How to protect wealth created by SIP: Part 1

We have stated a number of times in our blog that Systematic Investment Plan is one of the best ways of wealth creation over a long investment horizon. The benefits of SIP viz. power of compounding, rupee cost averaging and disciplined investing are well known to our regular readers. We have discussed earlier in our blog that bear markets or deep corrections are the best investment periods for your SIP because you can invest at very low prices.

Suggested reading: How to make the most of current investment opportunity

At the same time, a black swan event like the Global Financial Crisis of 2008 or market meltdown due to COVID-19 can wipe out several years of wealth created by SIP. Is it possible to create wealth by SIP and also protect it?

How to protect your SIP value from extreme volatility?

You first need to create wealth. You should invest systematically in a disciplined manner over a long investment horizon. You should continue to invest irrespective of market conditions (e.g. high market, low market, range-bound market etc) – do not stop your SIP when markets turn volatile and take advantage of Rupee Cost Averaging.

Over sufficiently long investment tenure you will be able to create wealth through compounding i.e. profit earned on profits. Due to power of compounding over long investment tenures, accumulated profits in SIP will be much bigger percentage of investment value compared to your cumulative investment. If you protect your accumulated profits you will be able to protect substantial part of the wealth created by SIP. How to protect your accumulated profits? You should book profitsat the right times.

When to book profits?

You can have several triggers for booking profits. For example, you can choose to book profits when your accumulated profits cross a certain target (set by you) in Rupee terms or in percentage terms. You can have a time based trigger e.g. booking profits every year, every 3 years, every 5 years etc. These approaches may not however, maximize your profits. In order to maximize your profits, you should follow the age old stock market wisdom – buy low, sell high. How will you know, which price is high, at which you can book profits?

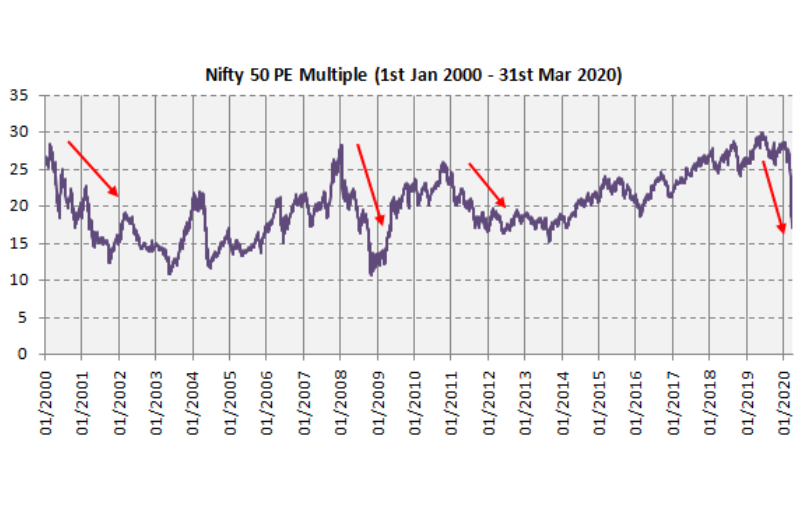

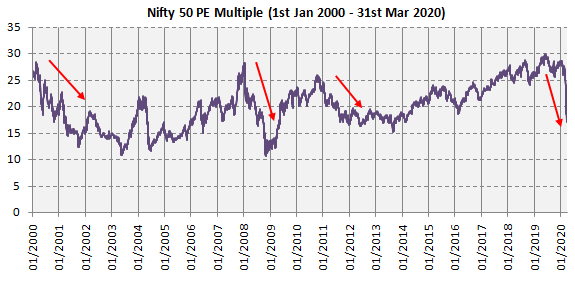

We look at valuations. There are several valuation measures of which the most popular is PE multiple. We will look at the historical PE multiple of Nifty 50 over the last 20 years.

Source: National Stock Exchange

You can see that over the last 20 years Nifty traded in the valuation (PE) range of 10 to 30 times. The average Nifty PE multiple was 20 andstandard deviationof PE was 4.2. If we assume that all possible Nifty PE multiples are distributed in the form of a bell curve (normal distribution) with 20 being the mid-point, the possibility of PE rising above 1.5 standard deviations from average i.e. PE of 26 is only 13%. Therefore, this is a good level to book profits because the chances of prices correcting from this level are quite high (87%). We will do some profit booking at this PE level but we will not book the entire profits because our experience in Indian stock market shows that momentum can take prices significantly higher even at high valuations.

We want to ride the momentum for extra profit. So we need to look at the next profit booking level. The possibility of PE rising above 2 standard deviations from average i.e. PE of 28 is just 5%. We will book the remaining profits at this level. Let us assume we book 75% profit when PE crosses 26 and the remaining 25% when PE crosses 28. The red arrows in the Nifty PE historical charts support our hypothesis that PE levels of 26 – 28 are good levels to sell. You can have a more aggressive or defensive strategy depending on your risk appetite.

How to make this strategy work with SIP?

Let us assume you started a monthly SIP of Rs 10,000 in Nifty 50 TRI. At the end of every month we will do the following:-

- Look at the prevailing PE multiple of Nifty.

- If Nifty PE is less than 26, then no action is required.

- If Nifty PE is more than 26, then book 75% profit. If accumulated profit (Investment market value – Cumulative investment) is Rs 100,000 then you will book Rs 75,000 profit.

