Financial Planning in the Tantalizing Twenties

Advertisements and billboards have you convinced that you have entered the most happening period of your life: the 20’s. You start the 20’s with zeal to change your life, figure out the purpose and aim of life, go down paths that have been not been explored and do all things that make your life fulfilling. However, you are also trying to get rid of the often used phase 'but I do not have money' by trying to have more money. You are probably tired of living a borrowed existence and do not want to go back to college days where you could barely make ends meet.

In your early 20's, your inflated sense of self often stops you from asking parents for more money. You soon land in your first job with a humble pay and this sense of not so empty bank account overwhelms you. Suddenly you have the financial capability to fulfil all your needs and the self imposed restrain is no longer in place. You work hard and play hard. You keep telling yourself, 'I have a lot of money and lot of time to think about real life' and laugh when someone mentions retirement.

As and when you are nearing the end of your twenties and your expenses are climbing up, you are probably wishing you had some savings to aid you in this ever increasing expenses scenario. You are probably not alone in such wishful thinking. A lot of us think in this way and savings for us remains just that: wishful thinking. It is probably high time that you start thinking about saving and investing. Saving and investing is not sacrificing the present needs to fulfil the future ones. Rather it is a means of prioritizing what is important today and what all will be more important tomorrow.

So how can you plan your finances in the 20s? One of the biggest benefits of being in twenties is that time is on your side. With time by your side you can benefit from compounding, the best results of which are felt over a long period of time. If the questions such as: 'Where do I find the money?', 'Why should I invest so early?' are plaguing your mind, it is natural.

Where is the Money?

To be able to find money to invest within your tight budget may seem like an arduous task because you barely have enough for the things you need. You can never have the money because you do not keep a track.

- Have a budget where you keep track of your spending. This will help you find the areas in which you are over spending or splurging giving you an idea of where to cut back.

- Pay your bills on time and avoid paying late charges. Same applies for your credit card bills because interest of which can soar as high as 36% - 48%. Not an ideal scenario if you are willing to save.

- 'Pay Yourself First' is a concept that is gaining popularity. The conventional norm is to spend first and then save. However, the chances of saving are higher if in the beginning of month you save a certain amount before you start spending.

- It is a very common habit amongst us to splurge on ‘Sales’ offered by various merchants by telling ourselves we are saving more than we are spending. The reality is we are only spending and barely saving. Quit buying things that are not needed. This is probably the simplest and easiest way to save: Just a ‘No!’ once in a while.

Have a List of Goals

Savings and investing takes place only when it becomes an emotional priority. This can only occur if you have a list of goals which you think are emotionally fulfilling and financially demanding. Hence, ensuring that you make saving and investing a priority. Savings could be short term goals like a holiday next month or a foreign holiday the year after. It could also be intermediary goals like getting married or saving enough for a down payment for a house.

Do not forget to make the long term goals a priority. It may seem far away in the horizon but starting early will give you the advantage of relaxing in your later years. There is no need to laugh or scoff when someone mentions retirement. It happens to be one of the most important long term goals but often suffers from lack of attention at the right time. Retirement is one goal for which you cannot take personal loan or borrow money. You need the amount that is sufficient for you to live a good life.

Put a Price Tag on your Goals

Having short and long term goals and starting to invest is the first step in the right direction. However the question still remains: How much is enough? While investing you must remember that what the present cost is and what the future cost will be. Future cost of a goal is usually determined by taking the inflation into consideration. If you are investing for higher education, the current cost of a foreign university is Rs. 25 - 30 lakhs, whereas 18 years from now the costs will approximately be Rs. 76 lakhs. In present day cost you maybe are managing household expenses with Rs. 1 lakh a month. However, to maintain the same lifestyle after retirement, 30 years or more from now on, you will need Rs. 6 lakhs a month.

As you can see the future costs of your goals seem alarming. Hence, it is important to put a price tag on your goal to know at all times the total corpus that your investments must create. You cannot just depend on your current income or future income to fulfil all your goals because as you may have already guessed it may not be possible.

