Make the most from your PPF Investments

Public Provident Fund is one of the most popular investment choices for Indian investors. There are a number of reasons that make PPF an excellent investment choice for the average investors.

It is easy to open a PPF account:

You can open a PPF account with just Rs 100 in any branch of State Bank of India or its associated banks. A number of other PSU banks offer PPF facility. You can also open a PPF account in General Post OfficeFlexibility with respect to the investment amount:

The minimum investment amount is Rs 500 and the maximum amount is Rs 100,000. You can also pay in 12 or less instalments during the financial year. Failure to pay the minimum amount will result in your account being discontinued, but your accrued balance will continue to earn interest. You can regularize by paying a small penalty along with the investment arrearsIt is risk free:

Your investment is risk free, as PPF is backed by the governmentIt has multiple tax benefits:

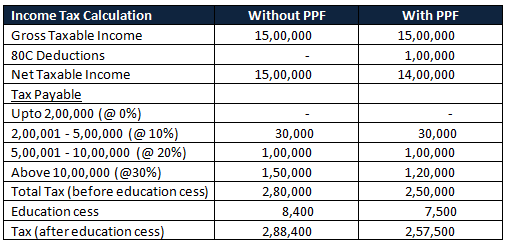

Investment made in PPF qualifies for deduction from taxable income under section 80C. For example if your annual taxable income is Rs 15 lakhs, your tax saving by investing Rs 1 lakh in PPF will be Rs 30,900. See table below for calculations.Further, Interest earned on PPF is exempted from income tax unlike Fixed Deposits and other debt investments.![Income Tax Calculation Income Tax Calculation]()

It offers flexibility of loans and premature withdrawal:

PPF investment matures in 15 years. However, under certain conditions you can take a loan from your PPF balance. The loans can be availed between third and sixth year, and should not exceed 25% of the balance second immediate preceding year. Rate of interest of the loan will be 2% more than prevailing PPF rate and the loan must be repaid in two years. Under certain conditions you can also withdraw from your PPF account before the maturity. Withdrawals are permitted after 7 years subject to certain conditions and such withdrawals must not exceed 50 per cent of the balance at the end of the fourth year, or 50 per cent of the balance at the end of the immediate preceding year, whichever is lower.Investment can be continued after maturity:

You can continue your PPF account even after maturity, with or without making further investments. Your investment will continue to earn applicable interest rates till your account is closed

How can you maximize the benefits from your PPF?

The points above make PPF a very attractive option. Combined with equity investments over a long time horizon, PPF is an excellent investment option for retirement planning. The following considerations below will help the investors to maximize the benefits from PPF.

How much should you contribute to your PPF account:

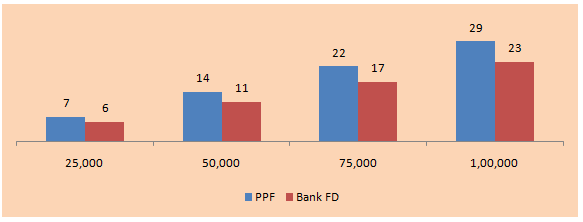

Depending upon your income and savings, try to maximize contribution to your PPF account every year. The tax free interest earned in PPF is 8.7%. On a post tax basis this is a much better investment option than other risk free investments like Bank FDs, in which the interests are taxable. See chart below shows PPF and bank FD returns, for different annual investment amounts (in horizontal axis), for an investor in the highest tax bracket.

If you invest Rs 1 lakh every year in PPF, your maturity amount will be Rs 29 lakhs, which is Rs 6 lakhs more than what you can get over a similar period from bank FD. Therefore you should try to maximize your contribution to PPF.![How much should you contribute to your PPF account How much should you contribute to your PPF account]()

When should you make your PPF deposit:

