ITI Focused Equity Fund NFO: A good investment opportunity for long term investors

ITI Mutual Fund has launched a New Fund Offer, ITI Focused Fund, an open-ended focused equity scheme which will invest in portfolio of maximum 30 high conviction stocks across market capitalization segments i.e. large cap, midcap and small cap. The NFO has opened for subscription on 29th May 2023 and will close on 12th June 2023.

Current market context

After a difficult 2022, global equities have bounced back in 2023. Indian equities have also made significant gains after a difficult start to the year; the Nifty is trading near its all time high. The trajectory of the benchmark 10 year Government bond yield indicates that the market is expecting an end of the interest rate cycle in the near future. From a long term perspective, the outlook for Indian equities is good. India is expected to benefit from structural realignments in global supply chains e.g. China + 1 strategy. The banking system has made a strong turnaround from the NPA crisis. GST collections in the last 12 months have been very strong. IMF has forecasted India’s GDP to grow by 5.9% which is significantly higher than other major economies including China.

What is focused investing?

The “eye of the bird” story Arjuna and Guru Drona is part of our folklore. Guru Drona asked Arjuna to take aim at a bird’s eye sitting on a tree. Drona asked Arjuna, “What are seeing? Do you see the tree?” Arjuna replied “no”. Drona asked, “Do you see the bird?” The answer was again “no”. Drona asked “What do you see?” Arjuna replied, “Only the eye of the bird”.

Focus yields better results. We have seen this in all walks of life from academics to professional sports, to arts, to business. The legendary investor, Warren Buffet said, “Diversification preserves wealth, but concentration builds wealth”. He goes on to say,”If you understand the business, you do not need to own very many of them”. Focused investing refers to building a relatively concentrated portfolio of high conviction stocks.

How focused approach can make a difference?

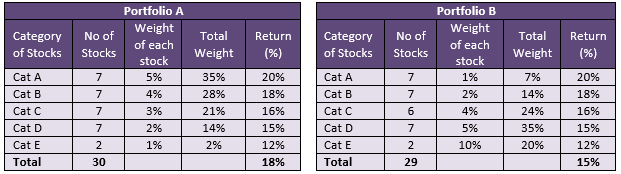

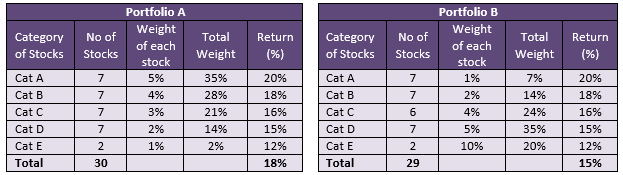

Consider two portfolios A and B with 30 stocks each, one with higher weights to winners and one with lower weights to winners. Portfolio A outperformed because it had higher allocation to winners (see the table below).

Consider two portfolios A and C with 30 stocks each, one with higher weights to winners and one with equal weights to all stocks. Right weight to winners can produce significance outperformance versus an equally weighted portfolio (see the table below).

Note: The table above is purely illustrative for investor awareness purpose. Higher concentration may increase unsystematic risk. You should invest according to your risk appetite. Consult with your financial advisor before investing.

How to get the benefits of focused investing?

Focused equity funds invest in a portfolio of 30 stocks or less. There is no market cap allocation limit for these funds. They have the flexibility to invest across market cap segments based on the fund manager’s outlook and strategy. Since these funds invest in 30 or less stocks, concentration risk is higher in focused funds compared to more diversified equity funds.

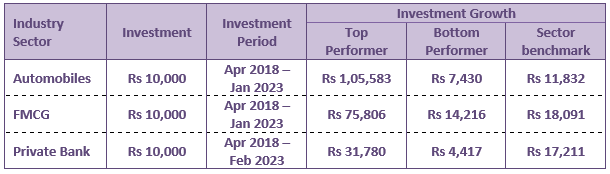

How right stock picking makes a huge difference?

The table below shows the difference in wealth creation by investing in the top performing stock versus the bottom performer over sufficiently long investment horizon.

Salient features of ITI Focused Equity Fund

- A ‘Growth’ oriented fund

- Focused approach of max. 30 stocks

- Benefits from stock selection

Portfolio strategy

- Core Portfolio (40%): Steady compounders generating reasonable returns with low volatility. Horizon: 3-5 years

- Alpha Portfolio (40%): Companies that are market share gainers. Horizon: 18-24 months

- Emerging Themes New Age Companies (20%): Generating break-out growth going forward. Horizon: 5+ years

Stock Selection strategy

- Strong size of Opportunity.

- Areas where it involves high technology intensity and entry barriers.

- Companies able to maintain leadership augmenting capacities, market share & newer capabilities in their space.

- Turnaround candidates vitiated by temporary events like duties, unabated imports, labour problems etc.

- Focus on stocks which have characteristics & management capability to sustain high growth resulting into their ability to outgrow peers.

- Stocks that transgress from being a small cap to a midcap, &/or from a midcap to a large cap Functionally these buckets will be strongest buckets of wealth creation.

- New Age Companies.

Why invest in ITI Focused Equity Fund?

- Optimally Positioned: Distinct portfolio relative to broader market indices with potential for alpha creation.

- Concentrated Portfolio: Exposure to hand-picked high-conviction ideas.

- Leverage of Research Expertise: Experienced fund management team tracking large set of companies.

- Portfolio Diversification: Maximum of 30 stocks across sectors and market capitalization.

Is this a good time to invest in ITI Focused Equity Fund?

- Government spending on capex in the last few budgets may have a major multiplier effect on economy that is growing steadily & this bodes well for India’s growth engine.

- India’s consumption drivers e.g. rising per capita income, favourable demographics, reducing urban rural gap, nuclearization of families, growing urbanization, online penetration etc will drive strong demand growth.

- The health of economy is strong. India is expected to outperform major markets including China in economic growth and show better resilience in economic downturns.

- There are tailwinds from global environment.

- Growing digitalization will boost growth.

- Valuations have moderated in the last few months.

Who should invest in ITI Focused Equity Fund?

- Investors looking for capital appreciation over long investment tenures.

- Investors with high risk appetites.

- Investors with minimum 5 year investment tenures.

Investors should consult with their financial advisors / mutual fund distributors if ITI Focused Equity Fund is suitable for their long term investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF

Feb 2, 2026 by Advisorkhoj Team

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team