Strong performance from this consumption themed mutual fund

Domestic consumption is one of the most important themes of the India Growth Story. Young population and high proportion of working population are the structural demand drivers that distinguish us from other large emerging markets, as far as consumption growth potential is concerned. By 2030, India is expected to be the third largest consumer market in the world. The consumption theme has been favoured by many investors and fund managers over the past few years.

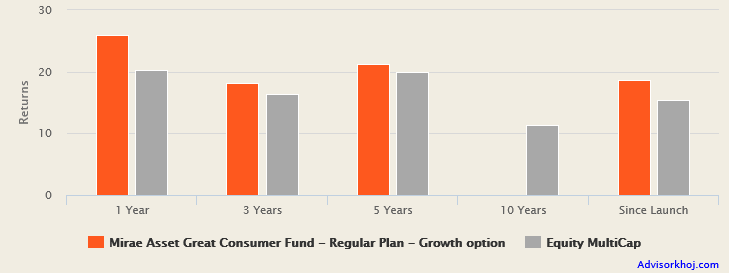

Mirae Asset Great Consumer Fund, a lesser known diversified equity fund, has had an impressive track record in the last 5 years which has not been noticed by many investors and financial advisors. If you invested Rs 1 lakh in Mirae Asset Great Consumer Fund, your investment value would have grown to over Rs 2.6 lakhs (around 21% CAGR). In the last 12 months itself, this consumption themed fund has given nearly 26% return. The chart below shows the annualized returns of Mirae Asset Great Consumer Fund versus the Multicap equity category across different trailing periods.

Source: Advisorkhoj Research

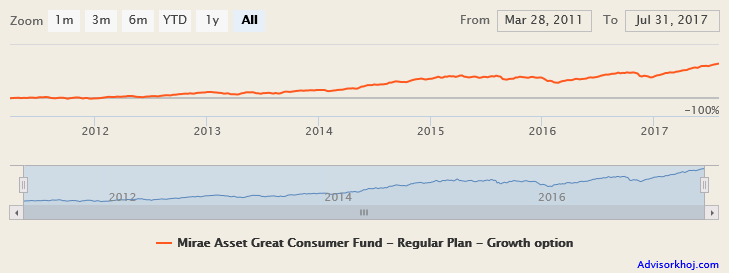

Mirae Asset Great Consumer Fund was launched in 2011 and has given nearly 19% returns since inception. The expense ratio of the fund is 2.98%. Bharti Sawant and Ankit Jain are the fund managers of this scheme. The chart below shows the NAV growth of the fund since inception.

Source: Advisorkhoj Research

The Assets under Management (AUM) of Mirae Asset Great Consumer Fund is only Rs 77 Crores. Mutual funds with small asset sizes are usually not on the radar of the mutual fund rating firms and since many investors / financial make investment decisions / recommendations based on star ratings / rankings, small sized funds get bypassed by investors or financial advisors.

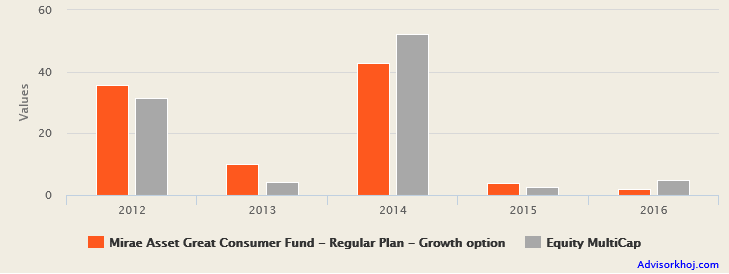

We have mentioned a number of times in our blog that, fund size usually has no correlation with fund performance (except in the case of midcap funds, where a large fund size can be a handicap). If you base your investment decisions only on star ratings you may miss good investment opportunities. Mirae Asset Great Consumer Fund, its small AUM base notwithstanding, performed very well almost every year since inception. The chart below shows the annual returns of the fund versus the category.

Source: Advisorkhoj Research

Rolling Returns

The chart below shows the 3 year rolling returns of Mirae Asset Great Consumer Fund since inception. We have chosen a three year rolling return period, because in our view investors should always have a sufficiently long (at least 3 years) investment horizon for equity funds.

Source: Advisorkhoj Rolling Returns Calculator

The three year rolling returns chart of Mirae Asset Great Consumer Fund shows that, the 3 year returns of the fund were almost always above 15% despite the fact that, we has multiple bear markets over this period. The strong rolling returns not only is a testimony to the fund management team’s competence, but also shows, as the fund manager of the scheme, Ankit Jain said in his interview with Advisorkhoj, that “India consumption as a theme has show strong resilience in comparison to other themes irrespective of the investment cycle”. You may read the interview – We look at quality businesses with decent growth prospects as well as return on capital employed

The maximum three year rolling return of Mirae Asset Great Consumer Fund is around 26%, while the minimum three year rolling return is around 12%. The average three year rolling return of the fund since inception is 18.58%, while the median three year rolling return of fund is 18.6%.

