Midcap versus Large Cap Investing in mutual funds

From time to time, investors find midcap stocks and funds very attractive. 2014 to 2017 was a fabulous period for midcap mutual funds, with some mutual funds delivering 20%+ CAGR returns during this period. Investors flocked to these mutual funds investing both in lump sum and through SIP. Investor interest in these funds were so high, that some midcap mutual fund managers were struggling to deploy the fresh inflows in attractive investment opportunities because valuations of many midcap and small cap stocks had sky-rocketed by 2017. As a result, some midcap mutual fund schemes put restrictions on lump sum investments and some suspended subscriptions (both in lump sum and SIP).

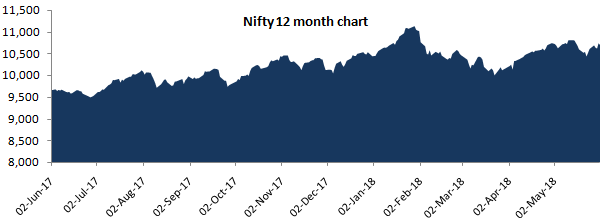

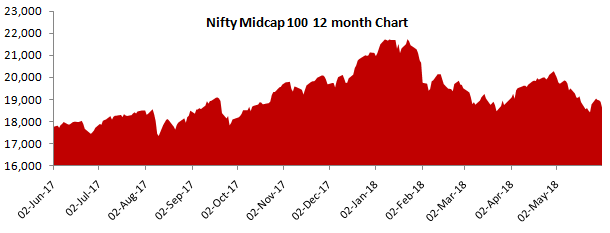

Come 2018, the picture is different. Mid and small cap stocks have come under pressure. The Nifty Midcap 100 index is down nearly 13% on a year to date basis, while the Nifty is almost flat (up about 1%). In the last one year, Nifty Midcap 100 index gave just 5.8% return while the Nifty gave 11.2% return. The charts below show the movement of Nifty and Nifty Midcap 100 in the last 12 months.

Source: NSE

Source: NSE

You can see that Nifty Midcap 100 was much more volatile (both on the upside and downside) than Nifty in the last 12 months. Volatility characteristic is one of the primary differences between the large cap segment (represented by Nifty) and midcap segment (represented by Nifty Midcap 100); the small cap segment is even more volatile than the midcap segment.

Investors who understand the risk characteristics of these two market cap segments and have high risk appetites, prefer to have substantial allocations to midcap mutual funds if they have long investment tenures. However, many retail investors get attracted by high returns given by midcap mutual funds in bull markets, without understanding the risks.

The insatiable appetite for midcap mutual funds seen from 2014 to 2018 is not a new phenomenon in our market – we saw similar levels of interest in 2006 and 2007 too. But midcap mutual funds were among the worst hit in the financial crisis of 2008. Midcap stocks (represented by BSE Midcap index) crashed 62% in 2008, while large cap stocks (represented by BSE 100) fell 54%.

Let us now understand the fundamental differences between large cap and midcap segments, so that investors understand the risk factors clearly before investing.

Key differences between large cap and midcap equity mutual funds

Definitions:

SEBI in its circular for mutual funds have issued clarifications with regards to market cap definitions. The 100 largest companies in terms of market capitalization (market capitalization is the share price times the number of shares outstanding) are large cap companies. The next 150 companies in terms of market capitalization are midcap companies. The remaining companies are small cap.Ability to withstand recessions:

Large cap companies by virtue of their size are leaders in the respective industry sectors. Due to their larger proportional market shares, large cap companies usually enjoy relatively higher stability across different economic cycles – growth and downturns. Midcap companies tend to be more vulnerable than large cap companies in economic recessions and small cap companies are the most vulnerable.

On the other hand, in the face of protracted global downturns lasting several years, as sometimes seen in certain commodities, some experts argue that, midcap and small cap companies are more nimble to adjust their strategy or make business model changes compared to large cap companies and therefore, can perform better than their large cap counterparts.Access to finance:

Large cap companies have easier access to financing (credit) compared to mid and small cap companies. This can help them emerge stronger from downturns and be better poised to take advantage of demand recovery when economic conditions improve.Growth rate:

