Sundaram Select Focus Fund: A top performing focused fund

Regular Advisorkhoj readers know that we give a lot of importance to performance consistency when evaluating mutual fund scheme. Performance consistency across mixed market conditions is particularly important for focused equity funds which invest in relatively small number (less than 30 stocks) of high conviction stocks which puts great emphasis on stock selection by the fund manager.

Suggested reading: Insight into a new mutual fund category – Focused Equity Funds

Since focused funds have higher concentration risk compared to more diversified funds, underperformance of just a handful of stocks can significantly affect scheme performance. Sundaram Select Focus Fund is one of the top performers in the focused fund category over the last 1 to 3 years (please see Top Performing Focused Funds) when market was very volatile at times.

Sundaram Select Focus Fund

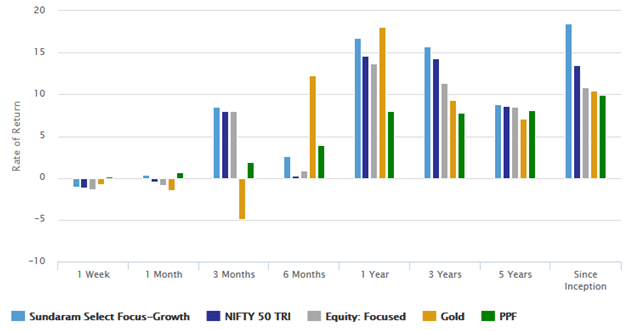

The scheme was launched in July 2002 and has Rs 1,046 Crores of Assets under Management (AUM). The expense ratio of the fund is 2.39%. It is a large cap biased focused equity fund and the scheme benchmark is Nifty 50 TRI. The chart below shows the trailing annualized returns of Sundaram Select Focus fund over different time-scales (periods ending 11th December 2019). You can see that the scheme was able to beat Nifty and the focused fund category across all periods.

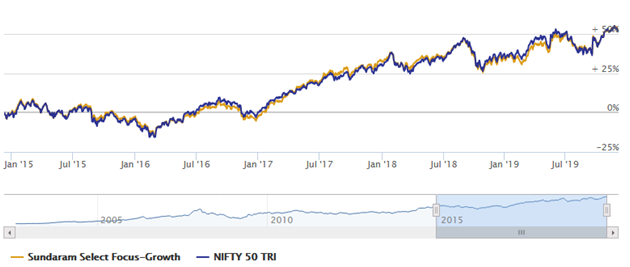

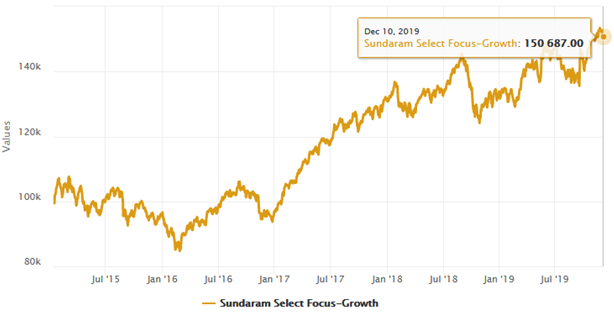

The chart below shows the NAV movement of the scheme over the last 5 years.

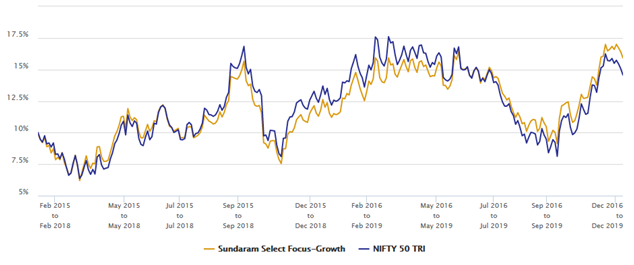

Rolling Returns

The chart below shows the 3 years rolling returns of Sundaram Select Focus Fund versus its benchmark Nifty 50 TRI over the last 5 years. We are looking at 3 year rolling returns because investors should have a minimum 3 year investment horizon for equity funds. You can see that the fund has been outperforming the Nifty since July 2019 and also before May 2018. The reason for underperformance from July 2018 to July 2019 was the nature of Nifty performance and the characteristics of the index. Nifty performance during the period was driven largely by just a few select very large cap stocks. Since the Nifty is a market cap weighted index, higher weights were assigned to these high performers. This was an anomalous situation. This situation was corrected when the market fell in June and eventually started recovering in September.

The average 3 year rolling return of the scheme over the last 5 years was 11.9%, while the median 3 year rolling return of the scheme over the last 5 years was nearly 11.5%. The maximum 3 year rolling return of the scheme over the last 5 years was 17%, while the minimum 3 year rolling return of the scheme over the last 5 years was 6.2%.

