Nippon India Small Cap Fund: Strong Wealth Creation track record

If you had invested Rs 1 lakh in Nippon India Small Cap Fund at the time of its inception (September 2010), the value of your investment would have grown to nearly Rs 6.6 lakhs (as on 21st May 2021). The CAGR returns of this scheme since inception is 19.3%. If you had invested with a monthly SIP of Rs 10,000 in this scheme the value of your SIP would have grown to Rs 47.36 lakhs with a cumulative investment of Rs 12.9 lakhs only. The annualized SIP returns (XIRR) of this scheme since inception is 22.9%. This fund is a fabulous example of wealth creation by mutual funds over long investment tenures.

Fund Overview

Nippon India Small Cap Fund was launched in September 2010 and has over Rs 13,085 Crores of assets under management (AUM). Some investors express concerns about the AUM size of small cap funds. While a large AUM size can become a disadvantage for small cap funds in the historical context in India, we are seeing evolution of our market structure over time. Our stock market is growing bigger and deeper. Institutional investors, both FIIs and DIIs are investing in the small cap segments. The mutual fund regulation changes made by SEBI will further deepen the small cap segment. In the past, an Rs 15,000 Crore sized small cap fund may have accounted 4 – 5% of the total small cap market capitalization. But today (as on 31st December 2021) an Rs 15,000 Crore sized small cap fund will account for less than 1% of the total small cap market capitalization.

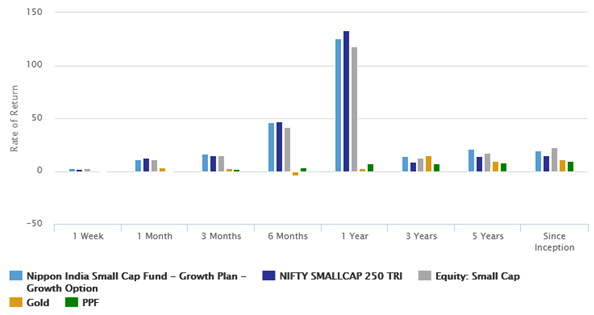

One of the advantages of a large AUM size is lower expense ratio. The expense ratio of Nippon India Small Cap Fundat 1.86% is the lowest among all small cap funds (as on 30th April 2021). The table below shows the annualized trailing returns of Nippon India Small Cap Fund over various time-scales. You can see that, the fund has outperformed its category and the benchmark Nifty Small Cap 250 TRIacross different time-scales.

Source: Advisorkhoj Research

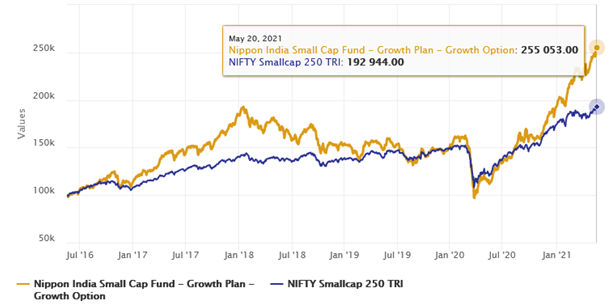

The chart below shows the NAV movement of Nippon India Small Cap Fund over the last 5 years.

Source: Advisorkhoj Research

Rolling Returns

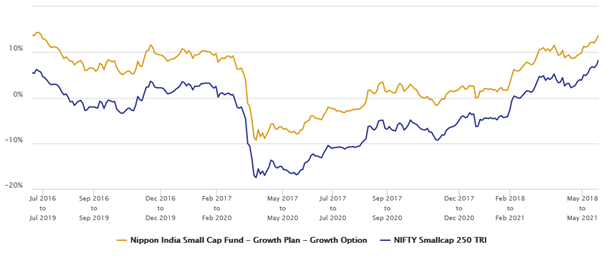

Readers who are familiar with our blog know that, we believe rolling returns is the best measure of a fund’s performance. For readers who are not familiar with the concept of rolling returns, they can note that the annualized returns of the scheme taken for a specified period (rolling returns period) on every day and taken till the last day of the duration. In this chart we are showing the annualized (CAGR) returns of Nippon India Small Cap Fund (yellow line) over the rolling returns period on every day over the last 5 years and comparing it with the benchmark, Nifty Small Cap 250 TRI(blue line). We have chosen a rolling return period of 3 years, because it is advisable for equity fund investors to remain invested for at least 3 years to get the best returns from the investment.

