Know your Mutual Fund tax implications in FY 2016 17

Benjamin Franklin, one of the founding fathers of United States of America, in his 1789 letter, shortly after the establishment of the US constitution, wrote that, “in this world nothing can be said to be certain, except death and taxes”. Tax is one of the most important considerations in any investment for three important reasons.

- Investors must declare income which is taxable (under our tax laws) in their income tax returns and pay the necessary tax to the Government. Failure to disclose the correct income and not paying the correct tax amount is punishable by law.

- In India, all tax payers (except retired senior citizens), whose tax liability exceeds

र10,000 must pay Advance Tax. Instead of paying taxes in lump sum at the time of filing returns, advance tax is to be paid in 4 instalments (June, September, December and March), based on the accrued tax liability during the period or a certain percentage of the total estimated tax liability for the year, whichever is bigger.

If you do not pay the correct advance tax in time, you are liable to pay interest on the late payment to the Government. For salaried individuals, payment of advance tax on salary is taken care of by the employer through TDS. However, profits made on investment (if taxable) are not always subject to TDS. Therefore, for profits made on investments (if taxable), where TDS is not deducted, investors should calculate the tax obligation before the Advance tax due dates and pay the taxes, if they want to avoid penal interest payment later. - Knowing the tax implication is very important for making investment decisions. What ultimately matters to the investor, is the money left after paying taxes. If you are not able to correctly assess the tax implication, you will be left with less money than anticipated. All investments are not subject to the same tax treatment; some investments get favourable tax treatments, while others do not. Therefore, it is important to understand the tax treatment of your investment, so that you are able to make the most efficient investment decision.

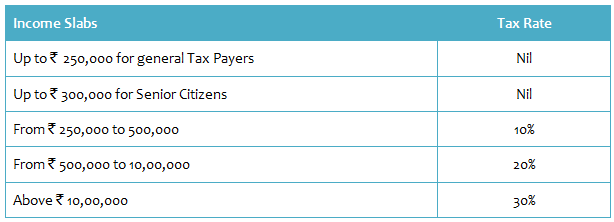

In this blog post, we will discuss the tax implications of mutual fund investments, so that you are able to correctly assess the tax obligation arising out of your mutual fund transactions and also help you in making the correct investment decisions. In the last 2 years since the NDA Government came to power, some important tax changes were made, which we had discussed earlier in our blog. Please note that, in this post we will discuss the tax implications for Resident Indian, Hindu Undivided Families and Non Resident Indians only. If you are interested in understanding tax implications of mutual fund investments made by your company, please write to us separately and we will try to clarify. For the benefit of our readers, let us recap the tax slabs for resident Indians and Hindu Undivided Families (HUF).

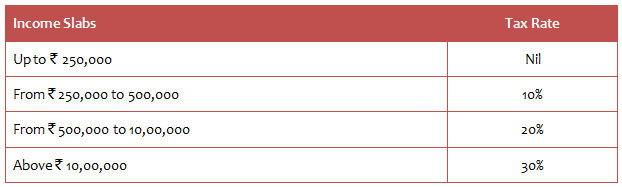

The tax slab for Non Resident Indians (NRIs) for incomes in India is shown in the table below.

Various deductions are allowed from your gross taxable income under various provisions, some of which are discussed below.

- Section 80C: A deduction of

र1.5 lacs from your gross taxable income is allowed for investments under Section 80C of The Income Tax Act 1961. Investments eligible for Section 80C deduction include employee provident fund, voluntary provident fund, public provident fund, life insurance premiums, mutual fund equity linked savings schemes (ELSS), National Pension Scheme, Post Office Time Deposit, home loan principal repayment etc. - Section 80CCD: A further deduction of

र50,000, over and above the Section 80C limit ofर1.5 lacs, has been allowed for investment in the National Pension Scheme. Therefore the total deduction allowed under Section 80C and 80CCD is nowर2 lacs. - Section 80D: Maximum allowable deduction for health insurance or Mediclaim premium under Section 80D is

र25,000 for self, spouse and dependent children. The applicable deduction for senior citizens isर30,000. If an individual pays for medical insurance of parents who are senior citizens, then the he or she can claim a total deduction ofर55,000. - Section 24: The maximum deduction on account of interest paid on home loan for a self occupied property is

र2 lacs per annum.

Income from Mutual Fund

To understand how mutual fund returns are taxed, let us understand two ways investors make money from mutual fund investments:-

Capital Gains:

Capital gain is the appreciation in the value of the units of a mutual fund at the time of the sale. From a tax standpoint, there are two types of capital gains.Short term capital gain:

If the units are sold within the period as defined under tax laws, then it leads to short term capital gain. Please note that under our tax laws periods of short term capital gains are different for different investment types.Long term capital gain:

If the units are sold after a period defined under tax laws, then it leads to long term capital gain. Please note that under our tax laws periods of short term capital gains are different for different investment types.Dividends:

Dividends are profits returned by the mutual fund to the investor at regular intervals. However, the intervals are not certain and dividend amount is also not fixed.

The tax treatment of capital gains and dividend incomes are different. Tax treatment is also different for different types of mutual funds. Let us discuss it one by one.

