Nippon India Large Cap Fund: A good large cap mutual fund for wealth creation

Indian equities have enjoyed a terrific bull run since the crash in March 2020 in the wake of COVID-19 pandemic. In the last one year (ending 31st August 2021) Nifty 50 TRI has given 51% returns, while the broader market (Nifty 500 TRI) has given 56% returns. The Indian economy is also showing strong signs of recovery from the COVID induced economic downturn, with strong GDP growth in the first quarter of FY 2021-22. While the post COVID corporate earnings growth prospects look promising, investors should also be aware of the risk factors:-

- COVID cases due to spread of the delta variant is rising in many countries around the world

- Inflation continues a concern for central banks around the world including India

- China's regulatory crackdown is also a cause of concern for global investors

- The ongoing bull market has been largely fuelled by easy global liquidity as a result of US Federal Reserve's monetary policies after the outbreak of COVID-19 pandemic in 2020

- In 2013 when the Fed began tapering its Quantitative Easing Program initiated during the Global Financial Crisis of 2008, we saw volatility in the equity markets - in market parlance it was called the taper tantrum. The Fed has signalled that at some stage, they will begin tapering the bond buying program and we may see repeat of taper tantrum.

- In the taper tantrum of 2013, midcaps and small caps experienced much more volatility than large caps. If there is a pullback in equity markets when Fed begins its taper, large caps will be less volatile compared to midcaps and small caps if history is any indication to go by.

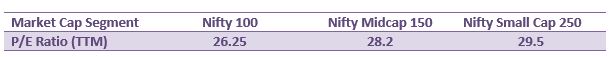

- Further to the above, midcap and small cap valuations are also a cause of concern for many investors (see table below). While valuations are on higher side across all three market cap segments, valuations of midcaps and small caps are significantly higher than the long term averages.

Source: National Stock Exchange, As on 31.08.2021

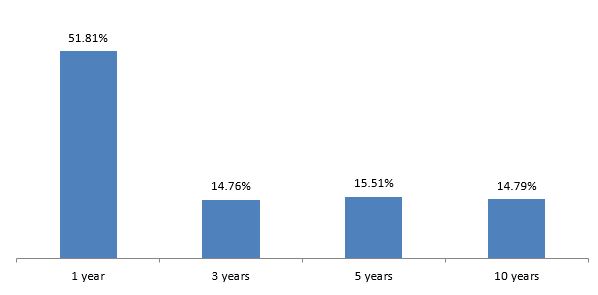

Long term performance of large caps (Nifty 100 TRI)

Source: National Stock Exchange, Advisorkhoj Research, as on 31st August 2021. Returns are in CAGR

The large cap segment of the market has been a wealth creator for investors over long investment horizons and has at the same time, provided stability to the investor's portfolio in volatile market conditions - lower downside risks. As such, large cap mutual fund schemes have traditionally been one of the most, if not the most, popular equity mutual fund category among investors - both retail and HNIs.

About Nippon India Large Cap Fund

Nippon India Large Cap Fund was launched in August 2007 and has Rs 11,025 crores of of assets under management (AUM) as on 31st August 2021. The expense ratio of the scheme is 1.89%. The scheme is helmed by veteran fund manager Shailesh Raj Bhan and Ashutosh Bhargava. Mr Bhan has been managing the scheme since inception. As per SEBI's mandate for large cap funds, the scheme invests at least 80% of its assets in large cap stocks. SEBI classifies the top 100 stocks by market capitalization as large cap. Large cap stocks are much less volatile than midcap or small cap stocks.

Wealth Creation by Nippon India Large Cap Fund

Rs 10,000 invested in Nippon India Large Cap Fund 10 years back would have multiplied more than 4 times (as on 31st August 2021). The scheme outperformed its benchmark index S&P BSE 100 TRI. The scheme has been able to create substantial alphas for investors as the CAGR return of the scheme over the last 10 years was 15.3%, while that of the benchmark was 12.3%.

Source: Advisorkhoj Research (as 31st August 2021)

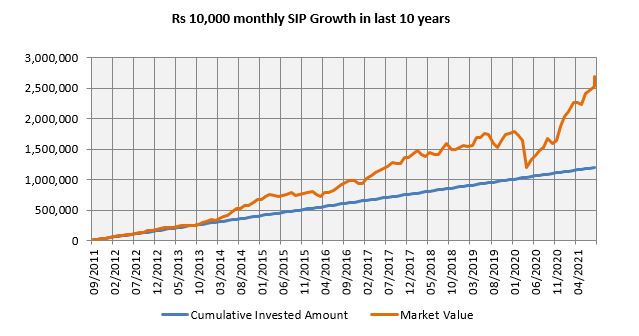

The systematic investment plan (SIP) performance of the scheme over the last 10 years is equally impressive. A monthly SIP of Rs 10,000 in Nippon India Large Cap Fund would have grown to nearly Rs 27 lakhs in market value (as on 31st August 2021) with a cumulative investment of just Rs 12 lakhs. The annualized SIP return of the scheme was 15.66%.