Mid and small cap companies because of their smaller size can grow at a faster rate than large cap companies. Mid and small cap companies also tend to be more reactive to emerging opportunities in the market and can capitalize of these opportunities faster than large cap companies. Higher earnings growth rate of mid and small cap companies translate into higher share appreciation. Therefore, midcaps (and small caps) tend to outperform large cap companies in bull markets. The opposite is however the case in bear markets because, as discussed earlier, midcap companies are perceived to be more vulnerable in downturns.Valuation:

Large cap companies are more widely held by the public (both retail and institutional investors) compared to midcap (and small cap) companies. Due to higher institutional ownership, large cap companies tend to be better researched than midcap (and small cap) companies. Due to greater visibility in these companies investors are ready to pay a premium for large cap companies. Also, as discussed earlier, large cap companies are perceived to be less vulnerable in downturns than midcap companies and therefore, seen as safer investments. A combination of these two factors usually results in large cap companies enjoying a valuation premium compared to midcaps.

Mid and small cap companies usually are available at a cheaper price (valuation) compared to large cap companies. As discussed earlier, midcap companies can grow faster than large cap companies. Midcap companies of today have the potential of becoming large cap companies of the future. Over a period of time, when midcap companies of today grow to sizes comparable to large cap companies, valuation re-rating will take place and these companies will be rated as large cap companies. A combination of higher earnings growth and valuation re-rating can result in midcap (and small cap) companies giving multi-bagger returns to investors.

Readers may have noticed that we have italicized the word usually in the two earlier paragraphs. This is because even though midcaps (and small caps) tend to trade at lower valuations, we have seen an unusual situation over the past 2 to 3 years – many midcap stocks are trading at much higher valuations than large cap stocks. Even though midcap valuations it has come down a bit from the 2017 highs due the correction over the last 4 – 5 months, the Nifty Midcap 100 valuation (P/E ratio) is still at significant premiums to Nifty. Therefore, in the current circumstances, there is higher possibility of valuation re-rating on the downside rather than on the upside.Correlation with global risk:

Foreign institutional investors (FII) are a very important constituent in India’s stock market. Historically, FII trading volumes have been higher than Domestic Institutional Investors (DII) volumes. Though the gap has narrowed over the last few years, FIIs continue to be the dominant player in our market. FII trading is mostly driven by global factors and they invest / trade primarily in large cap stocks. Therefore, price movement of large cap stocks is more closely correlated to global factors compared to price movement of midcap (and small cap stocks), which are driven more by local factors. We saw in 2015 / 2016, when Nifty fell by more than 20% and many large cap funds gave low or even negative, while midcaps showed a lot more resilience, with some midcap funds giving double digit returns.Liquidity:

Large cap stocks are much more liquid than midcap stocks. Large cap stocks are more widely held and daily trading volumes of large cap stocks are much higher than midcap stocks. In India the percentage of free-floating shares (shares not held by promoters, related parties, management, Government etc) is quite small in midcap companies and even smaller in small cap companies. Stocks that have small free float are likely to see higher price volatility as it takes fewer trades to move the share price. Also due to small free-float, fund managers may not be able to get the number of shares they want to buy, because there may not be enough sellers in the market (below a certain price).

The bigger problem is that, in certain market conditions, you may not find sufficient buyers in the market, if you want to sell a large block of shares. This had happened in the past – in face of redemptions pressures during market crashes, fund managers were not able to find enough buyers in the market. In such a situation, fund managers are faced with two choices – either to sell high quality liquid stocks (which they would not have sold, if there were no redemption pressures) or to suspend redemptions. Both are bad choices because in the first case, the interest of the investors who remain invested are harmed and in the second case, the interests of the investors who want to get out are hurt.

We have discussed the different characteristics of large cap and midcap mutual funds. Midcap mutual funds have the potential of generating higher returns for the investors compared to large cap mutual funds in the long term but they are more volatile and can be illiquid in certain conditions. If you have high risk appetite and are willing to ride out the volatility, no matter how long it takes, midcap mutual funds can be good investment options.

Large cap mutual funds on the other hand provide stability to your portfolio, they are highly liquid irrespective of market conditions and good large cap funds can generate good returns for investors in the long term.

We will now discuss a large cap mutual fund, which has consistently outperformed the benchmark and category returns.

