Reliance Tax Saver Fund: The best performing ELSS in the last 10 years

Investors can save up to Rs 46,350 in taxes per year by investing up to Rs 1.5 Lakhs in certain schemes specified under Section 80C of the Income Tax Act 1961. Public Provident Fund, National Savings Certificates, 5 year Tax Saving Fixed Deposits, life insurance policies etc are traditional tax saving investment options. Investors preferred these schemes because most of these products offered tax savings along with risk free returns. However, most people got their money locked in for long periods of time by investing in these schemes. The minimum lock-in period for most 80C tax saving schemes, with the exception of mutual fund Equity Linked Savings Schemes is 5 years; in some cases, the maturity period is even longer, e.g. 15 years for PPF.

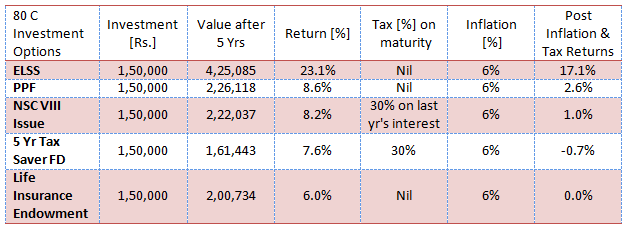

Many investors focus simply on tax savings and ignore the growth potential or the tax implications on the maturity amount. The result is that, they get sub-optimal returns which struggle to beat inflation on a post tax basis. Equity Linked Savings Schemes, on the other hand, offer both 80C tax savings and wealth creation potential over a sufficiently long investment horizon. The table below shows the post tax inflation adjusted rate of different 80C investment schemes.

Key Assumptions: Life insurance endowment plans returns assumption is based on prevailing IRRs of life insurance endowment plans. ELSS returns are based 5 year trailing returns of Reliance Tax Saver Fund.

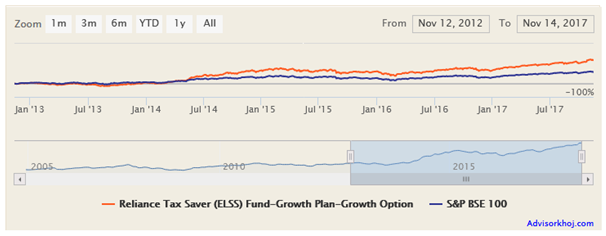

Fund Performance versus Category

Reliance Tax Saver fund has been one of the consistent performer among ELSS Funds for a long time. Advisorkhoj.com research team has developed a software tool which identifies the most consistent funds in different mutual fund product categories based on their quartile rankings in each of the last 5 years (please see our Most Consistent Mutual Fund Tool) using our proprietary algorithm. Reliance Tax Saver Fund is among the most consistent ELSS funds in the last 5 years.

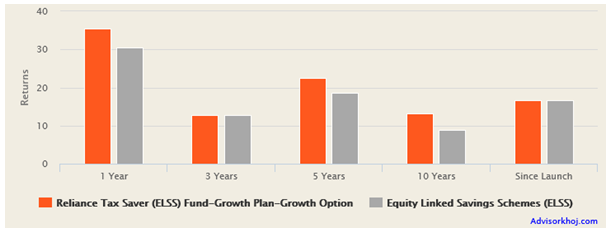

The fund has generated nearly 16.6% compounded annual returns since its inception in September 2005. See the chart below, for the comparison of trailing annualized returns over three, five, and ten year periods, between Reliance Tax Saver fund (Growth Option) and the ELSS Category (periods endingNovember 15 2017). As you can see, the fund has beaten the ELSS category returns by a good margin over various time periods.

Source: Advisorkhoj Research

Reliance Tax Saver Fund is one of the best performing Equity Linked Savings Schemes (ELSS) in the last 10 years. If you invested Rs 1 lakh in Reliance Tax Saver Fund 10 years back, your investment would have grown in value to nearly Rs 3.4 lakhs by now.

The Systematic Investment Plan (SIP) returns of Reliance Tax Saver Fund over the last 10 years are even more impressive. If you had started a monthly SIP ofRs 5,000 in Reliance Tax Saver Fund 10 years back, by now you would have accumulated a corpus of nearly Rs 17 Lakhs with a cumulative investment of just Rs 6 lakhs.

Rollover Benefit of ELSS

Equity Linked Savings Schemes have a lock-in period of three years; if you investing in ELSS through SIP, then please note that, each instalment will be locked in for 3 years. The maturity proceeds (both your initial investment amount and the profit) are entirely tax free. The proceeds of ELSS, once the lock-in period is over, can be re-invested to get further 80C tax savings. Let us see how this works with the help of an example.

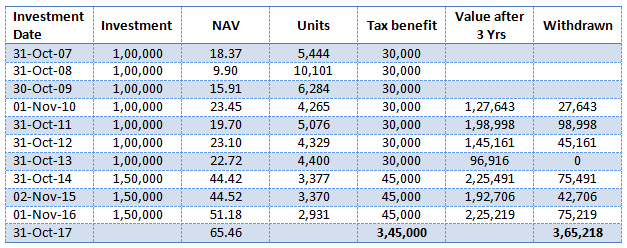

Let us suppose you had invested Rs 1 Lakh in Reliance Tax Saver Fund on October 31, 2007. Assuming you were in the highest (30%) tax bracket, you would have saved Rs 30,000 in taxes. You invested Rs 1 Lakh again on October 31, 2008 to get Rs 30,000 tax savings in that financial year. Similarly, you invested Rs 1 Lakh again on October 30, 2009 for tax savings.

On November 1, 2010 your 2007 tax saving investment completed its 3 years lock in period. Now the fun begins. The value of your 2007 investment would have been Rs 1.27 Lakhs. You redeemed your 2007 investment, re-invested Rs 1 Lakh for 2010 tax savings and withdrew the balance Rs 27,000. So essentially you not only got Rs 30,000 of tax savings, you also got Rs 27,000 of the redemption proceeds, without making any fresh investment. On October 31 2011, the 2008 Reliance Tax Saver investment would have completed three years and the value of that investment would have been Rs 1.99 Lakhs. You redeem and re-invest Rs 1 Lakh for that year’s tax savings, withdrew the rest. Similarly, in 2012, you would have got Rs 1.45 Lakhs from your 2009 investment, which you could have used to re-invest for tax savings and kept the balance.

The table below shows how this strategy could have worked out for you. Remember the last investment from your own savings was in 2009; from then onwards it was only re-investments. Please note that, from 2014 onwards the 80C investment limit was increased from Rs 1 Lakh to Rs 1.5 Lakhs.

The table shows the awesome power of ELSS (Reliance Tax Saver Fund) in meeting your tax savings and returns needs. With just Rs 3 Lakhs of investments made over 2007 to 2009, you could have saved Rs 3.45 Lakhs in taxes in the 10 year period from 2007 to 2017 (this can go on for many more years). Furthermore, you could have withdrawn Rs 3.65 Lakhs for your personal use or other investments.

That is not all. Do you know, what would be the current value (as on October 31, 2017) of your ELSS investment, even after withdrawing Rs 3.65 Lakhs over the last 7 years? It will be Rs 6.33 Lakhs. The IRR of this rollover strategy, hold your breath, is 32%. An annualized return (IRR) of 32% over a 10 year period seems quite extraordinary, but this is a real example with actual historical data (NAVs) of Reliance Tax Saver Fund.

Fund Comparison with PPF

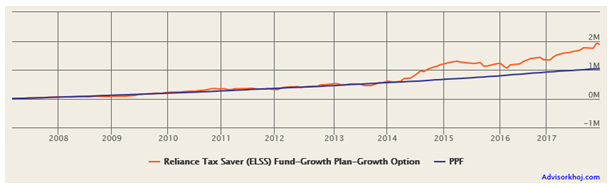

Since ELSS funds are essentially equity funds, therefore, it is subject to market risk and volatility as compared to other tax saving instruments like PPF, NSC and tax saving FDs etc. However, equities as an asset class generate superior returns over the long term and serves as an effective hedge against inflation. The same is evident from the chart below which shows how Reliance Tax Saver fund has beaten the returns of Public Provident Fund.

In the chart below we have compared the results of monthly investment of Rs 10,000 per month in both Reliance Tax Saver Fund and PPF from April 1, 2007 onwards using our own PPF Versus ELSS tool. The result shows that the Investor would have accumulated around Rs 19 Lakhs in Reliance Tax SaverFund compared to just Rs 10 Lakhs in PPF. The wealth creation potential of ELSS (especially Reliance Tax Saver Fund) relative to PPF is clearly evident in this example. You can use our tool to compare the returns of ELSS and PPF over various long term time-scales and you will get similar results.

Source: PPF Vs ELSS tool - Advisorkhoj

Fund Overview

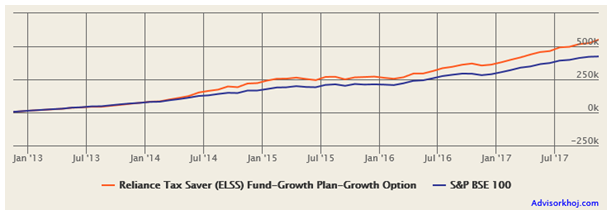

What distinguishes Reliance Tax Saver Fund from most of its peers is the midcap orientation of its fund portfolio, as opposed to the large cap of most ELSS funds. As such this fund is an aggressive Equity Linked Savings Scheme. Our readers know midcap stocks could be more volatile than large cap stocks, but they also have the potential to provide higher returns than large cap stocks. The fund has an AUM base of over Rs 9,983 Crores (as on Oct 31, 2017), with a low expense ratio of just 1.98%. The fund manager, Ashwani Kumar, is managing the fund since its inception. Kumar is an industry veteran and has a great track record of generating high alphas as a fund manager. The chart below shows the NAV growth of Reliance Tax Saver Fund over the last 5 years.

Reliance Tax Saver fund is an ideal fund those investors who are planning for long term financial objectives like retirement planning, children’s education, marriage and long term wealth creation etc.

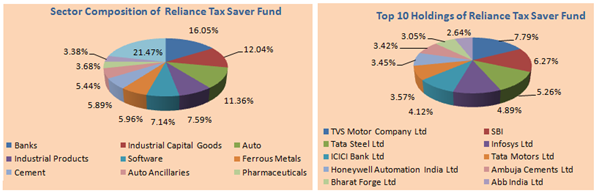

Portfolio Construction

Ashwani Kumar as a fund manager likes to employ a bottoms stock picking approach to his portfolio and identifies companies at attractive valuations with high growth potential. The fund manager has high conviction in his stock selection. About 40% of the portfolio holding of Reliance Tax Saver Fund is invested in midcap stocks. In the last two years the fund manager has reduced exposure to midcaps and allocated more to large cap companies. There is a sensible logic underlying increasing allocation to large cap companies like SBI, Tata Steel and Infosys.

From a sector perspective, the portfolio has a bias for cyclical sectors like Banking and Finance, Capital Goods, Automobiles and Auto Ancillaries, Industrial Products, Metals etc. As the investment cycle revives in our economy these sectors have the potential to deliver strong earnings and consequently excellent returns. In terms of company concentration, the portfolio is very well diversified with its top 5 holdings, TVS Motor, SBI, Tata Steel, Infosys and ICICI Bank accounting for only 28% of the total portfolio value.

Source: Advisorkhoj Research

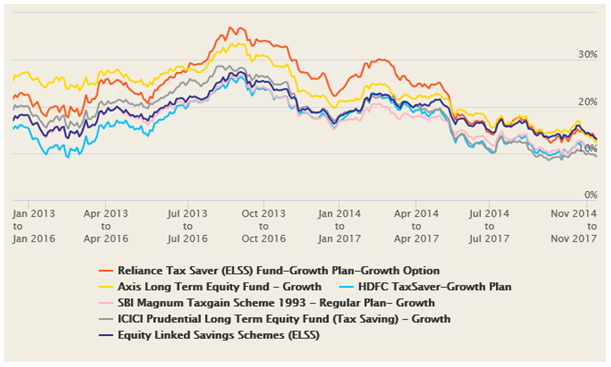

Performance comparison with Peer Set

Performance comparison of a mutual fund scheme with its peers can be done on several parameters and different time-scales used for comparisons can produce contrasting results because performances of different schemes are driven by specific market conditions. In www.advisorkhoj.com we think that, rolling returns is the best measure of comparing fund performances because rolling returns over a sufficiently long period of time shows fund performance across different market conditions.

Our research team has built a software tool, Mutual Fund Rolling Returns versus Equity Linked Savings Schemes (ELSS) Category Returns, which can enable investors to compare the rolling returns of different mutual fund schemes within a particular category. The chart below shows the 3 year rolling returns (we chose a 3 year rolling return period because ELSS have 3 year lock in periods) of Reliance Tax Saver Fund versus some other popular ELSS funds.

Source: Advisorkhoj Rolling Returns Calculator

You can see that, Reliance Tax Saver Fund (shown in orange in the rolling returns chart) has generated the highest 3 year rolling returns on a very consistent basis over the last 5 years. Our Mutual Fund Rolling Returns versus Equity Linked Savings Schemes (ELSS) Category Returns tool also shows some useful rolling returns statistics in a table at the bottom of the chart in our website page. Referring to the page, you will see that Reliance Tax Saver Fund gave the highest average 3 year rolling returns compared to its peer funds; the median 3 year rolling returns of Reliance Tax Saver Fund was also higher than its peer. Reliance Tax Saver Fund also gave the highest maximum 3 year rolling returns compared to other peer funds.

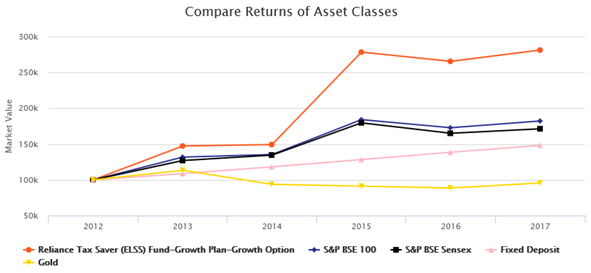

Performance comparison with other asset classes

The chart below shows the growth of Rs 1 lakh lump sum investment in Reliance Tax Saver Fund versus different asset classes like Fixed Deposit, Gold and stock market indices like Sensex and BSE – 100 over the last 5 years. Clearly the growth of investment in Reliance Tax Saver Fund is much higher than the other assets.

Source: Mutual Fund Comparison with Asset Classes

SIP Returns of Reliance Tax Saver Fund

The chart below shows the returns since inception of Rs 5,000 invested monthly through Systematic Investment Plan mode in the Reliance Tax Saver fund (growth option).

Source: Advisorkhoj Research SIP returns

The chart above shows that a monthly SIP of Rs 5,000 started 5 years back would have grown to over Rs 5.5 Lakhs by November 15 2017, while the investor would have invested in total Rs 3 Lakhs; a profit of over Rs 2.5 Lakhs. Investors should bear in mind that the last 5 years was not a one way bull market. We had flat market in 2013 and a bear market in in 2015 / early 2016. However, through the SIP mode, you can make volatility your friend, through rupee cost averaging and get excellent returns in the long term. The outstanding SIP performance of Reliance Tax Saver Fund is a terrific example of wealth creation over the long term, despite the intervening periods of volatility.

Dividends

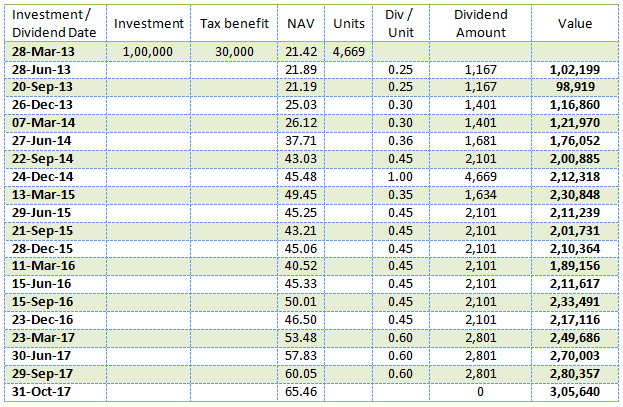

Some investors like income from their investments; dividend options are suitable for such investors. Reliance Tax Saver Fund has a strong dividend pay-out track record. The fund has been paying quarterly dividends for the last 4 years; the dividend yield is also extremely good. The table below shows the income and capital appreciation of investor, who may have invested Rs 1 Lakh in Reliance Tax Saver Fund on March 28, 2013.

By investing Rs 1 Lakh in 2013, the investor would have got tax savings of Rs 30,000 (assuming the investor is in the highest tax bracket). Therefore, in effect, the net investment for the investor would have been Rs 70,000. Let us now see what the investor would have got.

The total dividend received by the investor till date would be Rs 38,331. The value of his investment currently (as on October 31, 2017) would have around Rs 3.05 Lakhs. The table above is a testimony of the twin income generation and wealth creation record of Reliance Tax Saver Fund. Do you know what the Internal Rate of Return (XIRR) in the above example was? It was 45.8%, which seems quite unbelievable, but very true.

Reliance SIP Insure

Reliance Mutual Fund Insure offers free life insurance covers to pay Systematic Plan Instalments of investors for select schemes. In the event of an unfortunate death during the tenure of the SIP, the insurance company will pay the SIP instalments for the tenure of the SIP or when the investor would have turned 55, whichever is earlier.Life insurance cover comes at a cost in the form of premiums, but the SIP Insure feature offered by Reliance Mutual Fund for select schemes is completely free. Reliance Tax Saver Fund is one of the schemes which have the SIP insure feature.

Conclusion

Reliance Tax Saver Fund completed more than 12 years of wealth creation and during this time has established itself as one the best Equity Linked Savings Schemes (ELSS)Mutual Fund Schemes in the Indian Mutual Fund industry. Investors looking to save taxes under Section 80C can consider investing in the scheme through the systematic investment plan (SIP) or lump sum route with a long time investment horizon. The life insurance feature offered by this scheme is what distinguishes it, among many other performance parameters, from other ELSS funds.

When investing in equity mutual funds or in ELSS Funds, investors must ensure that the investment objectives of the fund are aligned with their individual risk profiles, time horizon and financial planning objectives. You should consult with your mutual fund advisor if Reliance Tax Saver fund is suitable for your tax planning and investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team