Start Small

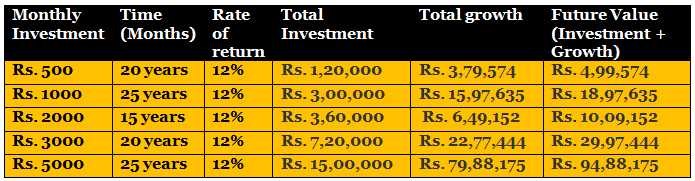

Just because you have too many goals to fulfil, do not hurriedly make bad investment decisions. Start slow and start small. In a Mutual Fund SIP the minimum investment is Rs. 500 a month. It is a good beginning and it inculcates the habit of savings. Once you are consistently investing, increase the investment amount in other funds after a period of time. Even though you may be investing small amounts, equity funds may be a good option. The investment horizon is long and hence, along with high returns the risk also tends to get reduced. Do not put too much pressure on yourself to invest lump sum. Start slow and steadily keep adding to your corpus. We have a habit of underestimating small amounts. However, if you invest a small amount per month in Equity funds and assuming it generates a return of 12% these are the future values that you could possibly generate:

Where to Invest?

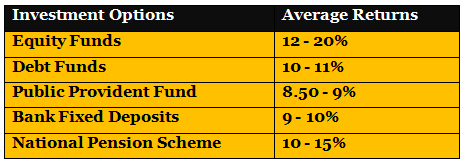

Given below are few of the most availed investment options.

Equity funds are known to generate high returns. But these are often avoided by investors because they are perceived to be risky. While the risk factor associated is not being denied, it can be negated by investing for the long term. The risk in equity investment is reduced when invested for a long period of time along with generation of high returns. Hence, if you start investing in your twenties you can get these advantages.

Debt Funds usually generate moderate returns while risk involved is also moderate. These funds are suitable for intermediary or short term goals as the investors need to generate moderate returns with minimum risk. The Balance Funds can also be an ideal investment in such a scenario because investment is made in both - debts and equities with emphasis on equities.

Public Provident Funds also invests in debt instruments and provides assured returns. National Pension Scheme is managed by the Government and it aims to promote savings for retirement. You might be in your 20s but you still have to start saving for your retirement. NPS maybe a good investment option because the corpus remains inaccessible till retirement and also offers tax rebate.

To have a better idea of where to invest, we suggest reading, Optimising your Asset Allocation through Mutual Funds

Start Early

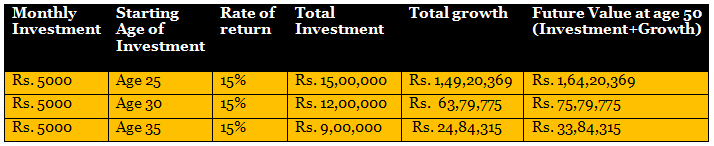

It is never too early to lay the foundation to your financial future. However, procrastination in the present could cause heavy losses in the future. If you spend a year without any investment then you have dramatically reduced your future corpus. This may sound farfetched in the present but have a look at the table below to understand the future impact of starting or not starting early. The example shows the return generated by three investors who started investing at different ages.

In the table above you can clearly see who the winner is. The investor who started at the age of 25 is a crorepati by the age of 50 with a total investment of Rs.15 lakhs he got more than 10 times the investment amount. The investor who started just five years later got a total future value of approximately Rs. 76 lakhs which is not even half the amount that the investor who started at age 25 got. Starting early is clearly marking you for a more secure financial future. Hence, there is no alternative to starting early no matter what the amount, start early and start now.

One of the biggest confusion a young investor faces is extent to which investments are to be made in debt and equity. We have tried to solve the confusion by showcasing the probable asset allocation that you could do in your twenties.

Conclusion

20’s happen to be the most thrilling of all ages. However, it is also the age where one can figure out their priorities and the ways to lead a good life. The foundation of the future is laid in the 20s and to build a strong and stable future you need to lay the foundation now. It is never too early but in the maddening rush to get ahead of the materialistic race, make sure it is not too late. While you have all the investing pressure on your shoulder do not let it break your back. Sit back, relax and have fun. Live your life because that is what you are working towards but do not let the priorities slip out of your mind. So work hard, play hard and invest harder.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team