Top Dividend Paying Large Cap Equity Mutual Funds in the last 5 years

The primary objective of investing in equity funds is capital appreciation over a sufficiently long investment horizon. However, different investors have different financial needs. Some investors want income from their investments, at the same time they want to take risks and consequently expect higher income compared to fixed income investments. Dividend options of equity mutual funds provide investors the opportunity to earn higher income than fixed income investments. However, investors should understand the underlying risk return characteristics of equity funds, whether they are growth options or dividend options, are the same. Investors should be very clear about the following points with respect to dividend options of mutual funds.

- Mutual funds cannot and do not assure a certain amount of dividend per unit. Dividends are declared on the basis of the performance of the underlying fund portfolio,

- Mutual funds cannot and do not assure that dividends will be paid at a regular frequency, monthly, quarterly or annual.

- Mutual funds paying high dividends are not necessarily better than funds paying lower dividends.

- Mutual funds paying higher dividends are not necessarily safer than funds paying lower dividends.

- Dividends are paid from the profits of the mutual fund.

- A mutual fund may not declare high dividends just because the underlying portfolio of a fund has given a high return. Dividends are at the discretion of the fund house.

- Dividends are adjusted from the ex dividend Net Asset Value (NAV) of the fund. In other words, the ex dividend NAV is lower by the dividend declared per unit.

So if dividends are assured neither in terms of magnitude nor frequency, why invest in dividend options? The simple reason is that, there are investors who want to get a higher income than fixed income instruments and are aware of the risks associated with equity. In this blog we will discuss some top dividend paying large cap equity mutual funds.

The problem of total returns

Total return is the most popular measure of mutual fund performance. It is the total return earned by the investor after factoring in both dividends and capital gains. Consider three different funds:-

- Fund A’s NAV rose from 100 to 120 in one year. It did not pay any dividend during the year.

- Fund B’s NAV rose from 100 to 115 in one year. It also declared a dividend of

र3 per unit. - Fund C’s NAV rose from 100 to 105. It declared a dividend of

र10 per unit.

The total returns of Fund A, B and C are 20%, 18% and 15% respectively. Which fund was best for the investor? It would depend on the investor’s need. If the investor wanted capital gains, then undoubtedly Fund A was the best option, on the other hand if the investor wanted the highest possible income, then Fund C was the best option. For the investor who wants the highest cash-flows from his or her mutual fund investment, total returns are of relatively less significance. Such investors should instead look at metric, known as Dividend Yield.

Dividend Yield

Dividend yield in the stock market parlance is simply the dividend paid by the company divided by the current share price. The dividend yield in the mutual fund context is quite similar. While there is no unified definition of the dividend yield of a mutual fund, the most common definition of a mutual fund yield is the aggregate trailing dividends paid by the scheme over a specified period of time divided by the current NAV annualized over that period. It is also known as the distribution yield. You can see the distribution yields of top mutual funds for various categories by selecting the period, in our MF Research section, Top Dividend Paying Mutual Funds.

Top Dividend Paying Large Cap Funds

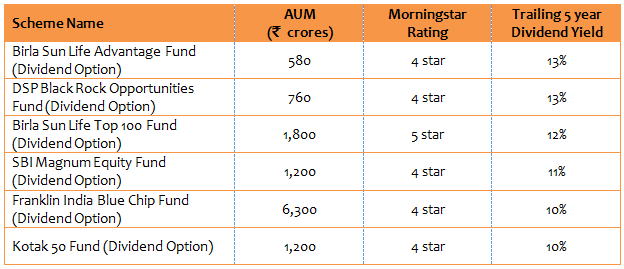

In this blog, we have selected some top paying dividend large cap equity mutual funds, based on the 5 year annual trailing dividend yield (5 year distribution yield). While dividend yields were the most important consideration, we had three other considerations when coming up with our selection:-

- Minimum 10% trailing 5 year annual dividend yield

- 4 star or 5 star rated funds

- Minimum AUM of

र500 crores

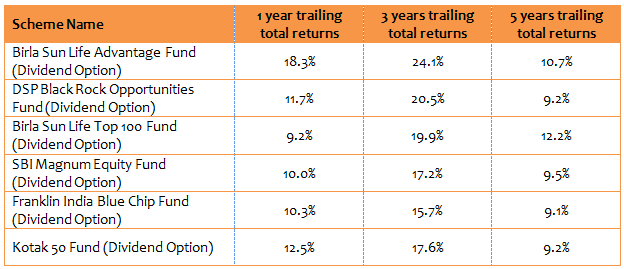

The table below lists the six top dividend paying large cap funds in our selection.