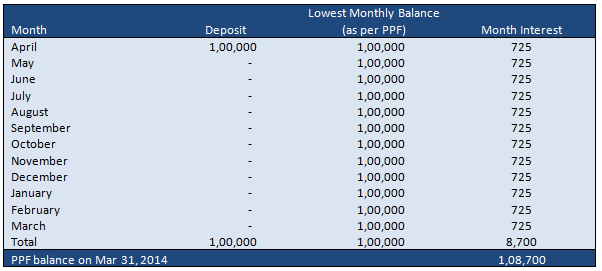

The interest on balance in your PPF account is compounded annually, but the interest is calculated monthly. If you can make the full annual investment early in the financial year, it is the best option. However if you are not able to make the full or a major part of the annual investment early in the year, it is better to invest in monthly instalments. Regarding when you make your deposit it is important to note that, the interest is calculated on lowest balances in account between 5th and last day of the month. So if you do not make your PPF deposit before the 5th day of the month, you will not earn any interest on the deposit made in the month. Therefore, you should try to make your deposit before the 5th day of the month. Let us illustrate this with an example.- Punit invests Rs 1,00,000 on April 1, 2013

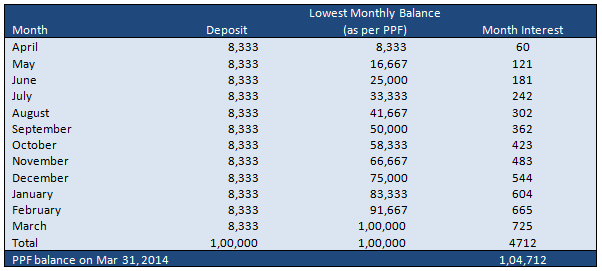

- Amit invests Rs 8,333 on the third day of every month (e.g. Apr 3, May 3, Jun 3 etc.)

- Sumit invests Rs 8,333 on the tenth day of every month (e.g. Apr 10, May 10, Jun 10 etc.)

Punit's PPF Balance at the end of the year

![Punit's PPF Balance at the end of the year Punit's PPF Balance at the end of the year]()

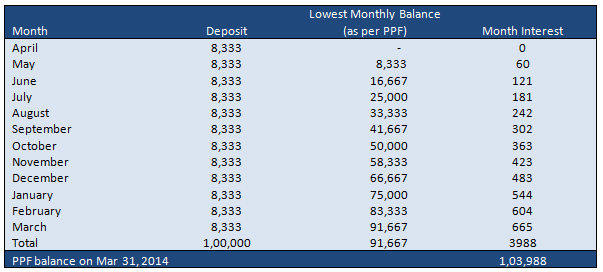

Amit's PPF Balance at the end of the year

![Amit's PPF Balance at the end of the year Amit's PPF Balance at the end of the year]()

Sumit's PPF Balance at the end of the year

The above table illustrates, that it is beneficial to make the annual PPF deposit in lump sum before the 5th of April. If you are making monthly deposits, you should try to make it before the 5th. However in the case of monthly instalments (Amit and Sumit) the difference in interest earned, whether the deposit is made before or after 5th, is small.![Sumit's PPF Balance at the end of the year Sumit's PPF Balance at the end of the year]()

PPF Investment for spouse:

You can make PPF investment even beyond your Rs 1 Lakh limit, for your spouse. Though you will not get any tax saving under section 80C, under the provisions of clubbing of income, your tax liability will not go up, since your spouse will also earn tax free income from her PPF. Same applies for your children. So it is a good idea to make a PPF investment for your spouse and children also, even after you have maximized your contribution under Section 80C.Withdrawal from your PPF:

As a rule, you should never withdraw from your PPF account, since PPF is a retirement planning investment. However, if you are facing a financial crisis you can take a loan or withdraw partially from your PPF account, as discussed above. The interest paid on the loan (@ 2% + 8.7% = 10.7%) or the interest loss (@ 8.7%) on withdrawal, will be much lower than a personal loan at 17 – 18%. You should ensure that you replenish your withdrawal as soon as you are able to.Extend your PPF beyond maturity:

It is a good idea to extend your PPF even beyond maturity, in blocks of 5 years, if you do not need the liquidity immediately. PPF is an excellent risk free investment option. You can continue to make deposits to your PPF, if you can afford to, as per your financial situation. Even if you cannot make deposits every year, you can stay invested in PPF and your accrued balance will continue to earn tax free interest.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team