ICICI Prudential Long Term Plan: Most consistent performing income fund in the last 5 years

Consistent performance, in our view, should be most important selection criterion for mutual funds. While consistent performance is important for all categories of mutual funds, it is especially significant for long term debt funds (or income funds). This is because a long term debt fund manager can deliver higher returns in a favourable interest rate environment, simply by taking more interest rate risk. However, the interest rate environment may not always be favourable and then higher interest rate risk may hurt investors.

In Advisorkhoj, we have built a research tool that identifies the most consistent performers across different market conditions. We look at the relative performance of mutual fund schemes (quartile ranks) for each year over the last 5 years and then rank schemes using our proprietary research methodology. Over 5 years, capital markets experience different conditions and our research tool identifies schemes which performed well in different conditions. You can see most consistent mutual fund schemes in each category by going to our tool, Top Consistent Mutual Fund Performers.

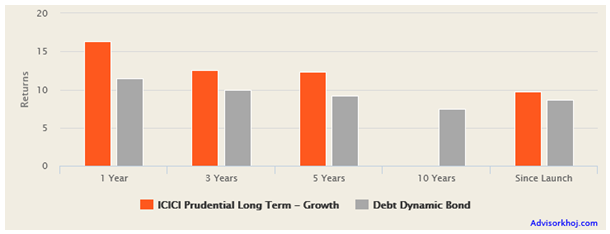

ICICI Prudential Long Term Plan is the most consistent Income Fund over the last 5 years (please see our tool, Top Consistent Mutual Fund Performers). The fund was a top quartile performer in 4 years out of the last 5 years, a truly outstanding performance. Even in the current year, this fund is a top quartile performer continuing on its exceptional performance in 2016, when the fund gave nearly 17% returns. The chart below shows the trailing annualized returns of ICICI Prudential Long Term Plan and Dynamic Bond Fund Category over the last 1, 3 and 5 years in the chart below (as on June 16, 2016).

Source: Advisorkhoj Research

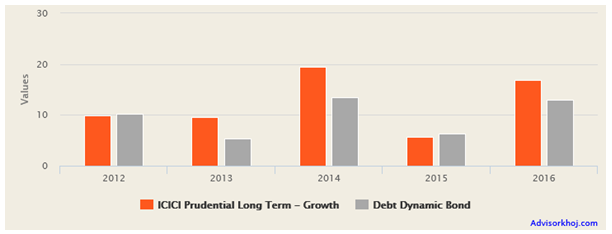

You can see that ICICI Prudential Long Term Plan has outperformed dynamic bond funds category by a significant margin across all time-scales. Even on an annual basis, ICICI Prudential Long Term Plan outperformed Dynamic Bond Fund Category in most years over the last 5 years (please see the chart below).

Source: Advisorkhoj Research

Rolling Returns

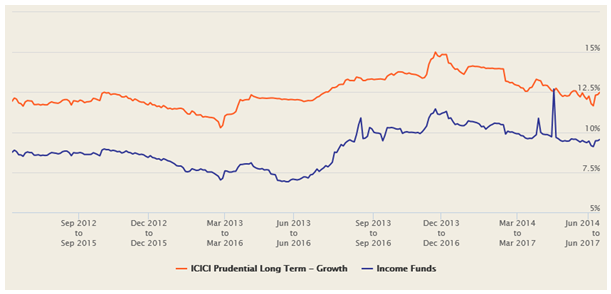

As discussed earlier, performance consistency should be one of the most important selection parameters for mutual fund schemes, especially income funds. Consistency of performance shows the income fund manager’s ability to manage the interest rate risk and therefore returns in different interest rate scenarios. We have discussed a number of times in our blog that, rolling returns is one of the best measures of performance consistency, because it is not biased by recent market conditions. The 3 year rolling returns chart over the last 5 years shows why ICICI Prudential Long Term Plan is rated as a top performer. We have selected 3 years as the rolling returns period, since one should have a long investment horizon for income funds.

Source: Advisorkhoj Rolling Returns Calculator

You can see in the chart above that, ICICI Prudential Long Term Plan consistently outperformed the Income Funds category. A look at the different 3 year rolling returns parameters of ICICI Prudential Long Term Plan reveals some very interesting insights.

