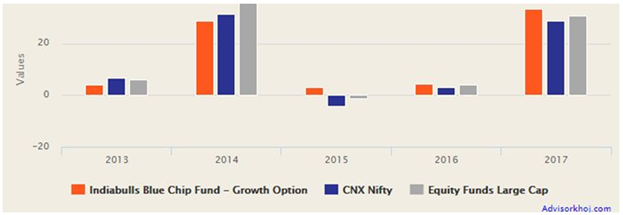

Indiabulls Bluechip Fund has beaten the CRISIL – AMFI Large Cap Index in financial year 2017 – 18. In our March blog (refer to our post, Why large cap equity mutual funds will always be a flavor for investing), we had mentioned that, Indiabulls Bluechip Fund has been able to beat its benchmark index (Nifty) consistently since 2015 (see the chart below).

However, beating the CRISIL – AMFI Large Cap Performance Index assumes special significance because the index comprises of peer large cap mutual funds – this shows that Indiabulls Bluechip Fund was able to beat the performance average of large cap funds in the industry.

CRISIL – AMFI Mutual Fund performance Index

In 2013 CRISIL, the well-known credit rating and research agency and AMFI (the mutual fund industry’s trade body) jointly launched mutual fund performance indices for different fund categories. The purpose of these indices was to enable the investor to compare how their mutual fund schemes performed against the peer group. In its report (available on the AMFI website), CRISIL and AMFI showed that the CRISIL – AMFI equity funds performance indices were able to outperform the market benchmark indices (Sensex, Nifty, Nifty – 500, Nifty – Midcap etc.) across most time periods. While the outperformance of CRSIL – AMFI mutual fund indices versus the market indices shows that the mutual fund industry as a collective was able to create value for investors, the implicit implication, as per some in the financial media, was that the CRISIL – AMFI mutual fund performance indices were, from the investor’s perspective, more relevant than market indices.

In our view, market indices are extremely important for mutual fund scheme’s performance evaluation because mutual fund industry assets are just one component of the market – the market itself is much larger. For measuring fund important performance metrics like alpha, beta etc. market indices are absolutely critical.

Nevertheless, the CRISIL – AMFI performance indices can also be useful for investors. Investors should, however, note that the performance comparison versus CRISIL – AMFI indices are not mandatory for AMC monthly factsheets. As such, there is little awareness about these indices among the investors and many distributors. We, in Advisorkhoj, from time to time will bring the CRISIL – AMFI performance indices to the investor’s attention.

CRISIL – AMFI Large Cap Index

The CRISIL – AMFI Large Cap Fund Performance Index seeks to track the performance of large cap equity funds. The index is constructed using asset weighted returns (larger a scheme’s AUM, larger will be its weight in the index), chain link method (re-scaling values) and quarterly re-balancing. The CRISIL – AMFI Large Cap Fund Performance Index comprises of large cap funds which are ranked by CRISIL. CRISIL has a minimum NAV history and minimum AUM eligibility criteria for mutual fund ranking. There are a total of 30 large cap equity mutual fund schemes that form part of the CRISIL – AMFI large cap index. Readers should note that Indiabulls Bluechip Fund is not part of the CRISIL-AMFI large cap index.

Performance of Indiabulls Bluechip Fund versus CRISIL – AMFI Large Cap Fund Performance Index

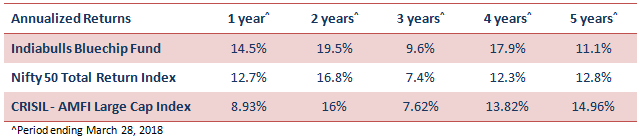

Indiabulls Bluechip Fund has outperformed both its benchmark index Nifty 50 Total Return Index (TRI) and also the relevant CRISIL – AMFI Large Cap Fund Performance Index. Please see the point to point annualized (CAGR) returns of the scheme, Nifty 50 TRI and CRISIL AMFI Large Cap Index over various time-scales in the table below.

