Principal Tax Savings Fund: 30 times return since launch

Principal Tax Savings Fund is one of the best performing equity linked savings schemes (ELSS) in the last 5 years. Section 80C of Income Tax Act 1961 allows tax payers to claim deduction of up to Rs 1.5 Lakhs by investing in mutual fund ELSS and certain other specified schemes. ELSS not only helps tax payers save taxes, it also helps them create wealth in the long term. Historical data shows that ELSS has been the best performing tax saving investment over a sufficiently long investment horizon.

If you had invested Rs 1 Lakh in Principal Tax Savings Fund at its inception in 1996, your money would have multiplied nearly 30 times to Rs 29.6 Lakhs.

Scheme Overview

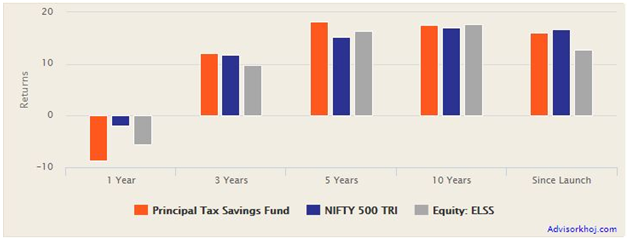

Principal Tax Savings Fund was launched in May 1996 and has Rs 368 Crores of Assets under Management (AUM). The expense ratio of the scheme is 2.62%. As mentioned earlier the scheme is one of the best performing ELSS in the last 5 years with annualized returns of 18.2%. It is also one of the best performing ELSS in the last 3 years, with annualized returns of 12.1%. The chart below shows the annualized returns of Principal Tax Savings Fund versus its benchmark Nifty 500 and the ELSS category, over various trailing time-scales.

Source: Advisorkhoj Research

You can see that the scheme underperformed in the last 1 year, but outperformed both the benchmark and the category over longer time-scales. The last one year has seen a lot of volatility in the stock market, especially in certain segments of the market like the midcap and the small cap segments, where the Principal Tax Savings Fund has considerable exposure (around 38% as on October 2018). However, the mid and small cap segments were outperformers in 2014 to 2017 period, which resulted in the superior outperformance of the scheme over longer time-scales. Equity Linked Savings Schemes (ELSS) has a lock-in period of 3 years; hence, short term performance is not relevant for investors who are looking to make tax saving investments.

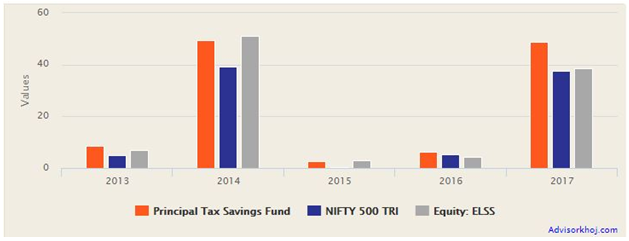

The chart below shows the annual returns of Principal Tax Savings Fund versus its benchmark and fund category over the last 5 years. You can see that the scheme outperformed the benchmark and category in most years in the last 5 years.

Source: Advisorkhoj Research

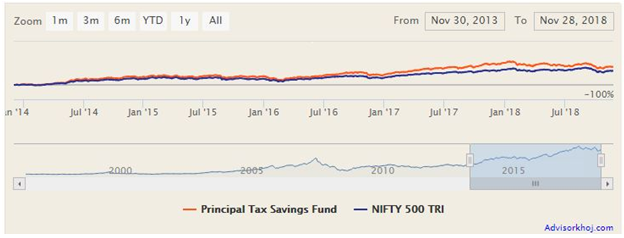

Principal Tax Savings Fund is helmed by veteran fund manager, PVK Mohan. The chart below shows the NAV growth of the scheme over the last 5 years.

Source: Advisorkhoj Research

Rolling Returns

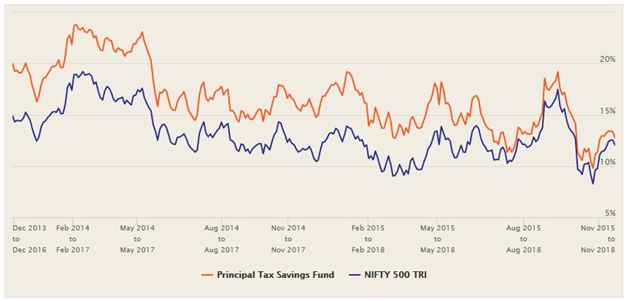

Regular Advisorkhoj readers know that rolling return is possibly the best measure of mutual fund performance because it measures performance consistency across different market conditions. Rolling returns tell investors whether a fund manager benefited from market conditions by taking more or less risk or if the fund manager was able to deliver alphas across different market conditions through superior stock selection and fund management. The chart below shows the 3 year rolling returns of Principal Tax Savings Fund versus its benchmark (Nifty 500 TRI) over the last 5 years. We have chosen a 3 year rolling returns period because ELSS have a lock-in period of 3 years.

