Reliance CPSE ETF third FFO: Invest in market leader PSUs at discount

Reliance Mutual Fund has announced the third tranche of Further Funds Offer (FFO) for CPSE ETF. The CPSE ETF is an innovative initiative of the Government to disinvest its stake in select Public Sector companies through the exchange traded fund (ETF) route. The Government plans to raise Rs 8,000 Crores through Reliance Nippon CPSE ETF FFO.

Background

The Central Public Sector Enterprise (CPSE) ETF was first launched (NFO) in March 2014, as part of the Government’s disinvestment initiative. The NFO of the CPSE ETF was a success with the issue being oversubscribed 1.45 times. The units of the ETF were listed in NSE and BSE in April 2014. Following the success of the CPSE ETF NFO, a Further Funds Offer (FFO) was launched in January 2017. The issue size of the FFO was twice that of the NFO. FFO was subscribed 2.28 times. Following the success of the FFO, a second FFO was announced in March 2017 and this was an even bigger success, getting oversubscribed 4.03 times.

CPSE ETF FFO-3

The latest FFO is the third in the series of CPSE ETFs. The FFO will be open for subscription for retail investors on November 28th and close on November 30th. After the FFO is closed for subscription units of the FFO will be listed on the stock exchanges. One major advantage of investing in the FFO will be that investors will get a 4.5% discount on the market price of the underlying securities of the ETF. When the units are listed on stock exchange, you will have to pay the market price if you want to invest in the ETF.

What is an ETF?

We have discussed about Exchange Traded Funds (ETFs) a number of times in our blog. For the benefit of all our readers, ETF is a passive fund which tracks a particular market index. The fund managers of the ETF do not aim to beat the index. The primary objective is to reduce the tracking error relative to the index. Since ETFs are passively managed funds, their expense ratios are very low compared to actively managed funds. Units of ETFs are traded in stock exchanges. Investors need to have a trading and demat account to invest in ETFs. ETFs offer greater transparency than mutual funds. Whereas mutual fund scheme portfolios are disclosed monthly through factsheets, investors have visibility on the underlying portfolio of the ETF at any point of time because they track a market index.

What is CPSE ETF?

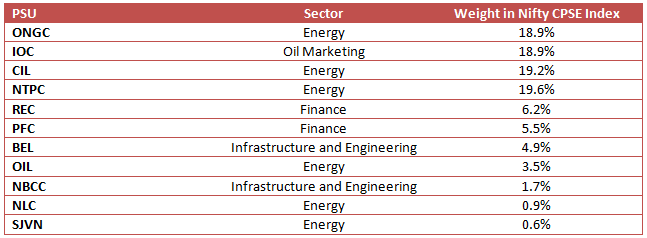

The CPSE ETF tracks the Nifty CPSE Index. This index was created as part of the Government of India’s disinvestment initiative. Public Sector Undertaking (PSU) companies, where the Government wants to disinvest its stake are included in the index. The CPSE index keeps changing both in terms of its constituents and weight of each constituent. The index is rebalanced quarterly. PSUs where the Government achieved its disinvestment target are taken out of the index and new PSUs where the Government wants to dilute its stake are added. Further, weights of index constituents are rebalanced every quarter capping weight of each constituent to 20%. Currently there are 11 PSUs in the Nifty CPSE Index.

Market Leadership of companies in the ETF portfolio

If you scan through the list of PSU companies in the Nifty CPSE Index, at first glance you will notice that these are some of the largest companies in India. Most of the companies (6 out of the 11) are market leaders in their respective sectors. ONGC and Oil India Limited (OIL) are the largest oil and gas exploration companies. Indian Oil Corporation (IOC) is India’s largest oil refiner and oil marketing company. Coal India Limited (CIL) has monopoly in coal mining. NTPC is India’s largest power generation company. Bharat Electronics (BEL) is the industry leader in the defense sector of our country. By investing in the Reliance CPSE ETF you will be able to invest in market leaders across a number of industry sectors. These are all large cap stocks, which will give stability to your portfolio.

Attractive Valuations

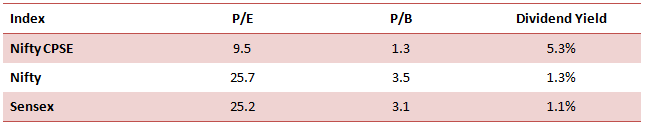

The Nifty CPSE Index, which forms the underlying portfolio of Reliance Nippon CPSE ETF, seems attractive on different valuation parameters compared to the frontline market indices like Nifty and Sensex.

You can see that on all valuation parameters, Nifty CPSE Index and therefore, Reliance Nippon CPSE ETF is more attractive than Nifty and Sensex. In a low interest rate environment, a dividend yield of 5.3%, by itself, makes an attractive investment proposition. The attractive valuations of Nifty CPSE index can yield strong returns for long term investors, if the intrinsic value is unlocked. The Government’s thrust on core sectors; reforms like “Fuel Deregulation”, Power Sector Reforms and the “Make in India” policy of the Government can unlock the intrinsic values in these PSUs and generate a lot of value for long term investors. If you look at the disinvestment history of the Government in PSUs over the past 20 years or so, it not only helped the Government in meeting its fiscal target, but also created wealth for long term investors.

Diversification Vis a Vis Nifty

The constituents of Nifty CPSE Index have relatively low weights in Nifty 50, which is the benchmark index of many large cap funds. If you have large cap funds in your mutual fund portfolio, then investing in the CPSE ETF will add diversification to your investment portfolio.

Conclusion

The 4.5% discount which the Reliance Nippon CPSE ETF is offering in this round of FFO obviously makes this an attractive investment. But investors should not just look at listing gains; instead they should take a longer term perspective because this ETF will enable investors to get a stake in market leaders across several industry sectors and as discussed in this post, also provides value opportunities as well as portfolio diversification. Investors should discuss with their financial advisors if Reliance Nippon CPSE ETF is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Financial Services Fund

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty India Infrastructure and Logistics ETF

Jan 30, 2026 by Advisorkhoj Team