Nippon India Pharma Fund: A good sectoral fund in the current environment

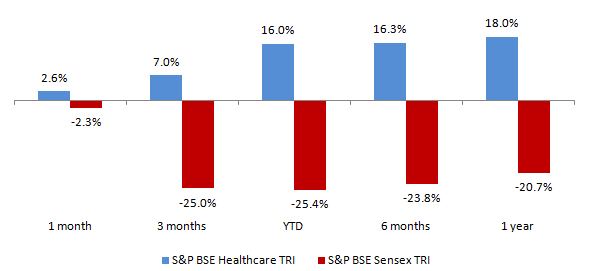

The equity market has suffered very badly since the outbreak of Coronavirus pandemic. The Sensex has already fallen 25% this year and more pain is expected in coming weeks and months. Almost all industry sectors are in the red with one exception, healthcare. The S&P BSE Healthcare TRI is already up 16% on a year to date basis.

The chart below shows the performance of S&P BSE Healthcare TRI versus S&P BSE Sensex over various trailing periods in the last 1 year (ending 25th May 2020).

Source: Advisorkhoj Research

Turnaround for the Pharma sector

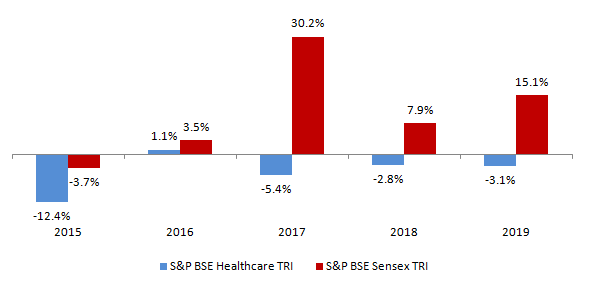

The stunning outperformance of Healthcare sector is all the more remarkable because healthcare, especially pharmaceuticals had been a laggard for several years (see the chart below). Over the last 5 years, the industry faced a lot of headwinds particularly in the area of export revenues due to regulatory challenges in the US. The industry also saw slowdown in domestic revenues.

Source: Advisorkhoj Research

However, in the last one year the sector has seen a turnaround in export sales growth (especially US exports) to around 8% and double digit (12%) domestic sales growth. Also the unfortunate outbreak of COVID-19 across the world has improved the future outlook of this sector considerably as overall spending on healthcare is likely to increase substantially and also as Pharma companies look to diversify away from China with India being the major beneficiary.

Nippon India Pharma Fund

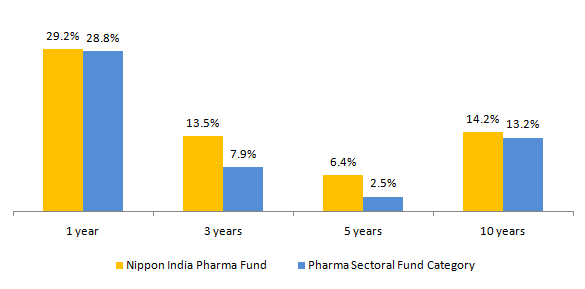

Nippon India Pharma Fund is the best performing Pharma fund in the last 3 to 5 years (please see Mutual Fund Trailing Returns - Equity: Sectoral-Pharma and Healthcare). The chart below shows the returns of the scheme versus the Pharma sector funds category over various trailing time periods ending 25th May 2020.

Source: Advisorkhoj Research

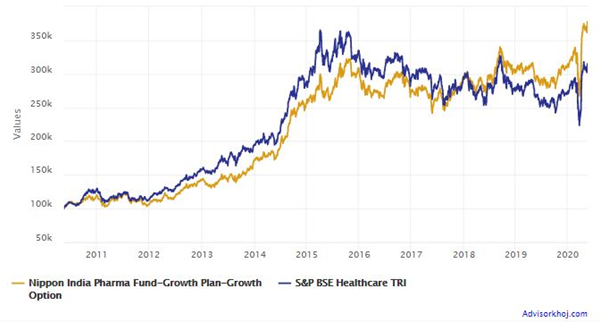

The chart below shows the 3 year rolling returns of Nippon India Pharma Fund versus its benchmark index, S&P BSE Healthcare TRI since inception of the benchmark. You can see that the scheme was able to outperform the benchmark most of the time. You can see that the scheme outperformed even during the period when the going was tough for the Pharma industry (2015 to 2019). This is the hallmark of good fund management as it displays the superior stock picking skills of the fund manager.

The average 3 year rolling returns of the scheme during this period was nearly 20%. The scheme delivered 12%+ returns, nearly 70% of the times over 3 year investment tenures during this period.

Source: Advisorkhoj Rolling Returns

Lump Sum and SIP Returns

The chart below shows the growth of Rs 1 lakh lump sum investment in the scheme over the last 10 years. You can see that your investment would have multiplied more than 3.6 times (as on 25th May 2020) in the last 10 years.

Source: Advisorkhoj Research

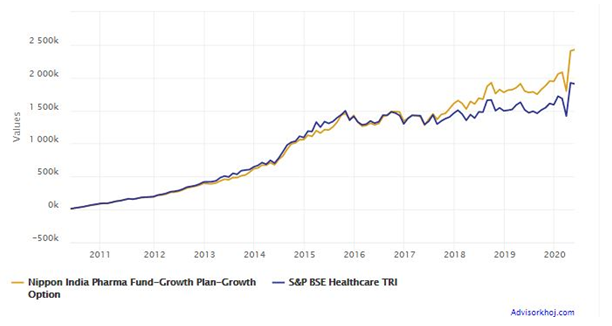

The chart below shows the growth of Rs 10,000 monthly SIP in the scheme over the last 10 years. You can see that with a cumulative investment of Rs 12 lakhs over the last 10 years you could have accumulated a corpus of more than Rs 24 lakhs (as on 26th May 2020). The SIP return has been over 13% XIRR!

Source: Advisorkhoj Research

Why invest in Nippon India Pharma Fund?

- Pharma is the brightest sector in the current economic environment. Healthcare and Pharma has outperformed the Sensex and the broader market in the last 1 year. The sector has largely been successful in resolving the US FDA related regulatory issues. The near term outlook of the sector is positive particularly due to the COVID-19 pandemic.

- Many financial advisors believe that market timing is important for performance of sectoral funds. As far Pharma sector is concerned, this is a good time to invest given current conditions.

- However, apart from market timing, we in Advisorkhoj believe that sectoral funds can also good long term investment options provided the industry is secular in nature.

- While Pharma is a secular industry, greater emphasis on healthcare and potential changes in the global Pharma supply chain in wake of COVID-19 pandemic bodes well for the Indian Pharma industry even in the medium to long term.

- Nippon India Pharma Fund has strong track record of alpha generation and wealth creation for investors. The scheme has delivered strong performance across different market conditions.

Summary

In this post, we have reviewed Nippon India Pharma Fund. We think that this scheme is a good investment option with minimum 3 to 5 year investment horizon. You can invest in this scheme either in lump sum or SIP depending on your financial situation. You should consult with your financial advisor if Nippon India Pharma Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Financial Services Fund

Jan 30, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset Nifty India Infrastructure and Logistics ETF

Jan 30, 2026 by Advisorkhoj Team