Reliance MIP is One of the best Mutual Fund Monthly Income Plans

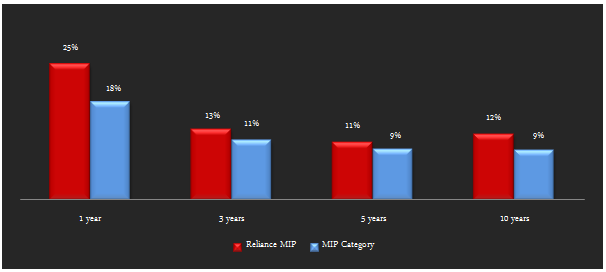

Monthly Income Plans (MIPs) are one of the best investment options for investors with moderate risk tolerance. These mutual fund schemes invest 70 – 75% of their portfolio in fixed income securities and the balance in equities. The return of the debt investments is supplemented by an additional boost from the equity investment, resulting in good returns at fairly low risk. Reliance Monthly Income Plan is one of the best performing MIPs. The fund has given nearly 11.4% compounded annual returns since its inception. It has consistently outperformed the MIP category across various time periods. The chart below shows the trailing annualized returns of the Reliance MIP compared to the MIP category over 1, 3, 5 and 10 year periods.

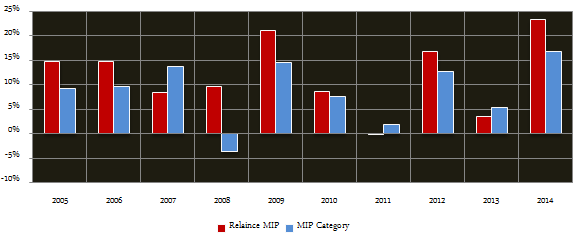

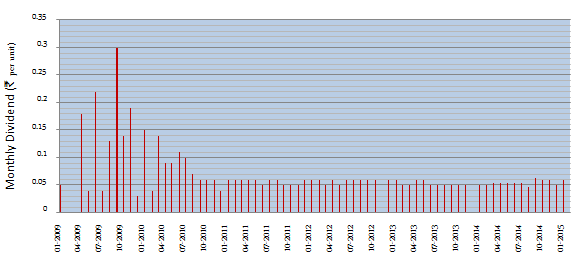

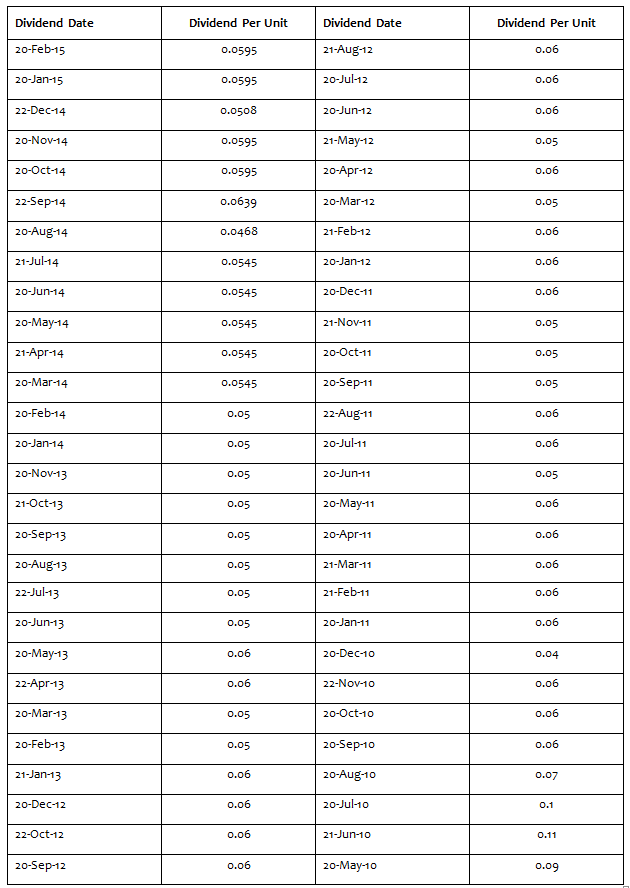

Reliance MIP, monthly dividend option has an excellent track record of monthly dividend payments. Over the last 5 years, the fund has missed paying monthly dividends only on a few months. If we look at annual returns of this fund and the MIP category over the last 10 years, we will see why MIP in general and Reliance MIP in particular is an excellent investment choice for investors with low to moderate risk tolerance.

The fund gave positive returns every year over the last 10 years, except in 2011 when the return was only slightly negative. Even in the downturn of 2008, when equity markets tanked globally, Reliance MIP gave around 10% returns. Thus we can see that MIPs provide downside protection to investors in bear market. However, once the bull market returned Reliance MIP gave very strong returns to investor in 2014. CRISIL rates Reliance MIP as a good performer (Rank 2). Morningstar has a 5 star rating for this fund.

