SBI Magnum Multicap: One of the best multicap SIP returns in the last 5 years

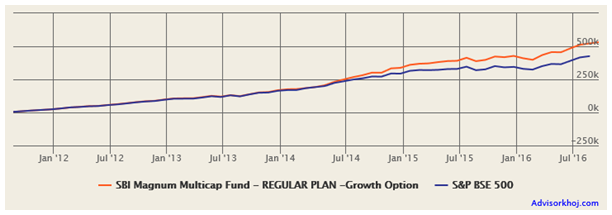

If you invested र 5,000 every month in SBI Magnum Multicap Fund through systematic investment plan (SIP) for the last 5 years, the value of your investment will be over र 5.2 lakhs (as on August 22, 2016). The internal rate of return of monthly SIP in SBI Magnum Multicap Fund over the last 5 years was around 23%, one of the highest in the diversified equity funds category (please see the chart below).

Source: Advisorkhoj Research

SBI Magnum Multicap Fund is also one of the most consistent performers among diversified equity funds, having ranked 3 times in the top quartile in the last 5 years (please see our research too on Top Consistent Mutual Fund Performers). The fund has continued its strong outperformance in 2016 and is ranked again, in the top 2 quartiles. In fact, in terms of trailing 1 year returns, SBI Magnum Multicap Fund has been ranked in the Top three quartiles, for the three consecutive quarters, including the current quarter (please see our MF Quartile Ranking Tool). This strong performance has been acknowledged by CRISIL and the fund has been ranked as a top performer (Rank 1) in the diversified equity category. CRISIL also ranks SBI Magnum Multicap Fund as one of the most consistent performers among all equity funds. Morningstar has assigned a 4-star rating for this fund.

Fund Overview of SBI Magnum Multicap Fund

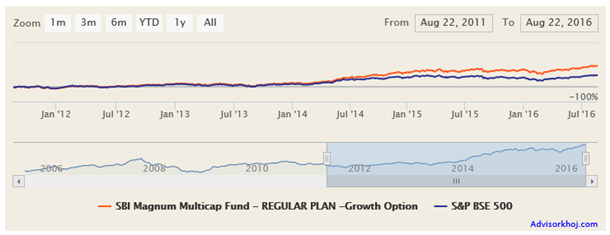

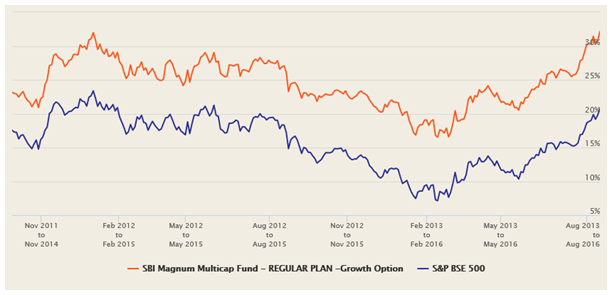

SBI Magnum Multicap Fund was launched in September 2005 and has र 1,000 crores of assets under management (AUM). The expense ratio of the fund is 2.27%. Richard D‘Souza is the fund manager of this mutual fund scheme. The chart below shows the NAV movement of SBI Magnum Multicap Fund versus BSE – 500 over the last 5 years.

Source: Advisorkhoj Research

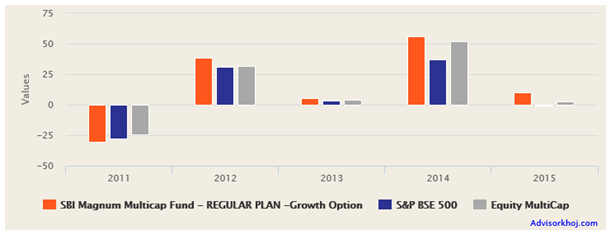

In the chart below you can see that, SBI Magnum Multicap Fund, after relative underperformance in 2011, was able to outperform both the fund category and the benchmark in the subsequent years. We think that, the 2015 performance of the fund was especially noteworthy; a year in which most large cap and large cap oriented diversified funds struggled due to difficult market conditions, SBI Magnum Multicap Fund was able to deliver close to double digit returns. Good performance in difficult markets is often the hallmark of a good fund manager.

Source: Advisorkhoj Research

Rolling Returns of SBI Magnum Multicap Fund

The rolling returns of SBI Magnum Multicap Fund shows why we think highly of this diversified equity fund. The chart below shows the 3 year rolling returns of the fund over the last 5 years. We are showing 3 year rolling returns because investors should have a sufficiently long investment horizon (at least three years) when investing in equity mutual funds.

Source: Advisorkhoj Rolling Returns versus Benchmark Calculator

You can see that the fund consistently beat the benchmark in 3 year rolling returns over the last 5 years. You can also see that, the 3 year annualized rolling returns were above 20%, more than 90% times, which is a very strong performance, especially since we saw a fair amount of volatility in the market over the last 5 years.

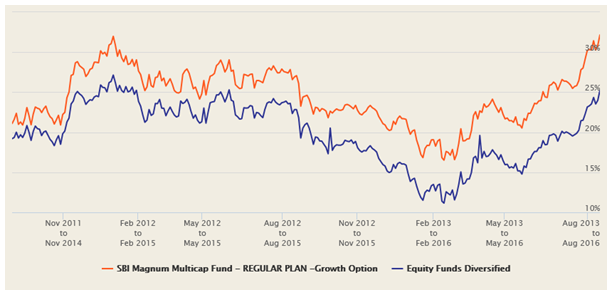

SBI Magnum Multicap Fund also outperformed diversified equity funds category in terms of 3 year rolling returns over the last 5 years. Please see the chart below.

Source: Advisorkhoj Rolling Returns versus Category Calculator

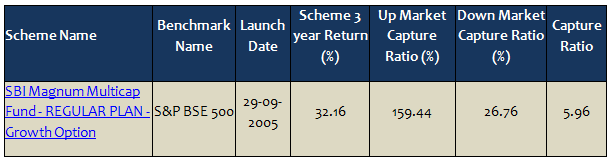

Performance in Up and Down Markets

Many investors and also financial advisors select mutual funds based on trailing returns. While trailing return is the most popular measure of mutual fund performance, it is not necessarily the best, because it suffers from one serious flaw. Trailing returns of a fund, especially over shorter time horizons, are influenced by recent market conditions. Different sectors tend to perform differently depending on market conditions. The trailing returns of a mutual fund will depend on how the market conditions affected the stocks in the fund portfolio.

One financial advisor once asked me, what if we look at trailing returns over a very long time period, say 10 years, because that would cover a broad range of market and economic conditions? Trailing returns over a long time period has its own set of issues. For example, if you are looking at 10 year trailing returns, you will exclude funds that were launched later. Further, the fund manager may have changed during the period. Growth versus value investment styles also have a role to play.

In Advisorkhoj, we believe that, it is the fund manager, the research organization supporting him or her and the investment mandate of the fund that plays the most important roles in an equity fund’s performance. Performance measures like rolling returns, alpha, Sharpe Ratio etc reveal more about the fund manager’s performance than trailing returns. You will find information on all these measures in the MF Research Centre on our website. In addition, we also look at a simple, yet highly effective analytical measure, known as Market Capture Ratio, to differentiate the performance of funds in different market conditions (up market / rising market and down market / falling market).

There are two market capture ratios we look at, the up market capture ratio and the down market capture ratio. Up market capture ratio is the ratio of the average returns of the fund and the benchmark, in the months that the market rose. Down market capture ratio is the ratio of the average returns of the fund and the benchmark, in the months that the market fell. High up market capture ratio (more than 100%) tells us that, the fund manager gave more returns than the market benchmark, when the market was rising. Low down market capture ratio (less than 100%) tells us that, the fund manager was able to protect investors from downside risks, when the market fell. You can check out up market and down market capture ratios of different funds by going to our tool, Market Capture Ratio.

We looked at up market and down market capture ratios of SBI Magnum Multicap Fund over the last 3 and 5 years. Up market capture ratio of SBI Magnum Multicap Fund over the last 3 and 5 years was more than 100%, which tells us that the fund manager was able to beat the benchmark when the market was rising. Down market capture ratio of SBI Magnum Multicap Fund over the 5 years was more than 100%, but over the last 3 years it is only 27%. This tells us that, the fund manager was able to navigate through the 2015 – 16 downturns much better than the 2011 downturn. The improvement in market capture ratio shows the improving quality of fund management, which is great and augurs very well for the future performance of this mutual fund scheme.