Tax Treatment of Equity Funds

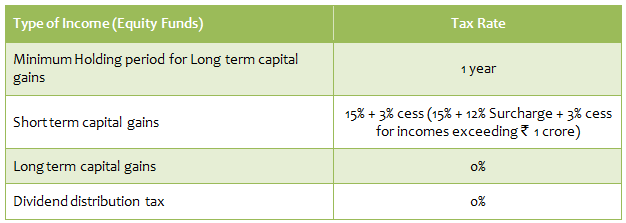

From a tax perspective, a fund in which at least 65% of the portfolio is allocated to equities is an equity fund. Diversified equity funds, sector funds, ELSS and balanced funds with more than 65% of its portfolio allocated to equities are categorized as equity funds from a tax standpoint. Please note that, arbitrage funds enjoy equity taxation under our tax laws. Further note that, certain hybrid funds, also sometimes known as equity savings funds, which invest in equity, arbitrage and debt (debt percentage less than 35%), are also treated as equity funds under our tax laws. The minimum holding period for long term capital gains in equity funds is one year.

Short term capital gains (if the units are sold before one year) in equity funds for Resident Indians, HUFs and NRIs are taxed at the rate of 15%. There is an additional surcharge of 12% for investors whose annual income exceeds र 1 crore. Education cess of 3% on tax plus surcharge will be levied on short term capital gains.

NRI investors should note that, short term capital gains tax will be deducted at source at the time of redemption of equity mutual fund units, if held for a period of less than 1 year. There is no tax deducted at source (TDS) for Resident Indians and HUFs. There is no capital gains tax on the sale of equity fund units held for a period of more than one year (long term capital gains). While dividends of mutual funds are tax free in the hands of the investors, for equity funds the dividend distribution tax is zero even for the fund house. Here is a quick recap of tax treatment of equity funds.

Non Equity Funds

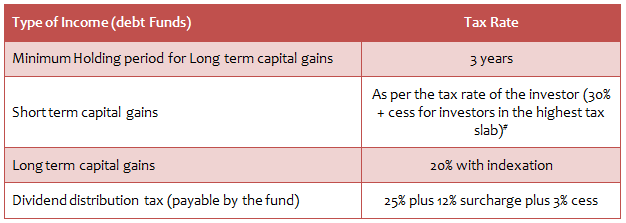

Non equity funds include debt funds (liquid funds, income funds, Gilt funds, Monthly Income Plans etc), fund of funds, gold funds, international funds etc. It is important for investors to understand that, fund of funds, gold funds and international funds are not treated as equity funds from a tax perspective.

The minimum holding period for short term capital gains in debt funds is now 3 (three) years. Short term capital gains (if the units are sold before 3 years) in debt funds are taxed as per applicable tax rate of the investor.

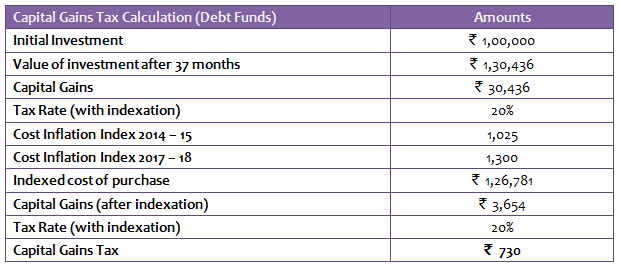

So if your taxable income is above Rs 10 lakhs then short term capital gains tax of your debt fund sale is 30% plus applicable cess and surcharges. Long term capital gains (holding period is more than 3 years) of debt funds are taxed at 20% with indexation. To calculate capital gains with indexation, you should index your purchasing cost by multiplying the purchasing cost with the ratio of the cost of inflation index of the year of sale and cost of inflation index of the year of purchase, and then subtract the indexed purchasing cost from sales value.

Let us understand how to calculate long term capital gains tax with indexation with the help of an example. Assume you want to invest र 1 lakh in an income fund for 37 months. The pre-tax return of your investment is 9% on a compounded annualized basis. You are in the 30% tax bracket. The Cost of Inflation Index in FY 2015 was 1,025. Let us assume the Cost of Inflation Index in FY 2018 is 1,300 (assuming an inflation rate of 8%). The table below shows the calculation of long term capital gains tax with indexation.

For NRIs, tax will be deducted at source at the time of redemption of non equity mutual fund units.

While dividends are tax free in the hands of the investors, the fund house pays dividend distribution tax (DDT) for non equity funds before distributing dividends to investors. For Resident Indians, HUFs and NRIs, the DDT paid by the fund house for non equity fund schemes is 25% + 12% surcharge + 3% cess = 28.84%. Here is a quick recap of tax treatment of debt funds. NRIs should note that, since the fund house pays DDT before paying dividends to investors, there is no TDS for dividends even on non equity funds. Here is a quick recap of tax treatment of debt funds.

# Surcharge of 12% will be levied on investors with incomes exceeding र 1 crore

Tax Savings by Investing in Equity Linked Savings Schemes (ELSS)

Investments in Equity Linked Savings Schemes qualify for deduction from your taxable income under Section 80C of the Income Tax Act 1961. The maximum investment amount eligible for tax deduction under Section 80C is र 1.5 lakhs. Investors in the highest tax bracket (30%) can therefore save up to र 46,350 in taxes (र 1.5 lakhs X 30.9% tax + cess) by investing in ELSS. Please note that र 1.5 lakhs is the overall Section 80C cap after including all eligible items like, your employee provident fund contribution (deducted by your employer), life insurance premiums, ELSS etc.

Conclusion

In this post, we have discussed the effect of taxes on your mutual fund investment. You should pay due attention to the impact of taxes on your investments and plan your investments accordingly, so that you achieve your investment objectives by maximizing the post tax returns from your investment.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Financial Services Fund

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty India Infrastructure and Logistics ETF

Jan 30, 2026 by Advisorkhoj Team