ESG investment theme: Axis ESG Equity Fund

Pillars of ESG

ESG is an acronym for environmental, social and governance, which form the three pillars of this style of investments. Environmental factors relate to impact (favourable or unfavourable) which companies have on climate change, how they use the natural resources, waste management etc. Social factors relates to how companies use human resources, health and safety of employees, how safe the products are for consumers, relationship with suppliers, customers and the broader community etc. Governance relates to how the management protects interest of all shareholders, prevents corrupt practices, ensures compliance with regulations and Government policies, accountability of the board of directors etc.

Advantages of stocks with ESG values

- Strong brands due to product quality standards and customer relationships

- Better operating margins due to lower costs through energy conservation, waste reduction etc

- Productivity due to better labour relations

- Faster approvals and product to market time due to regulatory compliance and Government relations

Why consider ESG in financial planning?

The advantages enjoyed by stocks which score high on environmental, social and governance parameters leads to the following benefits for shareholders / investors:-

- Lower Risk of disruptions caused by regulatory, legal and other issues.

- Improved financial performance due to cost efficiency and superior productivity.

- Improved valuation arising out of stronger brands, lower risk and earnings visibility.

The above factors combined together can lead to substantial returns for the investors.

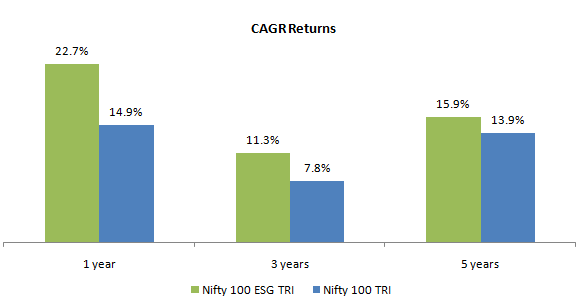

ESG can perform

There is a misconception among some investors that ESG theme will underperform versus the leading broad market indices because ESG criteria may eliminate some high earnings growth stocks. Historical performance of the Nifty 100 ESG TRI versus the Nifty 100 TRI shows that inclusion of ESG factors in stock selection does not compromise performance (see the chart below); on the contrary, it has the potential of enhancing the performance over sufficiently long investment horizons.

Disclaimer: Past performance may or may not be sustained in the future.

Source: National Stock Exchange, Total Return Index values have been used to calculate returns, Periods ending 31st January 2021, Returns over periods more than 1 year are annualized (calculated on Compounded Annual Growth Rate basis). Disclaimer: Past performance may or may not be sustained in the future. Above chart should not be construed as investment advice. Investors should consult with their financial advisors before investing.

ESG as investment theme in India

Axis ESG Equity Fund, launched in February 2020, is one of the pioneers of this investment theme in our country.

About Axis ESG Equity Fund

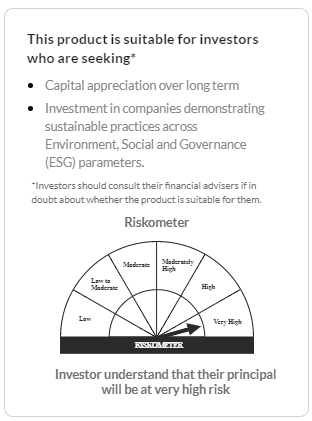

The scheme has just completed 1 year since launch. Mr Jinesh Gopani and Mr Hitesh Das are the fund managers of the scheme. The fund managers have combined experience of 29 years. (source: Axis MF January 2021 fund factsheet). The scheme benchmark is Nifty 100 ESG TRI. The investment objective of the scheme is to generate long term capital appreciation by investing in a diversified portfolio of companies demonstrating sustainable practices across Environmental, Social and Governance (ESG) parameters.

Investment strategy and process

- Sector level screening: Exclude sectors that are perceived to be harmful for the society.

- Stock level screening: Exclude stocks which throw up red flags as part of Axis MF’s internal ESG review.

- Portfolio construction: Portfolio allocation is based on detailed qualitative ESG review of each company complementing the fund house’s fundamental based investment process.

- International stocks: A portion of the portfolio is allocated to international stocks which score high on the ESG factors.

- Minimum 80% of the portfolio will be in stocks that rate highly in Axis MF’s internal ESG review. Selective allocations can be made to stocks with high growth potential and improving ESG trend.

Current portfolio – Axis ESG Equity Fund

- The current scheme portfolio has a large cap bias (94.1% of the portfolio), as on 31st January 2021. The midcap allocation of the portfolio is 3.6% (as on 31st January 2021). Source: Axis MF Product Leaflet (January 2021).

- Domestic equities constitute 69.5% while international equities comprise 28.02% of the scheme portfolio. 2.45% of the portfolio is in debt, cash and other current assets (as on 31st January 2021). Source: Axis MF January 2021 fund factsheet.

- Financial services (35.69% of portfolio), software (22.28%), consumer non durables (10.84%), retailing (10.26%) and industrial products (5.27%) comprise the Top 5 sectors of the scheme portfolio assets (as on 31st January 2021). Source: Axis MF January 2021 fund factsheet.

Why invest in ESG?

- Investors can aim for long term capital appreciation by investing in quality companies with sustainable growth prospect.

- Sustainable companies are expected to have lower risk and deliver sustainable growth.

- ESG factors are vital in ensuring the future of our planet and society. Companies which take into consideration the ESG factors in their business strategy and processes are making important contribution for our future generations. As investors, you can support such companies, by investing in ESG funds.

- Axis Mutual Fund is well positioned to incorporate ESG while investing basis their core focus towards quality and sustainable growth.

Investors should consult with their financial advisors to know more about ESG funds and how they can be suitable for your financial needs.

Axis ESG Equity Fund

An open-ended equity scheme investing in companies demonstrating sustainable practices across Environment, Social and Governance (ESG) theme

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Financial Services Fund

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty India Infrastructure and Logistics ETF

Jan 30, 2026 by Advisorkhoj Team