Direct Plan or Regular Plan: Is the difference really worth the debate

An often debate, are Direct Plan better than Regular Plan? Do we really need a Mutual Fund Distributor?

In real value terms, it’s a non-debatable topic though.

How often we get tempted as an investor to jump in & invest in a product performing well in short term or we have heard about it from a friend etc.? Not realizing if it actually fits well within our investment objective or, not understanding the actual reasons leading to this outperformance.

While creating your investment journey to achieve your investment objective, it’s important to note:

It’s not about how much you invest, it’s about where you invest.

It’s not about timing the market, it’s about time spent in the market.

It’s not about investing in an NFO, it’s about knowing if the NFO is well suited in your overall investment objective.

It’s not about defining your financial goals, it’s about working towards your financial goals with right asset allocation.

In this process of knowing what to do, but not actually knowing how to do? We end up making several mistakes in our investment portfolios.

We hear a lot about expense ratios, lower the better for superior fund performance. Does it actually work this way?

In practical terms, an underperforming fund irrespective of its lower expense ratio by a few basis point will continue to underperform its peers & the benchmark! A regular plan scheme, performing well over a consistent period does outperform a direct plan! Well, who guides, is important here.

Often a rearview approach is adopted while investing for a long-term approach.

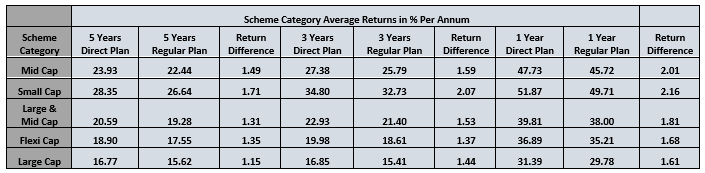

Here below, we have analysed the actual impact difference between a Direct Plan & Regular Plan.

The data shows the return differential between a Direct Plan & Regular Plan for a scheme category

Source: Advisorkhoj.com

- Period considered: 5 Years, 3 Years & 1 Year.

- Returns are considered for 5 different schemes categories as an example & sample.

- Returns are considered for a particular scheme category average. Best, medium & worst performing schemes are all included in a scheme category.

- Returns are considered from 2nd February 2024 & period backwards for each return period bucket.

- All large size, medium size & small size AUM schemes have been considered in the above.

- Note that the TER difference usually widens more between direct & a regular plan for a small size aum scheme. In above, all have been considered.

Now what should be noted here?

Difference in returns per annum is ranging between a Direct Plan to a Regular plan: maximum 2.16% to minimum as 1.15% considering all above scheme categories across all above periods & scheme aum sizes.

Do you really believe this is a huge difference?

Considering, a Mutual Fund Distributor provides -

- Entire hand holding from a Mutual Fund Distributor in your investment journey.

- All service level at your door step.

- Periodic reviews on scheme performance, asset allocation & long-term investment objective re-alignment.

- Manage investment behaviour.

- Complete query handling.

- Human touch.

- Manage hasty investment behaviour & decisions.

- Family orientation with long term relationship.

- Financial education/updates just a call away.

- All updates at your doorstep.

- Avoidance of kneejerk investment decisions, usually driven by information not deemed good for your long-term investment objective.

- Update on other financial products & opportunities.

- Above all, you get to focus at Your own work & Your competencies, rather than worrying what to do?

Actually, the list is endless…

So, for the above reasons, do you really still believe that this return differential is worth it?

It is always a great plan created, with a superior execution & followed through several periodic reviews that lead to achieve investment goals.

This journey cannot be accomplished without managing the “Investment Behaviour”, the real value proposition comes in here through a Mutual Fund Distributor.

Speak to YOUR Mutual Fund Distributor & receive him in, to “Your Life”.

Views expressed are personal & any recommendation/endorsement is not intended and not besought.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Financial Services Fund

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty India Infrastructure and Logistics ETF

Jan 30, 2026 by Advisorkhoj Team