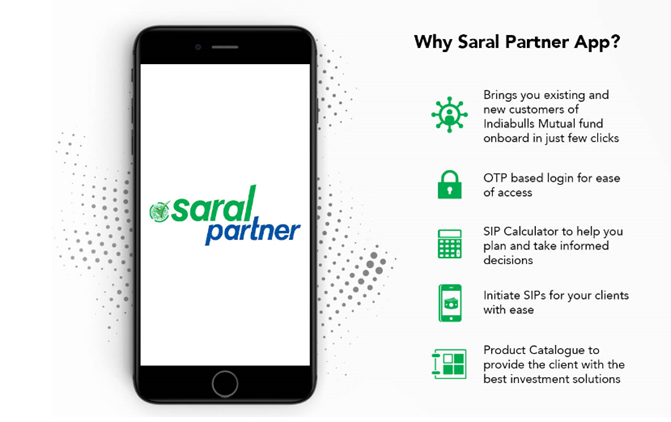

Indiabulls SARAL Partner Mobile App: Making investing in SIPs effortless

With increasing application of payments digitization for different types of transactions in the financial services domain, online transactions in the mutual fund industry is increasingly gaining currency. Based on our interaction with both mutual fund distributors and retail investors we are seeing a lot of interest in adoption of online platforms for investment purposes. Distributors are now recognizing the benefits of online investments over the traditional paper based transactions. The biggest advantage is obviously increasein productivity. Using digital platforms distributors can accomplish tasks spending a fraction of effort and time involved in paper based processes. This frees up time and resources of the distributor to focus on customer acquisition, increasing customer engagement and improving the quality of their services.

Indiabulls Mutual Fund’s SARAL Partner mobile app is a terrific initiative for enabling distributors to help their customers make SIP investments anytime, anywhere through a completely (end to end) online process. Investment can be made for any of the life goals like wealth creation, for saving tax or for utilizing your idle funds.One of the most pleasing features of this app is its ease of use and convenience, which will make the life of both the distributor and the investor much simpler (SARAL).

How to enroll in Indiabulls MF SARAL Partner?

- A distributor interested in becoming a SARAL Partner needs to download SARAL Partner APP from Google Play Store and install it on his / her phone.

- The distributor can then login to the app using the following steps

- Fill the numeric ARN number

- Select OTP as the login option

- A 6 digit OTP will be sent to the distributor’s mobile number and email registered with Indiabulls MF at the time of empanelment.

- Use the OTP to login to the app

- The distributor can then setup a password, if he or she wishes to use one to login to the app in the future. If the distributor does not setup a password then he or she will have to login every time using the OTP.

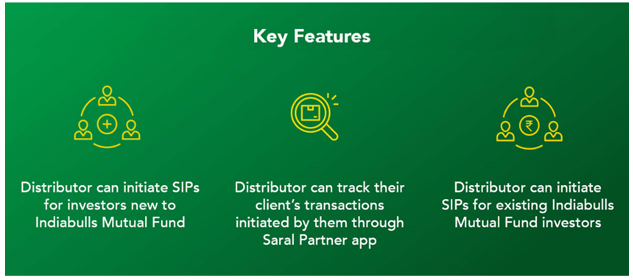

- Once you are enrolled in the SARAL Partner APP, you can setup SIPs for both new investors (investors who do not have folio in Indiabulls MF) and existing investors (investors have existing folios in Indiabulls MF) through a set of very simple steps.

How to set up SIPs for new customers?

- The first step is to login to the SARAL Partner APP using either OTP or the password setup by the distributor

- Click on “New Investor”

- Fill up the basic details of the investor i.e. PAN, mobile number, email etc. Please note that the investor must be KYC compliant.

- The distributor can review the investor’s details fetched from his / her KYC. The distributor can fill or edit details as required.

- The distributor will have to fill in SIP details i.e. Scheme Name, SIP amount, SIP date etc in the “Start SIP” screen.

- The distributor will have to fill in the Bank details of the investor. They have to enter the IFSC code and all details available with the RTA (Karvy) will be pre-filled. The distributor can edit if required.

- The distributor will then review the application and confirm to initiate the investment.

- Email and SMS with payment gateway link will be sent to the investor to complete the payment. The investor will simply have to login to his / her bank account to complete the payment. The investor will have to register the URN sent on his / her mobile with the bank for the recurring SIP installment auto debits.

Distributors will be able to appreciate how simple and efficient the process is. Instead of spending hours filling out application forms, visiting the customer to get signatures and collecting cheques, submitting documents at the AMCs or RTAs office etc, distributors can make SIP investments for their customers in a few minutes by completing the steps listed above using the Indiabulls MF SARAL Partner mobile APP.

How to set up SIPs for existing customers?

Setting up SIPs for existing customers is even simpler. The distributors need to complete the following steps.

- Login to the SARAL Partner APP using either OTP or the password setup by the distributor.

- Click on “Existing Investor”.

- If the distributor knows which folio number to use for the SIP then he / she can enter the folio number, otherwise he / she can search for all the folios of the investor using the investor’s PAN. If the distributor uses the investor’s PAN to search for all the folios an OTP will be sent to the investor on the registered mobile number, which needs to be entered in the app.

- The distributor will then select the appropriate folio and enter SIP details i.e. Scheme Name, SIP amount, SIP date etc. in the “Start SIP” screen.

- By clicking on Invest, Bank details attached to the Folio for Investor will be prefilled (the distributor will have to select the appropriate Bank in consultation with the investor).

- The distributor will then review the application and confirm to initiate the investment.

Other features of SARAL Partner APP

- Distributors can track transaction status by clicking on Transaction History in the app.

- Distributors can check Indiabulls MF product details by clicking on product catalog in the app.

- Distributors can use SIP Calculators by clicking on SIP calculator in the app.

Conclusion

We have seen that distributors and their staff usually spend most of their time doing operational tasks. Distributors, especially small IFAs, complain that they do not have enough bandwidth for sales and therefore, are unable to grow their AUM beyond a certain threshold. One important mission we have set for us in Advisorkhoj is encouraging IFAs to adopt technology to manage and grow their business. We are delighted to see a very enthusiastic response from IFAs with regards to the same. If IFAs are not leveraging technology, they run the risk of losing out to competition in the future.

With advancements in IT, distributors can put technology to work for them. Fund houses like Indiabulls MF must be congratulated for their initiative and investment to put technology at the fingertips of IFAs. Indiabulls Mutual Fund SARAL Partner APP is a testimony of digital technology use case. It is simple, convenient and a highly efficient productivity tool. If you are an Indiabulls MF empanelled distributor we encourage you to use to the SARAL Partner APP. If you are not empanelled with Indiabulls MF and wish to be, you can download the empanelment form from http://www.indiabullsamc.com/distributor-empanelment-form or visit the Indiabulls MF office in your city.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Bandhan Mutual Fund launches Bandhan Silver ETF FOF

Jan 12, 2026 by Advisorkhoj Team

-

Bandhan Mutual Fund launches Bandhan Gold ETF FOF

Jan 12, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF FOF

Jan 9, 2026 by Advisorkhoj Team

-

Mahindra Manulife Mutual Fund launches Mahindra Manulife Innovation Opportunities Fund

Jan 9, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Short Duration Fund

Jan 8, 2026 by Advisorkhoj Team