ITI Flexi Cap Fund NFO: A good investment opportunity for long term investors

ITI Mutual Fund has launched a New Fund Offer, ITI Flexi Cap Fund, an open-ended equity scheme which will have flexibility to invest across market capitalization segments i.e. large cap, midcap and small cap. ITI Flexi Cap Fund is the 9th scheme in ITI MF’s equity product offerings. The NFO opened for subscription on 27th January 2023 and will close on 10th February 2023.

What is Flexicap Fund?

As per SEBI’s mandate, flexicap funds can invest across market cap segments. There is no segment-wise limit for flexicap funds. In terms of risk profile, flexicap funds are somewhere between large cap funds and large & midcap funds.

Why invest in Flexicap Funds?

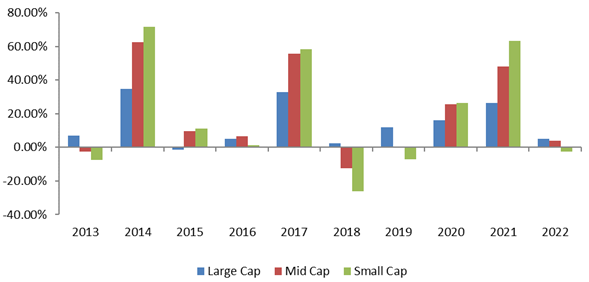

- Historical data shows that winners rotate across different market cap segments – see the chart below. Flexicap fund managers can generate risk adjusted returns by rotating allocations to different market cap segments based on their outlook.

![Mutual Funds - Historical data shows that winners rotate across different market cap segments Mutual Funds - Historical data shows that winners rotate across different market cap segments]()

Source: National Stock Exchange, Advisorkhoj Research (as on 31st December 2022). Nifty 100 TRI represents large cap, Nifty Midcap 150 TRI represents midcap and Nifty Small Cap 250 TRI represents small cap stocks. Disclaimer: Past performance may or may be sustained in the future.

- The small and midcap allocations provide growth potential to flexicap funds, while the large cap allocation provides stability.

- Flexicap funds can be overweight / underweight in large, mid and small caps depending on relative attractiveness of these market cap segments.

- Unlike other equity fund categories with mandated market cap limits e.g. large cap (minimum 80% in large cap), large and midcap (minimum 35% in midcap), multicap (minimum 50% in small and midcap), midcap (minimum 65% in midcap), small cap (minimum 65% in small cap), flexicap has no market cap limits. The fund manager can change market cap allocations as per prevailing market conditions.

- The fund managers can use their talent to spot ideas across market cap segments without any market cap restrictions.

Why invest in equity now?

- High inflation and rate hikes by central banks caused CY 2022 to be a very volatile year for global equity markets. Developed markets (US and major European markets) were down 10 – 20%, while emerging markets were down more than 20%.

- India was the bright spot in global equity markets in CY 2022, as it closed the year with modest gains. India’s weightage in MSCI Emerging Market index improved to 7.7% in March 2020 to nearly 15% in November 2022. This is a big positive from the point of Foreign Institutional Investors’ (FII) flows into Indian equity market.

- India was able to navigate through the global market crisis in 2022 much stronger than the previous global crises (e.g. Global Financial Crisis of 2008, Fed taper tantrum of 2013 etc). Inflation and currency depreciation were relatively more stable and forex reserves in a much more healthy position compared to previous crises.

- Global commodity prices are cooling down due to action taken by central banks. Crude oil prices have corrected by 39% since March 2022. Lower inflation and end of interest rate tightening cycle will have a favourable effect on equity markets.

- The consumption drivers of Indian economy e.g., per capita income, narrowing urban / rural gap, favourable demographics, shift towards organized sectors, internet penetration, online adoption and growth in affluent / middle income percentage of the population are very favourable for the long term India growth story and performance of equity as an asset class in the medium to long term.

- Despite global headwinds, the Sensex touched all time high in 2022. This shows investors’ (both domestic and FII) confidence in the India growth story. The 1,000 point correction in Nifty over the past two months (as 30th January 2023) can provide attractive investment opportunities for long term equity investors.

Salient Features of ITI Flexi Cap Fund

- Diversification across market cap segments

- No bias towards any market cap segment or industry sector

- Top down sector approach supplemented by bottom up stock picks

- The investment style of the fund is Growth at Reasonable Price (GARP)

Market cap selection approach – ITI Flexi Cap Fund

- Relative Valuation among Large, Mid & Small Cap

- Economic Indicator Evaluation

- Liquidity Scenario

- Global & Domestic Interest Rate Outlook

Sector Selection Approach – ITI Flexi Cap Fund

- Emerging themes

- Macroeconomic orientation

- Emphasis on valuation to assess risk-reward & provide reasonable margin of safety

- Holistic approach to valuations

- Expected tailwinds

Stock Selection Approach – ITI Flexi Cap Fund

- The financial strength of the companies, based upon select financial parameters

- Reputation of the management and their track record

- Good quality companies with above average growth prospects

- Companies that are facing a stable or improved industry scenario either because of the nature of their businesses or superior strategies followed by their management

- Valuation parameters & market liquidity of the securities

- Companies which pursue a strategy to build strong brands for their products or services and those which are capable of building strong franchises

Why invest in ITI Flexi Cap Fund?

- The fund can leverage opportunities in sectors and stocks appearing across market spectrum

- The fund can make tactical allocation bets within market cap segments depending upon market scenarios

- The fund will have flexibility to align with market risk reward perceptions

- The fund plans to have robust investment controls and risk framework in place

Who should invest in ITI Flexi Cap Fund?

- Investors who want capital appreciation over long investment horizon

- Investors with high to very high risk appetites

- Investors who have at least 5 years plus investment tenures

How can you invest in ITI Flexi Cap Fund?

You can invest in ITI Flexi Cap Fund either in lump sum or SIP depending on your financial situation and investment needs. To know more about the fund pls contact your Mutual Fund Distributor.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Financial Services Fund

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty India Infrastructure and Logistics ETF

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty 500 Healthcare ETF

Jan 30, 2026 by Advisorkhoj Team