Source: Advisorkhoj Research (as 31st August 2021)

Rolling Returns

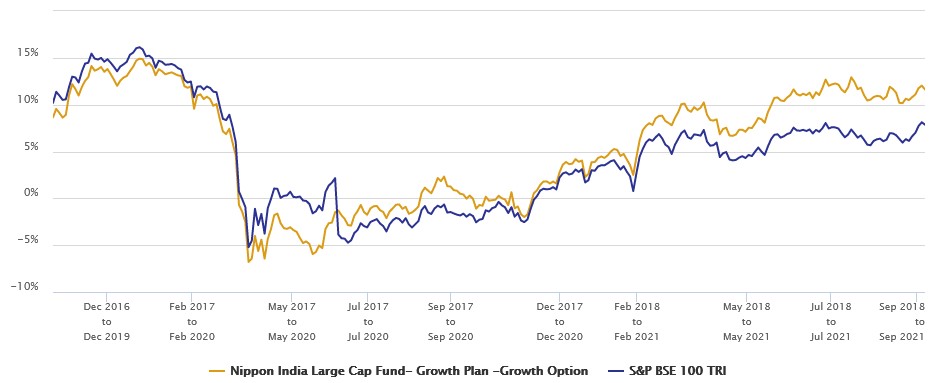

As mentioned earlier in our blog, rolling returns is the most unbiased measure of mutual fund performance. The chart below shows the 3 year rolling returns of Nippon India Large Cap Fund versus the scheme benchmark over the last 5 years. We have chosen to show 3 year rolling returns of the scheme because we think investors should have at least 3 year investment horizons when investing in equity funds. You can see that the scheme outperformed its benchmark most times.

Source: Advisorkhoj Research (as on 13th September 2021)

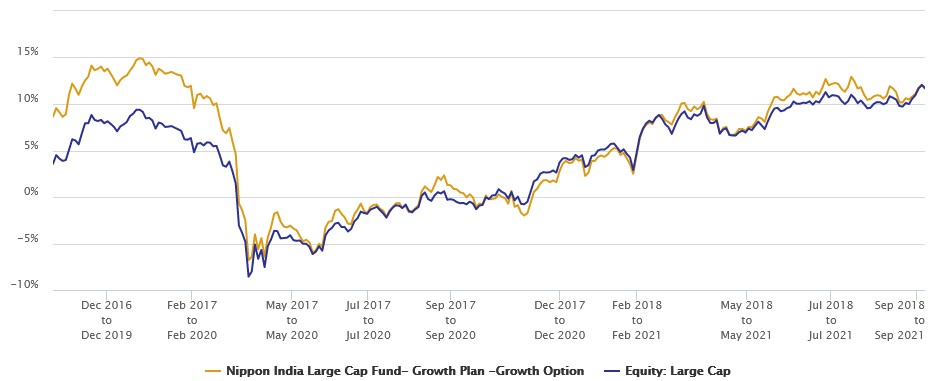

Let us now compare the 3 year rolling returns of the scheme with the large cap funds category, in other words, average returns of the scheme's peers, across different market conditions over the last 5 years. You can see that Nippon India Large Cap Fund consistently outperformed the large cap category average during this period.

Source: Advisorkhoj Research (as on 13th September 2021)

Why invest in Nippon India Large Cap Fund

- Large cap funds provide stability and liquidity to your portfolio in different market conditions.

- Since large cap funds are less volatile than small / midcap funds, they are suitable both for lump sum investments and SIPs.

- Nippon India Large Cap Fund is among the top 3 best performing large cap schemes over the last 1 year (see our tool -> Mutual Fund Trailing Returns - Equity: Large Cap)

- Even in terms of Nippon India Large Cap Fund stands out among its peers. It is one of the top 5 best performing large cap schemes over the last 10 years (se our tool -> Mutual Fund Trailing Returns - Equity: Large Cap)

- The scheme has consistently created alphas over long investment tenures.

Who should invest in Nippon India Large Cap Fund

- Investors who are looking for long term capital appreciation.

- This scheme is suitable for your long term financial goals like retirement planning, children's higher education, children's marriage, wealth creation etc.

- This scheme is also suitable for young or new investors since large funds are less volatile than flexicap, midcap or small cap funds.

- You need to have moderately high to high risk appetite for this scheme.

- You need to have minimum 5 years or longer investment horizon for this scheme

Investors should consult with their financial advisors if Nippon India Large Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Financial Services Fund

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty India Infrastructure and Logistics ETF

Jan 30, 2026 by Advisorkhoj Team