Why LIC MF Tax Plan is a good fund to invest

Mutual fund Equity Linked Savings Schemes (ELSS) is the best tax saving investment option under Section 80C of income tax. You can claim up to Rs 1.5 Lakhs of deduction from your gross taxable income by investing an equal amount in ELSS. Though ELSS are market linked investments (subject to market risks), they offer superior returns, higher liquidity and friendlier tax treatments compared to most other 80C investment options.

Rs 1 Lakh invested in LIC MF Tax Plan (ELSS) would have grown to over Rs 1.5 Lakhs in the last 3 years. The scheme has outperformed the ELSS funds category in the last 1 and 3 years. In this blog post, we will discuss why LIC MF Tax Plan is a good tax saving investment option for taxpayers.

Scheme Overview

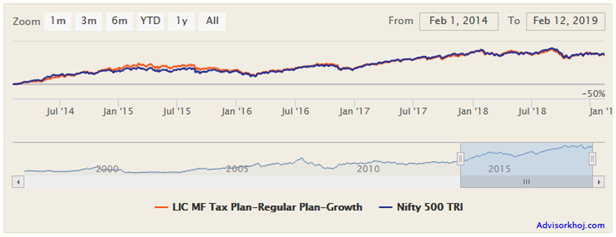

The scheme from LIC MF stable was launched in 1997 and has Rs 195 Crores of Assets under Management (AUM). The expense ratio of the scheme is 2.75%. Sachin Relekar is the fund manager of this scheme. The chart below shows the NAV growth of the scheme over the last 5 years.

Source: Advisorkhoj Research

Trailing and Annual Returns

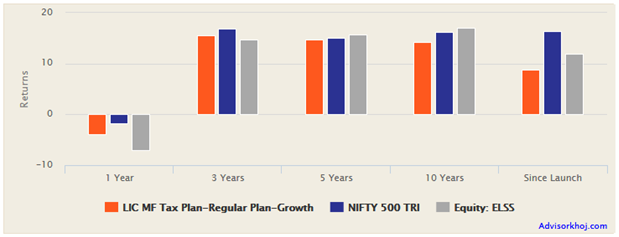

The chart below shows the trailing returns of LIC MF Tax Plan versus the ELSS category and the scheme Benchmark Nifty 500 TRI over different time-scales. You can see that the LIC MF Tax Plan outperformed the ELSS category over the last 1 to 3 years.

Source: Advisorkhoj Research

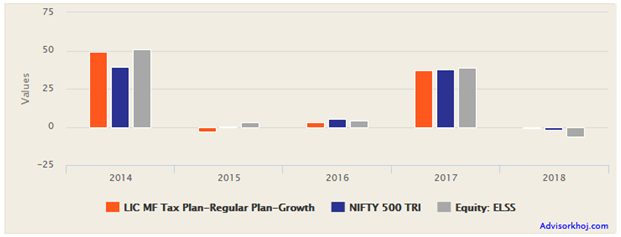

The chart below shows the annual returns of LIC MF Tax Plan versus the ELSS category and the scheme benchmark over the last 5 years. You can see that the scheme matched category performance in most years and beat the ELSS category in 2018, when the market was quite volatile.

Source: Advisorkhoj Research

Rolling Returns

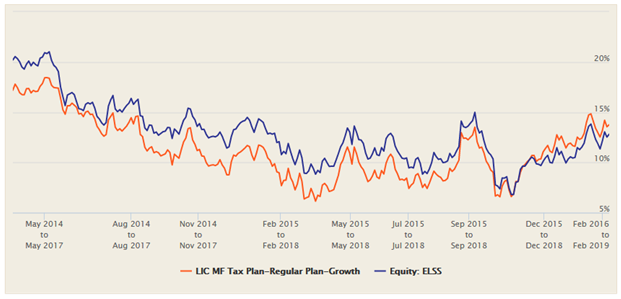

Rolling returns is one of the best measures of mutual fund performance because it measures performance consistency relative to benchmark or category across different market conditions. The chart below shows the 3 year rolling returns of LIC MF Tax Plan versus the ELSS category over the last 5 years. We are showing 3 year rolling returns since ELSS have 3 year lock in periods (you cannot redeem units of ELSS, partially or fully, before 3 years from the date of investment).

Source: Advisorkhoj Research

You can see that LIC MF Tax Plan has started outperforming the ELSS category average from 2015 / 16 onwards. The average 3 year annualized (CAGR) rolling return of LIC MF Tax Plan over the last years was 11.4%. The median 3 year annualized rolling return of LIC MF Tax Plan over the last years was 11%. The maximum and minimum annualized 3 year rolling returns of LIC MF Tax Plan over the last 5 years were 18.9% and 6.1% respectively. The scheme gave more than 8% CAGR 3 year rolling returns more than 88% of the times over the last 5 years; 36% of the times, 3 year rolling returns of the scheme exceeded 12% CAGR in the last 5 years.