Source: Advisorkhoj Rolling Returns Calculator

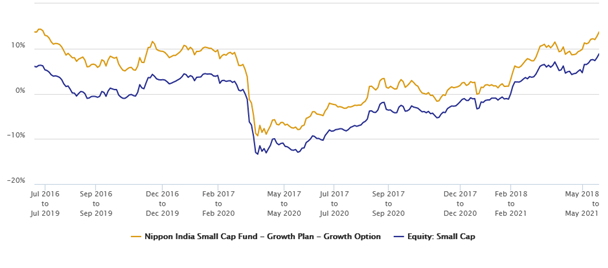

Over the last 5 years, the fund has beaten the benchmark index 100% times. This shows consistency of performance across different market conditions. Secondly, notice that the gap between the rolling returns of Nippon India Small Cap Fundand the benchmark index, Nifty Small Cap 250 TRI, is relatively high. This implies that the fund manager follows a structured and consistent fund management approach, which is very important for long term investors. The chart below shows the 3 year rolling returns of the fund versus the category (small cap funds) over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

Investment Style

Nippon India Small Cap fund focuses on small cap companies in the Nifty Small Cap 250 index. Small cap companies comprise nearly 68% of the portfolio in value terms. The fund manager identifies good growth businesses with reasonable size, quality management and rational valuation. The investment approach adopts prudent risk management measures like margin of safety and diversification across sectors & stocks with a view to generate superior risk adjusted performance over a period of time. The investment style is a mix of growth and value.

Lump Sum and SIP Returns

The chart below shows the growth of Rs 1 lakh lump sum investment in Nippon India Small Cap Fund (growth option) over the last 5 years. The fund has given nearly 20% CAGR returns.

Source: Advisorkhoj Research

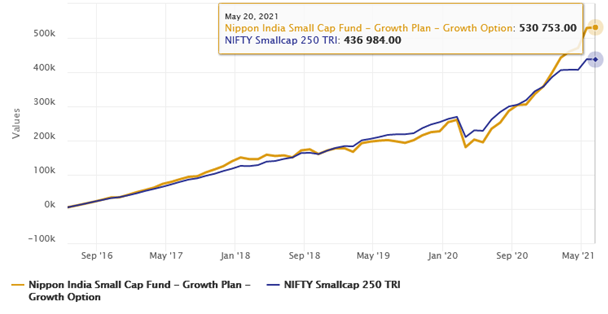

The chart below shows the returns of Rs 5,000 monthly SIP in the fund (growth option) over the last 5 years.

Source: Advisorkhoj Research

Outlook and conclusion

Small cap funds underperformed in 2018 and 2019. The underperformance in 2018 – 19 allowed small caps to find a firm bottom to consolidate. It also gave fund managers the opportunity to buy quality stocks at attractive prices. The stock market crash in March 2020 after the outbreak of COVID-19 made small caps very attractive and they have strongly rebounded since then. Though the near term outlook is uncertain due to the second wave of COVID, we expect small caps to outperform large caps in the medium to long term. We think that SIP is the best mode of investment in small cap equity mutual funds over long investment horizons. However, investors can also take advantage of deep corrections to tactically invest in lump sum. Nippon India Small Cap Fund has completed 10 years of strong performance. It is one of the best performing funds in its category. Investors should have a long investment horizon, when investing in this fund. Investors should consult with their financial advisors if Nippon India Small Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF FOF

Feb 2, 2026 by Advisorkhoj Team

-

Mirae Asset Mutual Fund launches Mirae Asset BSE India Defence ETF

Feb 2, 2026 by Advisorkhoj Team

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026 by Union Mutual Fund

-

SBI Mutual Fund launches SBI Quality Fund

Jan 30, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Balanced Advantage Fund

Jan 30, 2026 by Advisorkhoj Team