Fund Overview

The fund was launched in December 2003 and has nearly र 2,600 crores of assets under management. It has an expense ratio of 2.07%. Amit Tripathi and Sanjay Parekh are the fund managers of Reliance MIP. This fund is suited for investors with moderate risk tolerance, looking for both income and capital appreciation. Investors, who prefer dividends, can opt for monthly or quarterly dividends options.

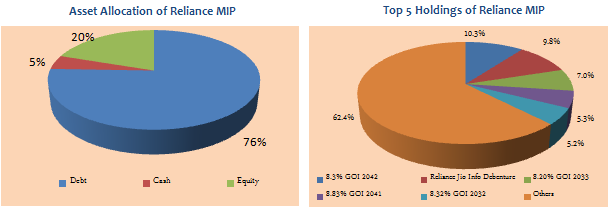

Portfolio

75% of the fund portfolio is invested in fixed income securities, 5% in cash and 20% in equities. The credit quality of the debt portfolio is excellent. The modified duration of the debt portfolio is 6.7 years, which makes the fund sensitive to interest rate movements. However, in the current interest rate environment good returns can be expected from bonds over a sufficiently long time horizon. The equity portfolio has a bias towards cyclical sectors, which can give good returns once the capex cycle revives in the economy.

Risk and Return

While in terms of volatility measures, the standard deviation of returns of Reliance MIP is quite low at 5.5% on an absolute basis, it is still a little higher than the average volatility of MIP as a category. However, in terms of risk adjusted returns, as measured by Sharpe ratio, Reliance MIP clearly outperforms the MIP category.

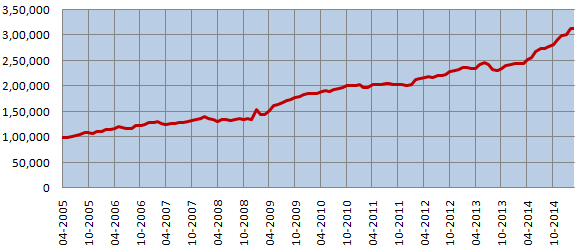

The chart below shows the growth of र 1 lac lump sum investment in the Reliance MIP (Growth Option) over the last 10 years. र 1 lac invested in Reliance MIP (Growth Option) 10 years back would have grown to over र 3.1 lac based Mar 18 2015 NAV.

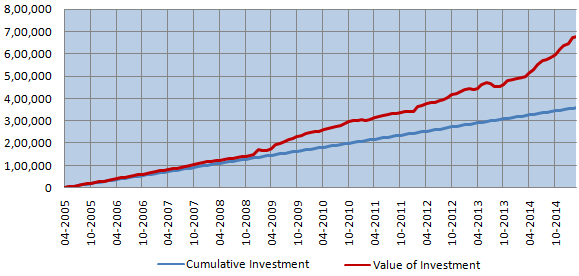

The chart below shows the returns over the last 10 years of र 3,000 invested monthly through SIP route in the Reliance MIP (growth option). The SIP date has been assumed to first working day of the month. The chart below shows the SIP returns of the fund. NAVs as on March 18 2015.

The chart above shows that a monthly SIP of र 3,000, started 10 years back in the Reliance Monthly Income Plan (growth option) would have grown to nearly र 6.8 lacs by March 18 2015, while the investor would have invested in total only about र 3.6 lacs. The SIP return (XIRR) is over 12% over the last nearly 10 years.

Monthly Dividend Track Record

The chart below shows the monthly dividend payout track record of Reliance MIP (Monthly Dividend Payout Option). We can see that, rarely did the fund miss out on paying monthly dividends. This is a good fund for investors looking for monthly income. However, investors should note that, like all mutual fund dividends, there is no certainty of dividend payment. Dividend payout track record can help investors get sense of the expected monthly dividends in the near term.

Conclusion

Reliance MIP has completed more than a decade of strong performance. It has created both income and capital appreciation for long term investors. Investors looking for regular dividend payments can also invest in the dividend option of the fund. Investors can consider investing in the scheme through the systematic investment plan (SIP) or lump sum mode with a long time horizon. Investors should consult with their financial advisors, if Reliance MIP is suitable for their investment portfolio.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Bank of India Mutual Fund launches Bank of India Banking and Financial Services Fund

Jan 8, 2026 by Advisorkhoj Team

-

Sundaram Mutual Fund launches Sundaram Income Plus Arbitrage Active FoF

Jan 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Dividend Yield Fund

Jan 5, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund