Sundaram Equity Savings Fund: A moderate risk scheme for income and capital appreciation

Sundaram Equity Savings Fund is an open-ended hybrid equity oriented mutual fund scheme. The scheme was launched in 2013. Minimum one-time investment amount in this scheme is Rs 100 and minimum additional investment amount is Rs 100. You can also invest in this fund through Systematic Investment Plan (SIP). Minimum SIP investment amount is Rs 100. The expense ratio of the scheme is 2.37%. There is no exit load in this fund. The zero exit load feature can enhance income for investors looking for regular withdrawals from their investments (we will discuss this in more details later in the post).

Asset Allocation Strategy

Let us now discuss the asset allocation strategy of this fund to understand why the risk profile of this fund is much more moderate than equity funds and even traditional balanced funds. The overall exposure to equity and equity related securities ranges from 65% to 90%, because of which the fund enjoys equity taxation. However, fund’s active (un-hedged) equity allocation ranges between 20 to 40% or even slightly higher with the objective of capital appreciation. 40 to 70% of the portfolio is allocated to completely hedged equity positions with the objective of generating arbitrage profits. 10 to 35% of the portfolio is invested in fixed income and money market instruments with the objective of generating income. Therefore, 60 to 80% of the portfolio has low volatility and generates regular income. Over a sufficiently long investment horizon, the active equity allocation can also generate capital appreciation for investors.

Investment Strategy and how does it work.

- Arbitrage: 40 to 70% of the fund’s portfolio can be allocated to arbitrage. Arbitrage by definition is defined as risk free profit, by exploiting pricing mismatches in the market. Capital safety, returns and liquidity are important considerations in arbitrage strategy. In fact, in volatile market conditions arbitrage funds can provide comparable or even higher returns than low risk money market mutual funds.

- Fixed Income and Money Market: 10 to 35% of the fund’s portfolio can be allocated to fixed income and money market instruments. Currently, around 30% of the portfolio is allocated to debt and money market instruments. With the debt portfolio, the fund manager usually employs an accrual strategy to generate income and minimize interest rate risk. The credit quality of the fixed income portfolio is very high, AA+. The fixed income portfolio has a moderate duration of less than 2 years; so interest rate risk is relatively low.

- Active Equity: 20 to 40% of the fund’s portfolio can be allocated to active (un-hedged) equity with the objective of capital appreciation. Currently, 41% of the portfolio was allocated to equities, net of hedged positions. This shows that the fund manager is bullish on equities within the investment strategy framework of this scheme. The fund manager, however, has the flexibility to reduce the equity allocations and increase exposures to safer options, if volatility increases in the stock market. This investment strategy ensures moderately low volatility for investors.

Limited Downside risk

The main advantages of equity savings funds are relatively lower downside risks and income. Risk and return are directly related; higher the return, higher is the risk. If you are looking for very high returns then equity savings funds are not for you. However, if your primary investment objectives are, low volatility, high liquidity, inflation beating returns (through limited equity exposure) and tax efficiency, then Sundaram Equity Savings Fund can be a good investment option for you.

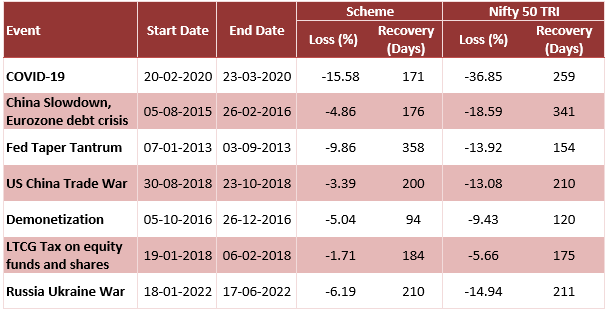

For first time investors, stock markets can be a bumpy ride. Even if they are investing in a bull market, a sharp correction can make first time investors very jittery. The table below shows the performance of Sundaram Equity Savings Fund in deep market corrections over the last 10 years or so. You can see that the Net Asset Value (NAV) fall of the scheme was much less than the fall in Nifty 50 TRI. The scheme was also able to recover faster than Nifty 50 TRI.

SIP Returns

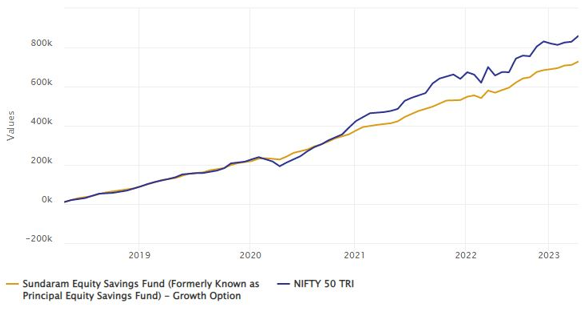

The chart below shows the growth of Rs 10,000 monthly SIP in Sundaram Equity Savings Fund over the last 5 years. The scheme gave an XIRR of 7.7% which is higher returns of traditional fixed income investments. Sundaram Equity Savings Fund enjoys equity taxation and therefor will give more tax efficient returns compared to fixed income investments.

Systematic Withdrawal Plan

Systematic Withdrawal Plan (SWP) is a smart investment option which gives investors the flexibility to draw the amount they need from their mutual fund investments at a regular frequency (e.g. monthly), by redeeming a certain number of units based on applicable NAVs. The balance amount remains invested in the scheme and continues to earn returns for the investor.

The chart below shows the results of a monthly Rs 5,000 SWP for the last 5 years from a corpus of Rs 10 lakhs invested in Sundaram Equity Savings Fund. Over the last 5 years, you would have drawn Rs 3 lakhs from your investments and yet the value of your balance units would have grown to Rs 10.1 lakhs. You can see that for moderate withdrawal rates, Sundaram Equity Savings Fund has the potential to give income and capital appreciation.

A feature which makes Sundaram Equity Savings Fund more attractive than other products in the category is the zero exit load feature. Many investors are forced to postpone their withdrawals from their mutual fund investments by as much as a year or sometimes longer due to exit load. The zero exit load feature of Sundaram Equity Savings Fund offers investors the convenience of initiating their withdrawals at any point of time, as per their needs.

Conclusion

For long term investors with moderate risk appetite, Sundaram Equity Savings Fund has the potential to generate both income and capital appreciation. Investors can take advantage of Regular Withdrawal Plan to generate regular income. Investors should consult with their financial advisors if Principal Equity Savings Fund is suitable for their long term investment portfolios.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

UTI Mutual Fund launches UTI Nifty500 Shariah Index Fund

Feb 5, 2026 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Multi Asset Omni Fund of Funds

Feb 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Services Fund

Feb 4, 2026 by Advisorkhoj Team

-

HDFC Mutual Fund launches HDFC Nifty India Consumption Index Fund

Feb 4, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team