Source: Advisorkhoj Market Capture Ratio Calculator

Portfolio Construction of SBI Magnum Multicap Fund

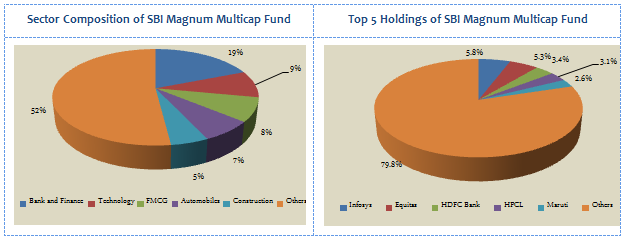

The fund has a large cap bias (67% of the portfolio in value terms) and follows the growth investment style. The fund has a bias for cyclical sectors like banking and finance, automobiles, construction etc. To balance the cyclical risk, the fund has around 20% allocation to defensive sectors like technology, FMCG and pharmaceuticals. The fund holds around 60 stocks in its portfolio. In terms of company concentration the fund is very well diversified, with its top 5 holdings, Infosys, Equitas, HDFC Bank, HPCL and Maruti accounting for 20% of the portfolio value. Even the top 10 holdings account for just around 34% of the portfolio value.

Source: Advisorkhoj Research

Most of the Top 10 stock holdings of SBI Magnum Multicap Fund have been held for more than a year. Equitas, a micro finance company, is a relatively new addition (added in end April, 2016) and has given around 35% returns in less than 4 months. HPCL, held in the fund portfolio for around 2 years, is another strong performer, aided by lower crude prices (57% returns in the last one year). With crude prices expected to remain low in the near term, as per a Goldman Sachs forecast, one can expect HPCL to continuing its very strong performance. HDFC Bank was added to the portfolio around a year back, and over the last one year has been the best performing bank stock (more than 22% returns in the last one year). Given the medium term outlook on interest rates, the prospects of bank stocks, especially HDFC Bank, with its low NPAs, look bright.

Among the cyclical sectors, automobiles and auto ancillaries have been one of the best performing sectors. Though Maruti Suzuki suffered a sharp decline of around 30% in the early part of this calendar year, it has recovered the losses and bounced back to all time high. The stock has given more than 14% return in the last one year. With the expected cyclical recovery in demand, the future prospect of this scrip looks bright. Within the top holdings of SBI Magnum Multicap Fund, Infosys has been an underperformer. While in the 12 months preceding Brexit, Infosys was one of the best performers in the large cap IT space, the stock fell more than 20% in the last 3 months, primarly due to Brexit related concerns. However, given the strong management team, one can expect Infosys to bounce back in the medium term.

Risk and Return of SBI Magnum Multicap Fund

From a risk perspective the volatility of SBI Magnum Multicap Fund is slightly lower than the average volatilities of multicap funds. Yet from the standpoint of risk adjusted returns, as measured by Sharpe Ratio and Alpha, the fund has outperformed the diversified multicap funds category. The chart below shows the growth of र 1 lakh lump sum investment in SBI Magnum Multicap Fund over the last 5 years (period ending August 22, 2016).

Source: Advisorkhoj Research

You can see that, the fund has grown more than 2.5 times in NAV over the last 5 years, nearly 20% compounded annual return.

For more risk return performance details please see our SBI Magnum Multicap Fund details page in our MF Research Centre.

Conclusion

SBI Magnum Multicap Fund has completed 10 years since launch. We have discussed in this article that, the performance over the last 5 years has been very strong. Risk sentiments towards emerging markets are turning bullish again among global fund managers. India is undoubtedly the brightest spot among the large emerging economies. If investors have a disciplined approach towards investing, they can create wealth in the long term in investing in Indian equities. Investors should consult with their financial advisors if SBI Magnum Multicap Find is suitable for their long term investment goals.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

UTI Mutual Fund launches UTI Nifty500 Shariah Index Fund

Feb 5, 2026 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Multi Asset Omni Fund of Funds

Feb 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Services Fund

Feb 4, 2026 by Advisorkhoj Team

-

HDFC Mutual Fund launches HDFC Nifty India Consumption Index Fund

Feb 4, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team