Let us now see the total returns from each of these funds, over a one, three and five year investment horizon (as on September 30, 2015).

Let us look at the dividend performance of each of these funds individually.

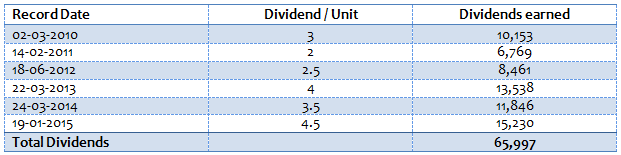

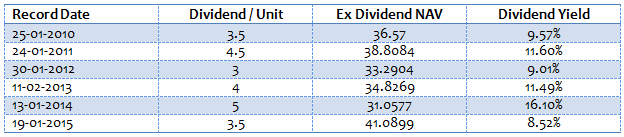

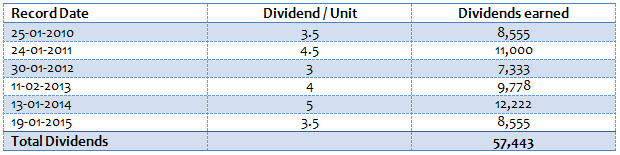

Birla Sun Life Advantage Fund (Dividend Option)

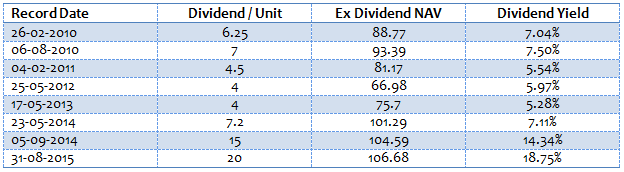

The table below shows the dividends paid by Birla Sun Life Advantage Fund (Dividend Option) over the last 5 years

How much dividends would you have got, if you invested र 100,000 in this scheme (dividend option) at the beginning of 2010? The NAV of this scheme (dividend option) on Jan 4, 2010 was 96.35. With a र 100,000 investment, you could have purchased 1,038 units. The table below shows the dividends earned.

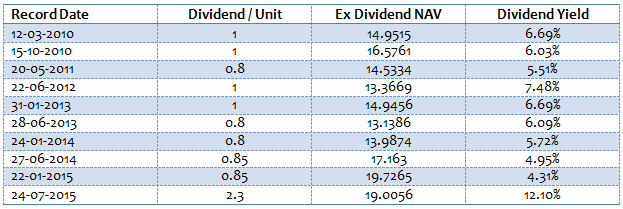

DSP BlackRock Opportunities Fund (Dividend Option)

The table below shows the dividends paid by DSP BlackRock Opportunities Fund (Dividend Option) over the last 5 years

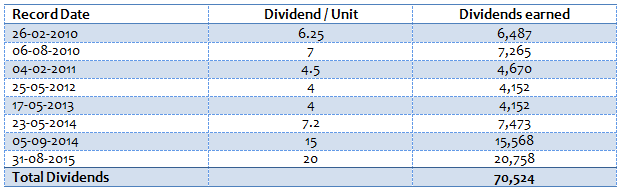

How much dividends would you have got, if you invested र 100,000 in this scheme (dividend option) at the beginning of 2010? The NAV of this scheme (dividend option) on Jan 4, 2010 was 29.5. With a र 100,000 investment, you could have purchased 3,384 units. The table below shows the dividends earned.