Source: Advisorkhoj Rolling Returns Calculator

You can see that Principal Tax Savings was able to beat its benchmark consistently. Let us now see how Principal Tax Savings Fund performed against the ELSS category, in terms of 3 years rolling returns over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

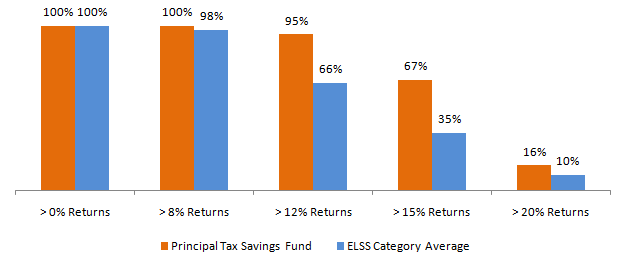

Investors can see that Principal Tax Savings Fund was able to outperform the category consistently across different market conditions over the last 5 years. The 3 year rolling returns chart of Principal Tax Savings Fund versus the ELSS category shows why we consider this fund among the best performing ELSS in the last 5 years. The table below shows some key rolling return statistics of the scheme versus the category.

Source: Advisorkhoj Rolling Returns Calculator

Let us now see the 3 year annualized rolling returns consistency of the Principal Tax Savings fund versus the ELSS category over the last 5 years. The chart again shows that Principal Tax Savings Fund consistently generated superior returns for investors, across different market conditions.

Source: Advisorkhoj Rolling Returns Calculator

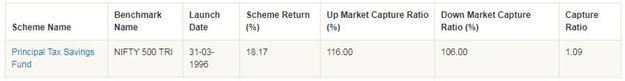

Market Capture Ratios

Market rallies and crashes are both realities of equity investing. Performance in different market conditions is measured by a set of metrics called market capture ratios. In this tool we see the performance of a fund both in up-market (months in which the benchmark index was up) and down market (months in which benchmark index was down). The ratio of the average monthly returns of a scheme versus average monthly returns of the benchmark when the market was up is known as Up-market Capture Ratio. The ratio of the average monthly returns of a scheme versus average monthly returns of the benchmark when the market was down is known as Down-market Capture Ratio. The table below shows the Up Market and Down Market Capture Ratios of Principal Tax Savings Fund, over the last 5 years.

Source: Advisorkhoj Research Market Capture Ratios

Up Market Capture Ratio of more than 100% implies that the fund manager is able to generate higher than market benchmark returns when market is rising. Down Market Capture Ratio of less than 100% means that the fund manager is able to provide some downside risk protection when market is falling. If Up Market Capture Ratio is more than Down Market Capture Ratio, it implies that the fund manager will be able to generate good returns over a sufficiently long investment horizon because in a sufficiently long investment horizon, there are usually many more up market periods compared to down market periods.

Lump Sum and SIP Returns

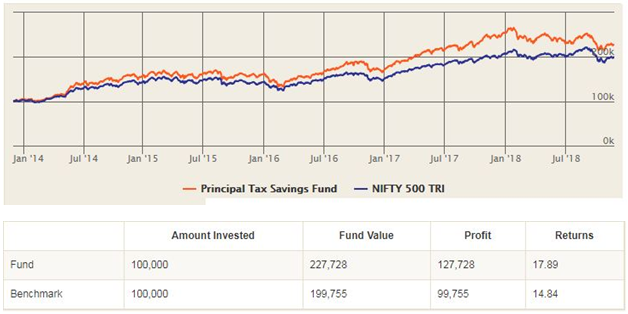

The chart below shows the growth of Rs 1 Lakh lump sum investment in Principal Tax Savings Fund (Growth Option) over the last 5 years. The table below the chart shows the returns in figures and percentages. You can see that the scheme delivered excellent returns in the last 5 years.

Source: Advisorkhoj Research

The chart below shows the growth of Rs 10,000 monthly SIP investment in Principal Tax Savings Fund (Growth Option) over the last 5 years. The table below the chart shows the returns in figures and percentages. You can see that the scheme delivered excellent SIP returns in the last 5 years.

You must read – Mutual fund SIPs: A checklist of myths and facts

Conclusion

Principal Tax Savings Fund has a 22 year track record of wealth creation. The last 5 year track record of the scheme is quite impressive and it is considered one of the best performing Equity Linked Savings Schemes. You can invest in Principal Tax Savings Fund in either lump sum or SIP, depending on what is more convenient for you, for tax savings and your long term investment goals. The scheme has a lock in period of 3 years, but to get the best returns you should be prepared to remain invested for longer periods of time. Investors should consult with their financial advisors if Principal Tax Savings Fund is suitable for their tax planning needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF

Feb 2, 2026 by Advisorkhoj Team

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team