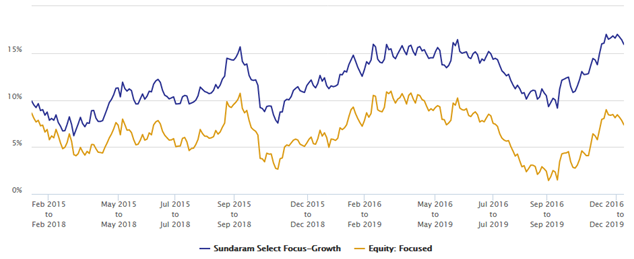

The scheme gave more than 8% returns nearly 93% of the times over the last 5 years. The chart below shows the 3 year rolling returns of the scheme versus the focused equity funds category over the last 5 years. You can see that the fund has consistently been outperforming the category during the entire period.

Portfolio Construction

Rahul Baijal is the fund manager of this scheme. The fund manager invests in a maximum of 30 stocks across sectors with the objective to deliver consistent and steady returns over time with limited volatility. At any time, the fund would have more than 80% of the corpus invested in well managed and established large cap companies (Top 100 companies by market capitalization). The fund manager follows a bottom up approach in stock picking based on in-house research and the fund manager’s conviction. The scheme portfolio is generally focused around 3-4 themes. The investing style of the fund manager has a GARP (Growth at Reasonable Price) bias.

Key themes of the fund manager are as follows:-

Discretionary Consumption:

Structural attractiveness due to higher incomes, improving consumption patterns and rising penetration. In relation to this theme, the fund manager is overweight on sectors like Consumer durables, Retail Banking etc.Domestic Cyclical Recovery:

The Indian economy is expected to witness revival in economic growth which will augur well for cyclical stocks. In relation to this theme, the fund manager is overweight on corporate lenders and select industrial stocks.Government Reforms:

From the perspective of Government reforms the fund manager is overweight on infrastructure and power sectors which are beneficiaries of Government reforms and spending.Weak Outlook on global sectors:

In this regard the fund manager is underweight on metals, US Focused generic drugs and IT.

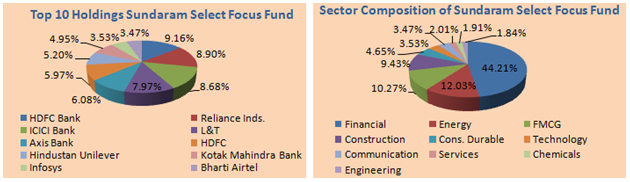

Sectors and top holdings

The chart below shows the major sector allocations and top holdings of Sundaram Select Fund portfolio.

Lump Sum and SIP Returns

The chart below shows the growth of Rs 1 lakh lump sum investment in the Sundaram Select Focus Fund’s growth option over the last 5 years. Your investment in the scheme would have grown more than 1.5 times in value over the last 5 years.

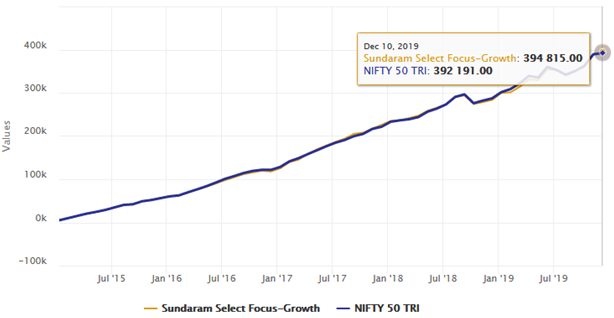

The chart below shows the returns of Rs 5,000 monthly SIP in the Select Focus Fund’s growth option over the last 5 years. With a cumulative investment of Rs 3 Lakhs, you could have accumulated a corpus of nearly Rs 4 Lakhs in the last 5 years – cumulative profit of nearly Rs 1 lakh. The scheme gave over 11% annualized (XIRR) returns during the period.

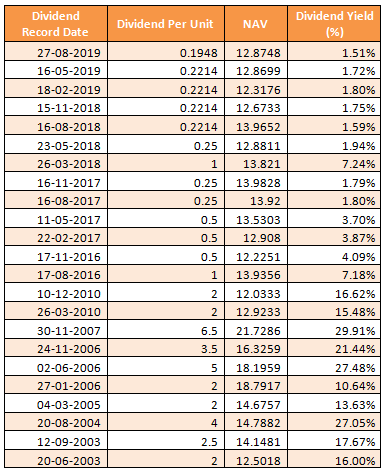

Dividend Track Record

Sundaram Select Focus Fund has been paying quarterly dividends for the last 3 years and has a strong dividend track record for the last 2 years or so. The table below shows the dividend track record of the scheme. Investors should remember that mutual fund dividends are not assured. The scheme may change the dividend payout rate or stop paying dividends at the discretion of the fund house.

Conclusion

Sundaram Select Focus Fund has completed 14 years. In our view, its risk adjusted performance is quite good. If you want capital appreciation for your long term financial goals then Sundaram Select Focus Fund could be an ideal choice. However, you need to have sufficiently high risk taking appetite and a long investment horizon. You can invest in the fund, both in lump sum and SIP modes; if you are worried about high valuations currently, then you can consider doing a 3 to 6 month Systematic Transfer Plan (STP). Investors should consult with their financial advisors if Sundaram Select Focus Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Financial Services Fund

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty India Infrastructure and Logistics ETF

Jan 30, 2026 by Advisorkhoj Team