Principal Balanced Fund: Outstanding performance consistency

Principal Balanced Fund is one of the best performing balanced funds in the last 3 to 5 years (please refer to Advisorkhoj research tool, Top Performing Balanced Fund Equity Oriented). In the last 5 years, Principal Balanced Fund was among the top 3 balanced funds, giving nearly 18.71% CAGR returns. In the last 3 years, Principal Balanced Fund was the best performing balanced fund giving nearly 14% CAGR returns. Even in the last one year, Principal Balanced was among the top 2 balanced funds, giving nearly 20% returns. Principal Balanced Fund is one of the fastest growing mutual fund schemes(in terms of AUM) in the Balanced Fund category – its AUM currently stands at Rs 1,060 Crores. The fund outperformed its more popular peers both in terms of trailing returns (1 year, 3 years and 5 years) and also in terms of performance consistency.

Principal Mutual Fund has been adjudged as the winner in Best Balanced Fund AMC of the Year category by Money Today Financial Awards held in Mumbai on Thursday, 22 March 2018.

The awards were preceded by a panel discussion on "Where to invest in 2018". The Money Today financial awards were instituted in 2013 and they recognize and award the best companies in various financial categories including insurance and mutual funds.

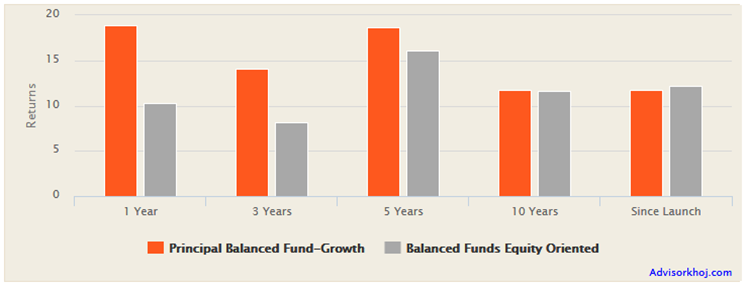

The chart below shows the trailing return performance of Principal Balanced Fund versus the Balanced Fund category over several time periods.

Source: Advisorkhoj Research

In our blog, we have often stated the importance of performance consistency in selecting mutual funds for long term investments. You can see in the chart above, that Principal Balanced Fund was able to beat the category average consistently over the last 5 years. In our research tool, Top Consistent Mutual Fund Performers, we identify the most consistent performers in any mutual fund category by looking at their annual quartile rankings over the last 5 years and using our proprietary algorithm to rank funds based on returns consistency. Principal Balanced Fund is at the top of the list of most consistent balanced funds.

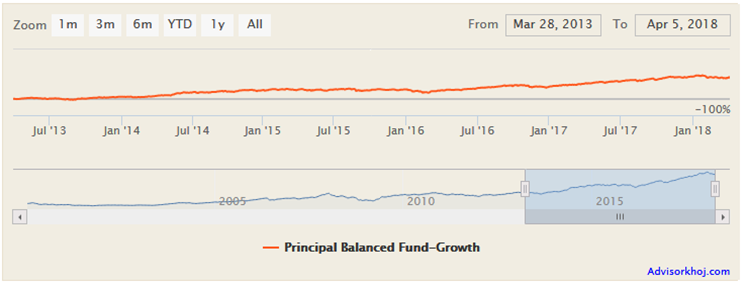

Principal Balanced Fund was launched in 2000. The equity portion of Principal Balanced Fund is managed by PVK Mohan who has total work experience of over 24 years. He has been managing this fund since May 2010. Ms. Bekxy Kuriakose manages the debt portion of this fund. She has total work experience of 16 years and has been managing this fund since Mar 2016. The expense ratio of the fund is 2.52%. The chart below shows the NAV growth of the fund over the last 5 years.

Source: Advisorkhoj Research

Rolling Returns

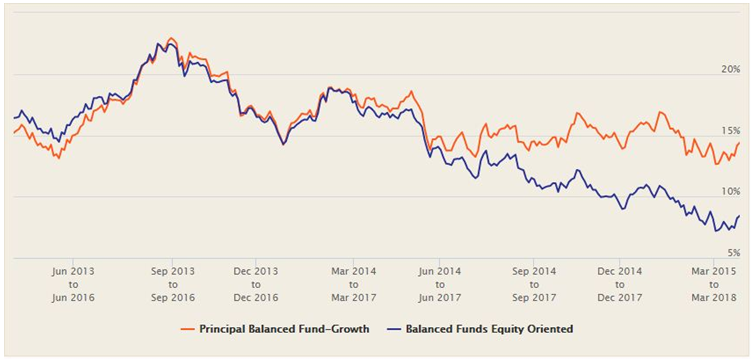

The chart below shows the three year rolling returns of Principal Balanced Fund versus the Balanced Fund category over the last 5 years. We have chosen a 3 year rolling returns period because in our view investors should have at least 3 years investment tenure for equity oriented funds, including balanced funds.