Portfolio Construction

Earlier known as Dhan Taxsaver '97, LIC MF Tax Plan seeks maximum capital growth with equity allocation of up to 85 per cent of the corpus. Allocation to debentures and money market instruments can be up to 15 per cent each. It was made open-ended in April 2000. The scheme has a large cap bias (62% of the current portfolio allocation is to large caps). Large cap bias will limit downside and help the scheme outperform in volatile markets e.g. 2018. The investment style of the fund manager is growth oriented. The sector strategy of the scheme has a prominent tilt towards cyclical sectors like banking and finance, automobiles and auto-ancillaries, construction, petroleum etc. The scheme is well diversified in terms of company concentration. The chart below shows the major sector and company allocations of the scheme.

Source: Advisorkhoj Research

Lump Sum and SIP returns

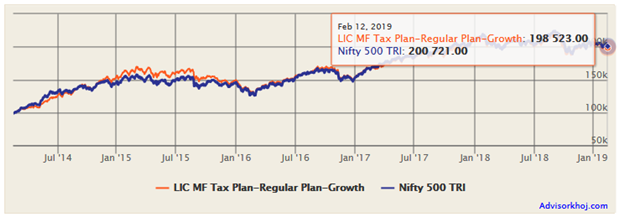

The chart below shows the growth of Rs 1 Lakh lump sum investment in LIC MF Tax Plan over the last 5 years. You can see that your investment in the scheme would have almost doubled in value over the last 5 years.

Source: Advisorkhoj Research

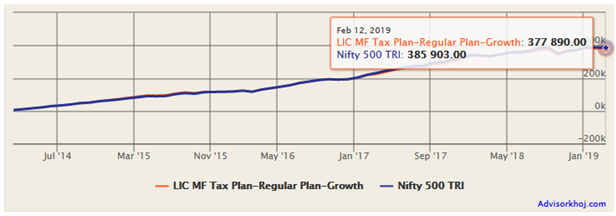

The chart below shows the returns of Rs 5,000 monthly SIP in the scheme over the last 5 years. You can see in the chart that you could have accumulated a corpus of nearly Rs 3.8 Lakhs with a cumulative investment of Rs 3 Lakhs, a profit of Rs 80K over the last 5 years.

Source: Advisorkhoj Research

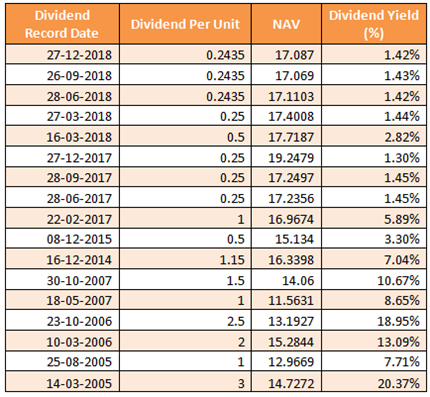

Dividend Track Record

The scheme has a good dividend track record over the past 2 years; it has paid regular quarterly dividends in 2017 and 2018. Dividend yield is quite good in the context of prevailing market conditions. Investors should know that mutual fund dividends are not assured either in terms of pay-out frequency or rate; dividends are paid at the discretion of the fund manager / AMC.

Other benefits

ELSS is one the most tax friendly investments among 80C investment options. Long term capital gains in ELSS up to Rs 1 Lakh are tax free. Capital gains in excess of Rs 1 Lakh are taxed at 10%. Dividends paid by ELSS are tax free in the hands of the investors, but the AMC has to pay 10% Dividend Distribution Tax (DDT) before paying dividends to investors. ELSS is also one of the most liquid investments. ELSS has a lock-in period of just 3 years, whereas minimum lock-in period of other 80C investment options is at least 5 years.

Conclusion

In this post we discussed why LIC MF Tax Plan is a good tax saving investment option. The scheme has put in a strong performance over the last 3 years or so. Maturity proceeds of ELSS are the one of the most tax friendly among all 80C investment options. You can invest in LIC MF Tax Plan either in lump sum or SIP. In our view monthly SIP is the best investment method for tax saving investments unless you have sufficient lump sum funds at the beginning of the year, because through SIP you can invest in a disciplined manner throughout the year and benefit both from the power of compounding and rupee cost averaging. Though the lock-in period of the scheme is 3 years, investors should be willing to remain invested for longer tenors to get the best results in terms of wealth creation. Investors should consult with their financial advisors, if LIC MF Tax Plan is suitable for their tax planning investments.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team