Source: Advisorkhoj Rolling Returns Calculator

You can see that, the minimum three year rolling returns of this fund over the last 5 years was 10.28%; this implies that, if you held this fund for a period of 3 years, you would have always got double digit returns from this fund over the last 5 years. The maximum 3 year rolling returns was 15.01%, which shows strong upside potential. The average and median 3 year rolling returns were 12.5% and 12.2% respectively; very impressive performance indeed.

Dynamic interest rate management works best for retail investors

Bond prices rise when interest rates fall and fall when interest rate rises. Long duration bonds are more sensitive to interest rate movements compared to short duration bonds.Forecasting interest rate outlook is not easy and investors can get caught on the wrong side of interest rate movement, e.g. investing in a long duration fund when interest rates have bottom out / rising. Therefore, in our view a scheme which employs a dynamic approach to duration management works best for retail investors, who do not have the expertise of making interest rate calls.

The investment strategy of ICICI Prudential Long Term Plan states that, “The fund intends to generate potential capital appreciation through active duration management. The Fund intends to generate potential capital appreciation by following model based dynamic duration management that will enable the fund manager to systematically manage interest rate risk”.

If the fund manager believes that interest rates will fall in the future then he or she will invest in long duration bonds to take advantage of price appreciation of the bonds. If the fund manager expects interest rates to rise, then he or she will invest in short duration bonds, which will limit interest rate risk. Therefore, this fund can give good returns in a lower interest environment, while limiting downside during periods of rising interest rates. As such this fundis ideal long term debt investments for retail investors who want to profit from interest rate movements but are unclear about the trajectory and timing of the movements. You can rely on the expertise of the fund manager to make the right call.

Portfolio Construction of ICICI Prudential Long Term Plan

We had discussed earlier that fund managers of ICICI Prudential Long Term Plan actively manage the portfolio maturity and duration, depending on their outlook on interest rates and bond yields. Therefore the portfolio construction can change a lot from time to time, depending on the strategy of the fund manager. Currently, 68% of the portfolio of ICICI Prudential Long Term Plan is invested in Government Securities, about 24% in corporate bonds and 8% in money market instruments.

The credit quality is excellent; with more than 90% of the portfolio isAAA rated and the balance AA rated. The average maturity of the portfolio is 12.4 years. It is clear from this portfolio construction that the fund manager is expecting interest rates and bond yields to decline. The yield to maturity of the portfolio is 7.5% and the modified duration of the portfolio is 6.8 years. Yield to maturity is the annual returns the fund will get by holding the bonds in its portfolio to maturity. Modified duration is the change in bond price for a 1% change in interest rate or yield. The modified duration of the ICICI Prudential Long Term Plan has come down over the past one year. This shows that the fund manager, while bullish, is at the same time prudent as far as interest rate risk is concerned because interest rates have declined considerably over the past 2 years or so.

Tax Advantage of Income Funds held for over three years

Over an investment horizon of three years or more, Income funds enjoy a big tax advantage over fixed deposits and many Government Small Savings Schemes. While fixed deposit and most government savings schemes interest is fully taxable, the debt fund profits over a three year investment period are taxed at 20%, after allowing for indexation benefits. The table below shows the post-tax returns of ICICI Prudential Long Term Plan over various 3 year investment periods compared to FD post tax interest (based on prevailing FD interest rates for respective periods).

Source: Advisorkhoj Rolling Returns Calculator

To compare the post-tax returns of this fund with FD interest over various time periods, please check our FD versus Debt Fund tool

Conclusion

The consistent performance of ICICI Prudential Long Term Plan makes it a good investment option for long term debt investors. To take full advantage of interest rate cycle and the tax advantage of debt mutual funds, investors should have at least a 3 year horizon for investing in the fund. Investors should consult with their financial advisors if ICICI Prudential Long Term Plan is suitable for their financial needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Financial Services Fund

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty India Infrastructure and Logistics ETF

Jan 30, 2026 by Advisorkhoj Team