Source: Advisorkhoj Research, CRISIL / AMFI

You can see that, Indiabulls Bluechip Fund was consistently able to beat both CRISIL – AMFI Large Cap Fund Performance Index and Nifty TRI over the last one, two, three and 4 years (periods ending March 28, 2018). An interesting point to note is that, CRISIL – AMFI Large Cap Fund Performance Index was unable to beat Nifty Total Returns in the last 1 and 2 year periods. Mutual fund investors should not get alarmed because the performance of a mutual fund scheme should be evaluated over a sufficiently long investment period (at least 3 years or more). Over the last 3 to 5 years, CRISIL – AMFI Large Cap Index was able to outperform Nifty TRI.

The underperformance of CRISIL – AMFI Large Cap Index versus Nifty, however, leads us to suspect that many large cap funds had substantial allocations to midcap or small cap stocks. On an YTD basis the Nifty is up 1.8%, whereas Nifty Midcap is down 6%. The underperformance of the midcap and small cap segment relative to the large cap segment may have dragged down the performance of these funds and consequently the index comprising of these funds.

Indiabulls Bluechip Fund on the other hand, was able to outperform the CRISIL – AMFI Large Cap Index in the long term (3 – 4 years) and at the same time, was also able to outperform Nifty TRI in the near to medium term (1 – 2 years).

The consistent performance is a testimony of the superior stock selection, as well as the astute risk management strategy of the fund manager of this scheme. Sumit Bhatnagar, Head of Equities, Indiabulls AMC and the fund manager of Indiabulls Bluechip Fund, in his interview with Advisorkhoj, told us that, “Blue chip fund has a mandate to deploy 80% in large caps, basically top 100 companies by markets cap and upto 20% mid & small cap space”.Bhatnagar stuck to the scheme mandate and was able to react to concerns around midcap valuations more adroitly than many of his peers. Bhatnagar still has about 14.70% portfolio allocation to mid and small cap stocks, around 81% in large cap stocks and the balance in cash (data as on April 30, 2018).

Bhatnagar has a conservative approach in his portfolio construction process. He told us, “Idea is to be conservative in the portfolio construction process. First we look to identify key themes to play by analyzing global macro environment, Indian macros, government policies and other economic factors. Once the key themes are identified, we look at companies that are near monopolies or oligopolies, having pricing power, strong brands, leaders/challengers in their respective sectors, strong distribution franchise, low leverage, decent growth prospects, decent Return on Equity and Return on Capital Employed, and high quality management teams and low leverage”. The fund manager’s approach has paid off in ensuring consistent superior performance in different market conditions.

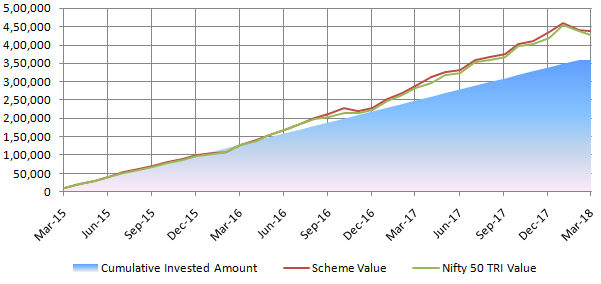

SIP Performance of Indiabulls Bluechip Fund

The chart below shows the SIP Performance of Indiabulls Bluechip Fund over the last 3 years (ending March 31, 2018) versus the benchmark index Nifty 50 TRI. SIP amount of Rs 10,000 per month is assumed for the purpose of illustration. You can see that the SIP performance of the fund was slightly better than that of Nifty 50 TRI. The SIP XIRR of Indiabulls Bluechip Fund was 13.2%, while that of Nifty 50 TRI is 11.5%.

Source: Advisorkhoj Research

Conclusion

Earlier this year, Indiabulls Bluechip Fund completed 6 years. The fund has outperformed both its benchmark index Nifty 50 TRI and CRISIL – AMFI Large Cap Fund Performance Index for the last 5 years. Considering the stellar performance of Indiabulls Bluechip Fund, investors with moderately high risk can consider investing in this fund as part of their core portfolio.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF

Feb 2, 2026 by Advisorkhoj Team

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team