Indiabulls Bluechip Fund – A Top Performing Large Cap Fund

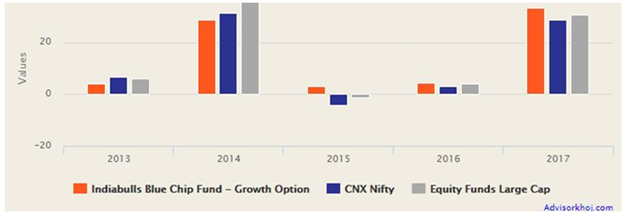

Indiabulls Bluechip Fund has consistently outperformed both the benchmark Nifty and the large cap funds category returns over the last 3 years (please see our chart below).

Source: Advisorkhoj Research

Indiabulls Blue Chip Fund was launched in February 2012. The scheme has Rs 1,022 Crores of Assets under Management (AUM). The expense ratio of the fund is 2.94%. The fund has given 11.33% compounded annual returns since its inception. The fund is managed by Sumit Bhatnagar, an MBA in Investment Management from University of Toronto, Canada and CFA Charter (USA). Prior to joining Indiabulls Mutual Fund he has worked with SEBI. The scheme benchmark is CNX – Nifty.

Regular Advisorkhoj readers know that, Rolling Return is the best measure of a mutual fund’s performance because it is not biased point in time market conditions. The chart below shows the 3 year rolling returns of Indiabulls Bluechip Fund versus the benchmark Nifty since inception.

Source: Advisorkhoj Rolling Returns Calculator

Fund manager, Sumit Bhatnagar, follows a combination of top down and bottom up stock picking strategies. The fund manager is to be conservative in the portfolio construction process. He looks to identify key themes to play by analyzing global macro environment, Indian macros, government policies and other economic factors. Once the key themes are identified, he looks at companies that are near monopolies or oligopolies, having pricing power, strong brands, leaders/challengers in their respective sectors, strong distribution franchise, low leverage, decent growth prospects, decent RoE (Return on Equity) & RoCE (Return on Capital Employed) and high quality management teams and low leverage.

Read how this fund beat the CRISIL AMFI LARGE CAP INDEX

The portfolio is built predominantly around domestic consumption and government spending themes. From a market capitalization perspective, Indiabulls Blue Chip Fund has a mandate to deploy 80% in large caps (basically top 100 companies by markets cap) and upto 20% in mid & small cap space.

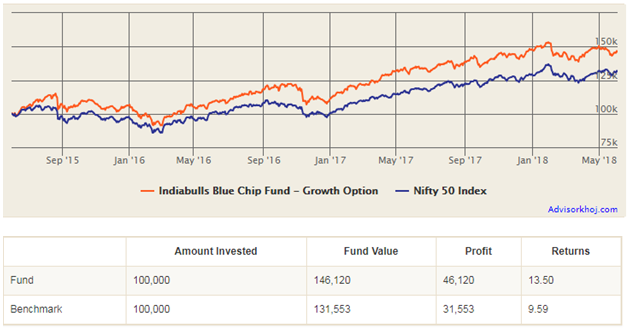

The chart below shows the growth of Rs 1 lakh invested in the Indiabulls Blue Chip Fund (Growth Option) over the last 3 years.

Source: Advisorkhoj Research

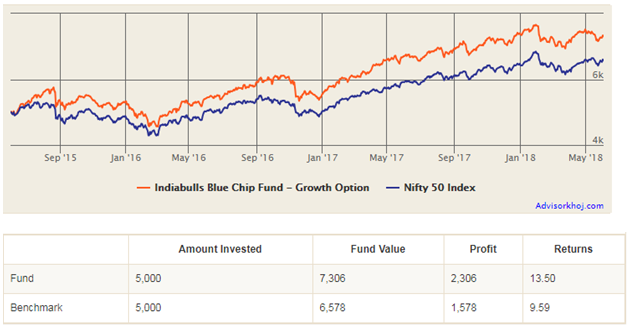

The chart below shows the returns of Rs 5,000 monthly SIP in Indiabulls Blue Chip Fund (Growth Option) over the last 3 years.

Source: Advisorkhoj Research

Read the complete fund review of Indiabulls Bluechip Fund and why it is one of the top performing large cap equity mutual funds

Conclusion

In this blog post, we discussed the key differences between large cap and midcap mutual fund investing. One it not necessarily superior compared to the other – it depends on your risk appetite. Financial planners usually recommend that, large cap or large cap oriented funds should form the core of your long term investment portfolio and depending on your risk appetite you can also have some allocation to midcap funds to diversify your portfolio and enhance your returns in the long term.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF

Feb 2, 2026 by Advisorkhoj Team

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team