ICICI Prudential Bluechip Equity Fund: Best performing large cap equity fund in last 10 years

ICICI Prudential Bluechip Equity Fund is the best performing large cap equity funds in the last 10 years (please see our Top Performing Mutual Funds (Trailing returns) - Equity: Large Cap). It is also among the top 3 large cap SIPs in the last 10 years (please see our Top Performing Systematic Investment Plan - Equity: Large Cap).

If you had invested Rs 5,000 every month in ICICI Prudential Bluechip Equity Fund over the last 10 years, you could have accumulated a corpus of Rs 12 Lakhs (with a cumulative investment of just Rs 6 Lakhs). Though the scheme has underperformed a bit in the last 12 months, we think that ICICI Prudential Bluechip Equity Fund has an excellent long term performance track record, across different market conditions and is definitely worthy of consideration for investment purposes. In this post, we will review the performance of this scheme.

Fund Overview

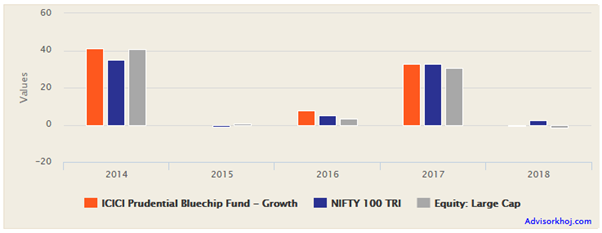

ICICI Prudential Bluechip Equity Fund, previously known as ICICI Prudential Focused Bluechip Equity Fund was launched in May 2008 and has more than Rs 20,000 Crores of assets under management (AUM). It has delivered 14% annualized returns since inception. The expense ratio of the fund is 2.02%. Rajat Chandak and Anish Tawakley are the fund managers of this scheme. The chart below shows the annual returns of ICICI Prudential Bluechip Equity Fund versus its benchmark Nifty 100 TRI and the large cap equity fund category over the past 5 years.

Source: Advisorkhoj Research

You can see that, ICICI Prudential Bluechip Equity Fund consistently outperformed the large cap funds category across different market conditions. Over the last couple of years, the scheme has struggled to outperform the benchmark, but this has been observed across the large cap funds space.

We will discuss why actively managed large cap funds are struggling to beat the benchmark in a separate post, but suffices to say for the purpose of this article that, large cap fund across the board have seen diminishing alphas and this trend may continue. Investors should note that diminishing alphas do not necessarily make an investment unattractive. Large cap funds have outperformed other equity fund categories in the last 12 months or so. Large cap funds provide stability to investor’s portfolios and should continue to play an important part in long term financial planning.

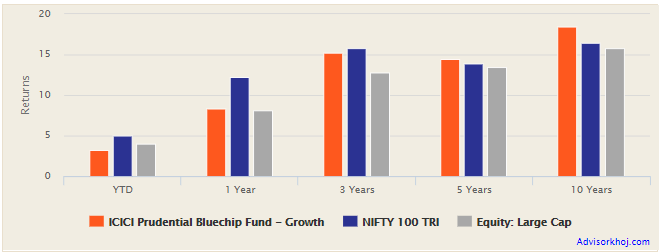

The chart below shows the trailing returns of ICICI Prudential Bluechip Equity Fund versus its benchmark Nifty 100 TRI and the large cap equity fund category over various time-scales. Again you can see that, underperformance versus the benchmark in recent years notwithstanding the scheme has outperformed the large cap funds category over various trailing periods.

Source: Advisorkhoj Research

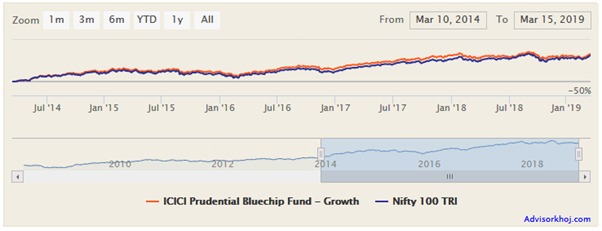

The chart below shows the NAV growth of the scheme over the last 5 years.

Source: Advisorkhoj Research

Rolling Returns

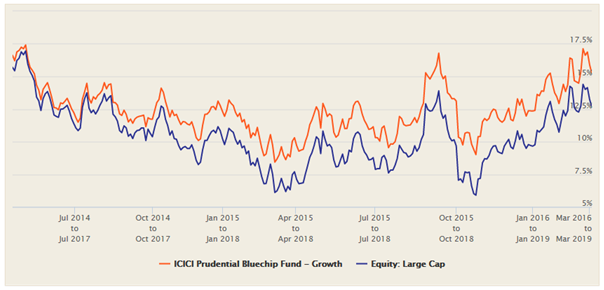

The chart below shows the 3 year rolling returns of ICICI Prudential Bluechip Equity Fund over the last 5 years. Rolling returns are the annualized returns of the scheme taken for a specified period on every day and taken till the last day of the duration. We have chosen 3 years as the rolling returns time period because it is always recommended that long term investors should hold equity funds for at least 3 years.Rolling return is one the best measures of performance consistency. The orange line shows the 3 year rolling returns of ICICI Prudential Bluechip Equity Fund since inception while the blue line shows the 3 year rolling returns of the large cap equity funds category. If we compare the 3 year rolling returns of the scheme versus the category we can see that fund has beaten the category on a consistent basis nearly 100% of the times. You can also see that the margin of outperformance of the scheme versus the category is fairly stable.

