Why is Mutual Fund ELSS the simply best tax saving investment for young investors

When it comes to investments made for the purpose of tax savings under Section 80C of Income Tax Act, Public Provident Fund (PPF), Life Insurance premiums and Equity Linked Savings Schemes (ELSS) are among the most popular choices, especially for young investors. However, as far as wealth creation is concerned, there is simply no comparison between ELSS and the rest of the 80C investment options. It is often seen that, when we compare different investments we are influenced by personal opinions, either our own or that of others. However, objective comparison should always be based on actual data. In this blog we will see how much wealth could have been created in the last 15 years by investing in ELSS. Why have we chosen a time horizon of 15 years? The term of one of the most popular tax saving investments, PPF, is 15 years. Hence it is appropriate to choose duration of 15 years when comparing ELSS with PPF. For our analysis we have assumed an annual investment of र 70,000 in FY 2000 – 2001, र 100,000 from FY 2001 – 2002 to FY 2013 – 2014 and र 150,000 in FY 2014 – 2015, as per Section 80C limits for the respective years.

What would your maturity amount be if you invested in PPF

Before we deep dive into the analysis, it suffices to say that PPF is one of the best fixed income investment choices under Section 80C. The tax treatment of PPF makes the returns more attractive relative to other fixed income investments under Section 80C (like NSC, PO time deposits, tax saving fixed deposits). Even when compared to historical returns of traditional life insurance policies, PPF returns are higher. The chart below shows the PPF returns since FY 2000 – 2001.

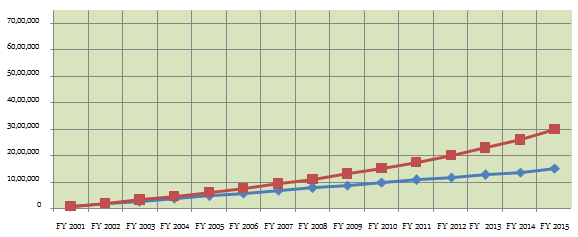

Let us now see how much maturity amount one would have accumulated in the last 15 years by investing upto the maximum 80C investment limit in PPF. The chart below shows the cumulative deposit amount and value of the investment in PPF.

The blue line shows the cumulative deposits made by the investor in his or her PPF account every year. The total deposit made by the investor is र 15,20,000 (र 15.2 lacs) over the duration of the PPF. The red line shows the value of the PPF account, inclusive of accrued interest. The maturity amount of the investor is about र 29,82,000 (around र 29.8 lacs).

What would your maturity amount be if you invested in ELSS

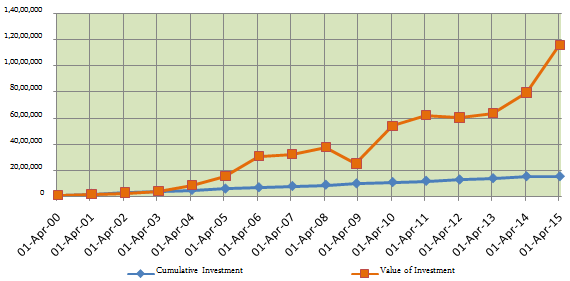

For the ELSS investment we have chosen at random a tax saver fund which has completed more than 15 years. For purpose of this analysis, we have selected HDFC Tax Saver Fund (Growth Option). Like in the previous example, let us now see how much corpus one would have accumulated in the last 15 years by investing upto the maximum 80C investment limit in the ELSS fund. The chart below shows the cumulative investment amount and value of the investment in ELSS.

The blue line shows the cumulative deposits made by the investor in the ELSS fund every year. The total investment made by the investor from 2000 – 2015, is र 15,20,000 (र 15.2 lacs), the same amount deposited in PPF in the previous example. The orange line shows the value of the ELSS investment based on prevailing NAVs. As we can see from the chart above, the ELSS returns are of a very different order of magnitude compared to PPF. In fact, the current value of the first two ELSS investments made in 2000 and 2001 itself is much more than the total maturity amount accumulated in PPF in the previous example. The value of the ELSS investment as on Apr 2, 2015 is over र 1.15 crores, nearly four times the PPF maturity amount.

Fund selection plays an important role in getting better investment returns

As discussed earlier, we chose HDFC Tax Saver fund at random from ELSS funds which completed 15 years. However, the HDFC Tax Saver fund has been underperforming relative to its peers for the past few years. The ELSS investor could have got even better returns than in the above example, by monitoring his investment portfolio from time to time and shifting to better performing funds. For example, if in 2010, the investor switched to Franklin India Taxshield fund, which was one of the better performing ELSS funds back then and even now, and continued to make 80C investments in the Franklin India Taxshield fund, the accumulated investment value of the investor would be over र 1.3 crores. This means through portfolio reviews and better fund selection, the investor could have got 13% higher returns over 5 years. There can be a number of other possibilities through which the investor could have got better returns. We have just shown an example of why it is important that, investors should do review their portfolio from time to time and make appropriate adjustments to get better returns. Investors should seek the advice of their financial advisors from time to time, to make necessary adjustments to their portfolio, as and when required.

Does the time period chosen skew the analysis?

Sceptics will argue that the time period chosen here (2000 to 2015) skews the analysis, because we are in a bull market currently. There is no denying the equity returns over the past 12 to 18 months have been very high and definitely have an effect on the analysis. To do the worst case analysis for ELSS, let us look at a 15 year time horizon which ends with the financial crisis and worst bear market in recent history. Over a 15 year period from 1993 to 2008, the Sensex gave a compounded annual return of 8.5%. While PPF returns over the 15 year period from 1993 to 2008 would have beaten Sensex returns because of the higher PPF interest rate in the 90s, if we compare Sensex returns from 1993 to 2008 with prevailing PPF interest rates the difference is only a few basis points. ELSS is definitely advantageous for younger investors because, even if there is sharp decline in market, they can wait for some time to ride through the volatility and then redeem their units when the market rises again, which is inevitable.

Is ELSS better than NPS?

The only 80C investment option that has the potential to give returns comparable to ELSS is the National Pension Scheme (NPS). In this budget the Government has provide additional tax savings for investment in NPS. Investors can get an additional tax benefit of र 50,000 over and above the 80C limit of र 1.5 lacs, under Section 80CCD by investing in NPS. This makes NPS an attractive investment option for tax payers. However, a major disadvantage of NPS versus ELSS is the tax treatment on maturity. While capital gains in ELSS are tax free, NPS maturity amount is taxable on withdrawal. The other problem is that, under the current rules, 40% of the NPS maturity amount must compulsorily be used to purchase annuities and the annuity income is taxable. There are also limits on equity allocations in NPS, which younger investors may find too conservative relative to their risk profile. However, NPS has certain advantages too. The fund management cost of NPS is lower than that of ELSS. While we will not get into a comprehensive evaluation of NPS in the blog, it suffices to say that, pros and cons notwithstanding, NPS is also a good investment option for younger investors.

Conclusion

In this blog we have discussed why ELSS is simply the best tax saving investment option for young investors under Section 80C. No other tax saving investment has the wealth creation potential of ELSS. ELSS should generally form a major part of the tax saving investments of a young investor.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Financial Services Fund

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty India Infrastructure and Logistics ETF

Jan 30, 2026 by Advisorkhoj Team