15 years of Mirae Asset Large Cap Fund: Wealth creation story

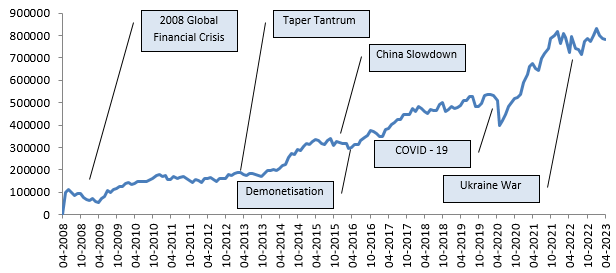

Mirae Asset Large Cap Fund has recently completed 15 years. If you invested Rs 1 lakh in Mirae Asset Large Cap Fund at the time of its NFO, your investment would have grown to Rs 7.75 lakhs (as on 1st April 2023). The chart below shows how your investment would have grown over the last 15 years despite many ups and downs in the market.

Source: Mirae Asset MF, Advisorkhoj, Period: 01.04.2008 to 01.04.2023

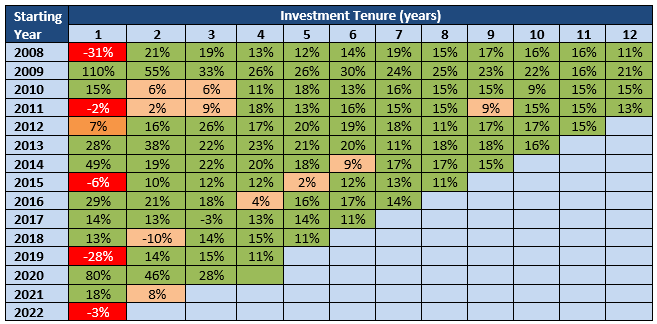

Strong returns over long investment tenures

The table below shows the returns of Mirae Asset Large Cap Fund over different investment tenures for different starting years. You can see that for all the years, the scheme always gave positive returns over 2 years plus investment tenures. Over 2 years plus investment tenures the scheme gave double digit returns (10%+ CAGR) in 87% of the instances.

Source: Mirae Asset MF, Advisorkhoj, Period: 01.04.2008 to 01.04.2023

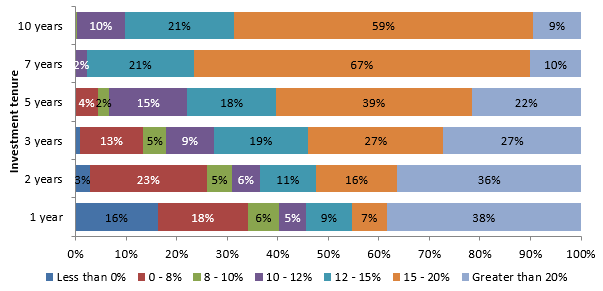

Performance consistency in different market conditions over long investment tenures

The chart below shows the distribution of rolling returns of Mirae Asset Large Cap Fund for various investment tenures since inception of the scheme. You can see that for 3 years plus investment tenures the scheme gave more than 12% CAGR returns in more than 70% of the instances. In our view 12%+ CAGR returns on a consistent basis is very strong performance by a large cap fund, where downside risk is much lower than midcap and small cap funds. This shows the strong performance consistency of the scheme over long investment tenures across different market cycles.

Source: Advisorkhoj Rolling Returns (rolled daily), Period: 01.04.2008 to 01.04.2023. Returns over 1 year plus investment tenures are in CAGR.

Consistently a top performer

The table below shows the annual performance of Mirae Asset Large Cap Fund over the last 10 years versus the large cap funds category and the benchmark index Nifty 100 TRI. You can see that the fund was able to beat the category and the benchmark returns by an overwhelming number of times in the last 10 years. For quartile ranks, we took the annual returns for all the schemes in the large cap category and classified the scheme in the 4 performance quartiles; the top 2 quartiles are in shades of green and the bottom quartiles are in shades of red. You can see that Mirae Asset Large Cap Fund was in the top quartiles 80% of the times in the last 10 years.

Source: Advisorkhoj Quartile Ranking, Period: 01.01.2013 to 31.12.2022. Returns over 1 year plus investment tenures are in CAGR

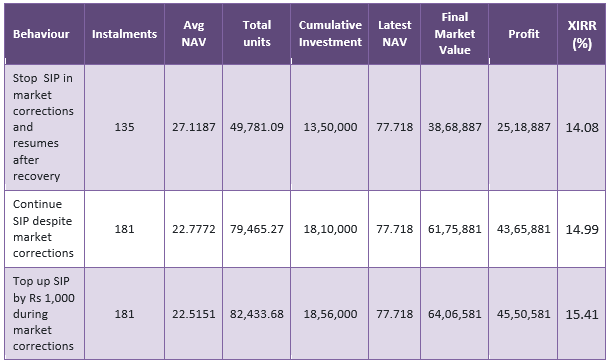

Opportunity cost of risk aversion

Opportunity cost is the profit foregone due to some behavioural biases. Some investors stop their SIPs in volatile market fearing losses. However, this behavioural bias harms the investors’ financial interest in the long term due to opportunity lost.

The table below will show the opportunity cost of stopping your SIP in Mirae Asset Large Cap Fund. We have assumed that you are investing Rs 10,000 through monthly SIP in the scheme since its inception. You can see that your behavioural bias can cause considerable opportunity loss. SIPs take advantage of market volatility through Rupee Cost Averaging of your acquisition cost by simply continuing your SIP, you could lower your average purchase NAV by nearly 20% (Rs 22.8 versus Rs 27.1) and earned Rs 18.5 lakhs higher profits. In fact, if you increase your SIPs in market corrections than you may earn even higher profits with minimal incremental investments.

Source: Advisorkhoj Research, Period: 01.04.2008 to 08.04.2023.

Why invest in Mirae Asset Large Cap Fund?

- The market seems to have moved past the Adani saga and has also taken the US Fed rate hikes in its stride. The RBI has taken a pause in its rate hike and the market has been consolidating from lower levels.

- However, there are medium term risk factors over the next 12 months or so, particularly with regards to the US economy. Most economists are predicting that the US may go into recession later this year or next year. While most economists expect the recession to be mild, we may see significant volatility if the US economy goes into a severe recession as some are expecting.

- Large cap funds are better positioned in bear markets by limiting downside risks compared to midcap and small cap funds.

- The Nifty is still considerably lower compared to its September / October 2021 highs. The current price levels can be attractive investment opportunities for long term investors.

- In the long term, India is strongly positioned among emerging markets to benefit from the realignment that is taking place globally e.g. China plus one, digitization etc, as well as a strong domestic economy.

- Mirae Asset Large Cap Fund has a strong performance track record over the last 15 years. Gaurav Misra (Co-head Equity) has been managing the scheme since 2019.

- Strong performance consistency has been one of the enduring attributes of Mirae Asset Large Cap Fund. We think that performance consistency can lead to superior investment outcomes for investors.

Who should invest in Mirae Asset Large Cap Fund?

- Investors looking for capital appreciation and wealth creation over long investment tenures.

- Investors with high-risk appetites.

- Investors with minimum 5 years investment tenures.

- You can invest either in lump sum or SIP based on your financial situation and investment needs.

- If you have lump sum funds but are worried about volatility, you can invest through STP from Mirae Asset Cash Management Fund.

Investors should consult with their financial advisors if Mirae Asset Large Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Financial Services Fund

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty India Infrastructure and Logistics ETF

Jan 30, 2026 by Advisorkhoj Team