Source: Advisorkhoj Rolling Returns Calculator

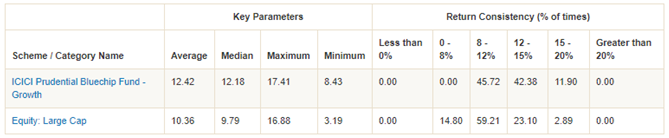

The average 3 year rolling returns of the scheme over the last 5 years was 12.42%, while the median 3 year rolling returns of the scheme over the last 5 years was 12.18%. The maximum 3 year rolling returns of the scheme over the last 5 years was 17.41%, while the minimum 3 year returns of the scheme over the last 5 years was 8.43%.

The scheme gave more than 8% annualized rolling returns 45% of the times over the last 5 years. This shows that despite being in a riskier asset class the scheme has always outperformed fixed income (in general) over 3 year holding periods, irrespective of market conditions prevailing during the investment tenor. The scheme gave more than 12% returns 42% of the times and more than 15% returns near 12% of the times over the last 5 years. The rolling return statistics shows consistent fund management approach and prudent risk management principles.

Portfolio Construction

The scheme initially had a concentrated portfolio of around 20 – 30 high conviction stocks mainly from the Nifty 50 basket. But the surge in AUM has led the fund managers to have a less focused and more diversified stock selection strategy. The current scheme portfolio has around 60 stocks with a pronounced bias towards banking and financial services stocks (30% of the portfolio value). The scheme portfolio has a cyclical bias but at the same time has significant allocations to technology and FMCG. The chart below shows the top stock and sector holdings of ICICI Prudential Bluechip Equity Fund.

Source: Advisorkhoj Research

Lump Sum Returns

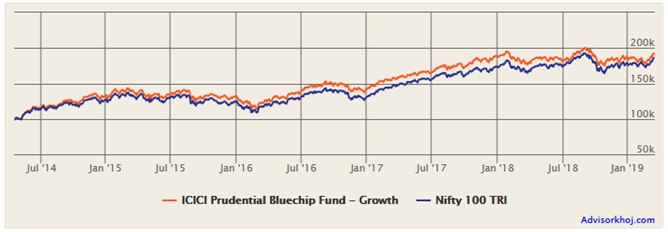

The chart below shows the growth of Rs 100,000 lump sum investment in ICICI Prudential Bluechip Equity Fund over the last 5 years.

Source: Advisorkhoj Research

You can see that Rs 100,000 lump sum investment in the scheme over the last 5 years would have grown to Rs 195,200; a profit of Rs 95,200 on an investment of Rs 100,000.

SIP Returns

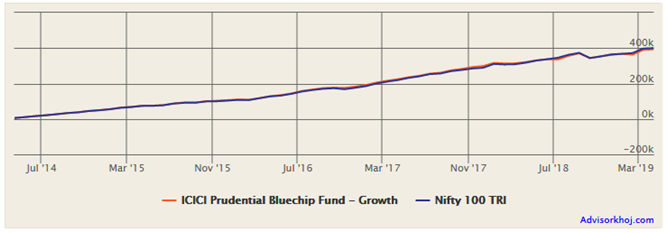

The chart below shows returns of Rs 5,000 monthly SIP started in ICICI Prudential Focused Bluechip Equity Fund, Growth Option, over the last 5 years. By investing Rs 5,000 monthly, the investor would have accumulated nearly Rs 395,641 with a cumulative investment of Rs 300,000 only, a profit of around Rs 96,000 (at an XIRR of 11%).

Source: Advisorkhoj Research

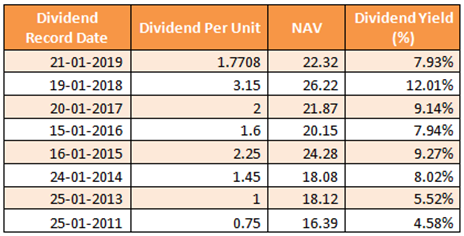

Dividend Track Record

ICICI Prudential Bluechip Equity Fund boasts of a strong dividend track record, having paid dividends to investors every year from 2013 onwards. With average dividend yield in the 8 to 9% range, the dividend option is also good for investors who want regular cash-flows from their investments. Investors should however, note that mutual fund dividends are not assured. Dividends are paid from the accumulated profits of a scheme, at the discretion of the Asset Management Company.

Conclusion

ICICI Prudential Bluechip Fund has a strong 10 year performance track record and has been one of the most popular mutual fund schemes with investors over the years. The scheme has sustained its strong performance in different market conditions.Though the scheme has underperformed in the last 1 year, investors should evaluate the performance of a scheme over a sufficiently long (at least 3 years) period. ICICI Prudential AMC is one of the largest and best managed AMCs in India. Investors can consider investing in this scheme with a long term investment horizon, after discussing with their financial advisors.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team