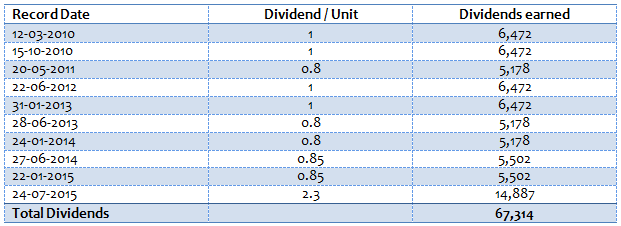

Birla Sun Life Top 100 (Dividend Option)

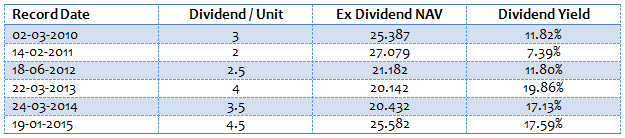

The table below shows the dividends paid by Birla Sun Life Top 100 Fund (Dividend Option) over the last 5 years

How much dividends would you have got, if you invested र 100,000 in this scheme (dividend option) at the beginning of 2010? The NAV of this scheme (dividend option) on Jan 4, 2010 was 15.45. With a र 100,000 investment, you could have purchased 6,472 units. The table below shows the dividends earned.

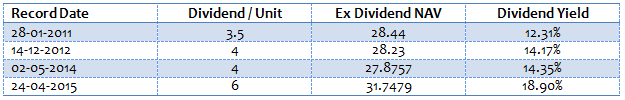

SBI Magnum Equity Fund (Dividend Option)

The table below shows the dividends paid by SBI Magnum Equity Fund (Dividend Option) over the last 5 years

How much dividends would you have got, if you invested र 100,000 in this scheme (dividend option) at the beginning of 2010? The NAV of this scheme (dividend option) on Jan 4, 2010 was 29. With a र 100,000 investment, you could have purchased 3,396 units. The table below shows the dividends earned.

Franklin India Bluechip Fund (Dividend Option)

The table below shows the dividends paid by Franklin India Bluechip Fund (Dividend Option) over the last 5 years

How much dividends would you have got, if you invested र 100,000 in this scheme (dividend option) at the beginning of 2010? The NAV of this scheme (dividend option) on Jan 4, 2010 was 41. With a र 100,000 investment, you could have purchased 2,444 units. The table below shows the dividends earned.

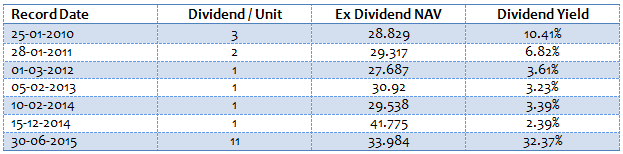

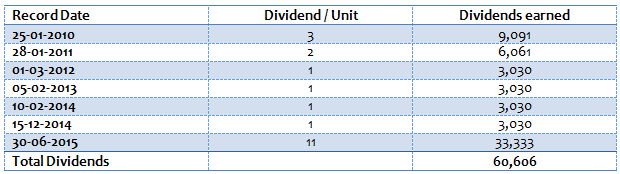

Kotak 50 Fund (Dividend Option)

The table below shows the dividends paid by Kotak 50 Fund (Dividend Option) over the last 5 years

How much dividends would you have got, if you invested र 100,000 in this scheme (dividend option) at the beginning of 2010? The NAV of this scheme (dividend option) on Jan 4, 2010 was 33. With a र 100,000 investment, you could have purchased 3,030 units. The table below shows the dividends earned.

Conclusion

In this blog we have seen that dividends from equity mutual funds can help the investors earn higher income compared to fixed income investments. What is even better is that, while interest from most fixed income investments is taxed as per the income tax rate of the investor, dividends from equity mutual funds is tax free. Choosing the best dividend paying mutual funds is not easy. As discussed, looking at total returns can be misleading, if your objective is to earn the highest income. You should look at the dividend payout track record over a sufficiently long time period. Just because a fund missed out paying dividends in a particular year due to market conditions prevailing during that time, it does not mean that it is not a good dividend payout fund. Trailing dividend yield over a specified time period as described in this blog is a good indicator of the dividend payout track record. You can see top dividend paying mutual funds by going to our mutual fund research section, Top Dividend Paying Mutual Funds. However, while dividend yields are important, you should also pay attention to the fundamentals of the fund.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

UTI Mutual Fund launches UTI Nifty500 Shariah Index Fund

Feb 5, 2026 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Multi Asset Omni Fund of Funds

Feb 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Services Fund

Feb 4, 2026 by Advisorkhoj Team

-

HDFC Mutual Fund launches HDFC Nifty India Consumption Index Fund

Feb 4, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team