- How will you book this profit? Look at the prevailing price (NAV). If NAV is 100, then you will redeem 750 units.

- Invest redemption proceeds in a liquid fund.

- If Nifty PE is more than 28, then book balance 25% profit (in total 100% profit). Use the method explained above to calculate how many units you need to redeem. Invest redemption proceeds in a liquid fund.

Using this strategy you are always invested in the scheme (Nifty in this example). You are simply taking out your profits at certain triggers. For the sake of simplicity, we have ignored complexities like exit loads and capital gains tax. You can fine tune this strategy to take in account exit loads and capital gains tax e.g. redeem only load free units etc.

How did this strategy perform versus normal SIP?

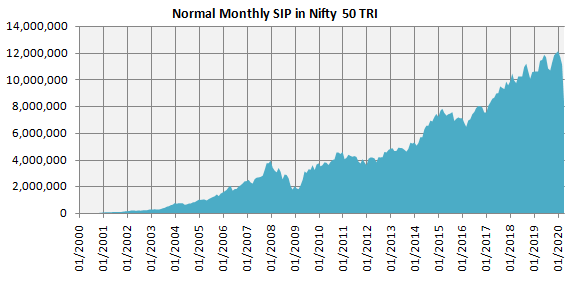

Let us first see how much wealth you would have accumulated through Rs 10,000 monthly SIP in Nifty 50 TRI from 1st Jan 2000 till date (24th Apr 2020). With a cumulative investment of Rs 24.4 lakhs, you could have accumulated a corpus of Rs 92 lakhs over the last 20 years.

Source: National Stock Exchange, Advisorkhoj Research

We have back-tested our profit booking strategy using last 20 years Nifty 50 TRI data. Let us see how this worked.

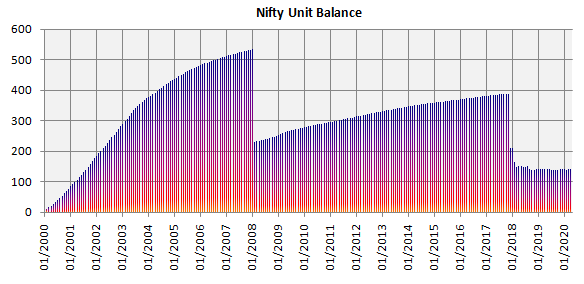

The chart shows the unit balance (net of unit accumulation and redemption) over the investment period. You can see that units accumulate steadily, then a sharp fall due to redemption for profit booking, again steady accumulation and fall due to profit booking when valuations cross our predetermined thresholds.

Source: Advisorkhoj Research

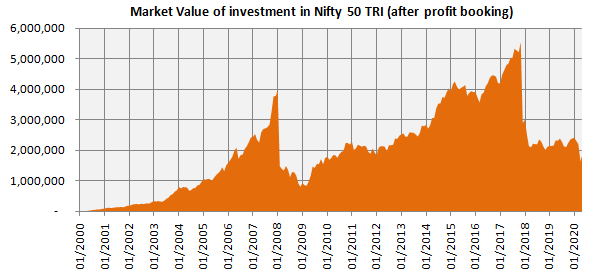

Let us now see the market value of our investment in Nifty 50 TRI over the investment period (see the chart below). You should note the sharp value in investment value is mainly due to profit booking and much smaller impact of market volatility. At the end of the investment tenure market value of investment in NIFTY is Rs 18 lakhs only.

Source: Advisorkhoj Research

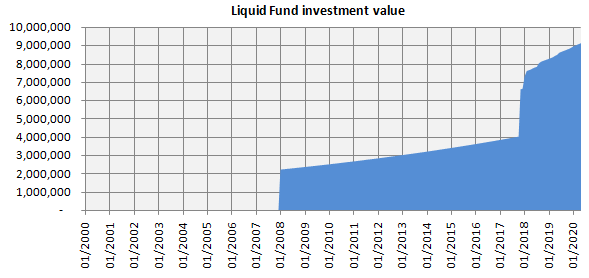

Now let us see, how much we have accumulated in the liquid fund. Let us assume that the liquid fund gave an annualized return of 6%. The chart below shows how much we accumulated in the liquid fund over the investment tenure. The value of our liquid fund investment is Rs 92 lakhs.

Source: Advisorkhoj Research

With the same cumulative investment (Rs 24.4 lakhs), you would have accumulated a corpus of Rs 1.1 crores with this strategy (please see the chart below) – around Rs 18 lakhs higher than normal SIP.

You should note that we could have also invested our accumulated profits in different category of debt funds which gives higher yields than liquid funds and could have created an even bigger corpus.

Source: Advisorkhoj Research

Conclusion

How did we make more money? We protected our accumulated profits by booking profit at the right valuation levels. We could have made more money by delaying our profit booking and riding the momentum a tad longer but in doing so we would have taken considerably higher risks. By following a rule based investing method we kept emotions like greed and fear aside. You can apply more complex rules, but by keeping our rule relatively simple yet fundamentally robust, we executed our strategy quite efficiently. In the next part of this blog post, we will use the same valuation based approach with some modifications and see if we can get better results.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Financial Services Fund

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty India Infrastructure and Logistics ETF

Jan 30, 2026 by Advisorkhoj Team