Source: Advisorkhoj Research

Rolling returns is one of the best mutual fund performance measures because it is not biased by recent market conditions and measures performance across different market conditions. You can see that, Principal Balanced Fund outperformed Balanced Funds category in term of 3 year rolling returns for most parts of the last 5 years (nearly 75% of the times). The 3 year annualized rolling returns was almost always in double digits over the last 5 years. The maximum 3 year rolling returns in the last 5 years was nearly 23%, while the minimum 3 year rolling returns in the last 5 years was around 10%. The average 3 year rolling returns of the fund was 16.44%, while median 3 year rolling returns o was 15.7%.

Portfolio

Currently, the fund is invested about 65.5% into equities across market capitalizations. The equity portfolio has a large cap bias (with about 63% equity allocations to large cap stocks). The composition of fund also spreads across sectors and industries which are expected to benefit from themes like consumption, infrastructure, affordable housing and rural/agriculture. Banks, consumer non-durables, chemicals, cement, automobiles etc. are the major sectors. The major contributors of the fund’s performance in the last 1 year are Phillips Carbon Black, KEC International, Chambal Fertilizer and Chemicals, Dewan Housing Finance Corp and Asahi India Glass.

The fixed income portion of the fund is deployed in (i) Debt instruments like bonds and NCDs, (ii) Debt Mutual Fund Units and (iii) Cash and Other Assets. The Debt Instruments currently have average maturity of 3.84 years, modified duration of 2.8 years and yield of 7.95%; over the past few months the fund managers have brought down the modified duration of the debt portfolio in line with their interest rate outlook. The interest rate sensitivity of the debt portfolio of Principal Balanced Fund is moderate.

Lump Sum and SIP Returns

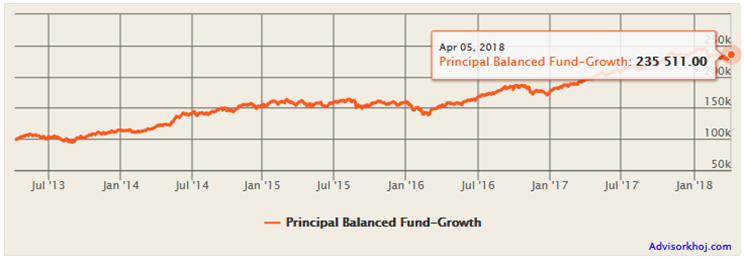

The chart below shows the growth of Rs 1 lakh invested in Principal Balanced Fund (Growth Option) over the last 5 years.

Source: Advisorkhoj Research

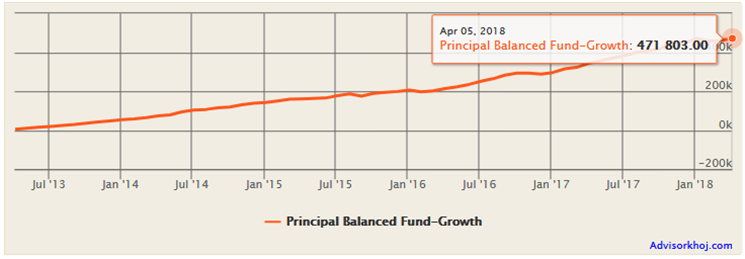

You can see that, the investment grew 2.35 times in the last 5 years. The 5 year annualized return was 18.7%. The chart below shows the growth of Rs 5,000 monthly SIP in Principal Balanced Fund (Growth Option) over the last 5 years.

Source: Advisorkhoj Research

With a cumulative SIP investment of just Rs 3 lakhs, the investor could have made a profit of over Rs 1.7 lakhs. The annualized SIP return over the last 5 years was 17.8%.

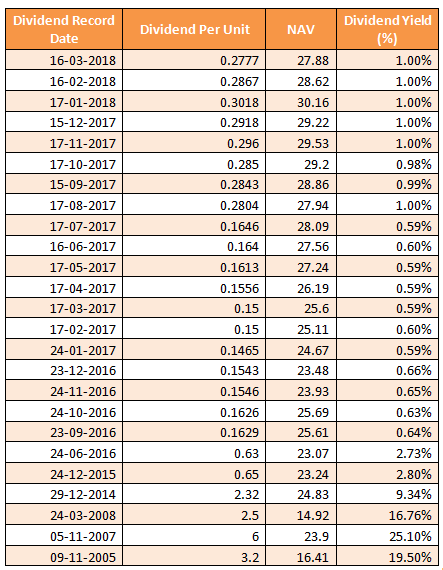

Dividend History

The table below shows the dividend history of Principal Balanced Fund – Dividend Option. You can see that, the scheme has been paying regular monthly dividends to its investors since the third quarter of FY 2017. Dividend yield in the last 1 year has also been good. However, investors should know that, mutual fund dividends are not assured.