The three year rolling returns of Mirae Asset Great Consumer Fund was between 15 to 20%, more than 60% of the time over the last 6 years or so; the three year rolling returns of the fund was more than 20%, around 30% of the times. The rolling returns of Mirae Asset Great Consumer Fund show strong performance consistency and as such, it is a good investment option for investors looking for capital appreciation with relatively lower volatility.

Investment Style and Strategy

The stock selection is based on three criteria:-

- Business Quality: The fund managers look for companies which have high growth prospects and can also generate sufficient returns on capital employed.

- Management Quality: The fund managers look at the track record of the management team and how efficiently the management deploys capital.

- Valuation: The fund managers employ the Growth at a Reasonable Price (GARP) style, in other words, the fund managers want to invest in growth businesses at a reasonable value, so that there is sufficient margin of safety.

The investment mandate of the fund is not restricted to the traditional consumer space (e.g. consumer durables, FMCG etc). The fund invests in a diversified set of sectors like automobiles, FMCG, media, banking, financial services etc which are going to benefit from consumption led demand growth in India. Since the fund invests in a diversified set of sectors, Advisorkhoj has categorized Mirae Asset Great Consumer Fund as a diversified equity fund (and not a thematic or sector fund). Read how mutual fund diversified multicap funds are ideal for retail investors.

Currently, more than 50% of the portfolio allocation is made to banking and financial services, consumer durables / non-durables and automobiles. The fund managers expect earnings growth to be in mid teens for consumer durables / non-durables and automobiles, while the earnings growth in financial sector is expected to be much higher due to the base effect.

Mirae Asset Great Consumer Fund has a unique proposition because it offers investment opportunities in both Indian and Asian consumption themes. 70 – 75% of the scheme portfolio is invested in Indian companies (which are likely to benefit from growth in consumption led demand) and 20 – 30% in Mirae Asset Asia Great Consumer Equity Fund, which invests in Asian (excluding Japan) companies which are likely to benefit from consumption growth in the region.

Mirae Asset Asia Great Consumer Equity Fund

Mirae Asset Asia Great Consumer Equity Fund is a SICAV fund domiciled in Luxembourg. A SICAV fund is the European equivalent of an open ended mutual fund in India. Geographically, Mirae Asset Asia Great Consumer Equity Fund has largest exposure in China, followed by India, Korea, Indonesia, Taiwan and other markets. From a sector perspective, the largest exposure is to high growth consumer discretionary sector, followed by Technology (including e-commerce), consumer staples and healthcare. Some of our readers may be aware that, e-commerce is highly evolved in China and is growing at a fast pace. Mirae Asset Asia Great Consumer Equity Fund has a six year track record and has outperformed the benchmark since inception. The international exposure of Mirae Asset Great Consumer Fund complements the India focused consumption investment theme.

SIP returns of Mirae Asset Great Consumer Fund

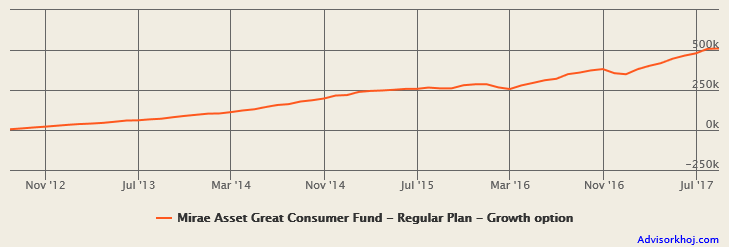

The chart below shows the returns of Rs 5,000 monthly SIP in Mirae Asset Great Consumer Fund over the last 5 years.

Source: Advisorkhoj Research

You can see that with a monthly SIP of Rs 5,000 over the last 5 years, you could have accumulated a corpus of around Rs 5 lakhs (a cumulative profit of around Rs 2 lakhs). The annualized SIP return was more than 20%.

Conclusion

The strong track record of Mirae Asset Great Consumer fund definitely merits consideration for investor portfolios. Consumption is a powerful long term investment theme in India; it has not only generated excellent returns for investors in the past but will also continue to play out in the future because it will benefit from the structural reforms done by the Government Of India. Mirae Asset Great Consumer Fund also offers investors the opportunity in one of the fastest growing regions of the world (outside India). Investors should consult with their financial advisors if Mirae Asset Great Consumer Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team