Top 10 Large Cap Mutual Funds to invest in 2015

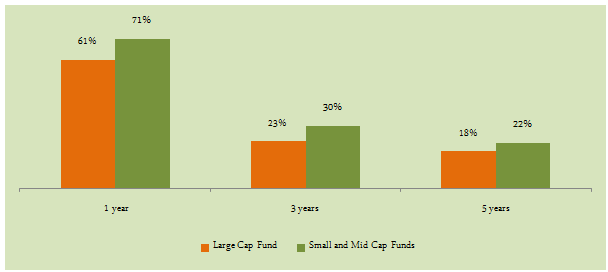

In the last one year the Sensex rose by 44% generating fabulous returns for many equity investors. If we look at mutual funds, the returns have exceeded even the Sensex returns. Large cap equity mutual funds gave on average over 61% trailing annualized returns over the last one year period. The returns of small and midcap equity funds have been even higher over the last one year. The chart below shows the comparison of average annualized returns of large cap and midcap fund categories over 1 year, 3 years and 5 years investment horizon.

While small and midcap funds have the potential to give higher returns than large cap funds, the intrinsic risk of small and midcap funds is higher than large cap funds. We can see in the chart above that while the average annualized returns of small and midcap funds category are higher than that of large cap funds category, the difference narrows as the horizon lengthens. Many mutual fund investors prefer large cap funds, because the portfolio mix of such funds limits downside risks in volatile market conditions.

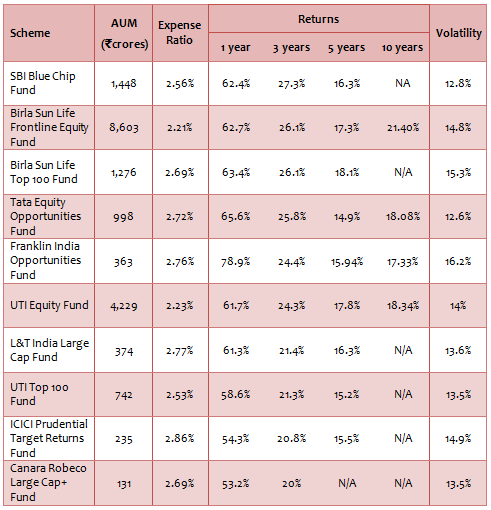

In this blog, we will review top 10 large cap equity funds based on CRISIL’s mutual fund rankings for the last quarter. CRISIL ranks equity funds based on several parameters like average 3 year annualized returns, volatility, portfolio concentration risk (both industry and company) and portfolio liquidity risk. On each of these parameters, each scheme is accorded a cluster rank (from 1 to 5) relative to its peer group. To derive a composite cluster rank, CRISIL has assigned different weights to each parameter, with average 3 year annualized return given the highest weights at 50%, volatility 30%, industry concentration risk 10%, company concentration risk 5% and liquidity risk 5%. The period of analysis is broken into four periods, latest 36, 27, 18 and 9 months. Each period is assigned a progressive weight starting from the longest period as follows: 32.5%, 27.5%, 22.5% and 17.5% respectively. Each of these large cap equity funds in our review has been assigned either Rank 1 or 2 by CRISIL. The table below lists the top 10 large cap funds, in order of the highest 3 year annualized returns. Returns in the table are for growth options in regular plans, based on NAVs on Feb 16, 2014.

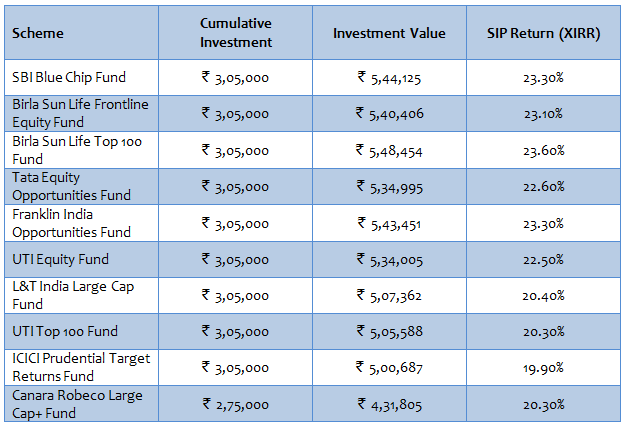

Let us now look at SIP returns of each of these funds over the last 5 years, assuming a monthly SIP of र 5,000 made in the growth option of these schemes on the first working day of every month. Please note that since the Canara Robeco Large Cap+ Fund has not yet completed 5 years, the SIP return of this fund is since inception.

Conclusion

In this article, we have reviewed the top picks among large cap equity funds based on the most recent CRISIL rankings. While all these funds have delivered strong returns across different time cycles, the suitability of each of these funds would depend on risk profile and time horizon. You should consult with your financial adviser if these large cap funds are suitable for your portfolio.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

UTI Mutual Fund launches UTI Nifty500 Shariah Index Fund

Feb 5, 2026 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Multi Asset Omni Fund of Funds

Feb 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Services Fund

Feb 4, 2026 by Advisorkhoj Team

-

HDFC Mutual Fund launches HDFC Nifty India Consumption Index Fund

Feb 4, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team