Investors should also note that till the last fiscal year, dividends paid by balanced were totally tax free. From this fiscal year onwards, dividends paid by Balanced funds and equity funds will continue to be tax free in the hands of the investors, but the fund house has to pay 10% Dividend Distribution Tax (DDT) before distributing dividends to investors. Due to change in dividend taxation for equity funds in this year’s Union Budget, the dividend yields of balanced funds and equity funds may come down slightly from April 2018 onwards.

Source: Advisorkhoj – Historical dividends of mutual fund schemes

SWP from Balanced Funds

In a Systematic Withdrawal Plans (SWP) the investor can regularly withdraw a fixed amount of money from the investment in a balanced fund scheme. The amount to be withdrawn and the frequency of withdrawal are fixed by the investor. So you can have a monthly, quarterly or annual frequency for any fixed amount that you wish to receive. SWP from a Balanced Mutual Fund is an ideal investment option for investors to get regular fixed monthly income from their investment and at the same time see their investment grow in value over sufficiently long investment tenures.

Investors should note that, SWP generates fixed cash-flows for investors by redeeming a certain number of units at prevailing NAVs. While unit balance goes down every month, the unredeemed units continue to accrue returns for the investor over the SWP tenure. If the withdrawal rate per annum is lower the average long term annualized returns of the fund, then investor can get both regular income as well as capital appreciation.

For example – Had you invested Rs 10 Lakhs in Principal Balanced Fund 5 years back and started monthly SWP of Rs 7,500 (annual 9%), the current value of your original investment (Rs 10 Lakhs) would have grown to Rs 15.95 Lakhs even after withdrawing Rs 450,000 as SWP in the last 5 years. The SWP return of the funds has been at CAGR 18.3% in the last 5 years!

Please check the detailed SWP Calculation of Principal Balanced Fund

Principal Mutual Fund offers a Regular Withdrawal Plan from Principal Balanced Fund to those investors who are looking for regular monthly withdrawal from their investment in this fund. How the Regular Withdrawal Plan works? Please read this – A smart and convenient way of getting regular income

Why is Principal Balanced Funds a good investment in the current environment?

The stock market has turned quite volatile in the last 2 months or so. The Nifty fell from its all time high of 11,130 to below 10,000 (correction of more than 10%) in late March 2018. Though Nifty has managed to stay above 10,000 this month so far, volatility is expected to continue over the next few months. In the last 12 months, Nifty gave 11.44% returns(as on April 06, 2018). We have often stated in our blog that, equity is the best asset class for your long term financial goals. Though our macros like GDP growth, fiscal deficit, IIP growth etc have been stable or improving, global factors like US interest rate movements, trajectory of crude prices etc. are causing uncertainties in our stock markets. As such, concerns related to future returns, volatility and fears of price correction in the short to medium term are undeniable.

Balanced Funds offer investors the opportunity to remain invested in the best performing long term asset class and at the same time, reduce the downside risks in the event of a correction, thereby giving your investment portfolio stability. Balanced funds also offer investors automatic asset allocation rebalancing, when relative price movements approach extremes. Auto asset rebalancing yields superior risk adjusted returns in the long term. Investors can rebalance their assets by switching partially from equity to debt funds, but there is a cost associated with frequent rebalancing in the form of exit loads and short term capital gains taxation. Through Balanced funds investors can achieve asset rebalancing at no cost.

To know more about Balanced Funds, do read this – What are Balanced Mutual Funds

Balanced funds are also very tax efficient investments because they are treated like equity funds from a taxation standpoints. Short term capital gains (investments held for less than 12 months) in balanced funds are taxed at 15%. Long term capital gains (investments held for more than a year) in balanced funds, of up to Rs 1 Lakh are tax free. Long term capital gains in excess of Rs 1 Lakh from April 1, 2018 onwards are taxed at 10%. Dividends are tax free in the hands of the investors, but the fund house will have to pay 10% DDT before paying dividends to investors.

Principal Balanced Fund has been one of the best performing balanced funds in the last 5 years of so. Helmed by experienced fund managers with very strong records, the future potential of the fund is very bright. We have seen that, funds which deliver consistent performance across varied market conditions – continue to deliver outperformance (good alphas) in the future. Investors with moderately aggressive risk appetites can invest in this fund with a long horizon of minimum 5 years. Investors should consult with their financial advisors if Principal Balanced Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team